According to the latest press release by the Philippine Statistics Authority (PSA), the current health expenditure (CHE) in 2022 had reached Php1.12 trillion.

In healthcare terms, current health expenditure (CHE) is the total sum of money that a country spends to keep everyone healthy.

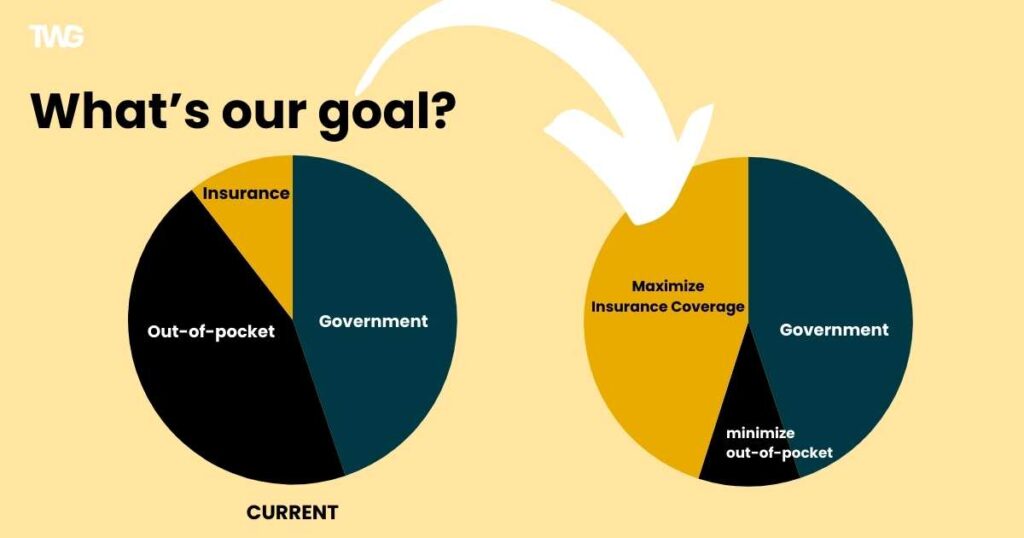

It includes contributions from the government (PhilHealth), insurance companies (health insurance and HMOs), and what individuals pay out-of-pocket (OOP).

And 44.7% of that comes from the individual pockets of Filipinos.

As a result, it created a huge health insurance gap, pushing approximately 1.5 million Filipinos into poverty each year. It is a major concern we must address.

Consequently, it forces families to cut back on education and vital spending.

Table of Contents

Health Insurance Gap

Would you agree that many Filipinos died not because there was no treatment available but because they could not access the medical treatment they needed?

While some survive only to face poverty, there’s a great need for life and health insurance, which play a vital role in nation-building.

How can we address the health insurance gap?

Remember, CHE has 3 components, namely, from the government, insurance companies, and household out-of-pocket spending.

Our goal is to minimize out-of-pocket spending. Because government benefits are pretty much fixed, the only thing you can do is increase your health insurance and HMO benefits.

The Rising Cost of Getting Sick in the Philippines

In 2017, there were only about 4 million Filipinos who had HMO coverage. In spite of that, the average maximum benefit limit (MBL) is only PHP 150,000.

Although it is a big help to ailing employees, the limit is very small compared to the average cost of medical treatments. Furthermore, it is not enough to cover major medical health concerns such as stroke, cancer, heart attack, etc.

It gives a false security blanket, saying that it is enough. But because a stroke costs around PHP 1.8 million, it is way beyond the average MBL. Let’s say you only have a 150k HMO benefit; you still need PHP1.65 million to afford the treatment.

Here’s the cost of other illnesses: a heart attack costs PHP 900,000, breast cancer costs PHP 430,000, and lung cancer costs PHP 2.7 million.

You are left with two choices when you get ill.

First, cover the medical cost by selling your properties or using your savings, which are intended for other things, such as the education of your kids, building a house, starting a business, etc.

Second, transfer the risk to an insurance company by getting life and health insurance plans.

How do we come up with the list?

Many companies are claiming the number-one spot as the top life insurer. Moreover, some blogs and websites have decided to consolidate the data from the Insurance Commission (IC). But the question is, “Is it okay to consume the data that way?”

So don’t worry; this blog is here to help you with the confusion.

On March 24, 2024, IC released seven (7) financial reports, and different companies topped each metric. But among the seven (7) categories, only one is widely used to come up with the top 10 life insurance companies. It is not just in the Philippines but the entire world, and that’s “Premium Income.”

How to interpret the categories

While premium income is used to determine the top life insurers, the remaining metrics are also important. Hence, IC releases them for a reason. For instance, you may use it to assess the overall financial health of a company.

You may interpret each category in this way.

Premium Income

It is a combination of the past and present business of an insurance company.

This figure reflects the overall size and revenue-generating capacity of an insurance company. A company with the highest premium income is considered the market leader as it corresponds to a larger market share.

The past business is often called the renewal premiums. And a good percentage of renewals means that clients are happy with the services, so they continue paying for their plans.

On the other hand, the present business is what we call the NBAPE. It denotes the ability of a company to attract new clients.

Thus, the combination of the past and present gives a better picture of the market share, stability, and competitiveness of an insurance company.

New Business Annual Premium Equivalent (NBAPE)

It signifies the sales performance of an insurance company in a given year. Thus, it is vital to acquire new business.

That is to say that the new business annual equivalent reflects how the general public perceives a company in a particular year.

Therefore, growth is desirable as it indicates growth potential and market competitiveness.

Net Income

Net income equates to the income of a company after expenses. Thus, it shows how profitable the business is

It’s something to consider because you will be putting your money into insurance, and, of course, you want the company to be there when the time comes.

Net Worth

Net worth is equal to the assets minus the liabilities. Undeniably, it shows the capacity of a company to cover liabilities, such as claims.

Use this to foresee if the company can cover future claims.

