Sun Fit and Well is the most comprehensive health insurance from Sun Life. It covers 114 critical illnesses up to age 100. Also, it gives guaranteed cash benefits and dividends while protecting you from financial struggles you might face when you get critically ill.

READ: Sun Fit and Well | A New Generation Wellness Plan

Do you know the reason why many critically ill patients die?

If you think about it, there are several medical breakthroughs.

But why?

Sadly, everything comes at a price that most of us cannot afford. So, it doesn’t matter how advanced medical treatment gets if we cannot afford it.

That is when Sun Life offered a comprehensive health plan to address this need. Something that can help you access the treatment needed when you get hit by a critical illness.

Table of Contents

10 Reasons Why You Should a Get Sun Fit and Well Plan

I know you are a responsible person. It is to say that you do not want to burden your family with medical expenses. Now, I’ll be sharing with you several reasons why you must inquire and get a Sun Fit and Well plan from me.

So here are the ten (10) reasons why you must get a Sun Fit and Well plan.

1. Pre-emptive Wellness Benefit

Sun Life’s mission is to provide lifetime financial security and healthier lives. With that in mind, they created the GoWell community, wherein members can access diverse health and wellness information, events, activities, and workouts.

You will automatically become a gold member once you avail of this plan. And these are the benefits you can enjoy.

- Gold card- you will receive a personalized membership card to be delivered by your advisor.

- Health and wellness content in gowell.com.ph

- Enjoy community workouts with other GoWell members and Financial Advisors.

- Fitness Classes: Get up to 20 FREE group classes per month in partner gyms.

- Perks and Privileges: Get discounts and freebies from partner establishments.

- Rewards: Earn points by joining events and by reading articles from the GoWell website, and get a fitness watch, mug, etc.

2. Guaranteed Limited Pay

Sun Fit and Well is a limited pay plan, which means you will not be required to pay after the payment period. So in this plan, you have more flexible and secured options of 10, 15, or 20 years.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan of Sun Life

3. Life Insurance

Sun Fit and Well provides life insurance coverage equal to the face amount, less minor claims if there are any. It is something that your family can use to continue the dreams you have made together even when you are gone.

