Latest Update: June 21, 2023

As a millennial, I never thought about life insurance. My mindset back then was different. I’m still young and healthy, so I don’t need it yet. Just like you, I’m living the now; millennials call it YOLO (You Only Live Once), and others call it “carpe diem” (seize the day). But whatever term we use, what’s certain is that we tend to focus on the present and little about the future, right?

Table of Contents

How Did I Become a Breadwinner?

But for me, things changed when my father died. His sudden demise has helped me to become the person I am today: practical and wise. As I became more discerning about finances, I got an insurance plan from Sun Life called Sun Maxilink Prime. First, let me share my story, and we’ll discuss it later.

READ MORE: Top 10 Life Insurance Companies in the Philippines

If you want to skip the story and proceed to the benefits of Sun Maxilink Prime, you may click [HERE].

From YOLO to WOLO (Weeping Over Lost Opportunity)

My father died in 2015. It was just a year after I got my license as an engineer. I enjoyed one year of vacation before working. And I’ll give you all the right to ask me why? Maybe it’s because I know my father will support me no matter what. But unexpectedly, when I was ready to give my all in my career, he died just a month after I started working.

It made me realize that we cannot control things, and time will not wait for anyone.

I can still remember it vividly. It was dawn, cold, and raining when I heard a loud voice from his room. So I immediately rose from the bed, checked on him, and called an ambulance to rush him to the nearest hospital.

After the CT scan, the doctor broke the news that he was suffering from a stroke; he might leave us soon.

While sobbing, I’m still praying for miracles. Being a son, I am still hoping he’ll get better. I have so many dreams for the family, and I don’t know how to continue them without him.

My Life After the Tragedy

I was only 23 at that time. You know, it’s sad to even up to this day. I don’t have a choice but to move on and suck it up. My Lola and siblings are now depending on me.

So from being careless, I have become careful. It’s when I can no longer do the things I previously enjoyed. I have been so focused on providing for the needs of my family.

But even if they are my family, there will be times when I want to give up. It’s simply too much for a 23 years old guy to cope with this kind of responsibility.

And then, I realized two things.

My family suffered 2 kinds of death.

We don’t just lose a father. We also lost the income he provided us.

So it leads me to think that this problem might have a solution.

Sabi nga nila “Sa bawat problema may solusyon.” Pero ano? Paano? So many questions are running in my mind. I need to find the answers.

I must prevent this from happening again to my family.

