SSS retirement benefit or pension as we normally call it is one of the few benefits employees are entitled to receive when they retire. So before you empty your savings by joining the YOLO, you will only live once, and FOMO, fear of missing out, craze you may want to consider how much you’ll be getting from SSS by the time you’ll retire. Are you ready to know how small it will be?

Yes I know, I also suddenly felt like a certified tito like how they call it now because of all these acronyms. Lucky me there’s Google to provide me with the info haha!

READ: New SSS Contribution Schedule | Bigger and Better Benefits

Table of Contents

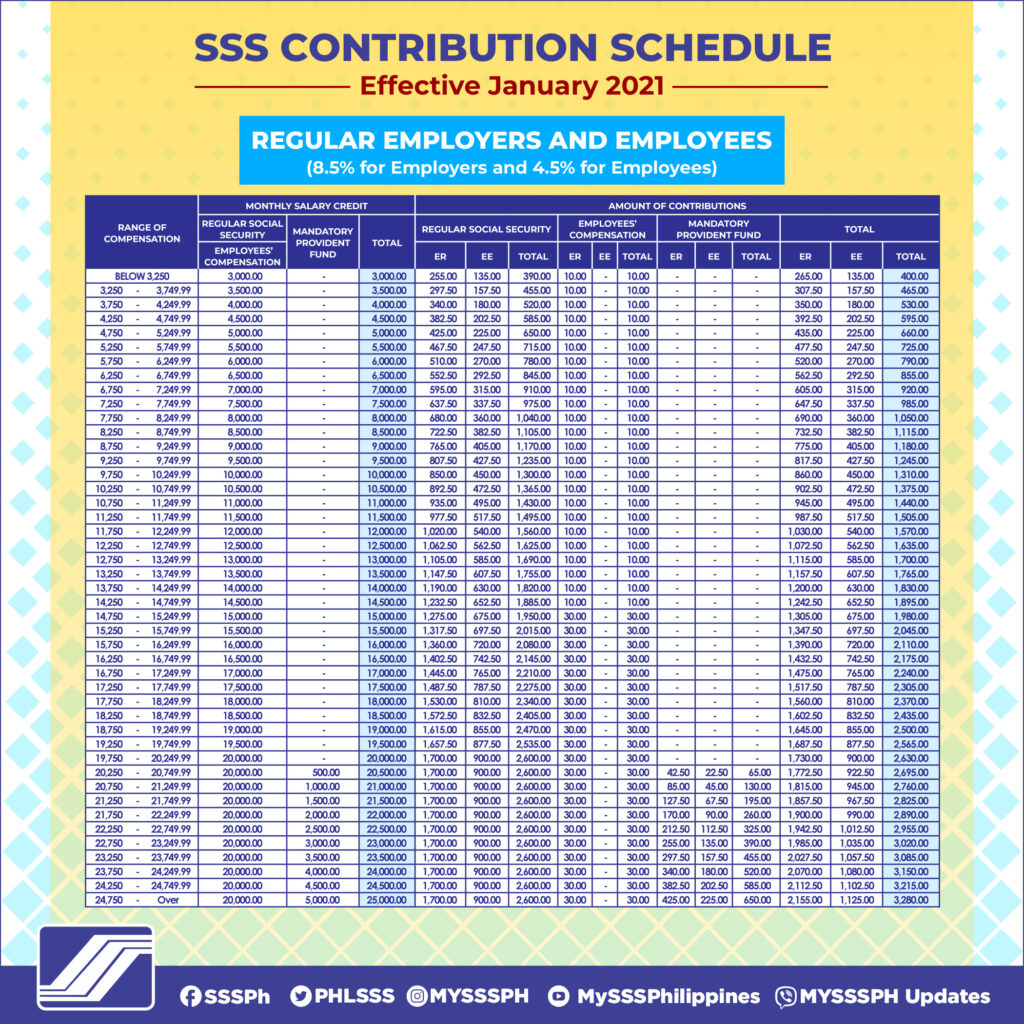

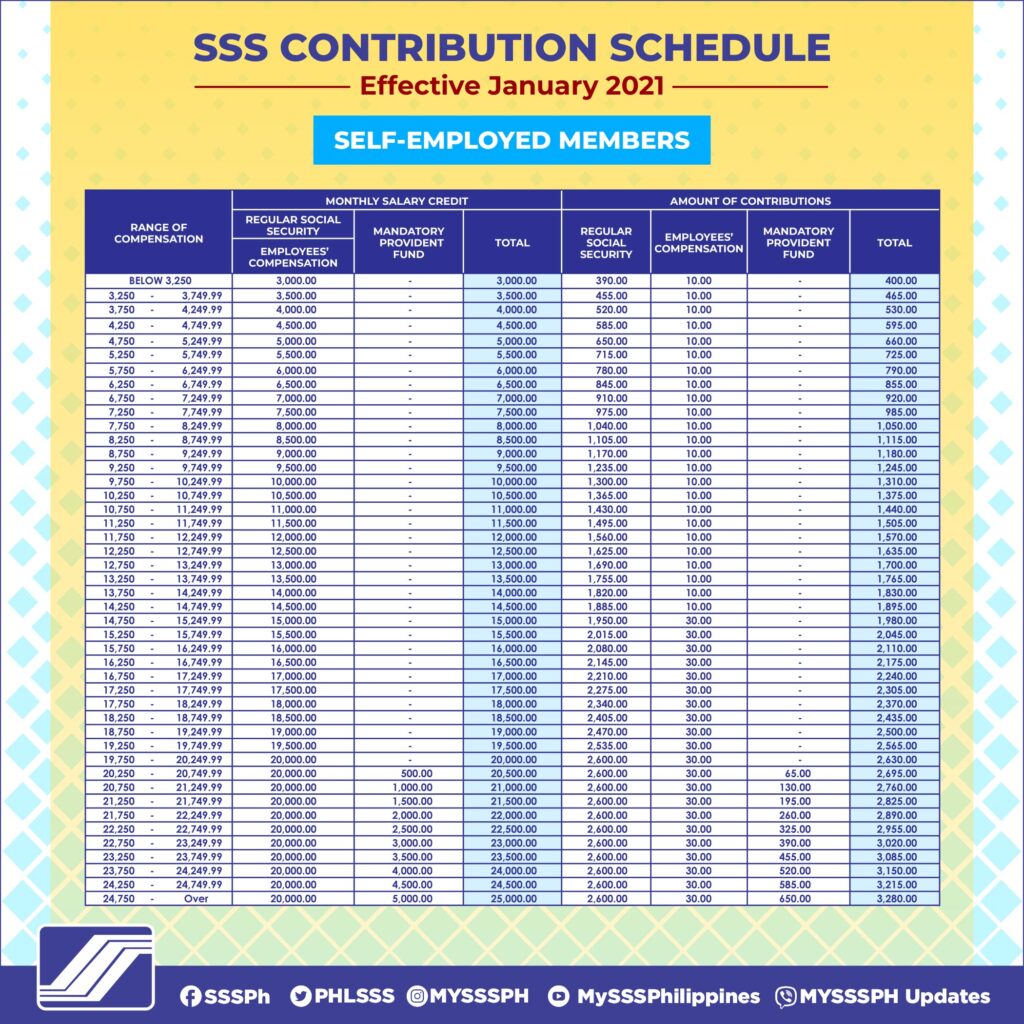

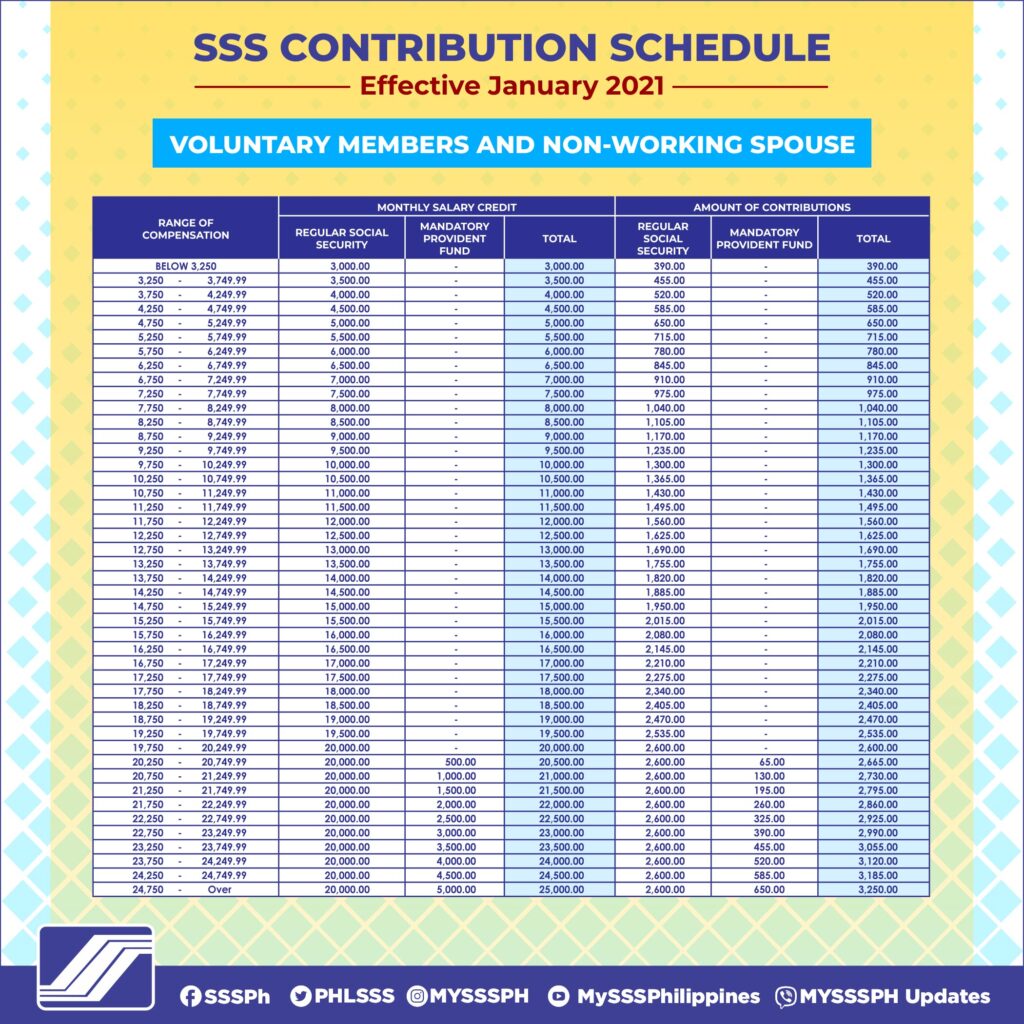

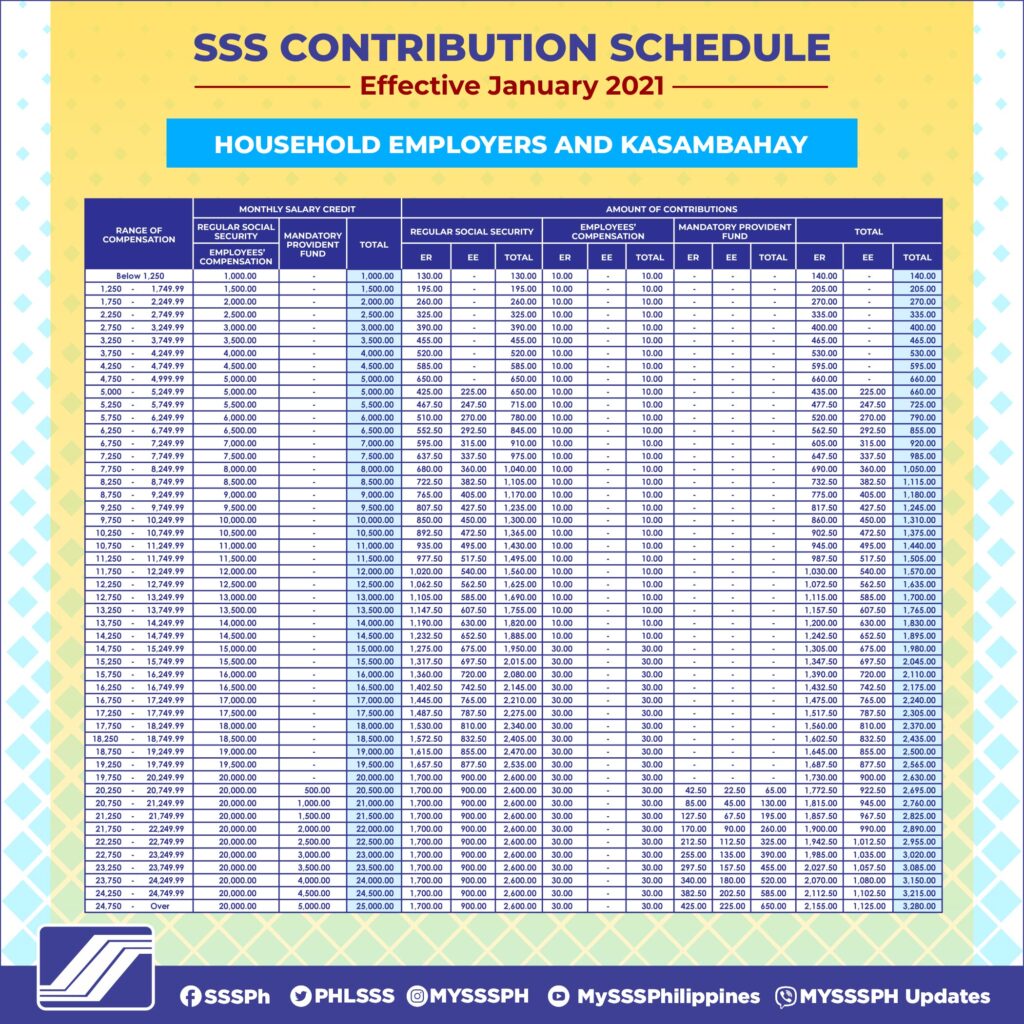

Know Your SSS Contribution Table

I’m going to teach you how to read the table below. Yes, I know how you despise seeing this kind of table so do I hehe. Sadly, this is needed in order for you to compute your monthly pension.

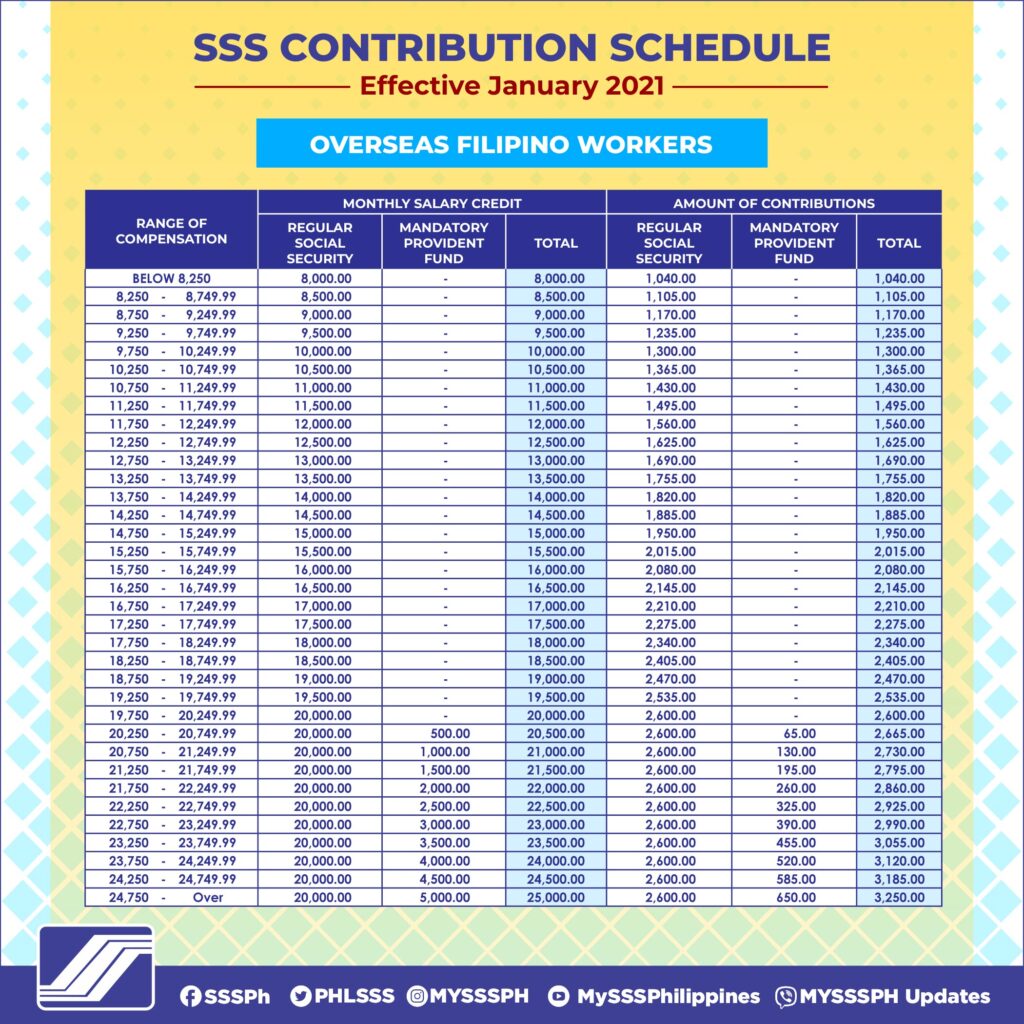

Here is the new SSS contribution table:

Employed, Self-Employed, Voluntary Member, and Non-Working Spouse

You can use this new SSS contribution table if you are an employed, self-employed, voluntary member, or non-working spouse.

Household Employers, Kasambahay, and OFW Members

You use this new SSS contribution table if you are a household employer, kasambahay, or an OFW member.

Let’s begin with the range of compensation. This is just your basic monthly salary on which the remaining components are based. Monthly Salary Credit (MSC) is the median of the range of compensation. It’s also good to note that the maximum MSC is only set at 20,000. The contribution rate on the table is 12% of your monthly salary credit which is being shared by you (4%) and your employer (8%).

I know you need an example so this is what you are waiting for. If an employee has a salary of Php 25,000 per month then his MSC is pegged at Php 20,000 only. Remember that it is already the maximum MSC in the table, right?

Average Monthly Salary Credit (AMSC) is computed based on the last 5 years of service.