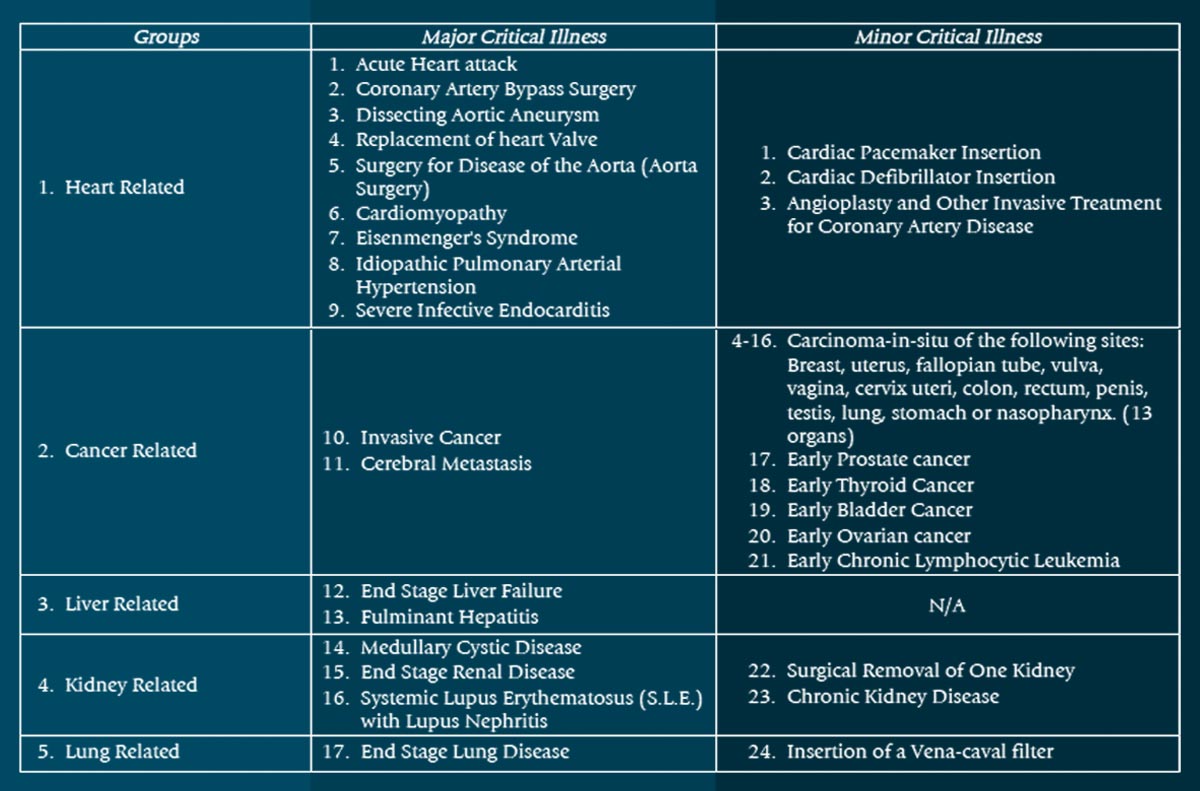

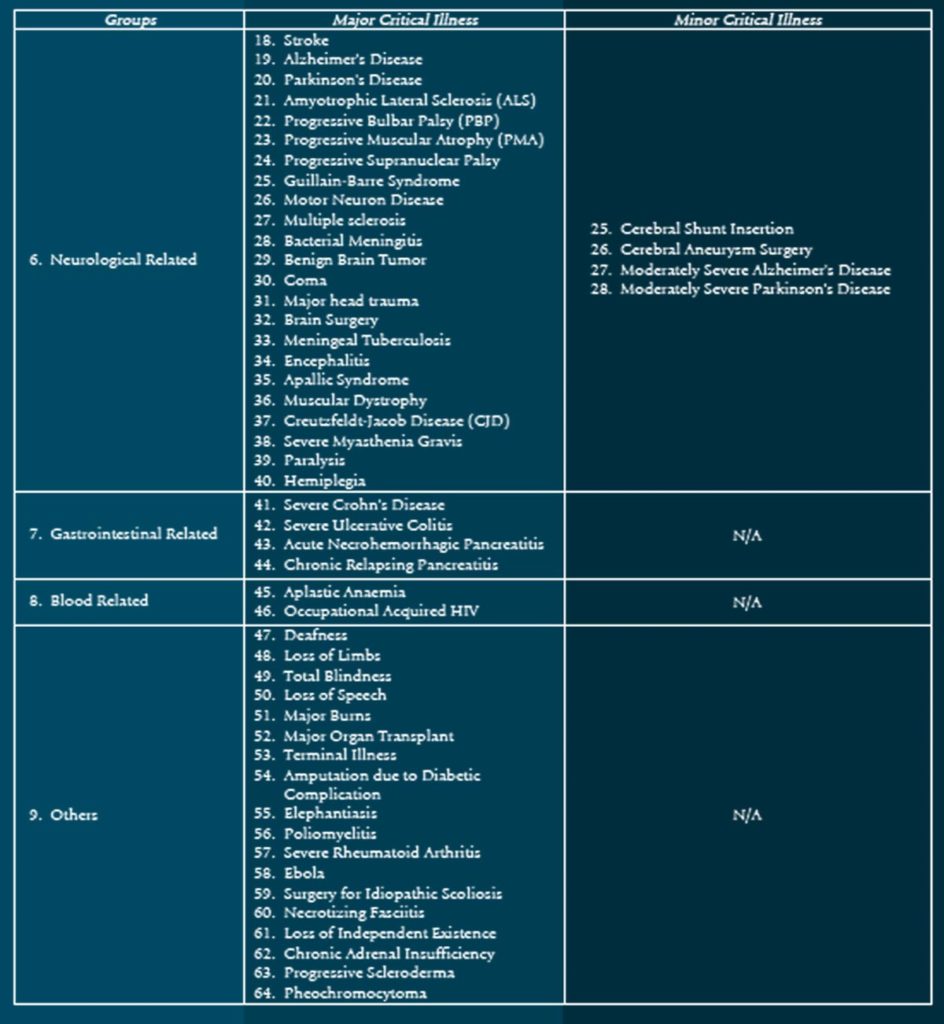

4. Comprehensive Critical Illness Benefit

It covers 114 kinds of critical illnesses, providing you with comprehensive health coverage. So, you can focus on your healing rather than thinking about where to get the money.

