As working individuals, undoubtedly, one of the things we often neglect is our health. Most of us exert time and effort to further our careers. In our quest to live our best lives, we forget to take care of our best asset, ourselves. But things may turn upside down once I get sick. We might empty our pockets, or worse, our savings, just to get treated. It is a nightmare that most Filipinos could not afford to imagine. It is important to get a HMO card from a trusted healthcare provider like Maxicare.

Table of Contents

Who is Maxicare?

Maxicare is one of the best HMO card providers in the Philippines. It was established in 1987 by Dr. Roberto Macasaet Jr. with doctors and entrepreneurs to envision better and more affordable healthcare for the country. Since then, Maxicare has focused on helping its members through an extensive network of medical providers in the Philippines.

Aside from affordable healthcare, Maxicare believes in providing an unsurpassed level of customer service, quality, and cost-effectiveness. Thus, it makes Maxicare the top choice by most employers in the country.

What is an HMO?

HMO stands for Health Maintenance Organization. It acts as a bridge between the patient and health providers. This setup helps both ends by making affordable healthcare for members and giving healthcare providers a steady stream of customers.

What is the difference between HMO and Health Insurance?

Many are often confused with HMO cards and health insurance plans. I can’t blame you. Adulting is hard because you must learn several things at once. You have to grow professionally, save and invest for the future, get insurance, and, of course, you have to live now.

Back to the topic, the difference is quite simple.

HMO is something you use for your immediate healthcare needs. For example, if you need consultations or lab work, you can also use it for emergency cases and hospitalizations. Maxicare HMO card is one of your best bets in health cards.

Health Insurance, on the other hand, is used for more critical and life-threatening illnesses. For example, cancer treatment may cost millions of pesos. HMOs alone cannot cover that, but with health insurance, it can help you get the treatment you need. Currently, the recommended health insurance coverage is Php 2 million.

If you do not have comprehensive health insurance yet, consider Sun Fit and Well by Sun Life, with over 100 critical illnesses covered.

READ: Sun Fit and Well | 114 Critical Illnesses Covered

TheWiseGuyPH is Now Affiliated with Maxicare

I have been an insurance agent since 2017. My existing clients asked me about HMO recommendations, but my knowledge is limited to life insurance only. So most of the time, I would refer them to my friends. But in 2022, my grandmother was confined, which made me realize that health care is expensive without an HMO card.

You would have no choice but to shoulder the entire cost with your savings.

Because my HMO card provider is Maxicare and I am pleased with the services I got, I decided to get affiliated with them. So I am delighted to share many things about Maxicare and how it can help you address your healthcare needs.

So if you are looking for an HMO provider, you can reach us, and we will help you find the best plan that fits you.