Credited Years of Service (CYS) is the total number of years your SSS contribution is paid. One CYS is equivalent to at least 6 months’ contributions paid in any given year.

3 Simple Formulas to Compute Your SSS Pension

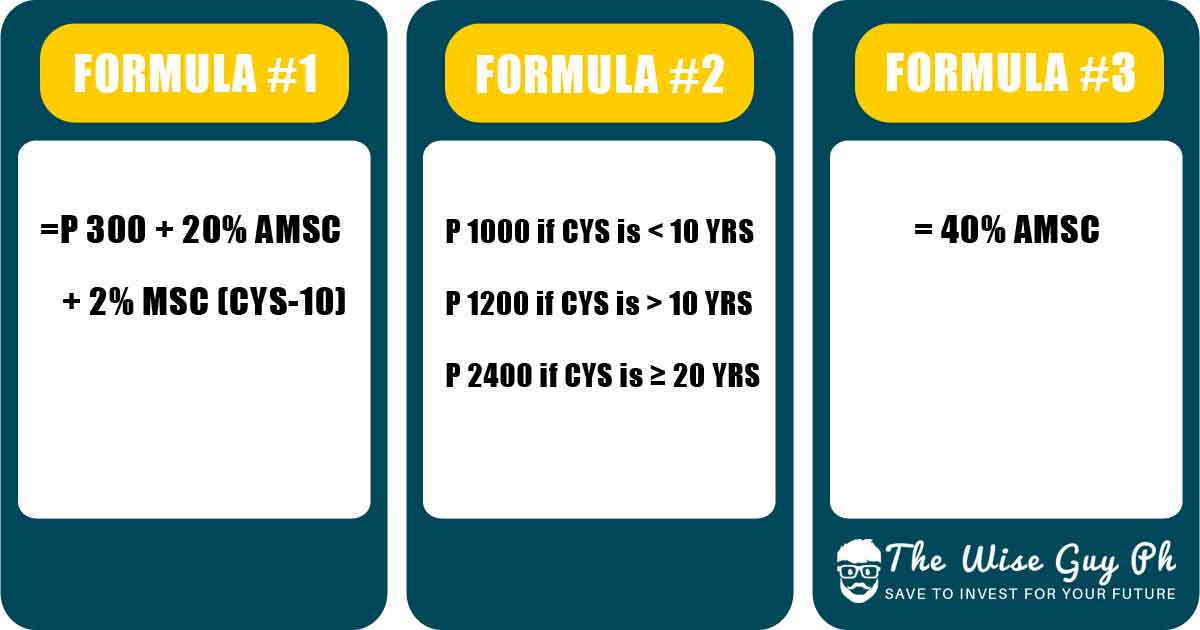

After knowing the terms, you can finally compute for your pension. SSS provided three formulas that you can use to compute your monthly pension. Because there are three formulas, you will also get three answers and whichever is the highest among them will be your monthly pension.

Here is how to compute the SSS retirement benefit:

1. Based on the Credited Years of Service (CYS)

The first formula is highly driven by the number of years you paid your contribution. This simply translates that the more years you contribute the higher your SSS pension will be. However, this formula is only good to use if you paid or planning to pay for more than 19 years.

2. Minimum SSS pension

SSS pegged the lowest pension that a member can receive in order for them not to get less than the minimum. This formula best serves the below-minimum wage earners and workers with less than 10 credited years of service.

3. Based on the Average Monthly Salary Credit (AMSC)

The formula is based on your AMSC. You can maximize your SSS pension using this by increasing your contribution. But it is also good to note that this is the formula to use if you contributed or planning to contribute for 19 years and below.

The three formulas remain the same as per R.A. 11199 plus Php 1,000 for all SSS pensioners.

Pursuant to Memorandum from the Executive Secretary in 2017, by the authority of the President, an additional Php 1,000 shall be given to all pensioners.

The first formula will give the highest amount if you plan to work for a very long time. Notice the 2% addition to your pension for every CYS when you surpass the 10 years mark. The second formula is something you don’t even want to have as your pension, right? Come on, even that ₱2400 plus Php 1,000 will not be enough for your maintenance medicine. The last formula, however, is very straightforward and easy to compute.