Total Assets

It is composed of current and fixed assets. Likewise, here you can see how the company manages its assets. Thus, a good company should have growing assets to support its business and sales.

Sun Life Remains the Top Life Insurance Company in 2024

Sun Life is still the number one insurer in 2024, based on the financial reports released by the Insurance Commission (IC). Thus, it is the 13th consecutive time that Sun Life has managed to top the premium income category both in traditional (whole life, term, and endowment) and variable plans.

So why is being number one (or being part of the top 10) important to you as an insurance buyer?

Because it serves as validation that companies like Sun Life can still fulfil their promises to their clients.

Remember, life insurance is an aleatory or promise contract, meaning that when a specific event occurs, like death, the insurer will have to pay the promised amount.

Of course, you want your family to get the benefits by the time it happens to you, right?

Sun Life’s Traditional and VUL Plans

It’s essential to consider the standing of an insurance company before availing of any insurance plan. You want that by the time the need arises, the company is still performing well to fulfill its obligations to you. But this shouldn’t be your sole basis for getting a plan. Undoubtedly, you might as well consider convenience, customer service, a reputable Financial Advisor, etc.

A VUL plan is perfect if you want income protection with a wealth accumulation plan. It lets you grow your money while giving you financial security and peace of mind.

As your investment fund grows, your insurance coverage also increases.

Here’s a link to one of Sun Life’s best-selling VUL plans to request a quotation and financial consultation.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

Health is wealth. So get one of the most comprehensive health insurance plans in the country, covering 114 critical illnesses. Make sure you get the treatment you need when you need it most. Click the link below to learn more.

READ: Sun Fit and Well | Most Comprehensive Health Insurance Plan

*****

Top 10 Life Insurance Companies in the Philippines 2024

Now, let us know more about the other companies that complete the list.

As mentioned before, we based the top 10 life insurance companies in the Philippines on premium income.

The table below summarizes the overall performance of each company.

| Insurance Company | Premium Income | NBAPE | Net Income | Net Worth | Total Assets |

|---|---|---|---|---|---|

| Sun Life | 1 | 2 | 1 | 2 | 1 |

| Pru Life UK | 2 | 1 | 2 | 11 | 5 |

| Allianz PNB Life | 3 | 7 | 13 | 14 | 8 |

| AXA | 4 | 8 | 4 | 6 | 3 |

| FWD | 5 | 3 | 9 | 9 | 11 |

| BDO Life | 6 | 4 | 3 | 4 | 7 |

| Insular Life | 7 | 6 | 6 | 3 | 4 |

| Manulife | 8 | 9 | 8 | 5 | 10 |

| BPI-AIA | 9 | 5 | 7 | 7 | 9 |

| Sun Life Grepa Life | 10 | 12 | 10 | 8 | 12 |

So here are the top 10 life insurance companies in the Philippines in 2024.

1. Sun Life of Canada (Philippines) Inc.

Established in 1895, Sun Life of Canada (Philippines) holds the distinction of being the pioneering life insurance company in the Philippines.

Renowned for its unwavering commitment to delivering on its promises, Sun Life has earned the trust and preference of countless households, solidifying its position as the top life insurance provider in the country.

READ: Sun Life | A Company that Loves to Pay Claims

Sun Life remained the number 1 life insurance company in the Philippines in 2024 for 13 consecutive years based on premium income.

However, due to steep competition, Pru Life has clinched the top spot in NBAPE with a very small margin of Php500 million.

It’s good to see that these two companies are working hard to secure market leadership, and in return, more families will enjoy the humanitarian benefits of life insurance.

Furthermore, Sun Life also comes in first in net income and total assets.

This year is a triple victory for the company, as it was able to get first place in the total assets category as it overtook AIA.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

2. Pru Life Insurance Corp. of UK.

The company started in 1996 after 27 years in the life insurance industry in the Philippines.

Despite being relatively new compared to its rivals, Pru Life UK bagged 2nd place in the list.

Pru Life has led in NBAPE as it regains the top spot from Sun Life. The last time they led the NBAPE was in 2022.

It came as a surprise that Pru Life has managed to earn 6 times their net income compared to last year.

Definitely a major peat, as it shows how progressive the company is.

3. Allianz PNB Life Insurance, Inc.

Allianz PNB Life was founded in 2001, operating as a subsidiary of Alliance SE. The company remained in 3rd place among the top 10 life insurance companies in the Philippines.

Truly, Allianz PNB’s business is a game-changer this year. It saw tremendous growth in net income of over PHP600 million from a loss last year.

However, NBAPE plummets to 7th place from 3rd last year.

4. Philippine AXA Life Insurance, Corp.

AXA Philippines was only established in 1999 in the Philippines but has shown massive growth and market penetration thanks to its bancassurance business.

In fact, it is a joint venture between AXA Group and Metrobank Group.

AXA has maintained its position in premium income. However, it dropped by 3 places in the NBAPE.

5. FWD Life Insurance Corporation

In 2014, FWD made its debut in the Philippines’ insurance landscape.

Despite being new, the company swiftly ascended to secure a coveted position among the top 10 life insurance providers in the Philippines.

FWD took the 5th position from BDO Life this year as they continued to expand their market share.

Most insurance companies net income this year increased compared to last year.

But FWD was able to make an incredible profit this year as its net income grew by 1,100%.

That’s 11 times what they did last year.

6. BDO Life Assurance Co. Inc.

Established in 1999 through a strategic partnership between Generali Pilipinas Holdings Company Inc. (GPHC) and BDO, the company has undergone a transformation.

Today, it stands under the new banner of BDO Life Assurance Co. Inc., marking a significant evolution in its identity and operations.

This year, BDO dropped to 6th place.

7. Insular Life Assurance Company, Ltd.

Founded in 1910, Insular Life holds the distinction of being the pioneering Filipino-owned life insurance company in the Philippines.

As a mutual company, its unique structure ensures that its policyholders are also its owners, fostering a sense of shared ownership and mutual benefit.