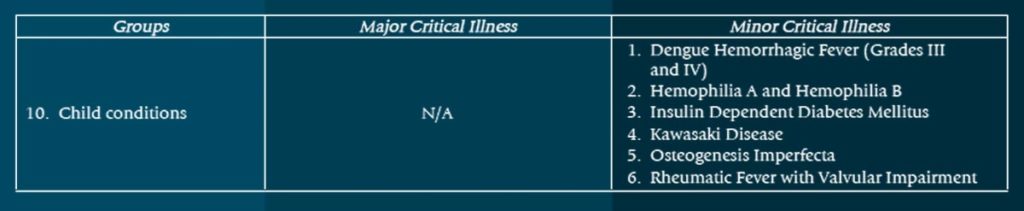

There are two kinds of critical illness claims to get from this plan.

Minor Critical Illness Benefit

If diagnosed with a minor critical illness, you will receive 20% of your face amount. You can claim this benefit for a maximum of 3 claims, but it should be from different critical illness categories. In addition, the 3rd claim is only 10% of the face amount.

Major Critical Illness Benefit

You will get 100% of the face amount if diagnosed or treated with any major critical illness.

5. Treatment and Rehabilitation Benefits

Sun Fit and Well provides hospitalization benefits to supplement the amount you will get from being critically ill.

Hospital Income Benefit: you will receive 0.125% of the Face Amount per day if hospitalized because of a critical illness. If confined in an ICU, this amount will double.

Post-Hospitalization Benefit: you will get a fixed amount of Php 5,000 after hospital discharge that you can use for a follow-up checkup.

Home Recovery Benefit: You will get 50% of your hospital income benefit after discharge. It is something to help you while recovering from a critical illness in your home.

6. Palliative Care

You may advance the 10% of your face amount if you get diagnosed with a critical illness with a life expectancy of 6 months or less. Hence, you may use this amount to manage the pain associated with your illness.

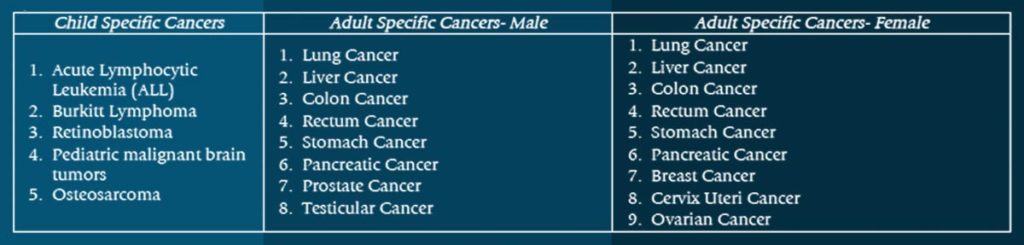

7. Specific Cancer Booster

If you get any specific cancer listed below, you will get an additional 50% on major critical illness claims, hospital income benefits, post-hospital benefits, home recovery benefits, and palliative care.

8. Guaranteed Cash Benefits

Sun Fit and Well also accumulates guaranteed cash value that you can lean on when there is a great need. Unlike VUL plans, it will not suffer from stock market crashes, just like what we are experiencing with the COVID-19 pandemic. You can loan from your policy with a lower interest than banks.

9. Earn Dividends

Sun Fit and Well is a whole-life participating plan. It means you are eligible to earn yearly dividends. It is a non-guaranteed benefit that you can get or leave in Sun Life to accumulate interest.

10. Endowment Benefit

At age 65, you will get an annual endowment benefit equal to 5% of the face amount for the next eight (8) years. Like dividends, you may also leave it with Sun Life to earn interest.