Sample Computation of SSS Pension

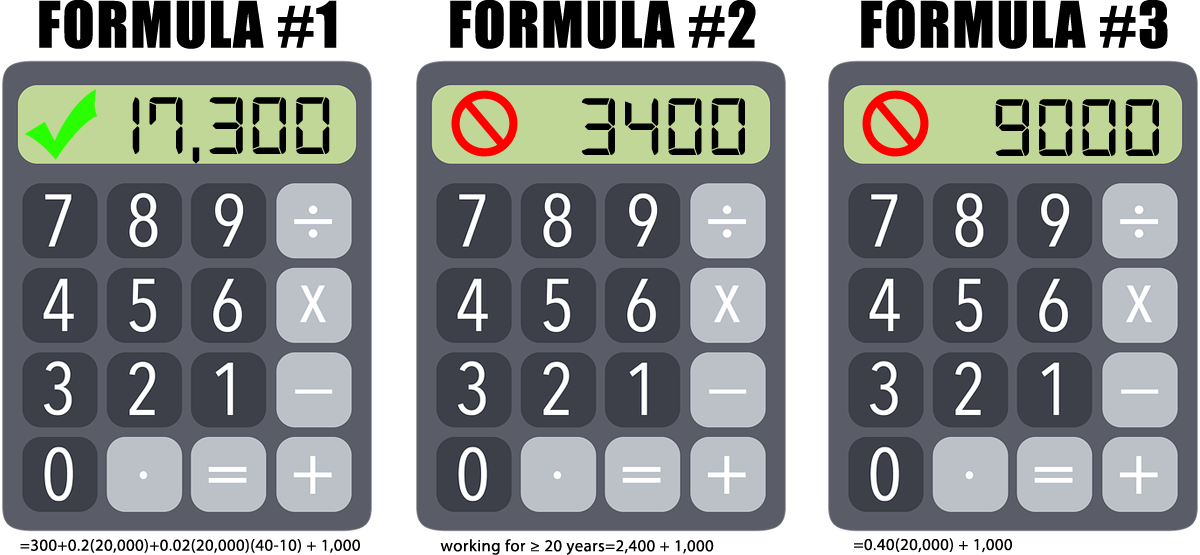

With all the formulas presented, you might feel the need for an example so I decided to add one. In this example, Mr. Wise started working at the age of 20 and he is planning to retire when he reaches the age of 60. His salary for the last 5 years is ₱60,000. Can you help him in computing his pension?

Given:

CYS: 40 years (started working at 20 and plans to retire at 60)

AMSC: ₱ 20,000 (this is the maximum MSC regardless of his salary)

The following values are attained based on the new SSS contribution table for 2019. This is for illustration purposes only as it will be different in the coming years.

If you’ll look at the figure above, formula #1 provides the highest amount which means that this is the pension Mr. Wise Guy will get starting at age 60.

Suan, malaki-laki na din pala yung pension sabi mo maliit lang.

A good thing to understand is that the amount was calculated from 40 years of credited years of service. If you are planning to have an early retirement then your pension will be lesser. Personally, I don’t want to work for that long. I want to enjoy life and spend more time with my family. If you are like me, a pension of ₱17,300 is pretty impossible knowing I’m not planning to work for that long.

Average SSS Retirement Benefit

Do you know the average pension retirees get? The illustration above is just an example so don’t be excited yet. The following is the average SSS pension throughout the years and you’ll be alarmed knowing that it may not be enough to sustain a living.

2012: ₱3,707

2013: ₱3,577

2014: ₱3,792

2015: ₱3,780

2016: ₱3,658

2017: ₱5,123

READ: 2 Ways to Get the Highest SSS Pension | Have a Comfortable Retirement

Can you get over those digits? These are only averages so you must keep yours on top of it but if you don’t and settle with those numbers then your retirement will be doomed. So how can you level up the game and secure your future? Simple, you must have a contingency plan. Don’t just settle for saving your money, you must also invest to beat inflation.

Build Your Retirement Fund

You may consider getting a VUL plan that has income protection with a wealth accumulation plan. Give your family financial security and peace of mind while growing your money over time. You may request a quotation and financial consultation by following the link below.

READ: Sun Maxilink Prime | The Best Selling VUL Plan from Sun Life

If you have at least Php 250,000 sitting in your bank account then you may consider investing it in a single-pay VUL. This will help you grow your money better than what you normally get for your savings account while getting life insurance protection.

READ: Sun Maxilink One | Earn Better than Banks

Conclusion

While SSS provides a good retirement benefit. You should not rely on it solely if you don’t want to struggle financially during your golden years. Consider investing your money in a mutual fund, UITF, VUL plan, etc. that will not only beat inflation but also provide you the comfortable retirement you deserve.

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

297 thoughts on “SSS Retirement Benefit: An Easy to Follow Guide in Computing Your Pension”

Hi Federico,

Kumusta? Ako po ay 61 years old at naninirahan sa ibang bansa. Ako po ay nagtrabaho sa Pilipinas from 1983 hanggang 2004 (a total of 252 months contributions). Ako ay nangibang bansa noong taong 2004. Fast forward year 2023….gusto ko po sanang mag voluntary contribution starting 2023 hanggang maging 65 years old na ako. Siguro ang maging voluntary contributions ko ay equivalent to 48 months. Tama ba ang assumption ko na to get the 60 months AMSC, it will be based on my 48 months voluntary contributions and on the last 12 months contribution in 2004 & 2003 when I was still working in the Philippines.

Maraming salamat po sa inyong kasagutan.

Yes, it will be based on the last 60 contributions or the average of all your contributions, whichever is higher.

Hi Sir,

Question may 2 scenarios po ako sana ma compute mo po sir 🙂

First scenario: Total of 10 yrs contribution with max MSC of 20k

Second scenario: Total of 12 yrs contribution but 10 yrs with max MSC of 20k and 2yrs with 2k as MSC

Thanks!

Thanks, Jaime. I will consider creating an article about this. But in the meantime, you may follow the steps above to get a snippet of how it will look like ?

Sir, for the year 2023 the maximum MSC is 30,000 composed of the total of Regular Social Security Employees Compensation of 20,000 plus mandatory provident fund of 10,000. For computation of pension purposes, am I going to use the 20,000 or the total of 30,000 for year 2023 considering that my contribution is on the maximum range?

There was gap of my SSS contributions for 4 months in year 2020 as I was not able to report for work due to company restrictions brought by the pandemic.

I will retire by January 2024 at age 60.

To get my last 60 months contribution, is the gap of 4 months included in counting of 60 months? Does it mean that my Average Monthly Salary Credit for 60 months will become lesser due to 4 months gap of contribution? (total of 56 months with contribution and 4 months with zero (0) contribution)

Looking forward for your reply.

Thank you and stay safe.

Janiel

Hi, Janiel! The maximum MSC for the computation of benefits is still pegged at 20,000. WISP is just an additional benefit you get upon retirement. As to answer your other question, as of the latest, CYS is computed as number of contribution divided by 12. So gap will not be included in getting your AMSC. I hope it helped.

Hi Sir, just want to ask lang po how much po my pension if ganito po scenarios?

Scenario 1: 10 yrs with a contribution for 20k MSC

Scenario 2: 12 yrs with contribution but 10 yrs for 20k MSC and 2yrs for 2k as MSC.

Thanks in advance.

Thanks, Jaime. I will consider creating an article about this. But in the meantime, you may follow the steps above to get a snippet of how it will look like 🙂

Hello Sir,

i am 57 yrs old po if magretire na po ako sa 60 yrs old at 400 months na po yun contribution ko atleast 20,000 po yun MSC ko mga magkano po yun pension ko?

Good day Sir!

Yung LOLO ko 82 years old na. Hanggang ngayon hindi pa siya nakapagpension kasi Dual yung SSS number niya. Sa ngayon nakapagfile na din po kami nang Cancellation last week lang po. Upon checking SSS niya meron siyang 139 months contribution. magkano kaya ang retieremnt na mataggap niya at magkano ang monthly pension niya?

Maraming salamt po and GOD Bless

Hi, Robi! You may follow the steps in this post if you have the details. But to be sure, you may go to SSS for the actual pension.

Hi Sir,

Regarding don sa formula number 1,

“Notice the 2% addition to your pension for every CYS when you surpass the 10 years mark”

For example in the year 2025, the MSC will become 35k, I’m an OFW so I will be paying 5250 (15% * 35k). in order to have 1 CYS, I need to pay annually 5250×12=63K annually, but in return, I will only receive an additional 700 (2%*35K) on my monthly pension. I’m 49 years old and have already contributed 144 months, I’m planning to stop contributing for 5 years and continue on my 54th year.

In summary, in order to get 1 CYS, I need to pay 15% of MSC and then earn 2% in return, my question is it worth contributing for 10 years?

Thanks for all the replies!

Thank you for patronizing our blog!

Btw, even when the MSC increased, the maximum MSC for the computation of pension is still pegged at 20k.

Anything you pay more than that is invested in WISP. It’s like a pooled investment thing like UITF/mutual fund. At your retirement, get your WISP in full and your regular pension.

Hi Federico! What if naka pag hulog ako sa isang taon ng 4 months lang. Hindi po ba ma-cover yun? Need talaga ng not less than 6 months a year? Hindi po ba masasayang yung contribution ko na 4 months? Please in lighthen me .thank you and God bless.

Hi, Randy. It will depend on which year you contributed. As of now, CYS is computed as a number of contributions divided by 12.

This year inangat nila ang contribution almost doble na.

Isang malaking scam tong SSS. knowing nagbabayad ka ng “insurance” pero in the end di mo maeenjoy kinita mo. Sa halip na magamit mo ngayon, habang mura pa ang bilihin, nasa kanila at hindi mo makukuha. #ripPH #ScammerSSS

Sana ang retirement ng SSS is at the age of 55 kc marami ng namamatay before reaching 60 hindi nila naeenjoy ang kanilang contribution.

Unfortunately, I guess it’s because they need to manage their resources 🙂

Hi Sir,

Salamat po sa pagbigay linaw sa tanong ko about MP2 maturity.

May tanong lang po ako about sa pension, na compute ko na po un pension ko gamit ung explanation niyo and nag arrive ako sa 9000 monthly. Ito po ung tanong ko

1. Halimbawa po ay na dedo ako edi un asawa ko ang magtutuloy tanong ko lang kung 9000 pa din ba monthly ang matatanggap niya?

2. Hanggang kelan po siya makakatanggap ng pension?

3. Paano po kung siya din eh mawala titigil na po ba un pension

You’re welcome, Coleto! Your spouse will receive the same amount until she expires, remarries, or cohabitates.

Hello Sir. I am 48 years old and paying the minimum contribution for now. I will be retiring (60 yo) in July 2034. Kelan po ba ako mag start ng maximimum contribution (20k) para makakuha ng 9k na pension? I heard 6 months before mag 55 yo ay mag maximize na. Tama po ba? Maraming salamat po in advance.

You may start at any time. CYS will also play an important role of how much you’ll get.

PA HELP PO MAGKANO PO KAYA ANG MAGIGING PESION KO

EMPLOYED PO AKO

NASA AVERAGE 1600 PO ANG PART KO SA CONTRIBUTION FOR 145 MONTHS

MAGKANO PO KAYA?

SALAMAT PO.

