Sun Maxilink 100 is the newest insurance with an investment plan from Sun Life. It gives you an extended coverage of until age 100 compared to the other Sun Life VUL plans, which are only until age 88. A cheaper alternative to Sun Maxilink Prime but equally mightier plan.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan From Sun Life

Table of Contents

Why Sun Maxilink 100 is for you?

Nowadays, you have several options when it comes to life insurance protection. Which can be a good thing because you can have something more tailored fit to your financial needs. Or a bad thing because you will be overloaded with terms, thus making you indecisive.

To help you decide, I listed 5 reasons why Sun Maxilink 100 is suitable for you. So here it is:

1. Higher Insurance Coverage

You will get insurance coverage of equal to 200% of your face amount from this plan. Thus, giving you more insurance coverage versus other plans with the same premium.

2. Cheapest VUL Plan

It is a regular pay VUL plan, which makes it cheaper compared to a 10-pay plan. It was made possible because charges are spread throughout your lifetime.

3. Regular Pay Until 100

If paying until age 100 doesn’t bother you, then you may consider this plan. Well, not really until 100, but simply put it as pay until you’re able because time will come that you can no longer work. By that time, the fund will be sufficient to take care of the charges.

READ: Top 10 Life Insurance Companies in the Philippines

4. Insurance Over Investment

This is something you may consider if you’re more after the life insurance coverage than the investment. But this is a VUL plan, so you will still have something you can look forward to using maybe as a retirement fund.

5. Premium Holiday Option

You can make this plan to be paid in 10 years through the premium holiday option. One advantage of this over Sun Maxilink Prime is that you can instantly see how well your investment will grow through the years if you stopped paying the plan. Oh yes, you may also opt to pay for it for 5 years, 6 years, 7 years, and so on.

How Much is Sun Maxilink 100?

Now, you may be liking this plan already and would want to know if it’ll fit your budget. That’s why I created a table below for Php 1Million coverage of Sun Maxilink 100. So, for example, you are 37 years old, female, and non-smoker, then your annual premium is between Php23,870 to Php24, 405. Yes, it’s not exact, but you know it’s just enough to give you an idea.

But if you are really interested to know the exact figures, then you request a quotation by clicking [HERE].

Eligibility: 18-70 years old

Minimum Insurance Coverage: Php 700,000

Mode of Payment: Yearly | Semi-Annually | Quarterly

The table above is created for non-smokers and to those who are willing to pay until age 100. But then again, if you want 10 years to pay Sun Maxilink 100, then the premiums will definitely change just like the sample proposal I created below.

Sun Maxilink 100 Sample Proposal

I will be sharing a sample quotation to help you understand the benefits you can receive if you availed of the plan. So here is a sample proposal for 10 years to pay Sun Maxilink 100:

Federico Suan, Jr. | Engineer | 25 years old | Non-smoker

Annual Premium: Php 48,000

Semi-annual: Php 24,000

Quarterly: Php 12,000

Monthly: Php 4,000

Daily: Php 133 (just the price of a fast-food meal)

Life Insurance Benefits

What’s good about this plan is that you can get higher insurance coverage for a lower premium. Thus, giving you more value for your money. It will provide you with peace of mind that your family will get a decent amount of money when you’re taken out of the picture. Which they can use to continue living the life you dreamed of giving them even when you’re gone.

Death Benefit: Php 1 Million

This is the amount of money your family will get if you die due to natural causes. You know how hard life can get for your family if the main provider of income, which is you, is gone. But by giving them this much, it will lessen the financial struggles they’ll have to face.

Accidental Death Benefit: Php 1.5 Million

If you are taken out of the picture due to an accident, then your family will get Php 1.5 Million. This is an additional 50% on top of your basic insurance coverage.

Dismemberment Benefit: Up to Php 500k

When you got into an accident and lost any part of your body, then you are entitled to receive a percentage of Php 500k. So, for example, you lose one eyesight, then you will get 50% or equivalent to Php 250k.

Disablement Benefit: Php 50,000/year

If you become totally and permanently disabled due to an accident, then you will receive Php 50,000 per year for the next 10 years. This will give you a total benefit of Php 500k.

Hospital Income Benefit: Php 2,000/day

You will receive this if you are confined for at least 3 days if due to sickness or 1 day if it is because of an accident. This amount will double or becomes Php 4,000 per day if the confinement is in ICU or because you are confined due to a dreaded disease.

Critical Illness Benefit: Php 1 Million

A lump sum of worth ₱2 Million is the amount you can claim when you are diagnosed or get treated for any of the 36 critical illnesses listed here. This rider covers most of the critical illnesses around like stroke, heart attack, brain tumor, major organ transplant, invasive cancer, etc.

Projected Investment Fund

This plan was personally designed to be paid in 10 years, with all the riders attached. What’s good about this is that you can quickly see how well your investment fund grows after the paying period. Something you will not get from Sun Maxilink Prime because you will still be required to pay for some riders after 10 years.

Initial Investment

I will have to pay a total of Php 480,000 in the next 10 years with the plan. I have chosen the Index Fund for my investment because it has an average return of 10% p.a. Something I will not get if I just placed my money in a time deposit.

Index Fund

So why the Index Fund? I’m an aggressive investor who doesn’t mind substantial fluctuations in my investment in exchange for capital growth. I’m just in my 20’s, so this fund is a right choice as I still have many years ahead of me. Don’t worry because your Financial Advisor will guide you in choosing the best fund for you to achieve your financial goals.