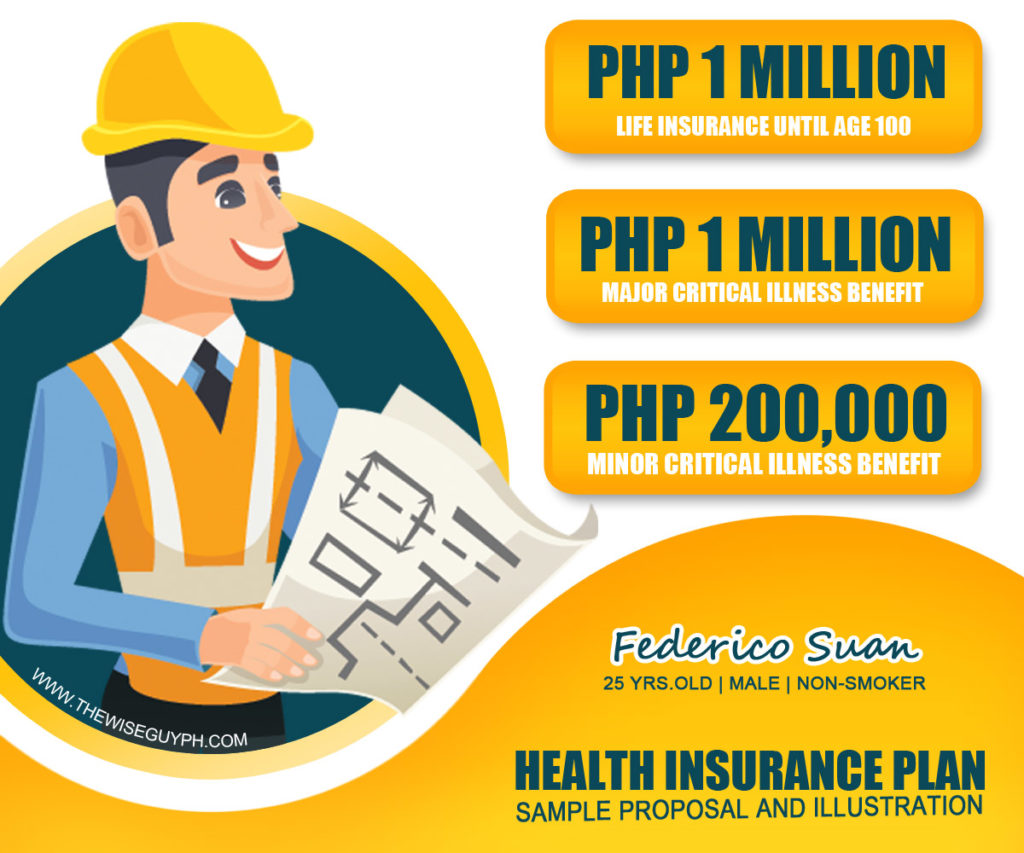

Sun Fit and Well Advantage 10 Proposal

The best way to understand this plan is by a sample proposal. So now, I’ll be showing you a quotation for Sun Fit and Well Advantage 10 that I created for myself.

Federico Suan, Jr. | 25 yrs old | Male | Non-smoker

Annual Premium: Php 52,860

Semi-Annual: Php 28,015.80

Quarterly: Php 14,536.50

The life insurance coverage is Php 1 Million for a Php52,860 annual premium. If you’ll notice, it becomes slightly expensive when you pay it semi-annually or quarterly. Fret not, it is customary in all traditional life insurance, and we call the added price the modal factor.

Thus, you can save more money if you pay it annually.

By how much?

You can save as much as 10% to 12% compared to paying it quarterly or monthly.

Health Insurance Benefits of Sun Fit and Well

So here is the Sun Fit and Well review of its health insurance benefits.

Major Critical Illness Benefit

I will get Php 1 Million if diagnosed with a major critical illness. I can use this amount for the treatment I need so I can recover faster.

It is also the amount my family will get if I die for whatever reason.

If I die early, it will give me peace of mind that my younger sister can continue her education and my grandmother can still buy her medication.

Total Disability Benefit (TDB)

Sun Life will waive my payment dues if I get disabled due to an accident within the paying period of 10 years. It means I don’t have to pay for the plan and still enjoy its benefits. Thus, it is another layer of protection.

Accidental Death Benefit (ADB)

If I die due to an accident, my beneficiaries will get an additional Php 1 Million on top of the life insurance coverage. Thus, my beneficiaries will get Php 2 Million.

Minor Critical Illness Benefit

I can get Php 200,000 once I become diagnosed with a minor critical illness. Also, I can claim up to 3 times, but the 3rd claim will only be Php100,000. Nonetheless, it’s still a huge help to me.

Specific Cancer Booster

I will get Php 500,000, on top of the major critical illness claim, if I get diagnosed with any of the 16 major cancer conditions. Aside from it, I will also receive an additional 50% on hospital income benefits, post-hospital benefits, home recovery benefits, and palliative care.

Hospital Income Benefit

I will receive Php 1,250 per day if I get confined due to a critical illness. I can claim up to 90 days of confinement per group of critical illness, up to 4 groups.

If confined in ICU, I will get a double amount of Php 2,500 per day.

READ: Top 10 Life Insurance Companies in the Philippines

Post Hospitalization Benefit

I will receive Php 5,000 following the hospital discharge. In this case, I can use this amount for a follow-up checkup. This is a one-time benefit per group of illnesses, a maximum of 4 groups.