Your information is incomplete. However, if you have an SSS online account, you may check it there to save you from computing it yourself 🙂

I retired at the age of 60 and claimed my retirement benefit

Date Filed : 02-10-2022

Approval Date : 02-15-2022

Pension Start Date : 07-14-2021

when will I receive my monthly pension?

hello.pos.sir pls magkano pension ko kapag ang hulog ko ay ganito

2yrs=360

3yrs=980

5yrs=2400

120 months po. conti

ribution.ko ..slamat

magkano maging.pension.ko po pls

Ano yung 2400 Alma? Kung monthly contribution ito, nasa 20k ang MSC mo. Using formula 3, pension is 40% of AMSC plus 1,000. Nasa Php 9,000 siya.

Hello po Sir,,,Magandang Araw po,,,Sorry po medyo mahina ako sa Math gusto ko lang po tanungin sa maging monthly pension ko..On May 20, po ay 60 years na ako…naka contribute po ako ng 251 months,,,,eh pwede po ba makisuyo magkano po kaya ang monthly pension ko,,,Salamat po . God Bless po sa lahat

Hi, Ms. Lydia. It will depend on your AMSC which you did not provide in your comment. You can go to a SSS branch to have it computed for you. Thanks 🙂

Hi Federico,

Thank you for the informative piece, it was clear and not too long to read.

Considering that formulas 1 and 3 both uses the AMSC which is based on just the last 5 years of contribution before pension, where does the Total contribution matter?

Im still far from retirement, yet the 3 formulas dont encourage me to pay a higher contribution because it seems only the last 60 contributions would take play.

Ive read that the death benefit that is given to the secondary beneficiaries will be matched by the total contributions given by the member. Where else is this total important?

Thank you po!

Lumpsum will be given if your contributions are less than 36. Retirement and death claim are only 2 out of the 7 benefits.

Hello, ask ko lang po regarding Monthly pension and Lumpsum.

My mom got her retirement claim of P16,823. She has 155 total contribution. Base sa claim information, Number of Monthly Pension Paid: 6. Makakareceive pa po ba si mother ng pension after 6mons? or eto na yung Total lumpsum? pero naka 155 contributions naman sya. Thank you po sa pag sagot.

Hello

I am an OFW at gusto ko imaximize ung contribution ko para malaki din ang makukuha kong contribution. What if po 3k ang monthly contribution for 120 months or so, magkano po kaya yun (benefit) na makukuha pag magpepensin na pagdating ng 60 yrs old or after 10 years or so na pagcontribute?

Good evening. My SSS contribution is only 4.83333 years and GSIS Period with Paid Premium (PPP) is only 6.5833 years for a combined total of 11.41666 years of creditable service. Because of RA 7699 or the Portability Law, I will qualify for SSS pension because I already exceeded the 10 years requirement. How do I apply?

Thank you and God bless.

Isn’t portability law only applicable to GSIS claim (15 years of contributions)? Anyways, I think it’s best to check it with them if you are qualified.

Hi Federico

Matagal ko ng gustong malaman kung magkano ang pension na tatanggapin ko.

I stopped contributing my monthly SSS premium last 1984, then suddenly I decided to finish my 120 months just to be able for me to have a bit of a pension. On November 2021 matatapos ang 120months ko. So in all I have contributed P17.256 for 120 months. EXACT no sobrang months dahil 65yo na ako at gusto kong maenjoy ang magiging pension ko.

With that amount, magkano ang magiging monthly pension ko. NO Loan to be considered. Clear iyan.

Noong 2019 I found out kulang ako ng 20 months so itinuloy ko ang hulog. for 9 months naghulog ako ng P600 then nitong January 2021 ginawa nilang P650/month… at ito ang magiging huling hulog ko dahil gusto ko lang makumpleto ang 120 months at luckily pumayag sila na iadvance ko ang hulog so bayad na ako para sa 120/months… at according sa record na nakuha ko from SSS website, aabot sa P17,256 lahat ang magiging contribution ko by November 2021.

Sana matulungan mo ako, gusto kong kuwentahin by myself kaya lang nahihilo akong intindihin at kung paano ko ia apply sa formula ang mga figures na hawak ko.

Maraming salamat Federico.

As much as I want to help you, the corresponding MSC of your contribution is needed to calculate the pension. If ever, you can always check it with SSS. Thank you 🙂

Good day!

Halimbawa po: nagbabayad po ako ng 2,145.00 a month for 120 months..magkano po magiging pension ko kapg 60y/o na po ako monthly? Kapag po ba itinuloy ko ng payment for another 120 months @ 2,145.00 monthly, magiging doble po ba ung matatanggap ko na monthly pagdating ko ng 60y/o? Salamat

Hi Joel. Based on the formulas, the pension will not be doubled. If you want, you may calculate it using the formulas above. It’s fairly easy to follow, plus you can also play with different scenarios in your mind. Thanks 🙂

Sir,

Ask ko lang po self employed po ako at patigil tigil po ang paghuhulog ko kasi po la naman stable na pinagkikitaan . My last contributioin is Feb. 2012 amounting P312.00 with total number of contribution of 104. Nag 55 years old po ako noong Aug.15, 2020. Gusto ko po sana na ituloy ngayong Jan. 2021 amounting Php 2695.00. Ask ko lang mag kano kya pension ko pag 60 years old na ko kasi di ko ma me meet ung at least 60 contribution kasi 55 contribution lang po.

Hi Roberto. You need 120 contributions to qualify for a pension, else, you will receive a lumpsum. Thanks 🙂

Good day po! Pahelp po. MUST po ito.

Yung mister ko po nagbukas ng SSS noong 2002. Simula po nung nagbukas siya,lumipas ang ilang dekada, di po siya nakapag contribute. Ngayon po na OFW sya, nagstart na po kaming magcontribute nitong Dec 2020 hanggang ngayon. Kukumpletuhin po namin ang 120 months na contribution kahit lumampas pa siya sa edad na 60. Please enlighten us po, do you suggest na magtuloy pa rin po kami ng pagcontribute? Paano po kayang maapektuhan ang pension/benefit nya if magclaim na po siya ng benefit? Tapos po gusto ko po malaman magkano na po ang maximum na contribution ngayon kac may 3k na daw po, magkano po kaya ang benefit na makukuha sa 3k na contribute after 120 months? Lastly, pede pa po kaya namin bayaran ung ilang taong hindi namin nabayaran noon? Like 2020 and downwards? I mean paatras po ang pagbayad, babalikan po namin ang mga taon dati na di nabayaran, pede po kaya yun?

Hi po , P3,500 monthly pension ng tatay ko Nung nabubuhay pa, magkano naman po ang death at funeral benefits niya ?? T.y. po

Hi Cathy. Yung funeral benefit ranges from 20k to 40k and anyone can claim it basta siya yung nagbayad ng funeral service. If yung mother mo ay buhay pa, siya yung magreresume ng pension. But to be sure, you have to go to an SSS branch to have it computed for you. And also, you can check who is/are eligible to claim for the death benefit.

Hello po ask ko lang po kung makakatanggap ng pension yung tatay ko kahit 60 months lang siya nakahulog sa sss.

Pension is available for those with at least 120 contributions.

Hi, I have questions. I have total numbers of 159 contributions as of this time. I Can still pay the lower contribution for succeeding years and can jump to higher contribution (salary 20K) for the remaining 5 years before retirement, its okay right? I’ll be getting higher (exp 17K) for my monthly pension?

for your assistance.

Thanks

Yes, Ana. You can do that for as long as you are still far ahead of retirement and, of course, a voluntary member. Thanks 🙂

Hi good day how much we will get from my father death pension he had contributed 70k in total and paid 23yrs in sss?

Hi Ayan. I do not know. Some info is missing. However, as I always say, this blog is created to educate about personal finance. And part of personal finance is to learn how to do calculations. It’s straightforward to follow, so I don’t think you’ll get lost. Thanks 🙂

Thank you for this. So is it correct to say that I can pay the minimum contribution for 7 mos (counted as 1 yr) until I reach 55. And then 56-60 years old, I’ll pay max contribution (still 7 mos only) for the AMSC computation?

Hi Roan. You are most welcome 🙂 However, you may also check that while it will be counted as 1 CYS, your AMSC is still based on the last 60 contributions. So that’s about 8.5yrs compared to 5 years when you pay all the months. it is just my 2 cents. Thanks 🙂

I had contributed 110 months in 1998. I stopped paying my SSS because of my work abroad.. now, I’m 52, I resumed paying again with the maximum premium (30,000 SALARY ) and paid more than 120 months already. If I will not continue paying my monthly premium for the succeeding months/year when I reach 60 years old, what will be the basis of my pension computation?

Erwin, it should be the last 5 years you are paying for your contributions. Thanks 🙂

Ask ko lang. nag-avail ako ng early retirement sa company na pinasukan ko. Iam 56 years old at ang huling sahod ko ay P27,000. Balak ko sana mag-stop contribution na kahit naka 362 contributions na ako. D ko na kasi kaya voluntary maghulog ng 2,400/month hanggang ma-reach ko ang age 60. Unemployed ako ngayon at kulang pa pang maintenance ko sa gamot ang nakuha kong separation pay sa company na pinagtrabahuan ko. Ang magiging basis ba ng AMSC ko ay ang 60 contibutions ko from 2015 hanggang 2020.

Yes, it will be the last 5 years 🙂

Hello po I paid 210 total of contributions latest payment done this year 2600 I’m 50 yrs old na OFW is it worth paying til I’m 60? Like you said last 5 yrs ang pension e calculate?

AMSC is the higher of the last 5 yrs MSC or the average of all the MSCs.

hi!

Question sir. My mother have 138 contributions udner 12 yrs of csv. She is 56 now. Im projecting her retirement pay at 60 but since nasa 360 monthly lang ung voluntary contri niya, the max we can get is 1200 monthly pension (regardless if ituloy or namin or hindi yung monthly bayad na 360 until maka age 60 siya). Im planning to stop paying for that and just wait na mag 60 siya 4 yrs from now. We are still entitled naman po for a pension right even if we will not contribute na for the enxt 4 yrs?

Just trying to max out our money now. We can invest it soemwhere else kasi wala na rin nmn halos itataas dito.. or very minimal lang..

Thanks in advance po

Hi Anna. The pension will be plus 1,000, so if you must add 1,000 from 1,200. Yes, you may invest it elsewhere if you really like, but of course with inherent risks. Thanks 🙂

Hi sir..ask lng po ako,56yrs old na po,still working at ang monthy hulog ko sa sss po ay 1040php 340 months contribution na po,how much po kaya ang monthly pension ko sir?thanks po sa sagot….

Depende po iyan sa CYS ninyo. If naka 29 CYS na po kayo. Nasa 5,780 siya monthly.

Hi po, nag start ako maghulog sa sss ko nung 2018 ng 880 montly, 2019-2020 960 monthly. balak kong gawin 1800 na monthly ang contribution ko from now hanggang mag 120 months na hulog ko. then i stop ko na. magkno kaya magiging pension ko.

Thank you 🙂

Hi Arlene. Kung plano mo na tapusin lang ang 120 contributions, nasa 40% ng AMSC plus Php 1,000 yung magiging pension mo. Keep in mind lang na it is just an estimate. Malayo at marami pang taon ang lilipas kung kaya’t madami pa ang pwedeng magbago sa computation ng SSS 🙂

Hi,I would like to ask if after 10 years ill stop my contribution then withdraw is that possible xe wr moving to other country and i guess ill just open other retiremnt plan etc xe konti lng makukuha pla ng pension sa pinas eh laki binabyaran a month ty

Hi Jane. Yes, you may get your SSS fund once you migrate to another country. Thanks 🙂

This is sad. Pag-ibig has a higher pension for retirees and it’s not even enough.