Insular Life has posted an applaudable performance this year by advancing 3 places in the top 10 life insurance companies in the Philippines in 2024.

Undeniably, the company has strong financial standing, as they come in 6th in net income, 3rd in net worth, and 4th in total assets.

8. Manulife Philippines

Manufacturers Life Insurance Company (Phils.), commonly known as Manulife, stands as a fully-owned subsidiary of its parent company, The Manufacturers Life Insurance Company.

Established in 1907, it proudly boasts a heritage that positions it among the oldest insurance firms operating in the Philippines.

Manulife slipped by one (1) place in premium income and by two (2) places in NBAPE.

9. BPI-AIA Life Assurance Corporation

Formerly recognized as Ayala Life Assurance Incorporated and established in 1933, this company has ascended to the forefront of bancassurance in the Philippines.

Its prominent position is owed to the strategic collaboration between BPI and Philam Life, solidifying its status as the leading entity in this sector.

BPI-AIA stayed in its 9th position.

10. Sun Life Grepa Life

In 2011, Sun Life Financial partnered with the Yuchengco Group to establish Sun Life Grepa Financial, Inc., marking its entry into bancassurance.

After only a few years, Sun Life Grepa was able to clinch one of the most coveted spots in the top 10.

Top 10 Life Insurance Companies in the Philippines (NBAPE) 2024

Attracting new clients means generating more income for business expansion and the payment of claims.

It can also lower administrative and insurance charges, resulting in more allocation in the investment fund of your VUL plan or dividends for a traditional insurance plan.

Pru Life UK has made a successful comeback as the front-runner in new business premiums from Sun Life. These two insurance companies are having a head-to-head battle, as Pru Life UK leads with only a small margin of PHP 500 million.

Sun Life of Canada (Phil) Inc. was not able to retain its lead from Pru Life UK in NBABE this year. However, they had a good performance last year.

For a comprehensive overview of the top 10 life insurance companies in the Philippines in NBABE in 2024, please refer to the table below.

| Insurance Company | NBAPE |

|---|---|

| Pru Life Insurance Corporation of U.K. | P10,540,295,465 |

| Sun Life of Canada (Philippines), Inc. | P10,067,323,180 |

| FWD Life Insurance Corporation | P4,596,178,178 |

| BDO Life Assurance Company, Inc. | P4,113,723,868 |

| BPI-AIA Life Assurance Corporation | P3,799,541,179 |

| Insular Life Assurance Company, Limited, The | P3,722,078,242 |

| Allianz PNB Life Insurance, Inc. | P3,300,593,643 |

| Philippine AXA Life Insurance Corporation | P3,300,593,643 |

| Manufacturers Life Insurance Co. (Phils.), Inc., The | P2,615,033,030 |

| Etiqa Life & General Assurance Philippines, Inc. | P2,049,011,442 |

Top 10 Life Insurance Companies in the Philippines Based on Net Income 2024

In a nutshell, net income represents a company’s profit after deducting all operating expenses. In line with this, Sun Life of Canada (Phil) Inc. has remained in the top position for this year.

Pru Life came in a strong second by managing to earn 6 times their previous income. It means they are very profitable, which is a good sign for an insurance buyer.

| Insurance Company | Net Income |

|---|---|

| Sun Life of Canada (Philippines), Inc. | P8,798,826,473 |

| Pru Life Insurance Corporation of U.K. | P4,364,912,1603 |

| BDO Life Assurance Company, Inc. | P3,682,175,428 |

| Philippine AXA Life Insurance. Corp | P2,730,190,868 |

| AIA Philippines Life and General Inc. Co. | P2,660,695,472 |

| Insular Life Assce. Co., Ltd., | P2,450,565,196 |

| BPI-AIA Philippines Life Assurance Corporation | P2,395,831,036 |

| Manufacturers Life Insurance Company (Phils.), Inc., The | P1,898,673,118 |

| FWD Life Insurance Corportation | P1,215,862,946 |

| Sun Life Grepa Financial, Inc. | P1,048,522,526 |

Top 10 Life Insurance Companies in the Philippines Based on Net Worth 2024

AIA maintained its top position in the net worth category, showcasing assets that surpass liabilities—a testament to its financial strength.

Following closely behind are Sun Life, Insular Life, and BDO Life.

Their decades-long market leadership, spanning 60 years, has fortified AIA’s position.

Sun Life, securing the second spot, continues to steadily accumulate its net worth, now marking its 13th consecutive year as the market leader of the Philippine insurance industry.

| Insurance Company | Net Worth |

|---|---|

| AIA Philippines American Life and General Ins. Co., Inc. | P59,448,396,954 |

| Sun Life of Canada (Philippines), Inc. | P49,484,734,769 |

| Insular Life Assce. Co., Ltd., The | P46,343,400,123 |

| BDO Life Assurance Company Inc. | P20,195,928,686 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P15,431,906,716 |

| Philippine AXA Life Insurance. Corp | P11,228,412,663 |

| BPI-AIA Life Assurance Corporation | P9,311,087,979 |

| Sun Life GREPA Financial, Inc. | P6,957,963,449 |

| FWD Life Insurance Corporation | P6,009,444,650 |

| United Coconut Planters Life Assce. Corp | P5,255,593,279 |

Top 10 Life Insurance Companies in the Philippines Based on Assets 2024

An asset is anything expected to bring future benefits by generating cash flow, reducing expenses, increasing sales, etc.

Sun Life maintained the lead in total assets for the third consecutive year.

