Updated: May 19, 2021

In 2019, the Current Health Expenditure (CHE) in the Philippines rose to Php792.6 billion based to the Philippine Statistics Authority (PSA). CHE is the total amount spent by the government, HMO providers, insurance companies, and out-of-pocket (OOP) shouldered by Filipinos for health care.

And 47.9% of which is from the individual pockets of Filipinos.

As a result, a huge health insurance gap to address. As it pushes approximately 1.5 million Filipinos into poverty each year. Consequently, it forces families to cut back on education and some important spending.

Hence, insurance companies must work harder to fill this gap. On the other hand, we have seen improvements in out-of-pocket expenditure from 56.3% in 2017. This translates to a small improvement in the overall health care in the country.

Table of Contents

Health Insurance Gap

Certainly, the pandemic shocks the world, especially the medical industry. However, challenges in health care are an existing problem in the country. In other words, it was only amplified by the COVID-19 pandemic.

Many Filipinos died because they cannot access the medical treatment they needed. While some survive, only to face poverty. Here, the great need for life and health insurance plays a vital role in nation-building.

The Rising Cost of Getting Sick in the Philippines

In 2017, there were about 4 Million Filipinos covered by HMO with an average maximum benefit limit (MBL) of Php150,000 only. Definitely a great help to ailing employees. However, it is not enough to cover major medical health concerns such as stroke, cancer, heart attack, etc.

Firstly, it may give you a false security blanket that your coverage is enough. Furthermore, a stroke costs around Php 1.8 million. In addition, a heart attack costs Php 900,000, breast cancer at Php 430,000, and lung cancer at Php 2.7 million.

Meanwhile, the difference between the MBL and the actual cost of treatment is what we call the “out-of-pocket”. Here, you have two choices when you get ill.

First, to personally cover the medical cost by selling your properties, using your savings intended for other things, such as the education fund of your kids, building a house, starting a business, etc. Second, to transfer the risk to an insurance company by getting life and health insurance.

How do we come up with the list?

Many companies are claiming the number 1 spot as the top life insurer. There are even blogs and websites that decided to consolidate the data from the insurance commission (IC) to come up with their own ranking. Don’t worry, this blog is here to help you with the confusion.

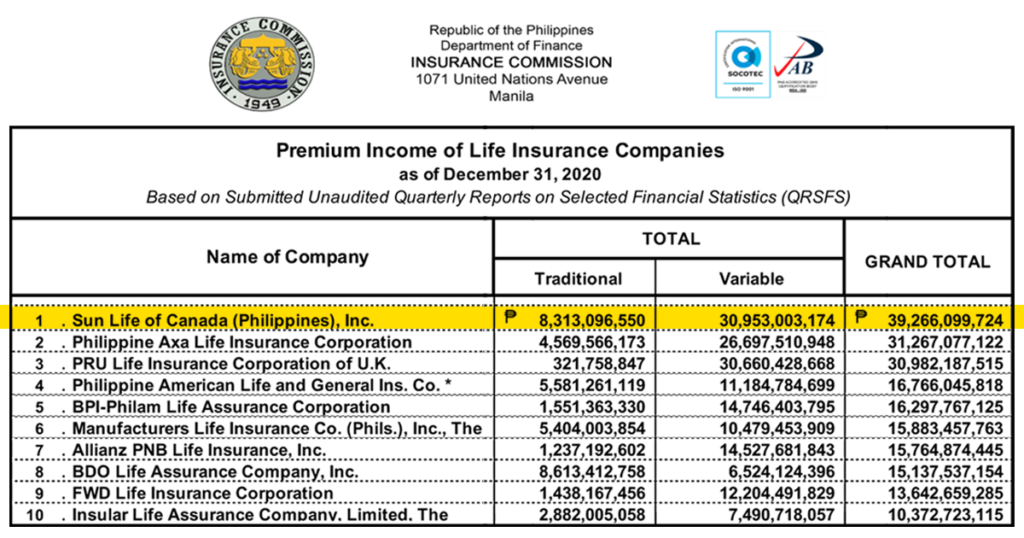

In April 2021, IC released 5 financial reports, and different companies topped each metric. But among the 5 categories, only one of them is widely used to come up with the top 10 life insurance companies in the Philippines in 2021. It is not just in the Philippines, but the entire life insurance industry in the world, and that’s “Premium Income.”