Exactly Ray! That’s why we must really take retirement seriously. Imagine, after years of hard work, the pension you will be getting may not be enough to cover your daily expenses. It is why most retirees chose to either go back working or rely on the acts of mercy of their relatives.

So while now, we are still young and healthy or in full capacity, we must do something for the future. Thanks 🙂

Hello Sir,

Thank you for the computation you presented.

I would like to ask when will they use Computation 1, 2 and 3.

I cant understand why retirement is computed using computation 1

or 2 or 3.

please apprise me

Thank you very much.

Judy

Hi Judy. It is used to ensure a minimum benefit and also to give better benefits to those who will pay more than the minimum required premium and credited years of service. You have to use the 3 formulas whenever you are computing for your retirement benefits. Whichever gives the highest amount will be your retirement benefit. Thanks 🙂

Hi Federico, thanks for this very informative blog.. I learned a lot from here..

I just wanna confirm something.. So as of the moment, I’ve got a total of 8yrs contribution with SSS having worked in various companies before, where my first 5 years got me an average monthly salary of 10k only while for my last 3yrs was 16k.. I resigned from my employment and have done some freelancing where salary is not that stable. Long story short, I stopped paying my SSS for 3 years now.. I have learned about the option of having a minimum of 10years sss contribution and I’m planning to just add 2 more years to my existing 8 years.. Now I learned here that they are going to consider the last 5years of my contribution in calculating pension when I get 60yrs old… So I was thinking to just pay the maximum 2400 monthly contribution (for 20k salary) for 2years as a voluntary member just to complete my 10years contribution then stop there. If I will do this, are they going to take into account my 3yrs of 16k salary + 2 years of 20k salary to get my AMSC even if there was a gap in between?

Hi Jen. They will just count your paid contributions and will neglect the gap. Thanks 🙂

@Jen. Yes to get the AMSC, they’ll just get the average of your Monthly Salary based on your last 5 years of service. So be sure to pay the highest Contribution before your retire! 🙂

Hi po Mr Federico

Tanong q lang po pwede q pa po ba bayaran ng sss contri ang nanay q kahit 56yrs old npo mags start palang po thank you po

Hi Marinet. Pwede pa siyang mag register sa SSS. Maaring mag parehistro bilang myembro hanggang sa edad na 60. Salamat 🙂

Tanong Lang po.dati dito ako sa pinas nag trabaho sa isang company’s ,tumigil Ang hulog ko dahil nag close ,,9 years na ako nag hulog ,,,at ako nag abroad ,ofw ,,upang matuloy ang hulog ko ,,sa ngayon nasa 120 month na ako ..Ang hulog ko buwan buwan ay 1,760 , at sa ngayon ay sa 61 years na ako ..magkano po ba matatangap ko ..

You may go to a SSS branch for computations po. Or you may also compute for it using the steps above. Thanks 🙂

Hello Federico, What is being used in computing the AMSC? Is it considering only the monthly contributions made during the last 5 years prior to retirement, even if contributions made was less than 60 months or is it considering the last 60 months or 5 years worth of contributions, assuming one’s contribution is on and off.

Thank you.

Dolly

Hi Dolly. It will depend on the case. If you only paid less than 10 years then you may not be eligible to receive the pension. Thanks 🙂

Hello po, Thank you so much for you time and response. This site is very helpful to us. I have more than 120 months of contributions, but lately I am not able to contribute regularly on a monthly basis. I am contributing as a voluntary member.

Thank you,

Dolly

In this case, will they base the AMSC on the number of contributions for the last 5 years or on the last 60 monthly contributions prior to retirement?

I would appreciate your thought on this.

Thank you.

It’s my pleasure. To answer your question, AMSC is based on your last 5 years of contribution. A credited year of service is a year wherein you contributed at least 6 months. I hope it helped you. Thanks 🙂

Hello Engineer,

I am 27 yo now and voluntary paying my sss premiums. When I worked in a corporate company (2 1/2 years), my premiums were at maximum. I got unemployed after I had my first child. I am now freelancing and have started to pay my sss premiums voluntarily. I’m glad to have seen this post which was really well explained and very informative. I am actually after the pension amount. Is it okay to pay the minimum premiums for now just to achieve & sustain paying the more than 120 years of eligibility? Though I planned to pay more years than that, say until I turned 55 or 60. Say I sustained paying the minimum premiums for 20+ years. And then 5 years before I planned to retire, I will jump to the maximum bracket and pay the maximum premiums to avail the maximum pension I can get (given that I am still below age 55 to be able to jump ). Is my understanding, correct?

Let me know if this is doable. 🙂 Thanks for your time!

Hi Dee. If you are after the pension then I think that is a great way to maximize it. However, if you do that then other benefits will be lowered like maternity benefit, accidental benefit, etc. Thanks 🙂

Tanong lang Federico, halimbawa if yung AMSC for the past 15 years is 20000 , then im working with other company but my AMSC is drop to 12000 . Magkano ba ang estimated na pension ang matatanggap ko when im retired . Is this still base on the last 5 years? or the SSS is not allowed to drop yung monthly contribution if nasa maximum ka na . Thanks boss !

Hi Ian. Yes, last 60 months contributions pa din yung magiging basis ng computation. Thanks 🙂

Dear Sir Federico,

Here is my contribution for SSS, Age 20 Monthly salary credit (MSC) is 1300 , Age 21- age 26 , MSC is 5000 , Age 27-Age 55 stop contribution, if Age 56-61 continue as voluntary by using 20,000 monthly salary credit , how much will be the monthly pension after Age 61 ? Thank you

Hi Emily. Is this something you plan to do? Your pension will fall on the 40% of your MSC based on the last 5 years. If we will be basing this in the future then it will change considering MSC will go up. But regardless of the change it will still be pegged at 40% of MSC if you will be paying for 10 years only. Thanks 🙂

Hi. I started contributing to the SSS last June, 2017, OFW status, and always the highest MSC. My bday is March, 1962. If I continue paying until I complete 10 years of contribution even after 65 y/o, how much pension, if I qualify at all, do I get? Thanks.

Hi Albert. You may use the formula 3 which is around Php 8,000 if you will complete the 10 years. Thanks 🙂

Hi Mr.Suan,

Nagstart ang SSS contribution ko ng 2009 (Feb-July) then stop work ako.

Resume work year 2010 (June) – 2012 (Jan)

Naging OFW nung 2012 (Feb) hindi ako nakapaghulog for 22months. nagstart lang ako ng voluntary contribution nung 2014 (Jan)

Ang Credited Year of Service (CYS) ba is pinakasimula nung nag SSS contribution despite may mga lapses sa paghulog?

Hi Jeng. Sa pagkakaalam ko dapat magkaroon ka ng di bababa sa 6 na hulog sa isang taon para maging isang CYS. Salamat 🙂

Hi Federico. If I met the 20 CYS, my AMSC is P5k but for my first 5 years of work my AMSC is P9k, will those earlier contributions count or only my AMSC for the latest 10 years, as per formula 1 (CYS-10) connotes?

Hi Christine. AMSC is based on your last 60 monthly contributions. Thanks 🙂

Gud am sir ilan po ba ang pensyon if matatapos ko na sa may 2020 ang hulog ko na 550 for the past 10yrs. at mag start ako sa 2022?

Hi Rizzalino. Kung sa sampung taon po yung 40% po yung magagamit natin na formula. Pwede kayong makatanggap ng Php 2,800 kada buwan. Salamat po 🙂

Maganda araw Federico!

Sir mayroon po akong online account sa SSS same po kami ni misis. Yung bang Stimulated Computation Retirement (not sure kung yun ba ang term niya don kasi ang SSS hanggang ngaun) na nagbibigay ng estimated na pension mo pag naging 60 years old at 65 years old kana ay tama po ba? So kung tuloy tuloy lang ang contribution namin na php2,400 (unless mag taas ulit ang contribution sa SSS sa maximum amount pa rin kami) until ma reach namin ang 60 years old kung ano man ang lumalabas sa computation ng Stimulated Computation Retirement eh yun na po ba or malapit sa katotohanan?

Salamat po!

Hi Jonathan. Medyo malapit naman sa katotohanan yung stimulated computation nila. Magkakatalo lang sa part na paibaba yung contribution mo sa loob ng 5 years dahil di ito kasama sa estimator nila. Pero kung more than 10 years pa naman bago kayo mag-retire then most likely dikit yung estimate nila provided na naka max ka at same amount yung contributions mo sa last 5 years. Salamat 🙂

Hi good morning tanong ko lang po mag kano po makuku kong pension if nakapag contributions po ako ng 17 years..

At gusto ko po sana na i take all nalang lahat mag kano po

Hi Antonio. This is from what I know, you are not allowed to that. However, you may advance the first 18 months as lump sum of your pension. Not unless you decided to migrate to another country. Thanks 🙂

hi. matagal na akong hindi nakahulog sa sss ko. isa akong ofw. mag 50yrs old na ako next month. gusto ko sanang ituloy ang contribution ko. sa amount na 1,200 monthly till mag retired ako. plan ko pa mag work as ofw till 60-62 if God is willing. possible ko bang maipagpatuloy ang contribution ko with my planned amount monthly. at kung possible pa ,pede mo ba akong tulungan pano i calculate ang magiging pension ko. hindi ko kase tlga makuha pano kwentahin. salamat kabayan.

Hi Mr. Eduardo. Kung nakasampung taon ka ng nagbabayad ng SSS pwede po kayo makakuha ng Php 5,000 monthly pension. Salamat 🙂

My contribution is 199,313 I am an OFW (seaman) I have 150 months of contribution can you kindly compute my retirement pension thanks.

Hi Redentor. I think I cannot help you with your concern. As total contribution is not used in any formula to compute SSS pension. If you happen to know your AMSC from the last 5 years then you may use the 3rd formula. Thanks 🙂

Hi Federico. Ask ko lng po sna nagstart sa sss 2009 ako po ay 12years na sa sss contibution,ung agency pa po ako maliit palang ang hulog then after 2012 naregular na po ako at tumaas ng tumaas 2400 ang monthly contribution ko nitong april 2019 so panu po sya ico2mpute? then now nman po ang monthly salary 19k na po sya panu sya icompute?

Hi Priscilla. Kung paibaba ang sahod mo, ang average ng last 60 monthly salary credit ang gagamitin sa pag compute ng retirement benefit. Salamat 🙂

Hi Sir good day! Ask ko lang po, I’m 58 y.o. now and planning to retire @ the age of 60. SSS member ako at naghuhulog since 1979 pero meron year i think mga 8 years ako na stop sa hulog and now i am employed and presently contributing 2400 php a month. Mga magkano estimated pension ko monthly if i will retire @ 60 option 1, 65 years old Option 2. Thanks…

Hi Ely. In your case, formul1 #1 will give the highest pension. If you plan to retire at age 60 with 35 CYS your pension will approximately be Php 14,300. If ever you decided to retire at age 65 it will be Php 16,300.

Please also note that these are just approximation and actual value will depend on the actual contribution paid. I did not also account your previous MSC and the future changes in contribution schedule.