AIA comes in second, and AXA comes in third.

| Insurance Company | Total Assets |

|---|---|

| Sun Life of Canada (Philippines), Inc. | P306,333,217,065.68 |

| AIA Philippines American Life and General Ins. Co., Inc. | P255,039,712,404.90 |

| Philippine AXA Life Insurance. Corp | P166,116,164,953.11 |

| Insular Life Assce. Co., Ltd., The | P150,488,008,143.60 |

| Pru Life Insurance Corp. of U.K. | P141,173,480,898.25 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P122,537,728,548.47 |

| BDO Life Assurance Company, Inc. | P116,489,209,615.81 |

| Allianz PNB Life Insurance, Inc. | P114,708,925,034.00 |

| BPI-AIA Life Assurance Corporation | P112,594,487,304.41 |

| Manulife Chinabank Life Assurance Corporation | P64,753,482,575.97 |

RELATED: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

How Do You Choose the Right Life Insurance Plan?

Finding the right life insurance plan as a first-time buyer can be daunting, but everyone starts somewhere.

After your first policy, choosing subsequent life insurance products becomes easier.

Follow the steps below to find the right plan for you.

5 Steps in Getting the Right Insurance Plan

1. Choose 3 insurance companies

Begin by identifying your priorities, such as excellent customer service, financial stability, and competitive pricing.

Then, select 2–3 companies from the top 10 that align with these qualities.

Remember, the cheapest option isn’t always the best insurance.

Focus on the value you’re receiving before considering the price.

2. Know what’s important for you

Before asking for life insurance plan proposals, ask yourself, “What are your top priorities?”

Understanding yourself is crucial; don’t rush into getting a plan without clear goals.

Perhaps your priority is safeguarding your family from financial hardships or addressing the escalating costs of medical care.

Maybe you’re focused on securing your children’s future with education and a stable home, planning for retirement, or are you interested in starting a business?

Reflect on the importance of this decision—it’s a long-term commitment.

Challenges will arise, and without clear goals, you might be tempted to abandon your plan.

To avoid wasting time and money, define your goals now.

3. Schedule an Appointment

Reach out to an advisor from each company and schedule a meeting.

Treat this process with the seriousness it deserves—this is about your future, not browsing a menu at a restaurant.

Take the time for a face-to-face discussion. Here are some qualities to seek in a financial advisor:

- He must be reachable. Your advisor should be available for account inquiries and regular policy updates. There may be occasions when you forget your coverage details and require a refresher on your plan. Avoid choosing an advisor you feel intimidated to approach.

- Is he knowledgeable? Can your advisor explain the plans and options clearly? While it’s important to review the fine print of an insurance plan to understand its pros and cons, a knowledgeable advisor will transparently lay out all the details without reservation. Their priority is not just making a sale but genuinely caring for your well-being.

- Dependable person. Keep in mind that you’re not just acquiring an insurance plan; you’re also gaining a partner. View your insurance plan as your contingency strategy for your family’s future. Will your advisor still be with the insurance company when you require assistance?

Selecting the ideal advisor can feel as daunting as navigating through insurance options.

Your insurance plan serves as tangible evidence of your commitment to your family’s security.

Conversely, your advisor acts as the guardian of that commitment.

Thus, it’s crucial to prioritize accessibility, expertise, and reliability when choosing an advisor.

4. Prepare questions

At this point, you may now prepare for questions that concern you the most. But then you don’t have to compute for each fee/charge every year.

Do you have to know the production cost of the bag of chips you buy? I don’t think so.

In step 3, you have set your goals. Price should not be the basis, but its value proposition.

Your advisor will answer all your questions during the product presentation.

Thus, ask if you have any remaining questions.

Again, this is for your future, so make sure the plan answers your needs.

5. Finalize your decision

Now that you have met the 3 advisors and reviewed their proposed plan, you may create a table or list of things you need and want from an insurance plan versus the proposals.

So which among them is the fittest to your goal?

While some riders or benefits are good additional features, remove them if they don’t fit your cause.

Just get what you need accordingly.

I hope this blog helped you get the “right” insurance plan.

Cheers!

READ: Sun Fit and Well | Most Comprehensive Health Insurance

*****

References:

- de Vera, Ben O. (2021, April 20). Insurer profit down 8.6 percent in 2020 as pandemic hammers markets. Inquirer.net. Retrieved May 29, 2021, from https://business.inquirer.net/322053/insurer-profit-down-8-6-percent-in-2020-as-pandemic-hammers-markets

- Funa, Dennis B. (2019, June 19). The health insurance gap in the Philippines. Business Mirror. Retrieved May 29, 2021, from https://businessmirror.com.ph/2019/06/19/the-health-insurance-gap-in-the-philippines/

- Mapa, Dennis S. (2020, October 15). Health Spending Grew by 10.9 Percent in 2019. PSA. Retrieved May 29, 2021, from https://psa.gov.ph/content/health-spending-grew-109-percent-2019

- Mapa, Dennis S. (2023, August 30). The Country’s Total Health Spending Contributes 5.5 Percent to the Economy in 2022, from https://psa.gov.ph/statistics/pnha

- Tan, Arlyn. (2021, April 28). [Fin Talk] Life Insurance Company Ranking: What’s in it for the Policyholders and Beneficiaries?. Now You Know. Retrieved May 29, 2021, from https://www.nowyouknowph.com/post/fin-talk-life-insurance-company-ranking-what-s-in-it-for-the-policyholders-and-beneficiaries?

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

175 thoughts on “The Top 10 Life Insurance Companies in the Philippines 2024”

Hello sir.. how much is Sunlife insurance per month and what are the offer benefits? Thank u

It will depend on what plan and coverage 🙂

Good am sir ,can an insurance company delete the life insurance of the insured for not claiming the insurance 13 years after the maturity date(2010) Type of insurance-5 year dollar earner),single payment-reason for not claiming-I misplaced the the policy and I forgot all about it and the company probably dib

did not give any notice, by the way I am 83 yrs old

Sorry for your experience, Alfredo. With the technology now, you don’t have to present your policy to claim the benefits they can search the account for you. Well, at least with our company. Please call your insurance provider so they can help you.

good day, is there any available branch/advisor of sun life in United Arab Emirates.. Please advise. thank you

Advisors here are not allowed to sell life insurance overseas. However, you may apply for one maybe during your vacation here.