Home Recovery Benefit

I will get Php 625 per day following the hospital discharge. It is computed based on the number of days confined in a hospital.

So, for example, if confined for 30 days then I will get Php 37,500 as my hospital income benefit, Php 5,000 as my post-hospitalization benefit, and PhpPhp18,750 as my home recovery benefit.

Palliative Care Benefit

I will get Php 100,000 if I become terminally ill with a life expectancy of 6 months or less. I can use this amount for my palliative care to provide me relief from pain and stress up to my passing.

Cash Savings of Sun Fit and Well

You might be thinking, what if I did not get ill? What are the benefits that I can enjoy from this plan?

So here are the benefits I can get even if I did not get a critical illness.

Special Paid-up Bonus

After ten (10) years, I will receive a paid-up bonus of Php 27,709 that I can get or leave with Sun Life to accumulate interest.

Guaranteed Savings and Dividends

When I turn 60, I will have Php 563,700 in Guaranteed Savings. My policy may also accumulate dividends of around Php 268,778 at age 65.

Endowment Benefit

I will also get a yearly Endowment benefit of Php 50,000 from age 65 until 72. It may not be a large sum, but who wouldn’t be happy to receive something during retirement?

I’m sure I’ll be happy when the time comes 🙂

Total Amount Paid vs. Benefits

You might be starting to like the plan already, but the crucial question is, “Is it worth it.” If we based it on the sample computations above, the total amount I would have to pay for a Php1 million health insurance coverage is Php528,600. At a glance, it is a large sum of money.

If you compare the two (2) figures, then it might look like an okay deal. However, it may not be good enough to convince you.

So, we have come up with something to help you paint a better picture; compare the total amount paid with the maximum benefits you can get.

Then it may look something like this.

Maximum Benefit (MB)= Face Amount + 50% from Cancer Booster + (0.125%/day for Hospital Income Benefit + Post Recovery Benefit + 0.0625% for Home Recovery Benefit) + Paid-up Bonus + Dividends per year + 5% of FA as Guaranteed Cash Benefit for 8 years

If we put the digits together, then this is how it looks.

MB = 1Million + 500k + 0.125%(1Million)(90 days)(4 groups)(2, if admitted in ICU)(1.5 from booster) + 5,000(1.5) + 0.0625%(90)(4)(2)(1.5) + (non-guaranteed benefits i.e. paid-up bonus and dividends) + 5%(1Million)(8)

MB = Php 3,932,500 + (paid-up bonus and dividends)

Is Sun Fit and Well worth it?

As they say, “Numbers do not lie.” It is a great deal if I have to pay Php 52,860 per year in 10 years for a Php 3.9 million benefit. Isn’t it?

So, get yours now!

Inquire NOW!

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in-person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

Quick Summary

Sun Fit and Well is a participating whole-life plan that offers comprehensive life and health protection. It addresses the needs of Filipinos for medical treatment due to the leading causes of death like cancer, stroke, heart attack, etc.

Sun Fit and Well have 3 variants, and these are Sun Fit and Well, Sun Fit and Well Plus, and Sun Fit and Well Advantage.

You may pay it in 10, 15, or 20 years.

Sun Fit and Well covers a total of 114 critical illnesses. It includes 64 major critical illnesses, 34 minor critical illnesses, and 16 specific critical illnesses.

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

36 thoughts on “Sun Fit and Well Review: A Complete Guide to Perks and Benefits”

Good day!

I have a Sun Fit and Well 20. I will be paying for it for 20 years, but it has the same amount in the example.

But I am having a difficulty in paying for it since I spent 30k a year for it. May I know if I can change it to a lower plan. Instead of 1million, it could be 500k?

Hoping for your response. Thank you!

Yes, just tell your advisor to facilitate the downgrade.

Hi sir!

I just want to ask for some clarifications. Example, I got sick & used the benefits such as Hospital Income Benefit, Post Recovery Benefit, Home Recovery Benefit etc. Does the benefit amount given to me will be deducted to the total FA if I die later on? And for the Endowment benefit, supposed I got it for 8 years and die after age of 72, do my beneficiaries will still get the same FA as per policy? Thank you!

It is best to ask questions with your advisor. As mentioned, the rehabilitation benefits is only for those who are confined due to minor or major CI. So the FA will be reduced, if you got minor CI. In addition, it will be terminated if it’s a major CI.