I hope it helped you. Thank you 🙂

I am an ofw, paying P2400 monthly contribution, now has a total of 189 contributions. started contributing 1991 till 2001 (employment in the philippines), stopped may 2001 till 2011 (being ofw), resumed paying since 2012. Will the 10 years (2001-2011) of not contributing affect the computation of my retirement? will retire in 11 years (60 years old), how much will my monthly pension be? thanks

Hi Geraldine. Yes, it has an indirect effect considering the number of years you missed paying the contribution. Since credited years of service is affected, formula #1 will give you almost the same value as the formula #3. Thus, the only way to increase your pension is not on how long you are going to pay but the average of your last 5 years of contribution. Thanks 🙂

hi sir ask ko lng how much makukuha naming sa death claim ng momy ko.7,200 monthly ung pension nya bale naka lumpsum sya ng 18months then after nyan start sya ng pension uli nung dec 2018.namatay sya march 18 2019 so ung total na nareceive nya na pension nya is 21 months only.ung remaining 39months po ba na pension nya na 7k monthly makukuha naming ng buo.kami na lng ng kapatid ko ang beneficiary nya wala na father,lolo at lola ko.thank you

Hi Mary Grace. Meron pa bang minor sa inyo naka depend sa mommy niyo? Or Buhay pa si Daddy? If yes, magtutuloy lang ang pension. Kung wala na, tigil na din yung pension. Salamat 🙂

Good day sir.

I’m an ofw,38 years old and I’m paying P2,400 monthly contribution.How much pension shall I get?

Hi Rufina. It will depend on how long you are planning to work. Thanks 🙂

Greetings! Sir, medyo po naguluhan po ako sa 1st formula. Base on your example ang nakuha ko po answer is 21,300

300.00

(20000 x .2) 4,000.00

(.02 x 20,000 x 20yrs) 16,000.00

approved increased 1,000.00

GRAND TOTAL 21,300.00

Pwede po makuha in details ung 17,300 na sagot nyo?

Thanks po & God bless!

Jay-R

Hi Jay-R. You can check the info below the picture. Ganito ko siya ginawa:

Monthly Pension= 300 + 20k (20%) + 20k (2%) (30) + 1000 = Php 17, 300

Salamat 🙂

Thank you Sir!

Good day Sir, ask ko lang may kaibigan kasi ako nag 60 last year may 160 total number of contributions displayed 131 total number of contributions not displayed a total of 291 months at ang contribution nya po ay nag range ng about 630- 1,560 yung last 7 yrs with total contibution of 155,909.50. Magkano daw po yung magiging monthly pension nya dapat nun? thank you po.

Hi Ms. Delia. With the given info I think it is best to go to a SSS branch near you and ask them for computation. Thank you 🙂

Sir Deric,

Tanong ko lang po, paano ang computation if and AMSC from start of contribution ay paiba iba..for example 30 years ago ang salary e 4500 pesos and then nag pa iba iba ka ng company at lumalaki na rin and salary mo hanggang naka pag abroad ka at sumusweldo ka na ng higit 100,000 pesos. alin po ba nag basehan sa pag compute para makuha mo yung pension payment mo..sabihin na natin na 10 years ka nakapag bayad ng SSS..maraming salamat po..Good day..

Hi Ramil. Yung huling 5 taon o 60 buwanang hulog ang magiging basehan ng computation. Salamat 🙂

Could you suggest any investment plan that could beat the P240-600 monthly premium that SSS offers?

Hi Riza. You may try MP2 or SSS PERA. Thanks 🙂

Hi Sir. Thank you for creating this page, this is really helpful.

My question is, what do you recommend to employees whose contribution back in 1990 is missing or is not posted in SSS website. The company is already a dissolved company, so ano po habol ng employee. What proof can he present to SSS that he has indeed contributions during that year? Should there be no way to prove his contributions, and he wanted to increase his CYS, can we pay voluntarily or let go na lang since naka 120 contributions naman na sya.

Thanks in advance for taking time to answer my question. God bless.

Hi Yhang. If you have anything to prove your claims like pay slip or ITR then I think it will help you with your concern. If you are after in increasing your retirement benefit then what you can do is to increase your SSS contribution and not the CYS (you need at least 19 CYS to increase your pension thru CYS). Thank you 🙂

Sir, 33 years na akong contributor maximum. P2,400 monthly. Magkano kaya ang pension ko. Thankyou

Hi Federico. I think Formula 3 should be Php9000?

Hi Rose. Thanks for your keen eye. I already updated my post. Thank you 🙂

Hi i would like to ask about my SS contribution tho. I had some related problem that ive reading your blog, Eventually my concern are as follows; since i have 131 contribution already & I’ve reach 16k MSC. Now i plan to stop paying coz im

Migrating here in USA and the reason also i have my VUL maxilink plan for 10yrs and im in 2yrs now and this is i want to continue paying till my maturity date. So Is there no problem with that if I stop paying my sss cont.? Can i still have 8,600 plus monthly pension sal? Also i have my flexifund very small amount only and i pay only once , still i able to get it whenver i want? Btw im OFw in macau for almost 11 yrs.And now here in US i have my new ss acount to pay. Thats why i plan to stop paying . .

Thank you and more power to you Sir kudos to you.

Hi Emelyn. If you have MSC of 16k then your monthly pension can be Php6,400 plus 1k or Php 7,400 based on the newly approved Social Security Act. I agree, you have a lot of things to settle and it can be a bit burdensome to monitor so maybe, for now, you can stop paying your SSS contribution but you can still resume in the future to maximize your pension since maximum MSC will eventually increase to Php35,000. Thanks 🙂

kelan po magtataas ng MSC to 35k? kasi I was planning for an early retirement sna, ngyon kasi base sa april 2019 table nai-adjust ko na sa max ung monthly contribution ko which is 2400php, and targeting to retire when I reached 20yrs of service which is 6yrs from now. bka po kasi in the middle of my 6yrs plan dun magtaas eh di dagdag yrs pa ko pra lang mamaximize ko ung benefits ko?

dhil sinasabi po 60 contributions prior to retirement.

20yrs & 20,000 AMSC:

base on the formula given:

F#1 – 7700php

F#3 – 7400php

is F#1 applicable to 20yrs of service?

same case with Emelyn, I have both Sunlife maxilink bright(paid in advance) and flexilink(yearly) and Balanced Fund also with Sunlife, I do not want to rely alone with the SSS pension because I wanted to enjoy my life with my family, but I am considering of maximizing my options.

Hi Aya. Every other year po ang increase until 2025. Baka di na po kayo abutin ng 35k MSC pero you can still maximize your pension if mag max contribution ka every time mag increase yung MSC.

For your 2nd concern, magagamit mo lang po yung F#1 if CYS is more than 20 yrs po. Thank you 🙂

Hi, for non-working spouse whose monthly contribution is 2400 per month, considering total contributions of 120 months, how much is the estimated monthly pension at 60 y/o?

Thanks!

Hi Kristine. You may use formula 3. Thanks 🙂

Sir, for example, i already finished 120 months contribution and my contribution is 550. if I stop contribute how much will be my pension? what advice can you give me?

Hi Erwin. Because you only paid 120 months you may use formula 3. Using that your pension will be Php 2,800 (Php 1,800 + Php 1,000). Thanks 🙂

Hi Sir. I will be turning 33yrs. of age, my 1st question is what if I want a 20,000 Pension a month during retirement so how much do I need to start contributing to the SSS monthly as an OFW. And how many yrs is the maximum to allowed to pay a head of time? e.g can i pay my contribution for the next 5 consecutive yrs.? tnx

Hi Alvin. SSS does not allow advance payment of contribution unless you are an OFW. As per the pension, I think this is doable because at the year 2025 MSC will settle at 35k. Thank you 🙂

Hi. Let’s say my father is currently 58 in 2019 and in 2021 will be retiring at 60. His contributions were stopped since 2016 and will be planning to continue payments again this year. We are planning to pay at max 2,400 for an OFW. So the last 5 years (2017 – 2021) will be the basis of the AMSC, right? Obviously, if we start paying this year for his SSS until he turns 60, it will only reflect 3 years. So MSC=20,000. AMSC will be (20,000*3)/5= 12,000. Could you help me out if this is the best way to maximize his future pension knowing he has not paid 2 of the 5 yrs inclusive for the AMSC?

Hi Ralph. Even the previously paid contributions prior to 2016 will still be counted. Firstly, is your father paying the maximum before? At the age of your father, he may only be allowed to jump one salary bracket per year. Thanks 🙂

Hi! Im planning to voluntarily contribute for my mother’s sss starting this year 2019. She’s already 44 years old. How much is her possible pension at the age of 60 if i’ll contribute p600/month?

Thank you

Hi Jes. Please kindly use formula #3. Thanks

Thank you! your blog was very informative and inspiring..

Decided to get a VUL in Sunlife! 🙂

Hi Arnie. You are most welcome. Hope you can pursue getting the plan. If you think I can still be of help to you just let me know 🙂

Hi Mr. Wise Guy,

Kudos to your blog. Enjoyed reading it.

I am continuing my father’s SSS contribution and he is to retire 8 years from now. He already had 51 months contribution amouting 110 a month from nov 2017 up to dec 2021.

Following the formula, how much monthly contribution I need moving forward so I can maximize the sss pension benefit? I understand that sss is only considering the last 5 years contribution (55yo – 60yo) monthly contribution in pension computation. What are the things I need to consider as well.

Thank you and God Bless

Hi Jums. It’s nice to have you in my blog 🙂

As of today, the minimum contribution is pegged at Php240 so for this month you’ll have to pay the higher amount. Aside from that, you have three things to consider for you to maximize the pension of your father.

1. The average MSC for the last 5 years will be the basis of retirement pension.

2. The member can jump at any number of brackets per year provided that the member is below age 55. When he reaches age 55. He’ll be only allowed to increase one salary bracket per year.

3. Due to R.A. 11199, MSC is scheduled to change every other year until the year 2025 and reaches the max MSC of Php 35,000.

This is my recommended solution:

1. Continue paying the minimum of Php 240 per month and then at age 54 he may start paying the maximum (you basically jumped 36 salary brackets).

2. At the year 2021, he is already 54 and starts paying the max contribution for that year with MSC of Php 25,000.

3. At the year 2022, he is already 55 and only allowed to increase one salary bracket per year.

4. At the year 2023, he is already 56 and you may again increase the bracket by one with MSC of Php 26,000.

5. Repeat no. 4 until he reaches the retirement age of 60.

6. His average MSC at that time will be like this (Php 26,000 + Php 26,500 + Php 27,000 + Php 27,500 + Php 28,000)/5 or AMSC of Php 27k.

7. Because he only paid 12 years (51 mos./12 plus 8) we can use formula #3.

8. Resulting pension is Php 11,800 (Php 10,800 plus Php 1,000 additional pension as per R.A. # 11199)

Thanks, bro for dropping by.

Hi derico,

If this situation would have been more than 20 years in service, we could have used Formula 1. But I think 20,000 pa rin AMSC gagamitin hindi yung 27k as you mentioned kasi max at 20k ang MSC, right?

Hi Ralph. The 27k you’re referring from my previous comment is actually attainable if the member will retire many years from today. With the recently approved law, SSS contribution is scheduled to increase until the year 2025. Thanks 🙂

hi sir, I was scheduled to retire this end of April 30, 2019 and worked from this company for 35 yrs. I’ve been in this company since i was 19 yo and i am only 56 yrs old and turning 57 by december 2019. However, my other ear (left) is impaired and currently used a hearing aid.My question sir? can i apply for an early pension from SSS due to my disibility? and how much pension will i get? Thank you sir.