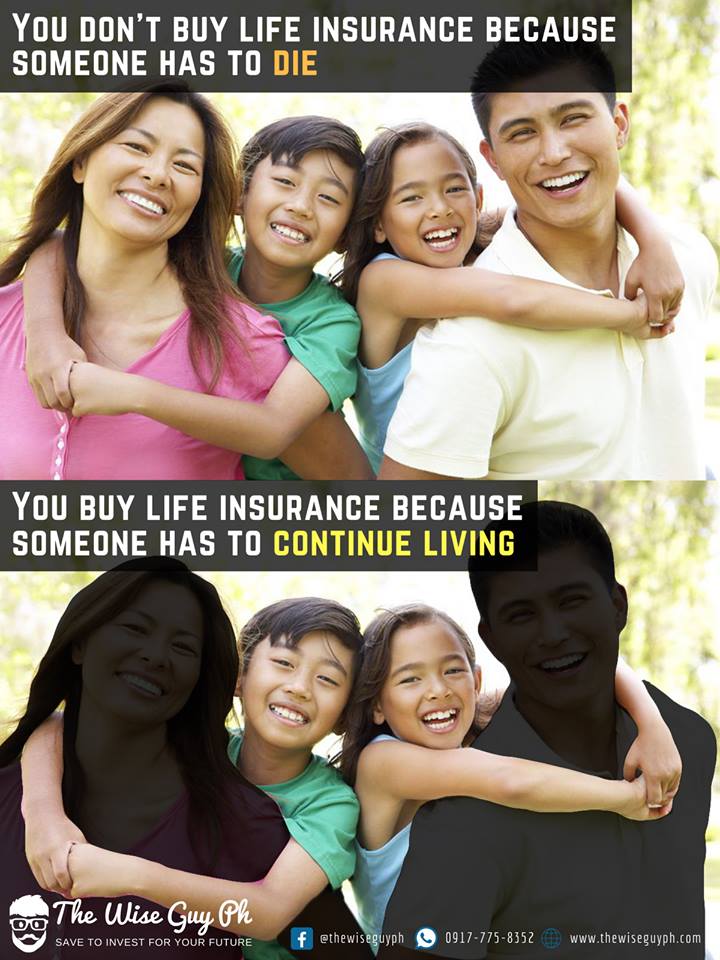

Why Life Insurance is Important?

But what if there’s a way you can do to prevent this from happening to your family? Your child taking up your role.

Somehow, I believe I was just lucky, in a way, because my father died after I landed my first job.

I can’t imagine if it happened when I was still studying. I might quit schooling and take a job I don’t want to do.

One thing is for sure.

I don’t want my family to suffer the same fate.

Thus, I must do something to prevent it, and luckily, I met someone who showed me how to address it by getting life insurance.

I initially thought to buy term insurance and go BTID (Buy Term Invest the Difference) because I’m already invested in stocks. But there’s something with a VUL (Variable Unit- Linked) plan that struck my heart.

So here’s why.

BTID strategy is NOT for everyone. It is merely a strategy and not an insurance plan. If you want to know about it, you may click [HERE].

Sun Maxilink Prime: Life Insurance with Investment Plan

It’s been months of countless research until I decided to go for a VUL plan from Sun Life called Sun Maxilink Prime. Like you, I wanted to get the BEST plan based on my needs to address my worries.

This plan is life insurance with investment components. Wherein my investments will be in a similar form of mutual fund in which I can choose between stocks or bonds, or both.

READ MORE: Mutual Fund 101 | Sun Life Prosperity Funds

What I love about Sun Maxilink Prime is the financial security it gives my family while growing funds.

It covers death, so my family can get a reasonable amount to continue their dreams. I can get something if I get into an accident and become disabled or lose parts of my body. If I get critically ill, the insurance company will give me the promised amount, which I can use for my treatment.

On top of that, I get to have a growing fund that I can use to fund my dream business or have a blissful retirement. Or simply something I can look forward to receiving.

I know it makes you feel excited, right? I also felt the same feeling when I heard it the first time.

Sun Maxilink Prime Sample Proposal

Sun Maxilink Prime is a VUL plan you can pay for at least ten (10) years. And you can increase its fund value by regular top-ups or excess payments.

Just note that Sun Maxilink Prime and your investment are linked, which makes it susceptible to volatility. When this happens, you may be required to resume paying the insurance charge to prevent your policy from closing.

Now, I will share with you the proposal I made for myself.

Federico Suan, Jr., Male, 25 yrs old, non-smoker

Annual Premium: Php 38,465

Semi-annual: Php 19,232.5

Quarterly: Php 9,616.25

Monthly: Php 3,205.42

Daily: Php 106.85 (just the price of a fast-food combo meal)

Annual payment are the most recommended. People tend to forget to pay their dues. By going annually, you don’t have to pay it frequently. Furthermore, it will help the investment fund grow faster because the entire investment portion is invested at the start of each policy year.

So going for the annual mode means you are giving your money more time to compound.

You can choose between annual, semi-annual, and quarterly. Monthly payments are only available when you pay using the auto-debit arrangements.

Let’s Talk About Life Insurance Benefits

My plan was a bit pricey for a young professional, It was because I wanted to be well covered. Anyway, your plan will be tailored to fit your needs, and if you feel you can’t afford the recommended plan, you can ask your Financial Advisor to adjust it to your liking. It’s better to start small than never to start at all.