Good day sir, is it possible to switch my present sun maxi link prime to this kind of plan?

Thank you

Sorry, you are not allowed to switch plans. Both of them are good insurance plans that address our diverse need for insurance. You may add this plan to your portfolio to have better coverage 🙂

Paano po pag after 40yrs ng policy nagkaroon ng critical illness si insured makukuha po ba nya is value ng face amount plus yung naaccumulate nyang cash benefits?

Yes, the insured will get the sum assured plus any unclaimed payouts.

Good day,

I have this insurance, well explain sa sample mo —my question is I have another insurance its VUL MetLife –I have no time to check the investment part and my surrender value is 2300 from 7600 that i have already given in USD –do you think I still need this, I’m confuse im paying too much and I thought sila na bahala sa investment side yun pala –ako pa mg momonitor –please help thanks

Thank you!

VUL can also be a good insurance plan. Maybe you can choose a targeted fund that is more actively managed but expects more charges.

But, if you are not happy with it, you may get something else that is aligned with your goals.

Hello Sir, ask ko lang po if may grace period ang payment ng Sun fit & well? Or para syang term na kapag di ka nakabayad within the deadline is mag lapse na sya? Thanks po!

Yes, it will lapse in its early years up until you have cash value.

But make sure you choose the automatic loan to your cash value as a non-forfeiture option.

Hi! This is really the smartest read I’ve ever read. Comprehensive and easy to understand. I was talking to my advisor and was still perplexed after our conversation. Was trying to search online more info about this and finally your blog really helped a lot. Our next meeting will help me understand what she will be talking about. Hahaha. This will be my guide while talking with her on our next meeting. I was needing thoughts about this ‘cause I am about to get this policy on top of my basic policy. Thank you!

Thank you for your kind words, Trisha!

Happy to help 🙂

Is this applicable for kids too?

Yes, it is also suitable for kids. Aside from the usual coverage, the plan covers several illnesses for kids.

Hello, Federico! May I know what will happen to the dividends and earnings and the bonuses accumulated given that there were no withdrawals made after an insured died? Will that be given on top of the face value of the policy? Thanks

Thanks, Alique! That is a very good question 🙂

Yes, any unpaid dividends and cash bonuses will be given as part of the insurance claims.

Hi, Federico!

Will this be great insurance for my mom who will travel to the US and needs medical insurance as a requirement nowadays since the pandemic? The only health insurance she has is Philhealth. She is diabetic and she is now 55 years old.

Thanks!

It is good health insurance per se. But I think you need something else like travel insurance because your mom is going to the US.

Hi, Federico! Can someone with Chronic Hepatitis B but in stable condition get approved for this health insurance?

Yes, it’s possible. But again, it is still subject to evaluation 🙂

Hello, Federico! Is the Go Well program available for any Sun Fit and Well Variant, or is it limited to a specific variant like Advantage?

It’s available for all variants 🙂

Does it require a medical report?

You don’t need a medical report unless you declare a health concern and other things that may affect your state of insurability.

So if I get this, and God forbid I get any major critical illnesses, I get 1M. Will that in effect terminate the insurance? What if I die after claiming the 1M critical illness benefit, but not because of the critical illness, do my heirs still get 1M?

Yes, you got it right. Once you already claim the major CI, the plan is terminated.

In summary, the plan pays whichever comes first, major CI or death.

I’d like to be a member of Sun Life’s Fit and Well Comprehensive Health Insurance.

Pls email me , asap, the Plans.

Thank you.

Glad to know you like it.

Btw, we already discussed an example above. If you want a personalized proposal, please fill out the form. It’s because each insurance proposal is different for each individual.

Thank you!

Very detailed and well-explained! Galing!

Thanks for your kind words 🙂

Hi Sir Federico. I have a friend that wants to get this plan sun fit & well. But he is HIV+. Can he still be able to apply and get approved in this plan?

Hi Adam. Well, I cannot say if he will be approved but the good thing is we can apply. The underwriters will have to assess if your friend is in a somewhat controlled condition. If he is then he might get approved. If you like I can assist you with this. Just send an email to me and we’ll talk from there. Thanks 🙂

I just read all of your post and you deserve more than just an appreciation comment. Your blog is the blog I would like to read over and over. A blog I would share to my friends. A blog I would subscribe to it and hit the notification bell for more updates. Looking forward to more posts like this. Thank you

Thank you very much 🙂