Premium Income is the revenue that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customer’s cost for a specified term of the policy is called the premium. (Investopedia)

How to interpret the categories

But it doesn’t mean that other metrics are not important. For instance, you can use them to know the overall financial health of a company. So here’s a way to interpret each category.

Premium Income

It is the combination of past and present business of the insurance company. The past business is often called the renewal premiums. And a good percentage of renewals means that clients are happy with the services so they continue paying for their plans. On the other hand, it means that the company made quality business. While the present business is what we call the NBAPE.

New Business Annual Equivalent (NBAPE)

It signifies the sales performance of an insurance company in a given year. Therefore, acquiring new business is very important. That is to say, new business is a reflection of how the general public perceives a company. Thus, growth is desirable. While a decline might mean losing interest or trust.

Net Income

Basically, it is the income minus expenses. It shows how profitable the business is. Importantly, you must consider profitability because you will be placing your hard-earned money through insurance. Of course, you want the company to be there when the time comes.

Net worth

It is equal to the assets minus liabilities. Certainly, it shows the capacity of a company to cover its liabilities such as claims. And you can look at this to foresee if the net worth of a company will be enough for future claims.

Total Asset

It is composed of current and fixed assets. Here you can see how the company manages its assets. Thus, a good company should have growing assets to support the business and sales.

Sun Life Remains the Top Life Insurance Company in 2021

Sun Life is hailed as the number one insurer of 2021. It is based on the latest performance released by the Insurance Commission last April 2021. Thus, It is the 10th consecutive time that Sun Life managed to top the premium income category both in traditional (whole life, term, and endowment) and variable plans.

So why it’s important to be the number one (or to be included in the top 10) insurance company?

Because it serves as a validation that companies like Sun Life can still fulfill their promise to their clients.

Remember that life insurance is an aleatory contract or a contract of promise that when a specified event occurs like death, then the insurer will have to pay the promised amount.

Of course, you want your family to get the benefits by the time it happens to you, right?

Sun Life’s Traditional and VUL Plans

It is why it’s important to consider the standing of an insurance company before availing of any insurance plan. You want that by the time the need arises, the company is still performing well to fulfill its obligations to you. But this shouldn’t be the sole basis for getting a plan might as well consider convenience, customer service, a reputable Financial Advisor, etc.

If you want income protection with a wealth accumulation plan, then a VUL plan is perfect for you. A VUL plan is designed to give you financial security and peace of mind while growing your money over time. You can request a quotation and financial consultation by following the link below.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

If you want a cheaper VUL from Sun Life, then you can follow the link below. It is for those who are looking for another VUL plan with a cheaper tag. It has better life insurance coverage than Sun Maxilink Prime but with a lesser investment fund.

READ: Sun Maxilink 100 | Affordable VUL Plan from Sun Life

*****

Top 10 Life Insurance Companies in the Philippines 2021

Now, let us get to know more about the other companies that complete the list. To clarify, the top 10 life insurance companies in the Philippines are based on premium income. Importantly, the table was only made to summarize the overall performance of each company.

| Insurance Company | Premium Income | NBAPE | Net Income | Net Worth | Total Assets |

|---|---|---|---|---|---|

| Sun Life | 1 | 2 | 1 | 2 | 2 |

| AXA | 2 | 3 | 5 | 6 | 3 |

| Pru Life UK | 3 | 1 | 4 | 7 | 5 |

| Philam Life | 4 | 9 | 2 | 1 | 1 |

| BPI-Philam | 5 | 5 | 7 | 5 | 7 |

| Manulife | 6 | 6 | 3 | 4 | 6 |

| PNB Life | 7 | 8 | 13 | 26 | 9 |

| BDO Life | 8 | 7 | 30 | 8 | 8 |

| FWD | 9 | 4 | 12 | 12 | 12 |

| Insular Life | 10 | 12 | 6 | 3 | 4 |

So here are the top 10 life insurance companies in the Philippines 2021.

1. Sun Life of Canada (Philippines) Inc.

Officially founded in 1895, making Sun Life of Canada (Philippines) was the first and the oldest life insurance company in the country. The ability to fulfill its promises to its clients has made Sun Life as the preferred life insurance company in most households. No wonder why it is still the top life insurance company in the country.