Life Insurance Coverage: 1 Million Pesos

It is the amount of money my family will get if I die due to an accident, illness, or natural cause. I will leave them peacefully, knowing that they will receive this amount. I know no amount of money can ever replace me, but they still need to move forward. Hopefully, my brothers will use the money to finance the needs of my Lola.

Total Disability Benefit (TDB): Waiver

It is a rider (optional) that can be attached to an insurance policy. If I get disabled and can no longer work, this rider will waive the premiums. It is as if I am still paying for my plan. Though optional (it only costs less than a thousand pesos a year), I consider this a MUST-have rider in any life insurance policy.

Accidental Death, Dismemberment, and Disablement Benefit (ADDD): ₱500,000

My family will get this amount if I die due to an accident, together with the basic life insurance coverage, so the total death benefit is ₱1.5 Million. If I survived the accident but lost any part of my body, I would receive a percentage of my ADDD coverage. For example, if I lose one eye, I will receive ₱250,000 (half of my ADDD). If I am disabled (can no longer work due to accidental disability), I will receive 50,000 pesos per year for ten (10) years, for a total of 500,000 pesos.

Critical Illness Benefit (CIB)*: ₱2 Million

I can claim a lump sum of ₱2 Million when I get diagnosed or treated for any of the 36 critical illnesses listed here. This rider covers the most common illnesses in the Philippines, like stroke, heart attack, brain tumor, major organ transplant, and invasive cancer.

*Please note that the premium for CIB and HIB continues after 10 years. And as for CIB, premium increases every 5 years.

I love this rider because my father died from a stroke. Though it’s not hereditary, we must still think of the future. And yes, I may be healthy today, but I’m not sure about the future.

Hospital Income Benefit (HIB)*: ₱2,500/day (1000 days maximum)

I will receive ₱2,500 per day when confined to a hospital due to sickness or injury. It doubles to ₱5,000 if I get admitted to ICU or admitted due to any of the following dreaded diseases: acute heart attack, chronic liver disease, dissecting aortic aneurysm, end-stage lung disease, end-stage renal disease, invasive cancer, major organ transplant, multiple sclerosis, poliomyelitis, progressive muscular atrophy, and stroke.

Investment Benefits

I will only pay a total of ₱384,650 for all the benefits listed above.

But what if I am lucky not to die early, get disabled, or be hospitalized?

Total Premiums Paid: 10 x ₱38,465 = ₱384,650 ONLY

(Suan, parang lugi ako kapag nagka-ganyan?)

Don’t worry because a VUL policy has an investment component (the much-coveted living benefit) designed to give you financial protection while giving you a growing fund.

If the investment is in the Index Fund, composed of top publicly listed companies in the Philippines (i.e., Jollibee, Ayala, SM, San Miguel, URC, BPI, etc.), The average historical return is around 8% p.a.

It is not guaranteed because past performance will not necessarily indicate the future result.

There are several funds you can choose from the plan. They will be explained further by a financial advisor.

Projected Fund Value

The projected fund value at age 45 is ₱848,275

The projected fund value at age 55 is ₱2,181,982

At age 65, it is ₱5,642,255

Withdraw against the fund value anytime without charges or interest, unlike other types of insurance. Also, a VUL policy is less likely to lapse for as long as the fund value is enough to cover the insurance charges.

The accumulated fund value can be used as an educational fund for your kids, a retirement fund, an extra health fund, or to fund your life goals, etc. You have the freedom to choose whatever you want to do with your investment funds.

(You may think life insurance was just about death benefits. There is much more you can gain if you avail of a VUL policy.)

Exactly! VUL is more than just life insurance; it combines income protection and investment opportunities for every Juan.

Why choose Federico to be your Financial Advisor?

- Young professional. Picking a young Financial Advisor means he can grow old with you. It is a lifelong commitment, and he is ready to serve.

- Friendly with the utmost professionalism. He won’t give you that ultra-silent awkward moment when meeting up—no dull moments. He ensures an enjoyable and factual meeting.

- Reachable. You might have a sudden question that’s crucial to you; that’s why his lines are always open to attending to your needs.

- Well-trained Financial Advisor. He attended several training and seminars inside and outside Sun Life to upskill himself because you only deserve the best.

- Needs-based financial solutions. His financial advice is based on your current financial situation and needs.

- Non-discriminating. His clients range from minimum wage earners to engineers, accountants, doctors, lawyers, company directors, etc.

- Full-time Financial Advisor. He can focus on your needs and assist you with any transactions or updates on your account.

- Purpose and substance. His mission is to help clients achieve lifetime financial security and healthier lives.

To all Financial Advisors like us, we treat life insurance as LOVE insurance. Because when you love someone, you want to give every protection you can to ensure their safety and well-being.

I hope you enjoyed my blog!

Inquire Now!

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in-person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

96 thoughts on “Sun Maxilink Prime: Life Insurance and Investment You Need”

Hi Federico! I would like to ask what policy is fit for me, 34 yo. Only child still single, my dad died already, so it is just me and my mom (63yo). I’m confused to what policy fits for me and my mom?

It depends. It’s always best to talk with an insurance agent to assess your needs. Just let me know if you want to schedule for one 🙂

Hi, Federico!

This blog is very informative. I am planning to get the same plan – Sun Maxilink Prime. I just noticed that the amount coverage is different than what was quoted to me. Does it really vary? Or the plan coverage is the same to all?

Female, 25, Non-smoker and was advised my monthly premium is 2,500; HIB is 700 only.

Thanks, Emma, for the kind words.

Yes, the coverage may change depending on your age, budget, and several other things.

Hello! I’m in my third year under this plan but I’m not satisfied with the performance of my Advisor, is it possible to change?

Yes, but is it irreconcilable differences? Hopefully, you can sort it out 🙂

Hi Mr. Suan, I am 47years old OFW and no insurance. My husband 52y/o and a 10 y/o son. Gusto ko sanang mag-apply ng insurance VUL sa Sun Life. May chance po ba to apply online? Pwede po bang maka kuha ng quotations. I am confused if I need to apply also for my husband and educational plan for my son. I don’t know how much money needed if I Include them. Thanks for your blog.

Yes, you can apply for insurance and I’ll be more than happy to help.

However, while it is allowed to get insured online, cross-border selling is still not allowed.

Hi Sir Federico,

Would like to ask what will happen if my monthly premium is 2000 but I will pay 2500 or 3000 which is higher than my agreed premium. What is the effect of this on my fund?

Yes, anything you pay in excess of your annual premium is added to your investment fund.

Hi Sir,

Possible po ba pag nag apply ako ng insurance for my live in partner pero hindi kami kasal and hindi pa sya annulled but ako po ang kanyang beneficiary and our 4 kids

Sadly, you cannot be a beneficiary because of legality. However, your kids can be the beneficiaries.

Hello.

I would like to request to pls expound the idea/statement written in your site about sun life maxilink (it’s a little bit confusing):

The premium for this rider increases every 5 years. After the paying period, the accumulated investment can shoulder the annual premium for this rider or you could pay it annually instead so that your investment could not be touched.

Hi Elvie. I find it confusing too, so I have updated the contents 🙂

Just to add, the premium for CIB reprices every 5 years to a new and higher amount. It is because we become more prone to illnesses as we age.

As a client, you can do a premium holiday after 10 years. If CIB and HIB are attached to your plan, you may not pay for it after the 10th year. However, the charges are still there and it will be deducted to your fund value. (It’s more advisable to continue paying for the plan so your fund value will not suffer.)

I hope it’s clear now. Thanks 🙂

Hi Federico, we are currently under maxilink prime me,my husband and my 5 yr old kid . Its been a year , but our financial status can no longer Sustain paying the premiums 200,000 annually for the 3 of us . Were planning to cancel the policy but i guess we cant get anything back from the paid premiums . Can we just withdraw all the money in our fund value ? Which means the Policy will be terminated also am i right ?? I already talked to our FA But i just want to hear It from another advisor …. I”ll appreciate your help thanks 🙂

Hi Mallette. It’s sad to know that you are contemplating surrendering your plans with us when you need it most at this time. Just like you have said, you can no longer sustain your premiums now, do you see yourself not being able to pay for it like in the next couple of years? You know, you have an option to only pay for the insurance charge so you can still keep the policy. If it’s not an option for you, then I think it is time to surrender it.

Yes, you are correct that you can only get the fund value of the policy (not the whole premiums paid). It is because of the insurance charges have already been deducted from your initial payment. Also, surrendering your policy at this time will actualize the loss incurred due to the market downturn.

I’m still hoping you keep the policy.

Thank you and keep safe 🙂

Hi Federico. Is it possible to pay the annual premium on a monthly basis? So that I can finish the plan in 10 months.

Hi Lydia. That’s a very good question you have there. Yes, the plan is flexible. You can finish it in less than 10 years or whichever works for you. I have a few clients who finished their plans in a year or two. So you can do that with your plan too.

I hope it helped you 🙂

Hi very interesting. can you explain how they compute the FUND VALUE? is that the earnings for the investment? If I completed 5 years paying for the premiums . How much is the estimate earnings for the MAXILINK PRIME for 500K insurance coverage? how about after 10 years how much is the FUND VALUE? Thanks.

Hi Ryan. We’re glad it caught your interest. Just to answer your questions, Fund Value refers to the value of your investment. At some point, it may include the earnings but not at the earlier years of the plan.

It is still an insurance plan, so even after 10 years, it may not accumulate much earnings. This plan is something you should consider if you are any of the following:

1. Breadwinner

2. Millennial

3. Newly married

4. A gift to your kid

Or maybe someone who doesn’t own insurance yet that would like to get something from the plan (living benefits). In this case, it’s the Fund Value.

The plan is created as a long term plan. So 10 years, may not be enough to see the growth of your total premium paid. Here’s a link to how a VUL plan earns.

READ: Sun Maxilink Prime | 3 Easy Steps to Secure Your Future

If you want an investment plan, you may consider our Mutual Fund.

READ: Sun Life Prosperity Funds | Mutual Fund 101

Thanks and keep safe from COVID-19 🙂

Hello Sir Federico,

I was so amazed by this Sunlife Maxilink Prime: VUL.

May you please send me a quotation po. I am 25 years old.

Thank you and Have a great day,

Hi Jonna. I’m glad you are interested in getting insured. I would love to connect with you, probably to discuss this and see if there might be options. If you need a quote to review, please kindly fill out the form above. Thanks 🙂

Hi Federico,

I have a Flexilink account and I think I have completed the 10yr payment of quarterly premiums. What to do next? If I stop paying the quarterly premium, am I still entitled of the face amount ?

Is there any certification that I completed the payments?

Sorry Im quite lost. ?

thanks in advance

Hi Angelvm. You may ask assistance from your advisor for this or call the Sun Life client care hotline. Thanks 🙂

Sir,just joined as a financial advisor,I would love to attened an incoming training or seminar you will hosted. Impressed the way you answer questions and inquiries,Impressive.?

Hi Alhen. Thanks for the kind words. It’s very seldom that I conduct training but just in case I’ll do some in the future I’ll post it on my page and blog. Looking forward to meeting you soon. All the best with you 🙂

Hello Sir Federico. For VUL products, how many percent allocations for insurance and then investment?

For example, my premium quarterly is PHP6000.

Thanks!

Hi Jnz. It will vary per VUL Plan and riders attached to it. This is best discussed in person as it may get too technical that you may lose your interest hehe. Kidding aside, if I can be of help just let me know. I’ll be more than glad to help you get things started. Thanks 🙂

Hi Sir Federico, question lang.

Kunwari po after 10 yrs, namatay yung insured, ang makukuha po ng beneficiaries nya ay yung death benefit saka yung laman ng investment?

Tama po ba?

Thanks

Hi Izza. Tama ka diyan. Kahit na wala pang 10 years yung plan miski 1 year pa lang makukuha na din siya ng beneficiaries. Salamat 🙂

Hi Federico. I have a question. How long is the Php 1 Million life coverage? Does it still apply after the first 10 years?

Hi Mark. The life insurance coverage is until age 88 starting from the policy approval date. Thank you 🙂

Hi Sir Federico, Pagnatapos na po yung 10yrs napagbabayad with benifits of CIB at HIB. Magkanu po ang benefits for annually?

Hi Jamar. Yung mga benefits ay magsisimula agad kahit di pa nakaka sampung taon. Maganda ito na upuan para mas maipaliwanag ng mabuti. Salamat 🙂

Hi sir ask ko lng po after 10 years po b magkano po makukuha sa investment Plano ko po Kasi pag nag 25 n po ako kukuha po ako Ng plan na kagaya sa inyo.

Sadly, it doesn’t work like that. Investment growth can only be seen after 10 years. We have a video about it. You may refer above 🙂

Hi Federico,

I’m an OFW and I’m interested in this product. Can you please send me a quotation?

Thanks,

Meron po ba after 5yrs or 10yrs pwede na iwithdraw in cash kung sakali hindi maccident or sa health

Hi Cammille. You are not supposed to get the money after the paying period if you want to keep your insurance coverage. But if you think and you are already happy with your gains then you may do that. Thanks 🙂

Im already 58 years old pwede pa ba ako ma insured

Hi Mr. Ferdinand. Yes po pwede pa po kayong kumuha ng ganitong insurance. Send po ako ng email so we can talk about this more. Thanks 🙂

Hi. Almost 40. Starting from scratch financially. What product is best? Will be upfront, can only afford minimum.

Hi Patrick. Good to know you are interested in this because it’s never too late. The plan will depend on what area/s you would like to focus on. If you are interested, please hit me up on my email it’s federico@thewiseguyph.com or federico.l.suanjr@sunlife.com.ph. Thank you 🙂

Hi Suan, may question po ako.

1. After ko magpay ng 1st quarter payment upon application and maging decided ako mag annual/semi annual. Kelan po pwede?

2. Pwede ba mag add ng riders in the middle of the policy years or upon application lang po?

1. You can do it anytime. 2. During the application and every anniversary only.

Hi, I’m really inspired to your story and how you came up to decide about your milestones. Now I’m interested to get this life insurance in Sunlife. I’m 23, the same when you started and not-smoker. My question, is it the Sun Maxilink Premium can help my parents in terms of their health maintenance or hospital bills when necessary? They are 63 yrs. old and they depend on us. I want to make sure that I can help or support them in their health necessities if necessesary.

Hi Rupert. I am so glad you liked my story and hope you learned a lot from it. The plan I got is actually for myself so that I will not become a burden to them if something happens to me. And also, I want the dreams of my family to be well funded should I get called earlier by our creator.

You are still lucky though to have your parents with you. But I think you need life insurance in the sense of “what if” something happens to you? Who will be in charge of the maintenance meds and hospitalization? Getting life insurance will answer that worry because if that happens then they will get something to continue living the life you would want to give them.

Plus, you will accumulate funds thru the years to finance your dreams for yourself or just something you can look forward. Let’s get in touch thru email 🙂

Hi Sir!

Thank you for all your blogs! Very helpful and informative. I’m soon to be father and ofw (just waiting for my exact flight date). I’m really interested to know more regarding Sun Maxilink Prime so that I wouldn’t waste my future hard earn income. Can I set an appointment for your Free Proposal?

Hello po sir Good day!

I’m 35 years of age I’m single and i’m OFW here in HongKong, maitanung ko lang po My branch po ba kayo dito sa hongkong?