Hi Ms. Ma. Lourdes. According to the Social Security Act of 2018, you may only avail a 10 month worth of pension if you lose hearing of one ear. You may kindly go to your SSS branch to fully assist you po with this. Thanks 🙂

Good day sir, ask kulang sir mag 60yrs old na po yung mother ko ngayung taon,tapos hanggang 84months lang ang nahuhulogan nya sa sss.Pwede ba syang mag pension kahit hindi umaabot ng 120months ang kanyang contribution?salamat po.

Hi Rodel. Base sa SSS, ang pwede lang ay lumpsum or ibabalik yung total amount paid. Para makasiguro pwede kang pumunta sa malapit sayo na SSS branch para masagot ang iyong mga katanungan ukol sa retirement ng iyong ina. Salamat 🙂

Sir, ask mo lang po ok lang po ba na mag start po ako with in my 5yrs minimum contribution then after 5yrs i will increase to maximum contribution ligeble po ba ako for pension? And how much po ang magiging pension ko po. Thanks.

Pwede yan naman yan provided that you are still below age 55. Thanks

Good day sir,

I’m 59 years old now. If I will retire at the age of 60 years old. My SSS

contribution as voluntary contribution has reach 185 months magkano po ba ang

monthly pension ko. Salamat…

Hi Mr. Aquilles. I cannot personally say how much will your pension be given that we are limited by information. However, you may check it with your SSS branch. Thanks 🙂

Sir can I ask you I hope you can answer my question 550 pesos contribution per month good for 120 months how much I earned the pension when I’m retired in 60 years old thanks I hoped you can answer me

Hi Arnel. Given the info, formula #3 will yield the highest amount of Php 2,000. Thanks!

Hi Federico. If 15 years ako naghulog in the amount of 2,400.00 how much will be my pension when I retire? Thanks a lot 🙂

Hi Marlou. If all factors remained constant, it’s Php8,000 using formula number 3. Thanks 🙂

Is the last 5 year contribution still the basis of SSS’ pension computation? Or has it changed already and you will get more if you contributed higher amounts? Thanks!

Hi Louise. As far as I know, nothing has changed with their computation. Thanks!

Hi Sir,

Just to inquire. I am voluntarily paying my sss at the maximum and I am an OFW. I have completed already 6 CYS and I am 54 yrs of age. How much will be my pension upon completing my contribution up to my retirement age and keeping the maximum amount of contribution. I appreciate your advise. Thank you.

Hi Ms. Tess. At age 60, you will have a total of 12years of credited service. Using the formula 3 then your pension will be around 40% of Php 16,000 or Php Php6,400 monthly. I hope I helped you. Thanks!

Ask ko lng po ngwork po ako ng 6months tapos my contribution nmn ung company ko then nstop po cya nung ng-abroad ako na continue ko po cya last year hulog ko po ay 550 magkano po kaya mgging pension ko? 35 yrs old po ako ngaun pagnatapos ko po ba ang 10yrs nahulog pwede ko parin b cya icontinue ang hulog ko at kung posibility po na lalaki ang pension ko nun?salamat ng madami in advance

Hi Maricor. 10 years po ang minimum na hulog para maging eligible sa pension. If minimum po yung number of years paid ibig sabihin minimum lang din po yung benefits. So I suggest kung kayang taasan yung hulog at kung kayang ituloy even after 10 years mas okay po iyon. Salamat 🙂

Hi Federico,

I am voluntary paying for my SSS contribution, tanong ko lang po kung pwd po ba 330 per month muna yung babayaran ko sa contribution tapos at age of 50 gawin kong 1760 na. Magkano kaya ang matatanggap ko na pension po at age of 60? Thanks po

Hi Hasper. Please use the three formulas to compute. The highest amount will be your pension. However, this is just an estimate as the real value is determined on the actual contributions made. Thanks!

Gud pm.ask ko lang po.naka26 yrs na ko naghuhulog Sss nasa 314 months na po .pano po pag compute nian kasi nag exceed na contri ko ng 16yrs.usually dapat 10yrs lang dapat ang require.makukuha ba ung 16 yrs na sobra sa hulog ko.tks

Hi Ms. Ann. Minimum contribution po to be eligible for pension po ay 120 months. If naka 314 contributions na kayo mas malaki na yung pension mo upon retirement. Salamat 🙂

10 years ako nag bayad ng 330 monthly for 120mos magkno makukuha q pension at my age 60?

Hi Jason. Based on the 3 formulas you may get a pension of Php 1,200. Thanks

i am 51yo, an ofw.my last sss cont payment was in may 2011 and i paid more than 200mos cont.do u think it will be better to continue paying my cont until i will turn 60 following the latest max MSC to get higher pension? if not, how much will i get when i turned 60? i dont have any existing loans..tnx.

Hi Jenna. I think it’s better if you’ll continue paying your contribution to make your pension higher. Given that you paid for almost 17 years only. So the question is “are you already paying the maximum”? If not, then take advantage of it. If you are still below age 55 yrs. old then you are still allowed to change your contribution in any number of salary brackets. Thanks 🙂

Hi Mr. Suan,

Ask ko lang. If SSS member will retire at the age of 65 still continues paying SSS contribution at the age of 65.

1. Makukuha ba ng member yong total contribution niya from age 60 to 65

2. Pag nag file ba siya ng pension at the age of 65 agad ba siyang makakuha ng lump sum for 18 months and monthly pension after 18 months?

Please reply at my email.

Thank you.

Hi Ms. Tess. You may not get it in a lump sum but you may use it to increase your pension because of the added CYS. For the second question, you’re correct that you can get the first 18 months and then the pension will resume after the 18 months period. Thanks!

ano po yung binibigay ni sss na 18th months pension ? utang po ba ito o lump sum ? 63 na po kasi papa ko pero mgayon lang sya magpasa ng retirement nya..

Hi Gizzelle. Advance pension ibig sabihin magreresume ulit yung pension after 18 month. Thanks!

Hi Mr. Suan.

How can I make a dispute on my pension amount? I am a former ofw until 2012 for 6 yrs. previous to that, i was a local employee. I have been paying voluntarily on and off when I was overseas. My premium payments became regular since 2012. When I was paying voluntarily, I inquired on line on how much is the estimate pension I will receive when I turn 60 yrs old. It says P 6,800.00. I made inquiry a couple more times up to the time I actually filed my pension application on Sept 2018. It still showed P 6,800. So, I was expecting to receive At least P 6,800 plus the P 1,000 per month additional benefit for a total of at least P 7,800.00. I was aghast when they said that my pension only amounted to P 5,800 plus. My total contribution was P 165,710.80 and made 307 months of contribution. Also, there are succeeding months before i turned 60 yrs old where my contribution increases every month. They said this is not acceptable. I cannot see how since my contribution is voluntary. I want to have the computation disputed. Is their computation correct more or less or I have the right to dispute. Also the amount they said they deposited in my account was P 35,022 representing my benefit from sept 2018 to feb 2019 while in fact I received P 39,859. Please help. Thank you po.

Hi Sir Ferdinand. I’m not from SSS nor representing SSS in any way but will answer your question to the best of knowledge.

The SSS pension estimator they have on their website is not accurate but just an estimate of your pension on certain conditions which I think don’t capture certain factors. Like your average monthly salary credit.

As per an SSS Circular 2015-007 for a voluntary member, you will only be allowed to increase one salary bracket per year if you are already 55 years old and above. So increasing your contribution will not necessarily increase your benefits if you have done it beyond 55 years old.

Another thing po, I guess why you received Php39k is because of the additional one month (13th month).

If you are still not satisfied with this explanation you may still have it disputed.

Thank you!

Hi Engr Suan I have been working for more than 20 years now and my contributions are at the maximum. I will retire in 2020 I just want to know how much monthly pension can I expect. Also I plan to request for a lumpsum amount to invest maybe through you, so I would like to know how many months can I request for lumpsum? I hope you can help me. Thank you.

Hi Mr. Catalino. Thank you for reaching out. Based on the info you provided you’ll be entitled to a rough estimate of Php 6,700 per month. As far as I know, you’re only entitled to advance the first 18 months of your pension or equivalent to Php 120,600. By doing this your pension will resume after 18 months. Thank you!

Hi,

Thanks, Ive always wanted to learn how to compute the sss pension. Im happy that I’m able to understand how you came up with the example formula #1. Just to clarify in the example is the Php 13k++ is that monthly? and for how long? thanks

Hi Mumtaz. I appreciate you liked my post. Yes, that’s a monthly pension provided that an employee or member has been a contributing member of 40 years at maximum MSC of Php 16k for the last 5 years. Oh yes, this is something a member can enjoy throughout his lifetime. Thanks!

Hi Sir Federico, Just want to know if sss member, upon reaching of 60 yrs old can avail retirement, kahit still working p sya, sa private company. I already have 252 total number of contributions. And how much po ang magiging monthly pension k. Ang monthly contributio k with my employer is 1485. Need your reply po. Thanks….

Hi Yam. You may only avail of retirement benefits if you are already retired. As for your pension, you may use formula 1. Thank you!

Hello. Could you please help how to compute for credited service years?

Hi Ms. Lukina. Your credited years of service is determined by counting the years when you have contributed for at least 6 months. Thank you 🙂

I’m ofw and I’m paying monthly contributions 1760. Just want to ask if wise decision ba n i stop ko ang pagbayad s sss and I will invest my money to mutual funds or stocks for long term investment?

Hi Elma. Personally, I will not recommend that to you. SSS may not be the best tool for retirement planning but having a contingent retirement benefit like what you can get from SSS is not that bad. Compared to any investments out there, SSS is still safer. And you don’t want to have empty-handed if your investments didn’t turn out well (but I hope it will be well though :)). Thanks!

Hi Mr. Suan, mgtatanung lang po. ngwork po ako yr 2000-2005 tpos nkapaghulog ng contribution that time pero nagstop ako work and so is sa pghuhulog ng contribution. and now i’m planning again na hulugan ang SSS ko (as voluntary) which is 38y.o. na ako. so tama po ba compute ko sa number of months like 60-38 = 22yrs plus ung 5yrs na nahulog before na ngwork pa ako so bale total number of months is 324months? Salamat po.

Hi Gladys. Tama naman po yung estimate niyo based dun sa info na provided pero yung actual si SSS pa din po yung records. Thanks

Good day.

My last contribution was on September 2016. And now I’m planning to continue my contributions, voluntary/OFW.

Should i start paying from the succeeding month of my previous contribution, or should i start later, like January 2018 or 2019 ?

How will it affect my future pension? Provided that I’ll be contributing continously from the month i decided to pay again upto the month prior to my retirement.

Thank you.

Hi Reynaldo. The one used in all the computations is the last 60 monthly contributions. If you’ll be contributing for more than 10 years then this shouldn’t be a problem. As far as I know, SSS does not allow its members to pay any missed months. Thanks 🙂

Good day sir,,,

Meron na po akong 196 months of sss contribution since 1996, at ngaun may monthly contribution akong 1,760.00 kc employed pa ako at age of 41,magkano po possible monthly retirement ko at age of 60…?

Hi Junjun. Please kindly use formula #1. Thanks

Hello po, ask ko Lang po if 20 years paying sss maximum amount makano po magiging pension thanks po.

Hi Jo. Please kindly refer to the formulas above. Thanks!

I’m 60yrs old and because of portability law I submitted for my sss pension.i had worked with the Doh for 5yrs and 10months went abroad as OFW had contributed to sss at 1760pesos monthly for five years and my total months I’d contribution is 131 months.Just want to ask how much I would recd monthly

Hi Sir Norman. You may kindly use the formula one or 40% of your MSC. Thanks!

hi 🙂 my mom is already 58 years old and want to apply for sss. She will pay the contribution voluntarily at its maximum amount. We are planning to pay the 10 years sss contributions for just 2 years. Could you advise us if what is her minimum & maximum pension per month?