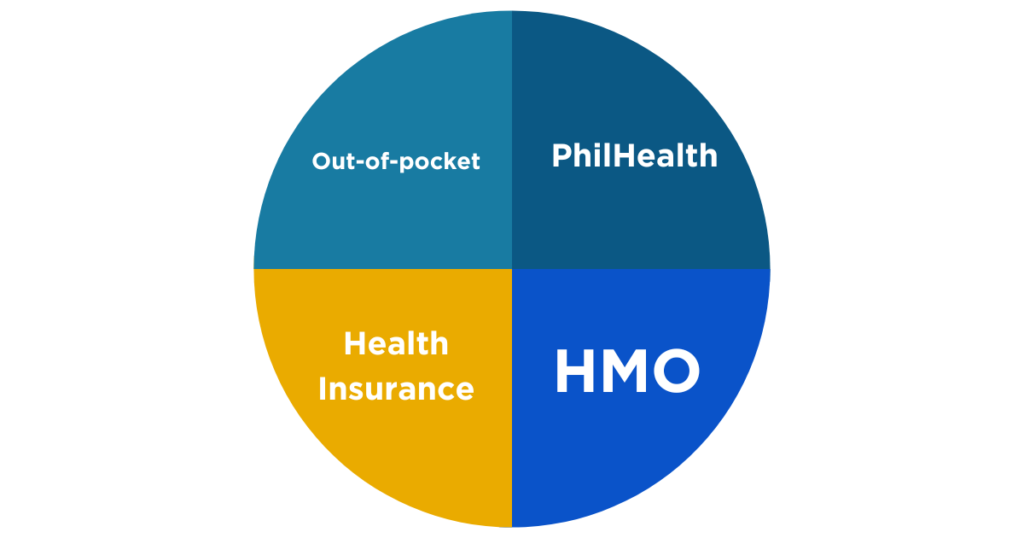

The Bigger Picture of Health Care

Health expenditure is the provision of our health care needs. According to the World Health Organization (WHO), it includes health services, family planning activities, nutrition activities, and emergency aid designated for health. But it excludes the provision of drinking water and sanitation.

If you, or a loved one, are confined, we know you will agree with us on how difficult it is to go to the cashier to update your account. For someone who has not experienced it yet, here’s how it usually looks:

PhilHealth

Believe it or not, PhilHealth is a tremendous help to our ailing population. It provides members with coverage for everything from basic to extreme health conditions. It is also the first deductible on your hospital bill. The amount will depend on the case and the diagnosis made by the attending doctor. While PhilHealth benefit is a great help, most of the time, it is not enough to cover the entire cost of treatment.

HMO (Health Maintenance Organization)

Usually, companies provide this as a benefit to their employees. However, with the rapidly increasing online opportunities, many are in dire need of getting HMO coverage because as freelancers. They must pay their memberships in SSS, Pag-IBIG, PhilHealth, BIR, and HMO cards from their pockets.

Getting an HMO card is economically better than using your savings.

HMO benefit comes in after the PhilHealth coverage. If you are not an active member of PhilHealth, you may be required to either pay for the supposed PhilHealth coverage or a certain amount of around Php2,400 before you can use your HMO card.

It is where HMO card companies like Maxicare come in.

Health Insurance

For critical care, HMO may not be enough to cover hospitalization and treatment. It is where the importance of getting comprehensive health insurance comes in.

If you get seriously ill, your health insurance can provide adequate funds to finance your treatment. It is a lump-sum benefit given to the policy owner. You only need to submit the necessary paperwork to claim it.

Regardless of the bill, you will receive an agreed-upon amount, whether or not you exhaust it.

READ: Sun Fit and Well | The Most Comprehensive Health Insurance of Sun Life

Out-of-Pocket (OOP)

Lastly, out-of-pocket is the money from your pockets that you use to pay for healthcare services. Most Filipinos are unprepared to cover their health bases for several reasons. In return, the amount of your out-of-pocket expenses depends on the first three sources. So, as much as possible, you must lessen this amount because whatever you spend on healthcare will diminish your savings. It must be your life fund, retirement fund, dream house, car, or business fund. Thus, be wary of this. You do not want to spend your life savings on health if you have options, right?

Based on the latest health expenditure report of the Philippines done by the Philippine Statistics Authority (PSA), OOP is still the biggest chunk of the pie for health expenditure. Hence, managing finances is vital to achieving financial security.

That’s nature. We all die. We do not know when, where, or the cause.

But based on statistics, most of us die after getting ill. So it is crucial to prepare for everything, not just about your career, kids, and goals, but also about yourself because you are your biggest asset.