Or if wala po how can i register via Online to avail VUL plan, maraming salamat po

Hi Ms. May. There’s a Sun Life company in Hongkong, though affiliated, it is not the same company as the Sun Life of Canada (Phil.) Inc.

Are you planning to come back to the Philippines soon? Because you can only apply for one if you are here in the country. I’ll send you an email about this so we can talk more about your options. Thanks 🙂

Hi Sir Federico, I am interested in Maxilink and I am at my 50’s is the Maxilink Prime still applicable for me and how much the monthly, semi-annual and annual premium. Thanks for your time.

Hi Gen. You are still eligible to get a Sun Maxilink Prime. Premium will depend on the life insurance coverage, riders attached, current health condition, and so on. But just to give you a ballpark you must prepare 50 to 60k for a 700k life insurance coverage. Thanks 🙂

Hi Sir Federico. Can I get a computation for the plan for my mom, she’s going to 50 years old and want to know if she will be able to get insurance with Sun Life and how? Thanks!

Hi Trish. Have you filled out the form? I haven’t seen it from my file. If not, please kindly fill it out so we can have an idea of what plan/inclusion is best suited to your mom. Thanks 🙂

which is better? maxilink or flexilink?

Hi Jovie. It will depend on your financial needs which are unraveled during financial planning. Thanks 🙂

Hi! I just started my VUL last year pero ask ko lang if kung what happen after 10 years na na hulugan ko na sya, required pa ba ako mag hulog ng same amount monthly? Or Pwede ko ba i claim yung money na nahulog ko?

Hi Alrey. The only person who can answer that better than me is your agent. You may kindly ask him/her as he/she is the one who designed the plan based on your needs. As for the second question, you may partially withdraw your fund but if you withdrew all of your funds then your insurance coverage will be terminated. Thanks 🙂

hi can you discuss it further? im interested… thank you

Hi Shiela. Looking forward to talking with you soon. Thanks 🙂

Hi, Sir im interested to this sun maxilink prime for my daughther..

Hi Mary Grace. Thank you for reaching out. Please kindly fill out the form so I can reach you easily and provide you more details. Thanks again 🙂

Hello, Sir. Question, if I get sun life maxilink bright and it indicates on the proposal that my annual premium is Php 96, 000 (So that means 96, o0o x 5 = Php 480, 000), why does the proposal further indicates premium amounts (ex. php 35, 000) for year 6 onwards? Solely for the riders?

Yes, Shammah. You have to pay for the riders even after the payment period or you may opt to not pay anymore provided that sufficient top-up was added in your plan. This is best explained by your advisor. Thank you 🙂

Hi sir, I am now 38 years old ofw, no insurance with 7 year old kid and i am interested about this insurance with investment side. aside from this particular, what other options i should get?

Hi Jun. Being an OFW, I know you wanted to give the best things for your child and even the best opportunities that’s why getting an insurance plan is already a must. For you might not know how long you’ll be working overseas due to factors like age and health.

You actually have two option: VUL and whole life insurance. This blog post is a VUL plan you can consider. It can protect you from uncertainties like accidents, deteriorating health, and even sudden demise. This, in fact, is a cheap option. But you can also get to maximize the potential growth of your money that you can withdraw for retirement or to achieve any other life milestones.

Thank you and I hope we can get in touch thru email.

Hi sir ask ko lang about sa account ko na sun maxilink prime, 1year na kong member and then gusto ko na pong iclosed or idiscontinue yung account ko, ask ko lang po kung maiwiwithdraw ko po lahat yung perang naihulog ko?

Thanks

Hi Christine. Actually, this is an insurance plan which means you will be charged for the 1-year insurance coverage including all the fees necessary to start the plan.

Think of it as if anything happened during that 1 year, Sun Life will have to pay your beneficiaries the sum assured. But I’m happy nothing bad happened though.

You may discuss your options with your advisor

Thanks.