Hi Gerlie. I don’t think they will allow advance payment of her SSS contribution. As per an SSS Circular 2015-007 for a voluntary member, your mom will only be allowed to increase one salary bracket per year. The basic requirement for pension is 120 contributions so if you are planning to pay less than that then your mom will not be eligible to have a monthly pension. I hope it helps. Thanks 🙂

Hi! Sir tanong ko lang po? Last 2011 po ako nakapagremit sa sss about 6 months po.bali june to dec. Natigil po xa kasi po nag ibang bansa ako. Ngayon po sir gusto ko sana ituloy po. Ano po gagawin ko?

Hi Jael. Voluntary member ka na ba? If yes, then you can pay it the usual. If not, you need to change your membership to voluntary or OFW. Thanks 🙂

Hi sir gusto ko po sanang mag hulog ng 1100 monthly sa pension ko.. Magkano po ang makukuha kng pension monthly and lumsum po

Hi Daryl. Depende kung gaano ka katagal magwork. Pwede mong gamitin yung tatlong formula. Madali lang siya. Anyways, thank you for dropping by 🙂

Good morning sir, may I ask on my sss pension computation. I’m working since January 21, 2005 and my employer start to paid my sss Feb. 2005 until now with basic pay of 54k. How much is my estimated pension? Thank you

Hi Donabel. Please kindly use formula 1. Thanks

Thanks Federico. I might contact you via email.

Looking forward to that. Thanks again!

Hello Federico

I have to admit that I can not believe that formula #1 is true, even if it is stated over and over again, also on the SSS website. The reason: If you take formulas #1 and #3 for granted, than, by simple mathematics, a contribution of 10 years would result in exactly the same pension than a contribution of 19 years. Formula #1 only kicks in after *20* years. For less than 20 years of contributions, formula #3 will always give the highest value. It does not depend on time, so 10, 11, 12, 13, 14, 15, 16, 17, 18, 19 years of contribution will result in exactly the same benefits (usually 6400 pesos per month). Something must be wrong there. A contribution of 11 years must result in higher benefits than a contribution of 10 years, diba? Can you enlighten us on that? Thanks a lot! By the way I am working at an international school and receive a taxable peso salary. My school pays the contributions.

Hi Christoph. I couldn’t agree more. Formula number 1 will only be beneficial after 19 years or more of paying SSS contribution. This is why retirement planning has been popular in the country. You now have several options on how to secure your retirement like the SSS Peso Fund and MP2 Program of Pag-ibig. Thanks for your insights and I hope more Pinoy will take retirement seriously just like the way you do.

Hi Sir,

I’m 41 y/o now with 220 months, my monthly contribution is 1,320 and a total of 150,667 as of today. If I will continue contributing 1,320, how much will I received on my 60th?

Thank you so much.

Hi Frannie. You can use formula #1 which will result into Php 9,180. Thanks

greetings

namatay na po dad before he past away naayus nya ung SSS contribution last 2016 po sya namatay nasa magkano po kaya pde namin makuha as his beneficiary.

thanks in advance

Hi Ryan. Sorry to know that. Depende yan kung buhay pa yung asawa ni father niyo. If buhay pa then meron makukuha si mother na pension or if may sibling ka pa na below 18 yrs. old. Thanks 🙂

Hi tanong ko lang po meron akong 311 total number of contributions nag start yung hulog ko ng jan 1987, and naka maximum po akosa monthly salary credit na Php16,000. magkano po kaya yung magiging pension ko?. nag try po ako gamitin yung formula #1 pero nasa 3820 lang po lumalabas. ganito po ang ginawa ko P300+3200(20%AMSC)+320(2%AMS)(31-10) pwede ko po ba makita yung details ng pag compute nyo po?. maraming salamat po.

Hi Ms. Gloria. Actually ang lumabas po sa akin ay Php 8,594. Ito po yung ginanwa ko.

Pension= Php 300 + (0.2 * Php 16,000) + {0.02 (Php 16,000) * [(311/12)-10]}

Thanks.

Sir itatanong ko lang kung pwede ko bang ipapaclaim sa sister ko ang pension ko kasi nasa USA ako at di pa ako makakauwi sa birthday ko for 60 years old, at yong brach nila sa SF ay parang closed na yata accdg. to google? Thanks . . .

Hi Ms. Emma. I’m not sure po if pwede. You can have your sister po to call or visit any SSS branch if this possible thru SPA. Thanks

Hi! Ang galing naman ng blog na to! Malaking tulong lalo’t grabe ang dami ng taong hindi nakakapunta sa mismong opisina ng sss dahil nadin sa haba ng pila doon. Anyway, ask ko lang, simula nong mawalan ng trabaho father ko (i think 8yrs ago) e hndi na sya nakakahulog sa sss then may naiwan pa ata syang utang doon na hindi parin nababayaran,makakakuha pa kaya sya ng pension? Willing naman kami bayaran yung mga kakulangan nya, he’s 58 na this year. Pano kaya magprocess? Thank you!

Hi Nicko. Yes, mas okay na isettle na. Once mag 60 siya eligible pa din naman siya sa pension pero ibabawas muna ang utang kung meron pang natitira. Salamat.

Hi Sir,

Ako ay isang ofw, nakaghulog na ako ng 105 months base sa ipinadala sa akin ng sss main manila, nitong nakaraang taon 2018 hindi ko nahulugan ang isang taon na may 550/month ngayun po ay gusto ko ito bayaran pwede pa po ba ito? at isa pa sa susunod na magbayad ako pagkatapos na mabayaran ko ang 2018 (kung lng po na pwede pa pa bayaran) gusto ko po sana gawing 1,760 na ang monthly ko ano po ang mga dapat na ayusin o ang proseso o kung magbayad na lng ako ng direkta sa sss ng 1,760. pakilinaw lang po para maisagawa ko na ang mga yan.

Thanks po

Hi Cesar. Ang alam ko di ka na pwedeng magbayad ng past contribution. Pwede ka pumunta sa SSS upang mataasan ang iyong monthly contribution. Salamat!

Magkano po makukuhang pension voluntary lang po 275 monthly then 2 years hulog 330 pesos na walang pong utang sa sss

Hi Ms. Evelyn. I think it’s too early to calculate your pension. But if you really want to know you can use the 3 formulas I provided on my post. Thanks!

Hi, magkano kaya ang highest monthly possible pension sa SSS at magkano ang lumpsum nito? Salamat. Sobrang helpful ng blog!

Hi Edgar, kung nagtratrabaho ka na at age 18 at magreretire ka at age 60 with AMSC na 16k then ang maximum pension will be Php13,740. Thanks!

Hi!

If my contribution is 1,770php monthly x 240 months, magkano ang aking pension when I turn 60yo?

Hi Jane. You can use the 3 formulas above. Another factor you did not give is the duration from today until you turn 60 yo. Actually, you can do it yourself you just need an ordinary calculator and you’re already set. If you’re still having difficulty just let me know. Thanks!

Good day po, voluntary member/OFW ako ask ko lng how much ung computation ng pension ng 120 months (5 yrs 520/mos & 5 yrs 1100/mos ang hulog?

Hi Charmie. You can use the three formulas. It’s actually fairly easy to do 🙂

Can you please send me some info on sun life investment?

Hi Francis. Actually, you can go to my homepage and all the things you need to know are already there at a glance. I hope you are enjoying the holidays. Thanks!

Good day Federico!

My case is a lot different from all i have read.

Prior to my employment in government service, i have worked in a private firm which did not remit to SSS which was deducted from me. anyway, I’m now 59, i have made only 10 contributions (min 756php) until year 2000, i want to continue the contribution, is it wise to do it? please advise. thank you for your time.

Thank you so much Federico for your

Hi Ms. Yem! I think it’s no longer advisable to continue paying for it because you are still lacking 110 contributions. It will take you more than 9 years to be able to complete the 120 contributions. But it’s still best if you can go to an SSS office to have this consulted. Thanks 🙂

Question po.. aside sa monthly pension when you retire.. may makukuha po ba na any amount?

Hi Jorge. You may get your first 18 months’ worth of pension and then it will resume after 18 months. Thanks 🙂

Good day sir, tanong lang po, trabaho as OFW, ang hulog per mo. 1700 pero pagbakasyon ng 3 mos. walang hulog, contrbution ko 220 mos. according to total contrbution months..na compute ko more or less 370k, but nag loan ako ng 45k na including interest. mag retire na ako nitong 2019,,,, magkano po ba pension ko per mo…

Hi Mr. Rommel. You may visit a SSS branch to assist you with this. Thanks!

I’m sorry if this sounds very stupid….. But what if my monthly salary is more than P25,000 per month and I am willing to pay more than P1,760 per month until I turn 60 years old? Is there an option for that? Like what if the person is willing to pay P5,000 month for 25 years? How much will my pension be at 60 years old?

Hi Margaux. Currently, that is not possible yet. However, you may try investing your extra money in SSS PERA and Pagibig MP2. Try searching them or you may consider getting an insurance plan, investing in stocks and mutual funds, etc. Thanks!

READ: How to Open Sun Life Mutual Fund

Hi im 50 yrs old and start contribution since i am 20 yrs old and stop at 48 yrs old, my highest contribution is 1,705 employee employer, how much pension i will get at age 60

Hi Elsie. The information you provided is quite limited. Assuming that your last five years of contribution are at Php 1,705 then your pension may be around Php 8,980 per month. I hope it can help you. Thanks!

Sir may konting katanungan lang po. Pakicompute lang po yong 10yrs versus 19yrs na sss contribution. Same AMSC P16000 yong maximum na po yan. Parang halos same lang yong makukuha na pension. Saan napunta yong 9yrs na dagdag?

Hi Rogie. That’s actually a very good observation. Intersection yun ng dalawang formula. So meaning kailanganiin mong mag contribute ng more than 19 years para mas maenjoy mo yung SSS pension. Kaya mahirap kung SSS pension lang ang meron kapag nagretire. Retirement planning should start as early as possible. Thanks for your insights.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan of Sun Life

Hi Rogie

Same observation here. I simply can not believe this. It must be a flaw. It’s against all logic. I guess that this flaw will be rectified soon? By the present government for example?

Chris

Ask ko po, Im self employed ofw and I contribute around 1750 to sss monthly. My monthly salary is 60k, I filed my retirement application and saw my Basic monthly pension is only around 5252, can someone explain this to me? Thank you

Hi Q.Soda. You can ask your SSS branch to be sure. Assuming you read my blog, the pension is calculated from the 5 years of contribution with the maximum salary credit of 16,000. Probably you paid some of the months less than the maximum contribution. Even if you paid for maximum contribution during the last 5 years it will only give you Php 6.4k per month nothing much of a difference.

Being an OFW is not a forever thing that’s why you really need to prepare for it. You may also expand your options like investing in the mutual fund, UITF’s, insurances, and so on.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan from Sun Life

I hope you’ll secure your future while you can. Thanks!

Sir! Good day, Magtatanong lang po. Pag po nkapaghulog lang ng 120 months at 440 pesos lang po monthly as voluntary member mga magkano po kaya ang nagiging pension?

Hi Catherine. Using formula 3, it’s Php 1,600. