Every parent wants to secure the future of their kids. It explains why I got tons of inquiries about building an educational fund for their kids. Though Sun Maxilink Prime can also be used to create the fund. But Sun Maxilink Bright seems more appropriate for this kind of goal. I will explain this in the latter part of the post.

Table of Contents

Educational Plan vs. Educational Fund

An educational plan is a pre-need product that pays a guaranteed amount as soon as your child turns at a certain age, like 17 yrs old (recall CAP?). An educational fund, on the other hand, is a fund made by investing regularly. These include stocks, UITF, mutual fund, or VUL to generate enough cash by the time your child enters college.

When to Start Building the Educational Fund?

It might be the first question you might ask. Suan, kailan ba dapat magsimulang gumawa ng educational fund? The perfect time to build this kind of fund is as early as your child is born. It will give you enough time to build a sufficient fund to finance the education of your kids.

Teka lang muna, bat kailangan agad? Eh di ba matagal pa naman mag cocollege si baby?

Your eyebrows might be raising right now (please pardon me). But as mentioned, this will give you more time to build the fund, but it doesn’t mean that you can’t build it when they are already 5 years old. But expect to set aside more money, of course.

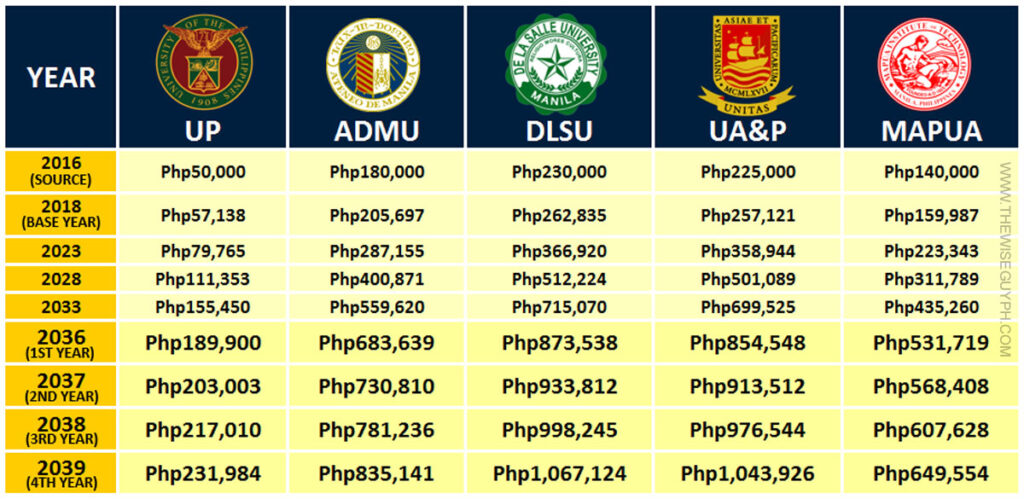

Assuming the plan was made in 2018, and in 18 years, 2036, the child will enter college. Figures are derived from 2016 with an annual increase of 6.9%.

Steps in Building an Educational Fund

Pick a School Where you want to Enroll Your Kids

The first thing you need to do is to know where you want your kids to have their college education. Just from my observation, parents tend to pick their alma mater as their primary choice. But, of course, it is still subject to change.

Your kids will still have to decide exactly where they want to study. But because they are still incapable of knowing where (they are still babies, right?). It will just serve as a reference. So we can start computing the cost we need to prepare in the near future.

As for me, I want my future kids to study in UP. It is because of the quality of education it provides at a very low price compared to other schools. So my computation from here will be based on my school of choice, which is UP, and he will take a four-year course. (Yes, I just assumed I have a son here, haha!).

Calculate the Cost of Education

If you’re lucky enough to start building the plan when your cute baby was born, then probably he will be in college after 18 years.

Looking at the table above, my son will turn 18 years old in 2036 and will enter college in the same year. Due to the surprising cost of education, we must account for a yearly increase in tuition fees at the rate of 6.96% (based on the CHED approved tuition fee rate hike for the school year 2017-2018 ).

If the cost of education in UP in 2016 is Php 50,000, then in 2018, it will be Php 57,138, considering an annual increase of 6.9%. The following is the computed tuition fee I need to pay from 2036 to 2039:

First Year: Php 189,900

Second Year: Php 203,003

Third Year: Php 217,010

Fourth Year: Php 231,984

Total Cost of a 4-Years Course is Php841,897

Add Other Expenses

Aside from tuition fees, we must also account for other expenses like allowances, cost of books, field trips, seminars, and so on. I will skip this part for the sake of making the computation more straightforward, but you can add this to your calculation if you would like.

We used approximations in values; that’s why we won’t have an exact figure of the total cost. Fret not; no one knows how much they will exactly be, so spare me if I don’t add these to my computation.

Set Your Target Fund Value

After adding the tuition fees and other expenses, you will come up with an amount that will serve as your target fund. It is the amount you must have on or before your child enters college.

In my case, the amount I need is Php841,897 to be able to send my son to a 4-year course in UP.

Find an Investment Product Suitable for Your Needs

It is the last step; you must find a financial product that can satisfy your needs. There is a wide array of investment products out there that you may want to consider, like the stock market, mutual fund, UITF, VUL, etc.

VUL is my personal choice in making this fund because it doesn’t just build the fund I need for my son’s education. But it also gives financial security and peace of mind to my family, Sun Maxilink Bright, on this particular instance.

READ MORE: Sun Maxilink Prime | 3 Easy Steps in Securing Your Future

Life Insurance to Ensure Your Kids’ Future

Some of you might be thinking that it’s not necessary anymore to have life insurance at this point, but you’re wrong. Life insurance act as a safety blanket in building the fund. It gives you peace of mind that your kids can still go to college no matter what happens to you.