These are great selections, I have Sunlife myself.

Really powerful article. Enjoyed the read!

Thanks for your kind words 🙂

Hi sir! What can you say about the expensive administration fees for VUL. I have a Sunmaxilink prime and I noticed that admin fees cost around 1050 per month. I thought it is expensive! It gnaws away your investment.

Hi Juan! Probably you are in your early policy years. As you reach the end of the accumulation period (10 years), you will notice that charges will drop significantly. It will allow your plan to breathe as it enters the investment growth period. I hope it appeases your mind.

Sir Federico,

Good day! I just want to ask which insurance companies with VUL have a good performance in terms of their investment.

Thanks.

Al

Hi Alvin. As of now, I don’t have the data about that. But considering of having a post regarding it just in comparison of how the investment funds of each insurance companies perform thru the years. The only thing that makes me wonder is that VUL is not an investment plan so even if the performances of investment funds of each company differ in terms of returns, point something difference, it should not weigh more compared to the insurance protection it offers. The focal point of the VUL plan is life insurance protection. Thanks 🙂

I saw tour Article on the best insurance in the Philippines. Excellent information. Do you have similar article on the best HMO in the Philippines? Thank you.

Hi Ruscelle. Thanks for the kind words. As of now, I don’t have a post regarding the best HMO in the Philippines. But I will consider writing about this once I’m finished with my list for this year. Thank you 🙂

Good day! I want to inquire about sunlife vul im 30 yrs old non smoker

Hi Camille. Thank you for showing interest. I’ll email you for additional info. Thanks 🙂

im interested.

Hi Marlon. Thank you for showing interest. Let’s talk thru email. Thanks 🙂

Can you give me quotation or details for educational plan.

Thanks.

Hi Jeffrey. I’ll be more than happy to assist you. You may kindly read my blog post about educational planning by clicking here.

You can also request for a proposal on the bottom part of the post. Thanks!

Hi , gusto ko po sana kumuha ng insurance, payable in 5 years, and pwedi mwithdraw after 10 years. Any details please.

Hi Shalyn. If I may ask, what’s your purpose of getting the insurance? Is it for life insurance coverage or as an investment? Basically, if you plan to withdraw after 10 years then your life insurance will cease. If it’s just a partial withdrawal then you can do that anytime. I’ll be proving you a link you can read. But I still suggest you meet agents to have your options discussed you may have a different view of what you are actually planning to get 🙂

http://www.thewiseguyph.com/sun-maxilink-bright-build-educational-fund

Hi how can I apply for sun life insurance? Any FA can help me ?

Yes, any insurance agent can help you. But just like how you choose your insurance, you must also look for someone reliable and trustworthy 🙂

Hi.. Would like to know about insurance company not listed on top 10 to invest like Phil. International Life Insurance… Is my money is in good hand to them?

Hi Imelda. You may visit the website of the insurance commission. Thanks

Hi sir, I’m looking for a life plan for my parents is there a bracket of ages that should be considered in applying?. Can you help me and give me right proposal for it? Thanks, looking forward with your reply.

Hi Emily. We have life insurances available until age 70. Just let me know if you are interested. Thanks

Hi,im looking for life insurance and investment at the same time.pls send me the details and all its covered.thank you

Hi Zandra. I’ll send an email regarding your inquiry. Thanks!

Hi interested to enroll for VUL. Please share how. Thanks!

hi Christian. I’ll be sending an email. Please kindly check. Thanks!

Hello i want to inquire an educational plan for my two sons age 11 and 2, is this a joint educational plan or separate? Im here in saudi arabia…pls include also medical insurance and hospitalization for myself age 42.

Hi Anthony. You can get one or two so each one can have a separate fund. We can talk over email about this. I’ll be sending an email to you. Please kindly check it. Thanks!

Im interisted on this insurance for my family in the philippines can you please tell me how?

Hi Shin Seung. I emailed you about your inquiry. Please kindly check it. Thanks!

Hi Federico. I love your blog. It’s very informative and I’m very interested in Sun Life. As you mentioned Sun Life has been in the Philippines for 123 years. I humbly ask if you can email me some details when you are not too busy. Thanks a lot!

I’m an OFW interested in VUL please send details.

Thanks

Hi Sonny. Thanks for showing interest. I’ll e-mail you the details. Thanks!

Hi frederico, I am interested in sun maxilink prime. Could you send me a quote please?

Hi Charles. I just sent an email. Please kindly check. Thanks!

Hi. I would like to have an insurance and also an investment, and additional insurance for my future son. Thanks

Hi Criz. Thanks for your interest. You probably looking for a VUL plan. If you want some read please search Sun Maxilink Prime and Sun FLexilink in my blog they can somehow help you in picking the right product for you. But of course, you can also reach me thru my number posted above or email if you would like. Thanks!

Sir May I know the benefit of being a member of the Insurance like this?

Hi Rowena. Life insurance has many benefits you may kindly read some of my many articles about it and if you want to make clarifications you can send me an email. I’ll be waiting for that. Hope we can talk about it more. Thanks!

Hi! Ano po ba ang best insurance for my parents? Is it too late to get them one? They are 50 and 54 years old. Hope you can answer! Thanks!

Hi Denise. They are still in insurable age but of course, you must be ready to pay a higher premium compared to someone younger. I hope you get a plan for them the soonest while they are still healthy (crossing my finger that they still are). Thanks!

I want to open an account for life insurance. Can you help me?

Hi Maria! You may kindly message us to get started. Thanks!

Hi! I’m interested to get healthcare and life insurance. Can you explain to me more about it? I have four children.

Hoping for your response.

Thanks!

Hi Ester. I would love to assist. Btw, I sent an email to you about it. Thanks!

HI I’m Ofw want to learn about insurance for my self and my children…

Please guide me or assist about insurance because I don’t have idea to start it…

Hi Aleli. Please send us an email so we can assist you with this. Thanks!

