Sun Smarter Life Elite is an insurance and savings plan from Sun Life. It provides life insurance protection and guaranteed cash benefits until age 100. A “lifetime pamana” that serves as a beautiful gift to your child or “apo.”

But before we proceed, let me ask, “Why are you working hard?“

If you’re married, probably it’s your family. Above all, it’s your kids. (No offense meant to your spouse, but I’m sure you have the same priority.)

Table of Contents

5 Reasons Why You Must Give a Pamana to Your Kids

A client of mine suddenly said, “Ton, I need this plan.” I was in deep shock because I rarely hear those words that fast.

So I asked her why?

She’s an excellent lawyer and has many businesses and assets.

She said that not long ago, her nephew died due to an accident, leaving his wife and newborn son.

Reality bites so hard that she realizes she needs something to protect her children’s dreams. Perhaps she wants to give them a lifetime pamana.

1. A better start in life

Giving a pamana to your kids can jumpstart their life, whether it’s buying a house or car, starting a business, etc. It can certainly give them the brighter life you always wanted for them.

2. Maintain the lifestyle

You may know a family that financially struggled after losing the breadwinner. Leaving a pamana will give them some wiggle room to adjust when they lose you.

3. Set a good example

I talked with someone who doesn’t like to leave an inheritance to his kids. For a simple reason, his parents did not leave them even a single centavo.

Thus, it marks an endless cycle of mirroring.

But if there’s a cycle that you must begin, it’s better to start the cycle of giving.

4. Give your kids some “time“

When you give pamana, you’re not only giving money but also the time value of money. You know by heart that the amount of money today will not be the same in the future.

Hence, it means your kids can maximize their earning potential.

5. Immortalize your love

Pamana is like the warmth of your embrace, caressing your kids and telling them, “Everything will be fine.”

And when the time comes that you’re no longer there, you’re still present in their lives, supporting them through your pamana.

Getting the right financial plan can even help you immortalize that love.

Sun Smarter Life Elite

Sun Smarter Life Elite is a whole life insurance plan from Sun Life. It has life insurance protection with a guaranteed cash benefit at the end of the 6th year and every two (2) years.

Eligibility Age: 0 to 80 years old

Riders: TDB, ADB, HIB, CIB, WPD/WPDD, and Sun Safer Life

Mode of Payment: Yearly | Semi-Annually | Quarterly

Payment Period: 5 years, 10 years, and regular pay (until age 100)

Nowadays, several plans can serve as an inheritance to your kids. It could be Sun Smarter Life Elite from Sun Life, which gives guaranteed cash benefits until the age of 100.

Yes, it’s a guaranteed benefit.

Unlike the projection you get with a VUL plan, which is not guaranteed, with this plan, we are talking about a lifetime.

Thus, it can immortalize your love for your kids.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan from Sun Life

It may sound too intimidating for some. So let us discuss this using a sample proposal.

Sun Smarter Life Elite Sample Proposal

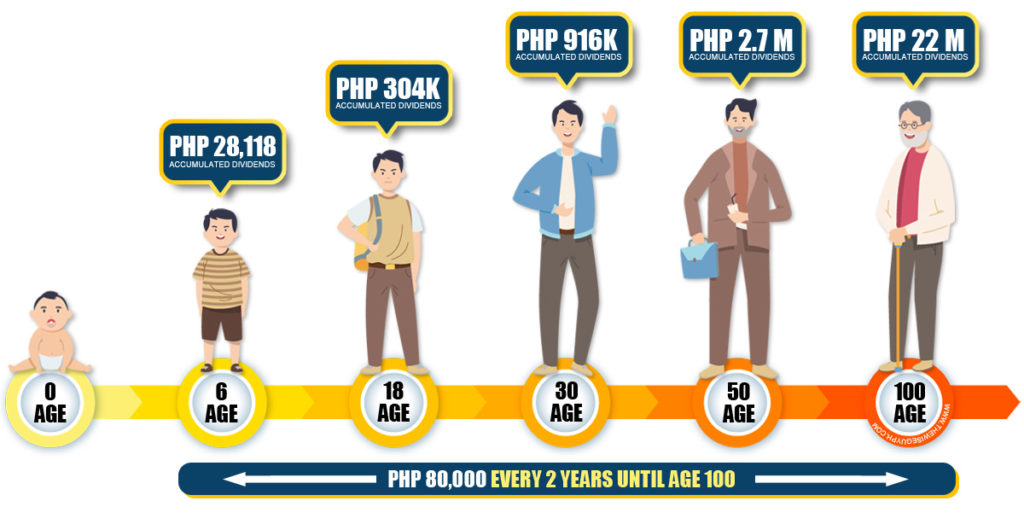

Now, I’ll be showing a sample proposal of Sun Smarter Life Elite. And how it can serve as a lifetime pamana to your kids or apo.

Juana Dela Cruz, Female, 40 years old, non-smoker, with newly born son

Annual Premium: Php 188,347.01

Face Amount: Php 1 Million

Insurance Coverage: Php 2 Million

Payment Period: 10 years

Endowment: Php 80,000

Riders: ADB and WPDD

Insurance Benefits

- Life insurance: equal to 200% of the face amount. The beneficiary will get Php 2 Million when the insured dies. Of course, no parent in his right mind will wish for it. With future-forward thinking, it is for the future family of your child (it can be for your in-laws and grandkids.)

- Accidental Death Benefit (ADB): an additional Php 1 million will be given to your kid’s beneficiaries if he/she dies due to an accident.

- Waiver of Premiums Upon Death or Disability of Initial Owner (WPDD): payment is waived if you, the parent, get disabled or die during the paying period. It adds another layer of security that no matter what happens to you, your kid’s future is secured.

Cash Benefits

- Cash Value: This is a guaranteed amount your kid can get when he decides to surrender the policy in the future. So, for example, at 60 years old, he’ll get Php 1,453,730. (The proposal contains the exact figures.)

- Dividends: a non-guaranteed benefit given every year. The amount may vary depending on the earnings and savings of the company.

- Endowment: your kid will get Php 80,000, equivalent to 8% of the face amount. This will start at the end of the 6th year and every two (2) years.

Why Give Sun Smarter Life Elite to Your Kids or Apo?

Sun Smarter Life Elite is a beautiful pamana for your kids. It has very flexible payment options and guaranteed cash benefits your kids (apo) can enjoy throughout their lifetime.

At this time, some of you might be having second thoughts. So I listed eight (8) advantages of getting it to help you decide why you should get it now.

Here are the eight (8) advantages of Sun Smarter Life Elite.

1. Guaranteed cash benefit

You can give guaranteed cash benefits to your kids, independent of market volatility. Thus, even if the stock market crashes due to the economic cycle, like the COVID-19 pandemic, your kids will get the benefits no matter what.

2. Give your pamana now!

Most parents are worried that their kids might be waiting for their death. That’s why other parents transfer their assets to their kids early on.

A nightmare in wealth transfer because what if you live longer? There are several horror stories you do not want to experience.

READ: Estate Planning | Get Liquid with Life Insurance

So why not just give a portion of their inheritance?

Getting a Sun Smarter Life Elite for your kids is like giving them some of their inheritance.

Thus, you can keep control of most of your assets while sharing a portion with your kids.

3. Time value of money

If you give it now, they can get more value from it. Your kids can invest the money to grow through compound interest. Thus, time is on your kids’ side.

4. Limited pay

You can opt to pay it for 5 or 10 years. It will give you a sense of fulfillment when finished.

5. Regular cash benefits

Most parents are afraid of leaving a massive sum of money to their kids because it may hinder their desire to strive harder in life.

But with Sun Smarter Life Elite, a cash benefit is given regularly.

Thus, it can train your kids on how to handle money. So when the time comes, they can manage your remaining assets properly.

6. Two are Better than One

Your kids will get the cash benefit at the end of the 6th year and every two years. But if you want to make it a yearly payout, get one now and another next year.

7. A lifetime pamana

What if you are gone? How long will your pamana last?

If you get Sun Smarter Life Elite, it can last a lifetime.

Your grandkids can also reap the rewards of your sound financial decision.

8. Get lucky with “8.”

Did you know that 8 is the luckiest number for the Chinese? Because it sounded like “fa,” which means wealth or prosperity in Chinese.

The plan gives cash benefits equal to 8% of the face amount, giving you endless luck.

Inquire NOW!

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

Final thoughts:

If you could give something to your kids that could last a lifetime, would you give it?

Is it a yes or a yes?

Giving a plan like this to your kids serves as a reminder of how much you love them. And it’s not just about the money they can get but the love and hard work you put into making this possible.

But if you are still undecided, then why not request a proposal? It will give you a bird’s-eye view.

After all, it is FREE.

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

2 thoughts on “Sun Smarter Life Elite: A Lifetime Pamana to Your Kids”

which is better? Regular pay or elite 10?

Hi, Ann! Which is better between the two or 3, including the Elite 5, is kind of subjective. If money is not an issue, then go for the limited pay variants like the Elite 5 or Elite 10.