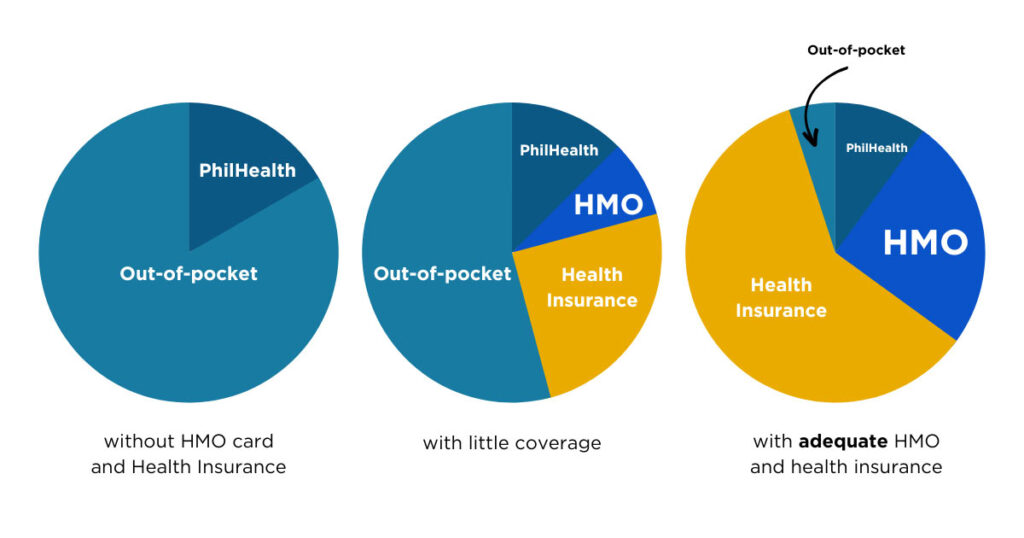

What does it look like?

Healthcare expenses can look different depending on your preparedness.

From above, the only variables are HMO and health insurance. So the higher and more comprehensive your HMO and health insurance, the less burden it puts on your pockets.

Paying the hospital bills is like a pie chart.

We prepared three (3) pie charts to help you visualize, i.e., without HMO and health insurance, with little HMO and insurance coverage, and adequate HMO and health insurance.

In the first chart above, there is no HMO or health insurance coverage; the out-of-pocket spending is almost as big as the pie. It is the reason why millions of Filipinos are pushed into poverty each year because of huge hospital bills.

In the second chart, there is small HMO and health insurance coverage. But because the HMO and health insurance coverages are small, the OOP is still a considerable piece of the pie.

On the last chart, with adequate HMO and health insurance coverage, you can see that there is no OOP. That’s our goal. To lessen or eliminate OOP from the equation.

Maxicare Prepaid HMO Cards

Maxicare has different plans for your different healthcare needs. There are two categories of HMOs you can avail of for you and your family: prepaid and full HMOs.

Prepaid HMO cards are the most affordable HMOs you can avail of. This is available for as little as PHP 1,300. The benefits include emergency care, hospitalization, and unlimited checkups and labs.

EReady

Be ER-ready with EReady. It is the cheapest HMO card you can get from Maxicare. It offers one-time coverage for emergency conditions only.

- Available for ages 15 days old to 65 years old

- Emergency benefits only

- Php15,000 limit is available for use in any Maxicare accredited hospital only

- AD&D (Accidental Death and Dismemberment) up to PHP 50,000.00

- 20% discount on all base dental services from Metro Dental Clinics

- 15% discount on derma services from My Health Clinics

EReady Variants

- EReady Titanium (Php1,300) -without access to 6 major hospitals

- EReady Platinum (Php1,500) – with access to 6 major hospitals

6 Major Hospitals

- Asian Hospital and Medical Center

- Cardinal Santos Medical Center

- Makati Medical Center

- St. Luke’s Quezon City

- St. Luke’s Global

- The Medical City

EReady Advance

The EReady Advance is a prepaid HMO card from Maxicare for one-time emergency cases, including those requiring confinement.

EReady Advance Variants:

- Titanium (Php4,999) without access to 6 major hospitals

- Platinum (Php5,999) with access to 6 major hospitals

Benefits:

- Php50,000 limit for emergency room and in-patient benefits

- ADD&D (Accidental Death, Dismemberment, and Disablement) of up to P 50,000

- Emergency medical evacuation for members who are more than 150 km away from their place of residence

- 20% discount on Metro Dental services

- 15% discount on MyHealth Clinic services

MyMaxicare Lite

MyMaxicare Lite is a prepaid health card for one-time in-patient coverage for eight (8) identified illnesses.

Eligibility:

- 2 to 60 years old

- One card per person per year only

8 Identified Illnesses

- Dengue

- Gastroenteritis

- Malaria

- Pneumonia

- Cholera

- Chikungunya

- Typhoid and Paratyphoid

- Leptospirosis

MyMaxicare Lite Variants:

- Blue (Php1,999) – without access to 6 major hospitals

- Yellow (Php2,499) – with access to 6 major hospitals

Benefits:

- Regular private room

- Php25,000 limit

- 20% discount on Metro Dental services

- 15% discount on MyHealth Clinic services

PRIMA

Maxicare Prima is a prepaid HMO card from Maxicare that offers unlimited consultation and laboratory procedures at Maxicare’s primary care clinics (PCC).

Prima Silver

- Php4,999

- 0 to 59 years old

- Unlimited consultations at PCC

- Unlimited laboratories at PCC

- Dental benefits once a year

Prima Gold

- Php12,999

- 60 years old and above

- Unlimited consultations at PCC and MyHealth Clinic

- Unlimited laboratories at PCC and MyHealth Clinic

- Dental benefits once a year

- Emergency coverage of Php20,000

HMO for Individuals and Families

An HMO card for individuals and families is usually a full HMO with full risk. In other words, you pay a small amount to get all the benefits. Of course, the premium will depend on the limit of your chosen package.

So what’s the difference between this and a prepaid plan?

In MyMaxicare, you get in-patient, out-patient, emergency cases, and dental benefits from any accredited hospital. Something you will not get from a prepaid Maxicare HMO card.

MyMaxicare

MyMaxicare is the perfect HMO card for individuals. For families, you will save money if you enroll your dependents under this program compared to getting individual coverage.

Age Eligibility

- Principal (Adult): at least 18 to 60 years old for new enrollees.

- Principal (Minor): at least 15 days old to 17 years old with an appointed guardian

- Dependents (adults): up to age 65 with renewing principal. Must be spouse or parent.

- Dependents (Minor): 15 days old up to 21 years old

Available MyMaxicare Plans:

- Platinum Plus (Large Private) – Php 200,000 MBL

- Platinum (Regular Private) – Php 150,000 MBL

- Gold (Regular Private) – Php 100,000 MBL

- Silver (Semi-Private) – Php 60,000 MBL

Benefits:

- In-patient (room & board, use of hospital facilities, professional fees, etc.)

- Out-patient (Diagnostic & therapeutic procedures)

- Emergency Care

- Preventive Care

- Annual Check-up (ACU)

- Dental Care

HMO for Business

Maxicare has 3 plans for different business needs: Maxicare Starter Plus, Maxicare Plus, and Business Essentials.

Maxicare Starter Plus

It is the starter plan for small businesses with at least three (3) principals and up to nine (9) principals.

Benefits:

- Standard in-patient and out-patient benefits

- Pre-existing coverage (PEC) is PHP 5,000 for dreaded and non-dreaded illnesses for the first year.

- PEC for the second year and up is 5,000 for dreaded illnesses and up to the maximum benefit limit (MBL) per year per illness per member for non-dreaded illnesses.

Maxicare Plus

Is a full HMO and full-risk product intended for small enterprises with a minimum of 10 principals.

Benefits:

- Standard in-patient and out-patient benefits

- PEC is at least 5,000 up to MBL, depending on the availed variant.

Variants:

- Maxicare Plus Nationwide has access to 9 major hospitals

- Maxicare Plus Provincial is for members in Northern Luzon, Southern Luzon, Visayas, and Mindanao except Baguio and Region IV & V

- Maxicare Plus Rated is for rated industries

- Maxicare Plus Graded is for NGO/Cooperative/Association/Religious Groups with members involved in “non-office based” work.

Business Essentials

It is an upgraded version of Maxicare Starter Plus, which is perfect for small businesses. It is an unbundled and full-risk product with outpatient unbundled or full HMO benefits.

Maxicare Corporate Plans

It is the only customizable plan being offered by Maxicare for at least 100 members and above.

Plan Options:

- Full Risk (premium based)

- Administrative Services Only (ASO)

- Full HMO

- Unbundled

Final Thoughts

Getting something, such as an HMO membership card, is very important. While we work to provide the best for our families, we must also not neglect our health. If, in any case, we become ill, we can have something to lean on and keep our minds focused on recovering.

It is also vital to get health insurance for critical care. The treatment cost for a critical illness (CI) averages Php 2 million. Thus, an HMO card will not be enough by then. So cover all the bases of health care by getting Maxicare HMO cards and Health insurance.

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.