Hi, i’m an OFW & i’d like to know more about insurance & benefits. I don’t really know much about insurance but maybe you can help me find the right one for me & my 11 year old daughter. Thank you

Hi Russel. I’ll be more than happy to assist you just send me an email. Thanks!

Hi. Can u sent me a quotation. I’m looking for a perfect life insurance for my future. This will be my firstime. can you pls Help and give some advice.! Thanks

Hi Arthur. Sad to say, there’s no such thing as a perfect life insurance policy but we can help you in getting the best suitable plan that can answer your needs. Please kindly email us. Thanks!

Hello,good day,im interested to know and to have insurance…i am ofw can u pls guide me in choosing the best insurance that suits me.thanks..

Hi Vanessa. Yes, of course. We can keep in touch on email. Thanks!

Hi Sir,

I would like to have an insurance with investment, retirement, health & emergency.

How much would it cost?

Thanks & Best regard

Hi Ruth. That I can’t answer as what you just said is very generic and vague. I suggest you meet an advisor so he can help you out with your concern. If you are just around Manila then I can help you out with regard to this. Thanks

Hi Federico,

Thank you for sharing your post. As an OFW especially in the Middle East where there are no any pension plan or investment opportunity for us and working for almost half of my life (I am 46 by the way – started working as an OFW since I am 23). Regretfully, I am not wise enough to invest and wasted those years. But I do believe, its better be late than never. So, in my situation, I need to decide now to invest in Life Insurance. By the way, my wife is an OFW also and we acquire for her insurance with BPI-Philam Life (under VUL) just this year. My mistake is that I am older than her I should get first… anyway, I plan to get insurance under SUN LIFE and my objective is that I need it for pension and investment as well. So I need from you what type of insurance policy I need for that matter. By the way, we don’t have kids yet, just for reference.

Appreciate your support and guidance. God bless your heart for educating us OFW for Financial Literacy. Its a great help for us.

Joel Lansang

Doha, State of Qatar

Hi. Just want to know about contribution, insurance, and investment. And if meron ung covered ang health benefits and educational fund. Or whole life insurance details please. Thank you

Hi Kim. Please send us more info at my email add it’s federico.l.suanjr@sunlife.com.ph. Thanks!

Hello! Gusto ko po insure yung mama ko po. She is 64 years old. Gusto ko is medical cover plus critical health cover and meron din po for funeral cover available and roughly how much do I need to spend.

Many Thanks in advance

Hi Soheila. We do not cover funeral expenses. However, proceeds of the plan can be used for that. She is still insurable but she may be required to undergo medical tests to prove her insurability. At her age, it’ll be costly and will depend on the insurance coverage, health condition, and inclusions in the plan. If you’re interested. Please send me an e-mail. Thanks!

I want to inquire family health insurance.

Hi Marou. I’m afraid, you are referring to an HMO. Thanks!

Interested to know about SunLife’s insurance package for my 12 yr. old kid. – rene calantuan, 0915 273 2812

Hi Renato. I already sent an email to you. Please kindly check. Thanks!

Hi I just want to inquire about Life and health care insurance and how to join?please let me know thank you

Hi Criselda. You may get your insurance plan from a licensed insurance agent from the company you trust. If you think it’s Sun Life then I can assist you with that. Thanks!

Hi. I am interested in getting a life insurance with investment, I will be grateful if someone will assist with this matter.thanks.

Hi Griezelle. You may read some of my articles about the different kinds of insurance we have in Sun Life. If you are having a hard time in choosing, I can assist you with that but only after personal discussion. Thanks!

hi!

i would like to have an insurance and also an investment at the same time. is it possible with sun life? thanks

Hi Flora. You are referring to a VUL plan. We have that in Sun Life. If you want assistance with regard to that you may reach me thru phone call or e-mail. Thanks!

Good day,

I would like to ask if there’s any life insurance company that will still allow me to purchased or avail a life insurance for my mother? She’s 75 years old this year.Thank you.

Hi Ms. Tessa. Sorry to say we don’t carry such insurance. I don’t know if there’s any insurance company that will still ensure in view of her age. That’s why it’s highly recommended to get it while young and healthy. I hope she’s still doing fine. Thanks!

Hi Sir, appreciate if you can give me advise or details for the future of my family. I want to have life insurance also, for retirement, savings and investment, educational plan, health coverage. Thanks in advance!

Hi Dianah. Btw, there’s no such insurance plan that can address all your concern all at once. They can touch several minor concerns but only one major concern. In your case, you have a family that depends on your income so instead on focusing on retirement at this stage you may consider getting an insurance plan as a health protection plan or income replacement plan. This will ensure your future if you get badly sick that money won’t be a problem for your rehabilitation. Or if you die too soon (sorry it’s kinda morbid but it happens) your kids can still continue the life they are enjoying today.

If you are interested in it, you know where to reach me. Thanks!

Hi Federico. I’m interested on the life insurance. Can you email me the options sunlife offers. I’m an OFW. Thanks.

Hi Keith. Thanks for dropping by. I’ll surely contact you at the soonest time. Thanks!

Hello, I don’t have any idea about life insurance also but I would like to know more. I would like to know about health protection, or maybe building an educational fund for my future kids and retirement fund. I am also interested for Insurance that has investment. Please email me for more details, please.

Hi Key Zee. You may want to read our article about Sun Maxilink Prime. It seems like it’s the fittest to what you like. If you have further questions about it please let me know. Thanks!

Hi, can u send me details pls… I’m interested in financial freedom, retirement benefits, life insurance as well as health assurance.

Hi Gay. If you are looking for a comprehensive health insurance plan, you may consider getting a Sun Fit and Well from Sun Life. Please follow the link below for your reference. Thanks!

http://www.thewiseguyph.com/sun-fit-and-well-comprehensive-plan/

Hi! Can you give me details, please? Thanks!

Hi Adi. May I know what kind of details are you referring to? I’ll keep in touch with you thru email. Thanks!

Hi, can u send me details pls… I’m interested also want to have a better future and financial freedom and for retirement.

Hi Jun. I’ll be reaching out via email. Please kindly check. Thanks!

Hi sir, I really need an investment just to have a higher interest. Just to have a higher return for my money. What would you suggest? Thanks

Hi Rald. I want that too, higher interest rates. If your goal is to make your money grow then you may consider a mutual fund, UITF, the stock market, etc. However, I don’t recommend it if you haven’t had an insurance. Make a solid financial footing first so you can have a peace of mind no matter what happens to you and/or your investment/s. Thanks!

Can you send me details please?

Hi Grace. Do you have anything specific in mind you want to know? Thanks!

Hi! I am interested to get life insurance. Can you send the details to my email? Thanks

Hi Choi. I’ll certainly will but do you already have a specific plan in mind? If none, you may kindly state your needs so I can give you options. Thanks!

Hi Federico, please enlighten me. Thank you!

Hi Ms. Reil. You may request a personal discussion about this but for now, you may browse our blog for topics that may interest you. Thanks!

Hi! Can you please send options for me in getting life insurance, accident, hospitalization and investment? Thanks

Regards,

Glenn

Hi Sir Glenn. I believe you are talking about a VUL plan. I highly recommend a Sun Maxilink Prime plan. If you want, you may request a proposal by filling out the form. Just click the request proposal tab on the main menu of this page. But I highly recommend a personal meeting to further assess your needs to see if this kind of plan really suits you. Thanks!

Hi! Can you please also write on about getting life insurance, accident, hospitalization, and investment? Thanks

Hi Joy. I already have a line up of things to write but will put your request on my list. Thanks 🙂

Sir,

I am an OFW and I want to know more about the products of SUN LIFE.

I want to secured my health and also save at time.

Hi Ms. Desiree. I recommend a Sun Fit and Well plan if you are looking for a comprehensive health insurance plan with an endowment benefit then this plan is perfect for you. Thanks!

READ: http://www.thewiseguyph.com/sun-fit-and-well-comprehensive-plan/

Hi, sir, I want to know more on Sun Life insurance especially VUL. Can you give me all the information on this? I am an OFW aged 56.

Hi Sir Benjie. OFW’s can get a VUL plan from Sun Life but application form must be signed here in the Philippines. You may consider getting one when you take your vacation. Don’t worry, my line is always open for inquiries. Thanks!

Hi sir I want to know more about Sunlife Insurance,I a.m interested,can you Help me?thanks

Hi Sir Arvin. You may send me an email at federico.l.suanjr@sunlife.com or you may call me at 0917-775-8352. Thanks!

I am a 59 yrs old OFW, What is the best investment for my age? I already have a VUL from BPI Philam. I’m planning to add another investment.

Hi Milan. You may consider getting a SPVUL from us. Thanks!

Hi,

I am an OFW and I am interested to get a VUL for husband as I already have one for myself. Can you tell me what is the best investment option for VUL can you suggest? I prefer something that is for long term growth. Hope to hear from you soon.

Thanks

Hi Yang. If you are looking for a long term invetment option then I strongly suggest Index Fund. But on actual, you must based it on your age and goals. Are you currently here in the Philippines? If yes, we can schedule a personal discussion about this. Thanks!

Hi,

Would like to know more about the offers from Sunlife. Please send me an email. Many thanks!

Hi Joseph. Thanks for reading my blog. Please kindly check your email. Thanks again!

Hello sir! Would like to know more about the VUL of Sunlife. And what are the benefits and inclusions and magkano po ang monthly. Very much interested.

Hi Ryan. Thanks for your interest. You may want to read our articles like Sun Maxilink Prime to better assist you. Thanks, again!

Hi! Good day! I would like to know more about insurance. I have a baby on the way and I am really looking for ways on how to wisely invest for me and my baby’s future. Thank you. 🙂

Hi Ms. Melissa. VUL plans like Sun Maxilink Prime from Sun Life is one of your best picks when it comes to building the educational fund for your baby’s future. If you are interested you may send us an email or contact us at anytime. We will be more than happy to assist you. Thanks!

I would like to make a quote for sun maxilink prime , if u hv terms 4 5 yrs,10yrs and 15 yrs. Also a quote for a 4 months old baby and 2 yrs old, also 35yrs old.tnx

Hi Ms. Jelyn. I’ll send an email with regard to your request. Thanks

Hello sir! Would like to know more about the VUL of Sunlife. And what are the benefits and inclusions and magkano po ang monthly. Thank you po.

Hi Ms. Jhonaika Faye. The premium will depend on a lot of things and the riders you may want to add to your policy. I do highly recommend to attach as many riders as you can as this will maximize your protection which is the main purpose of an insurance. Thanks!

Hello Sir. I would appreciate if you could give me more details about life insurance by Sun Life.. Do you offer non-life too?

Hi Jane. We do not have non-life insurance. May I know what kind of insurance you are looking for or the things you what to have in your policy. This will help us in determining the most suitable plan for you. Thanks!

please give me full details. thanks

Hi Reynaldo. You may read and browse my blog for full details. If you have questions. You can reach me thru my number or email address. Thanks and have a wonderful day!

Hi, Sir. I’m interested to apply for insurance and investment in Sun Life. Is it possible to avail of these two plan at the same time? Also I would like to know more of your offers. Thank you very much.

Hi Gie Ann. Yes, actually you are referring to a VUL plan. I’ve seen your request and thrown an email. Please check it out. I’ll be waiting for your response. Thanks 🙂

interesado po ako sa insurance. And taga Las piñas po ako. Pwede malaman mga benefits

Hi Ms. Hazel. Benefits will be different for each plan. Saan po ba kayo mas interesado? Yung insurance lang or yung may investment na po ba?

I’m interested having an insurance but I am afraid. I find it risky.

Maybe because I have a little knowledge about it. I’m 22 y/, I want to secure my future at early age. Any help you can give is very much appreciated. Thank you.