READ: Sun Life | A Company that Loves to Pay Claims

➡ Premium Income: 1

⬇ NBAPE: 2

➡ Net Income: 1

➡ Net Worth: 2

➡ Total Assets: 2

Sun Life remained number 1 in the Premium Income category for 10 consecutive years. While it dropped to second place in NBAPE by a very small margin. However, it still managed to be profitable despite the pandemic and was hailed as the top performer in Net Income. While it maintained being 2nd in net worth and total assets.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

2. Philippine AXA Life Insurance, Corp.

AXA Philippines was only established in 1999 in the Philippines but has shown massive growth and market penetration thanks to its bancassurance business. It is a joint venture between AXA Group and Metrobank Group.

⬆ Premium Income: 2

⬇ NBAPE: 3

⬆ Net Income: 5

⬇ Net Worth: 6

⬇ Total Assets: 3

3. Pru Life Insurance Corp. of UK.

The company started in 1996 or 23 years in the life insurance industry in the Philippines. Despite being relatively new compared to its rivals, Pru Life UK bagged 3rd place in the list.

⬇ Premium Income: 3

⬆ NBAPE: 1

⬇ Net Income: 4

⬆ Net Worth: 7

⬆ Total Assets: 5

4. Philippine American Life & Gen. Ins. Co.

Philam Life was founded in 1947 by Cornelius Vander Starr and partner Earl Carrol. Their incredible partnership has made Philam Life the number 1 life insurance company in 2 years, 1949, in the business.

⬆ Premium Income: 4

⬇ NBAPE: 9

➡ Net Income: 2

➡ Net Worth: 1

➡ Total Assets: 1

5. BPI-Philam Life Assurance Corp., Inc.

Previously known as Ayala Life Assurance Incorporated, founded in 1933. It is the country’s top bancassurance on the list thanks to the strategic alliance between BPI and Philam Life.

➡ Premium Income: 5

➡ NBAPE: 5

⬆ Net Income: 7

⬆ Net Worth: 5

⬇ Total Assets: 7

6. Manulife Philippines

Manufacturers Life Ins. Co. (Phils.) or just Manulife is a wholly-owned subsidiary of The Manufacturers Life Insurance Company. It was established in 1907, making it one of the oldest insurance companies in the Philippines.

⬇ Premium Income: 6

⬇ NBAPE: 6

⬆ Net Income: 3

➡ Net Worth: 4

⬇ Total Assets: 6

7. Allianz PNB Life Insurance, Inc.

Allianz PNB Life was founded in 2001, operating as a subsidiary of Alliance SE. The company has shown incredible growth coming from 10th place last year to being 9th in the top 10 life insurance companies in the Philippines.

⬆ Premium Income: 7

⬆ NBAPE: 8

⬆ Net Income: 13

⬇ Net Worth: 26

⬆ Total Assets: 9

8. BDO Life Assurance Co. Inc.

It was founded in 1999 as a joint venture between Generali Pilipinas Holdings Company Inc. (GPHC) and BDO. Generali is now renamed BDO Life Assurance Co. Inc.

⬇ Premium Income: 8

⬇ NBAPE: 7

⬇ Net Income: 30

⬇ Net Worth: 8

➡ Total Assets: 8

9. FWD Life Insurance Corporation

FWD was launched in the Philippines in 2014. Despite being a relatively new player in the industry they manage to be included in the top 10 life insurance companies in the Philippines.

⬆ Premium Income: 9

⬆ NBAPE: 4

⬆ Net Income: 12

⬆ Net Worth: 12

⬆ Total Assets: 12

10. Insular Life Assurance Company, Ltd.

Insular Life is the first Filipino-owned life insurance company in the Philippines founded in 1910. It is a mutual company, which means its policyholders own it.

⬇ Premium Income: 10

⬇ NBAPE: 12

⬇ Net Income: 6

➡ Net Worth: 3

⬇ Total Assets: 4

Top 10 Life Insurance Companies in the Philippines (NBAPE) 2021

Getting more clients means generating more income that can be used for business expansion and payment of claims. It can also lower administrative and insurance charges, thus, more allocation in the investment fund of your VUL plan or dividends for a traditional plan. Pru Life UK dominated this category with Php 7.9 billion worth of new business premium. Sun Life comes in 2nd with a small margin at Php 7.8 billion.