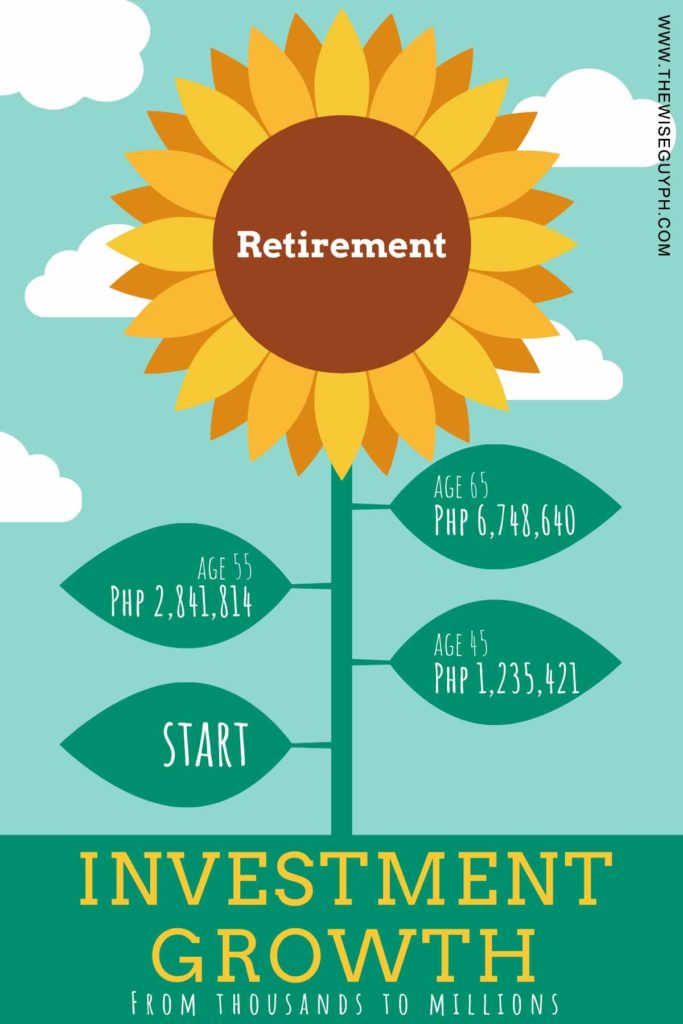

Return on Investment

This is a long term investment plan, so if you will notice, I just got an earning of a little over Php 7ok after 10 years. But still, it is something I will not get if I just put it in a bank. At the age of 65 or after 40 years, my fund would have grown to Php 6.7 Million, which gave me more than Php 6 Million in earnings.

Here are the projected fund values after a certain number of years:

10 years: Php 558,685

20 years: Php 1,235,421

30 years: Php 2,841,814

40 years: Php 6,748,640

Why choose Federico to be your Financial Advisor?

- Young professional. Picking a young Financial Advisor means he can grow old with you. It is a lifelong commitment, and he is ready to serve.

- Friendly with the utmost professionalism. He won’t give you that ultra-silent awkward moment when meeting up—no dull moments. He ensures an enjoyable and factual meeting.

- Reachable. You might have a sudden question so crucial with you; that’s why his lines are always open to attend your needs.

- Well-trained Financial Advisor. Attended several pieces of training and seminars inside and outside Sun Life to upskill himself because you only deserve the best.

- Needs-based financial solutions. His financial advice is based on your current financial situation and needs.

- Non-discriminating. His clients range from minimum wage earners to engineers, accountants, doctors, lawyers, company directors, etc.

- Full-time Financial Advisor. He can meet you in any place that you feel convenient with you any time of every day.

- Purpose and substance. His mission is to help clients achieve lifetime financial security and healthier lives.

My mission is to help you secure the future of your family. I acquired mine, and hopefully, yours is next.

For all Financial Advisors like us, we treat life insurance as LOVE insurance. Because when you love someone, i.e., your family, you don’t leave them without anything. You want every protection you can get to ensure their safety and well-being, right?

I hope you enjoyed my blog!

Inquire NOW!

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in-person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

Quick Summary:

It is the newest and most affordable life insurance with an investment plan from Sun Life. It gives an extended coverage of until age 100.

They are both variable unit-linked plans or VUL from Sun Life. The significant difference is that Sun Maxilink 100 is available for Php 700k life insurance coverage and up. If you want lesser than that, then Sun Flexilink is for you.

None. No plan is superior over the other as a good plan for you may be different from another person because both of you have different financial needs.

You can start for as low as Php 2,000 per month. But it will still depend on your age and other factors.

You just need one valid ID together with your initial payment of at least one quarter or equivalent to 3 months worth of premium.

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

4 thoughts on “Sun Maxilink 100: New and Affordable VUL Plan”

How much is my annual premium, 62 yrs old or semi annual ty

Only available up to age 60.

I had my Sun Maxilink 100 policy last December and I’m 37 yrs old. I got the policy with a 400k Face Amount and I paid **** monthly. I got very low..right?But I wanted to have a hard copy of my policy. How to get that?

Hi Evelyn. For any policy concerns, you may ask your advisor for guidance. Thanks 🙂