Imagine that along the way of building the fund, and you become totally and permanently disabled. Do you think you can still put money in the fund? No work means no pay, right? You also don’t finish the fund, so it means that by the time they’re about to enter college, the accumulated fund will not be enough.

You don’t want your kids cursing at you for being unprepared. Tama ba? Of course, they love you unconditionally, so you must love them the same way, and life insurance can serve as proof of that love.

It is why VUL or Variable Unit-Linked plan is my recommended financial vehicle, especially for those parents who still don’t have enough income protection. It can help families to build an education fund for their kids securely and efficiently through Sun Maxilink Bright.

What is Sun Maxilink Bright?

Sun Maxilink Bright is a life insurance with an investment plan that provides financial security and peace of mind while making your money grow. It is only payable for 5 years and best suited for educational fund building and other financial goals such as buying a car, house, or even starting a business.

Eligibility: 18-65 years old

Minimum Insurance Coverage: Php 400,000

Mode of Payment: Yearly | Semi-Annually | Quarterly

Benefits of Sun Maxilink Bright

Can you still recall my target fund if I have to send my child (imaginary for now hehe) in 2036? My target fund is Php841,897.

I’ll show you a sample quotation of Sun Maxilink Bright for myself, age 25, male, non-smoker, invested in an index fund with a historical return of 10% p.a.

Annual Premium: Php 42,000

Semi-annual: Php 21,000

Quarterly: Php 10,500

Monthly: Php3,500

Daily: Php 117 (the price of your favorite fast food meal)

Total Investment: Php 210,000

Life Insurance Benefits:

- My family will receive a lump sum of Php 400,000 when I die (please Lord, don’t call me too early). Because this is specifically for the education of my son, they can put this to another investment vehicle like a mutual fund until my son is about to enter college.

- I also attached a rider, or additional benefit called a waiver of premiums or TDB (Total Disability Benefit) to my plan so that when I become totally and permanently disabled during the paying period, Sun Life will pay the premiums on behalf of me until the 5th year. This only cost me Php572 per year, and I consider this as a must-have rider in any insurance policy.

- Accidental Death Benefit or ADB is an additional life coverage worth Php 200,000. It is the amount my family will get on top of my basic life coverage if I die due to an accident. The total amount they will receive when that happens is Php600,000, which is a guaranteed amount plus the fund value of my investments (not guaranteed as market performance is unpredictable).

Grow Your Funds Over Time

If you build an education fund for your kids as early as now means you will spare yourself from financial stress when the time comes that your kids will enter college. It will also give you confidence that somehow you can give them a bright future with the help of the right financial planning.

5 years: Php233,911

10 years: Php374,019

15 years: Php600,881

18 years (2036): Php792,055

Yes, I’m able to make it (almost), and time has helped me in reaching my target fund value. My total investment was the only Php210,000, or with just Php3,500 per month, I can send my son to UP for a 4-years course.

How about you, when do you intend to build the educational fund for your kids? Start as early as now so your kids can have a BRIGHTer life with Sun Maxilink Bright.

Inquire NOW!

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in-person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

Frequently Asked Questions (FAQ):

Sun Maxilink Bright is 5 years to pay life insurance with an investment plan from Sun Life. This plan is best for educational planning and other life goals like buying a car or house because the focus of the plan is wealth appreciation.

The main difference between Sun Maxilink Bright and Sun Maxilink Prime is the paying years. Because Sun Maxilink Bright is designed to be paid in just 5 years it will have more time to appreciate in value. Thus, it is better to be used in educational planning.

You can start for as low as Php 3,000 per month but it will still depend on your age and other factors.

You just need one valid ID together with your initial payment of at least one quarter or equivalent to 3 months worth of premium.

Source:

1https://www.imoney.ph/articles/cost-of-colleges-and-universities-in-the-philippines-2016/

2https://www.rappler.com/nation/171282-ched-approves-tuition-increase-colleges-universities-2017-2018

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

4 thoughts on “Build an Educational Fund for Your Kids the Wise Way”

Hi, I currently have Maxilink Bright payable in 5 years but my fund allocation is balanced fund. I see that you prefer index fund because it’s high risk high return. I probably wont be withdrawing funds in the next 18-20 years because i dont have a child yet. Would i get higher return with index fund?

Thank you.

Hi Carmela. Personally, the Index Fund is my preferred choice of fund. It may be different to your risk appetite, how much are you willing to take the risk. If you can see your funds cut it in half and you can still get sound sleep, then you could go for an Index Fund too.

If we consider your timeline of 18 to 20 years, that’s a reasonable amount of time to go for aggressive funds like the Index Fund. Somehow, the time will mitigate the risk associated with the fund.

The question now is, “Do you think it’s okay to switch funds?”

The answer is no. At this time, COVID-19 pandemic, investments funds are at a loss. Thus, switching now will do more harm than good to your investment fund.

However, if you still wish to switch funds, then do it when the market recovers. Just ask further assistance with your advisor. If your advisor is no longer active, just let me know so I can help you. Thanks 🙂

Hello Federico, I just want some clarifications. Is Sun Maxilink Bright still an insurance but payable for just 5 years? What if I’m still alive when my child turns to 18, will my child get the educational plan?

Hi France. You’re right, Sun Maxilink Bright is a 5 pay VUL plan best used for educational planning. The plan answers two problems you might face while preparing for your kids education.

First, what if you die early? The insurance coverage of the plan should be equal to the educational fund you need once your child starts going to college. This is the amount your child will receive instantly that the guardian can keep in a bank or mutual fund to earn interest until he begins college.

Second, what if nothing happens to you. (This is not a problem though) You may get the accumulated investment fund that you can use to pay for your child education.

Thanks 🙂