You may refer to the table below for a more comprehensive look at the performance of each life insurance company in 2021.

| Insurance Company | NBAPE |

|---|---|

| Pru Life Insurance Corp. of U.K. | P7,950,610,172 |

| Sun Life of Canada (Philippines), Inc. | P7,800,338,556 |

| Philippine AXA Life Insurance. Corp | P4,805,192,239 |

| FWD Life Insurance Corp. | P2,872,145,988 |

| BPI Philam Life Assurance Corp., Inc. | P2,833,506,107 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P2,757,772,799 |

| BDO Life Assurance Company, Inc. | P2,261,607,566 |

| Allianz PNB Life Insurance, Inc. | P2,233,140,100 |

| Philippine American Life & Gen. Ins. Co. | P1,861,860,556 |

| United Coconut Planters Life Assce. Corp | P1,477,778,436 |

Top 10 Life Insurance Companies in the Philippines Based on Net Income 2021

In a nutshell, net income is the total profit of a company after subtracting all the expenses in operating a business. Sun Life was able to claim the number 1 spot in net income.

| Insurance Company | Net Income |

|---|---|

| Sun Life of Canada (Philippines), Inc | P8,467,831,223 |

| Philippine American Life & Gen. Ins. Co. | P4,522,387,252 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P4,048,885,103 |

| Pru Life Insurance Corp. of U.K. | P3,274,475,424 |

| Philippine AXA Life Insurance. Corp | P2,832,628,279 |

| Insular Life Assce. Co., Ltd., The | P2,695,144,575 |

| BPI Philam Life Assurance Corp., Inc. | P1,432,222,722 |

| Sun Life GREPA Financial, Inc. | P958,088,123 |

| United Coconut Planters Life Assce. Corpn | P674,222,268 |

| Manulife Chinabank Life Assurance Corporation | P382,850,460 |

Top 10 Life Insurance Companies in the Philippines Based on Net Worth 2021

Philam Life maintained the number 1 spot in the net worth category or the amount by which the assets exceed their liabilities. It is followed by Sun Life, Insular Life, and Manulife, respectively.

| Insurance Company | Net Worth |

|---|---|

| Philippine American Life & Gen. Ins. Co. | P78,437,432,778 |

| Sun Life of Canada (Philippines), Inc | P31,342,290,335 |

| Insular Life Assce. Co., Ltd., The | P28,218,651,477 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P12,860,959,603 |

| BPI Philam Life Assurance Corp., Inc. | P8,817,496,193 |

| Philippine AXA Life Insurance. Corp | P8,044,250,809 |

| Pru Life Insurance Corp. of U.K. | P6,106,195,028 |

| BDO Life Assurance Company, Inc. | P5,275,716,39 |

| Sun Life GREPA Financial, Inc. | P4,220,141,927 |

| United Coconut Planters Life Assce. Corp | P3,032,631,184 |

Top 10 Life Insurance Companies in the Philippines Based on Assets 2021

An asset is anything expected to bring future benefits by generating cash flow, reducing expenses, increasing sales, etc. Philam Life has once again dominated this category having Php 291.2 billion assets. Being followed by Sun Life with Php 274.2 billion.

| Insurance Company | Total Asset |

|---|---|

| Philippine American Life & Gen. Ins. Co. | P291,223,060,576 |

| Sun Life of Canada (Philippines), Inc. | P274,212,700,617 |

| Philippine AXA Life Insurance. Corp | P141,500,316,009 |

| Insular Life Assce. Co., Ltd., The | P140,928,039,691 |

| Pru Life Insurance Corp. of U.K. | P117,193,453,060 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P117,133,189,676 |

| BPI Philam Life Assurance Corp., Inc. | P112,255,295,695 |

| BDO Life Assurance Company, Inc. | P68,467,307,840 |

| Allianz PNB Life Insurance, Inc. | P51,615,114,149 |

| Sun Life GREPA Financial, Inc. | P48,574,787,007 |

RELATED: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

How to Pick the Right Life Insurance?

Looking for the right insurance plan as a first-time insurance buyer is such a daunting task. Don’t worry it’s fine. Everyone started somewhere. And after getting your first insurance choosing the succeeding plans is much easier.

But for now, you may follow the steps below in picking the “right” plan for you.

5 Steps in Getting the Right Insurance Plan

1. Choose 5 insurance companies

First, narrow down your choices by picking 5 companies from the top 10 life insurance companies in the Philippines 2021. And then determine what important qualities you are looking for like positive customer service, financial standing, and competitive pricing.

But when we say price, cheapest doesn’t mean it’s the best insurance. Look at the value first before its price.

2. Know what’s important for you

Let me ask you this, “What are your top 5 priorities.” Before getting those proposals at your disposal you must understand yourself first. Don’t be one of those people who just got an insurance plan without a goal.

Is it for your family, you want to protect them from financial struggles? Nowadays, rapidly increasing medical care is a concern. Maybe you want to secure the future of your kids by providing the best education and a roof over their heads. Some people think about retirement or what to do as a retiree. Perhaps open a business to keep you busy?

So make sure to reflect on how important this decision is for you. I’ll tell you getting insurance is a long-term commitment. Problems will shake you from time to time. You might surrender the plan without a clear purpose of why you started. I know you don’t want to waste your time and money. Thus, set your goals at this point.

3. Schedule an Appointment

Get in touch with an advisor in each company and set a meeting either face to face or virtual, i.e. Zoom. Mind you, this is for your future so don’t just browse the pages of the proposals as if you are browsing a menu. You are not in a restaurant.

Life insurance is for your future so take time to have a sit-down discussion.

Here are some qualities to look for in an advisor.

- He must be reachable. Can you easily contact your advisor in times of need? An advisor should be around to check your account and do regular policy updates. Sometimes you’ll forget your coverage and may need a refresher of your plan. Refrain from getting an advisor you are intimidated to ask.

- Is he knowledgeable? Can he explain the plans and options well? You might have heard somewhere to read the fine prints of the plan. Yes, you need to know the pros and cons of the plan. But a knowledgeable advisor will always lay it down without reservation. Because he is not just after the sale but genuinely cares for you.

- A dependable person. Remember that you will be getting is not just an insurance plan. Consider it as your contingency plan that concerns your family’s future. So the question is, do you see the advisor will still be there when the time comes? On average, advisors stay in the company for 2 years.

Choosing the right advisor is as hard as picking the most suitable insurance plan for you. An insurance plan is like proof of how much you care for your family. On the flip side, an advisor is your partner or let’s say the caretaker of the proof. So be mindful of considering a reachable, knowledgeable, and dependable advisor.

4. Prepare questions

At this point, you may now prepare for questions that concern you the most. You don’t have to be computing all the costs here like charges and what goes here and there. Remember, in step 3, you already set your goals. Price is should not be the basis but its value proposition.

If you are able to get a qualified advisor, you will notice that most of your questions will be answered during the presentation. But then do not be afraid to ask your remaining questions. This is for your future so make sure the plan answers your needs.

5. Finalize your decision

You already met the 5 advisors and reviewed their proposed plan. At this point, you may create a table or list down the things you need and want from an insurance plan versus the proposals. Now, which among them is the fittest to your goal. While some riders or benefits are a wonderful addition remove them if it doesn’t fit your cause. Just get what you need.

I hope this blog helped you in getting the “right” insurance for you. Cheers!

READ: Sun Fit and Well | Most Comprehensive Health Insurance

*****

References:

- de Vera, Ben O. (2021, April 20). Insurer profit down 8.6 percent in 2020 as pandemic hammers markets. Inquirer.net. Retrieved May 29, 2021, from https://business.inquirer.net/322053/insurer-profit-down-8-6-percent-in-2020-as-pandemic-hammers-markets

- Funa, Dennis B. (2019, June 19). The health insurance gap in the Philippines. Business Mirror. Retrieved May 29, 2021, from https://businessmirror.com.ph/2019/06/19/the-health-insurance-gap-in-the-philippines/

- Mapa, Dennis S. (2020, October 15). Health Spending Grew by 10.9 Percent in 2019. PSA. Retrieved May 29, 2021, from https://psa.gov.ph/pnha-press-release/node/163258

- Tan, Arlyn. (2021, April 28). [Fin Talk] Life Insurance Company Ranking: What’s in it for the Policyholders and Beneficiaries?. Now You Know. Retrieved May 29, 2021, from https://www.nowyouknowph.com/post/fin-talk-life-insurance-company-ranking-what-s-in-it-for-the-policyholders-and-beneficiaries?

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.