Hi Kristin. Insurance itself is guaranteed thus it’s not a risky thing. Maybe you are referring to investment because all types of investment have inherent risk. You just must learn to manage the risk. Thanks!

Hi. I am interested in getting a life insurance with investment. I am turning 23 this year and this should be my birthday gift to myself.

Please help me.

Hi Louie. You may consider a VUL plan in your case. You get to financially secure the future of your family plus you get to enjoy its high earning potential. Please read Sun Maxilink Prime. I have a blog post about it. Thanks!

Hi, i am interested in getting an insurance with the investment plan. I am so confused which one i need. can you please help me?

Hi Isha. Getting your first insurance is really tricky. You must first identify your needs. Why are you getting an insurance policy? Is it for income continuation, health protection, or maybe you are building an educational fund for your kids (just in case you have any), retirement fund, or planning for your estate already? After identifying your needs/plans you may now consult a financial advisor to properly guide on what to choose. Just in case you want me to help you, I’m just a call away. Thanks!

Hi! I’m interested on how an insurance plan works, however I don’t know where to start. Can you please enlighten me. Thank you and God bless!

Hi Kate. Insurance is a broad topic but you may read some of my posts to enlighten you. Thanks!

I am an OFW. I want to know more details about Whole life and Universal Life Insurance. Thank you.

Hi Marigold. I have posts about that and I’m happy to share it with you. You may visit our homepage then click on the topics under whole life and VUL plans. This will greatly help you in choosing the right plan for you. Hope we can me and discuss your chosen plan the soonest time. Thanks!

Hi, I’m interested to know more about sunlife investment and insurance plan. Can you send a detailed presentation or briefer to me. Thanks!

Hi Ma Cristina. Thanks for visiting my site. You may browse my articles to learn more about insurance plans from Sun Life. Thanks!

Hi, I’m planning to have a life insurance for me and my wife. Don’t know where to start. Can you assist us? Thank you.

Hi Mikol. Thanks for visiting my blog. I hope enjoyed reading some of my articles haha. It’s always a pleasure to assist readers in getting their insurance plan. I’ll send an e-mail to you. Please kindly reply on it. Thanks!

Hi, I would like to know more your product as I’m interested having my Life Insurance.

Thank you!

Hi Sir Andrew. I just saw your e-mail to me. I’ll respond to it shortly. Thanks for visiting my site. Btw, you can also browse my blog posts about the different kind of plans we offer. Hopefully, we can meet the soonest to discuss the best plan for you. Thanks again.

Hello, I would like to know more and I would like to ask if its cover all the expenses such as medical, accident and etc. Please email me for more details, please.

Hi Ms. Lovely. I’m afraid you’re referring to HMO. Sun Life doesn’t have that. However, you may consider getting a Sun Fit and Well Advantage as this is the most comprehensive health protection from Sun Life.

Please read: http://www.thewiseguyph.com/sun-fit-and-well-comprehensive-plan

I’m determined now to start investing in the near future and beyond it. Here’s the Sun so, I’m good to go! Just let me know how to start this.

Hi. Thank you Sir for choosing Sun Life. We are happy to know that you’re ready to start doing forward. Please check your inbox. Thanks!

I would like to know more po. Pls email me…thank you

Hi Joey. Thanks for dropping by. Looking forward to personally discuss the plan with you. Also, please check your email 🙂

I need to know about pension plans

Hi Mon. Sadly, Sun Life does not offer pension plans but you may consider getting a whole life plan with endowment benefit like Sun Smarter Life Elite. With this, you will receive guaranteed payouts after surpassing a certain number of years. Please check it out. Thanks!

Here’s the link: http://www.thewiseguyph.com/sun-smarter-life-classic-and-elite/#sun-smarter-life-elite

Hello, I don’t have any idea about life insurance but I would like to know more. Please email me for more details, please.

Hi Anne. Most of the things you need to know about our product/plans are already here on my blog. Please do read some of my articles about it. Btw, I sent an email to you. Please kindly check 🙂

I need presentation. I have no idea how to deal with.

Hi Ernanie. Please kindly check your email for more details. Thanks!

Hello I’d like to Inquire about the Life insurance for my family in the Philippines

Hi Joan. Please kindly e-mail us with your concern so we can help you. Thanks!

Interisado po ako sir how to start po salamat

Hi Jay-r. I’m glad you’re interested to get started. Please do check your email. Thanks!

Can you send me the details, please?

Yes, of course. You may also check my website for more information on the plans 🙂

Hi, Im inquiring about the life insurance such as, the contribution, medical expenses, accident and others covered on the policy.

Hi Eliasa. Thanks for your interest. Let’s make the convo private because I’ll be needing some personal info about you to give you a clearer understanding of the plan.

good day,

i am an OFW, i am only inquiring about the life insurance such as, the contribution, medical expenses, accident and others covered on the policy. i am interested to open an insurance life policy for my future.

thanks and best regards

jaime

Hi Jaime. Thanks for your interest in securing your future. I removed some personal info in view of your safety. Please expect an email from me. Thanks!

Hi Federico,

We need a quotation for annual life insurance renewal. Could you please send me an email so we can share the information ASAP and get the quotation?

Thanks!

Hi Nohemi. Thanks for reaching out. I’ve sent an email please kindly check it.

I am Filipino with US citizenship and I work in New York. I would like to get a life and fire insurance for my young family here in Philippines. Thanks Paul!

Hi Paul. Good to know that securing your family is your priority. You may need to look for a life insurance company and non-life for your fire insurance. Thanks!

Hi Federico. Good morning, I m looking forward to getting insurance, can you recommend a good insurance company? Thanks. Hope you will reply to my email.

Hi Kenneth. Good to know that you are in search of an insurance plan. You know, all life insurance companies offer the same product. And I will be biased since I am from Sun Life. But you may choose any from the top 10. Let’s talk more about it over email. Thank you 🙂