Hi! Is this kinda pension plan which after yung ten years payment or maturity ay may makukuha ka certain amount monthly? I’m looking for a pension plan kse.thanks

Hi Delleyah. This is an insurance plan that you can use to build your retirement fund. So what’s good about it? Firstly, if you’re called by our creator too soon then your family can get an amount that they can use to continue with their life. Secondly, if you live long enough to attain the age of retirement then you can partially withdraw the portion of the fund and use it for your happy retirement without having money as a problem.

Plus it will cover you from the expenses against certain illnesses that can easily wipe out all your savings when you become ill.

Thanks!

Could I lower my life coverage to lower my annual premium?

Hi Benjie. You can but once you lowered your life insurance coverage you can never raise it back again. This is best discussed with your FA. You may kindly contact him as this can get a bit technical. Thanks!

Hi Sir Federico. After 10 years of payment and I want to withdraw magkano po ang makukuha ko? Very like ko yung blog mo sobrang enlightened ako.

Hi Jackie. Long term investment kasi yung plan also ang main focus ay insurance. Yung investment ay bonus na lang. If investment yung hinahanap mo then you may get mutual fund or UITF. Thanks!

Hi

May health insurance po ba ang Sunlife for those who are 74 years old and above?

Tia.

Hi Melody. We have until age 75 but this is a single pay VUL. It’s more of an investment than insurance. I hope you get one for yourself. Insurance is something you get while you don’t need it. If you are interested. Just let me know 🙂

Hi frederico

Hello Summer!

Pag nagavail po ako ng maxilink prime, automatic kasama na lahat ng benefits like ADDD, CIB and HIB?

Hi Camille. No, because they’re only additional benefits. Thanks!

Hi. pag natapos po ung pagbabayad ng 10 years ano n pong mangyayari? pwede n syang i-withdraw or until retirement age???

Hello,pwede bang paki explain ano ba yung TOP UP

Hi Remi. Top-up yung tawag natin sa excess na payment for the year. For example 80k per year yung plan niyo pero ang binayaran niyo ay 100k then yung 20k ay considered as top-up. Good thing ito kasi mas bibilis yung fund accumulation ng plan. Thanks!

Hello.. covered din po ba nito yung parents at husband and children like kng ma hohospital cla..if not covered..meron pa ba kayong insurance plan na ma cocover po cla?

Hi Kimberly. Sa per life lang ang insurance natin when it comes to health-related plan. Thanks!

Hello! Up to what age ang coverage nito? 65yrs.old ba or til age 99?

Hi Frederick. This will cover you until age 88. Thanks!

Sir, after po ng 10years na pag babayad ng premium. Ano pa po yung insurance charges na dapat pang bayaran? Are the charges will be calculated as per the current fund value?

Salamat po.

Hi Anna. Need bayaran yung critical illness and hospital income benefit pero pwede naman mag premium holiday just ask your financial advisor about it. Kung wala ka pang plan. We can get in touch. Thanks!

Hi, Federico! Follow-up question about HIB, if the client opted to remove it from the policy before his next annual payment date, will HIB be completely removed and he won’t be charged (from the premium or fund value) for it for the next calendar year? TIA

Yes, but it can only be removed during the anniversary. However, if you remove it now, you cannot add it anymore.

More interested on investing

Hi Ms. Hyna. VUL is not an investment product but an insurance with investment plan. If you don’t have a good financial footing (insurance) then you may consider getting a VUL plan which enables you to financially secure the future of your family while increasing your wealth. Thanks.

Hi Suan. Please respond on my request.

Hi Ms. Nerissa. Sorry if it takes time before I can finally reply to this because I only have myself to do all the work on my blog. I apply the first in first out policy hehe I actually receive around 10-15 emails a day plus add the texts and calls, and a bunch of proposal requests every day. Anyhow, I love the volume of inquiries so please keep it coming. I’ll answer everything as much as I can 🙂

Btw, I’ve seen your proposal request and I’ll send it in a while. Thanks!

Quality content is the important to attract the viewers to go to see

the site, that’s what this web page is providing.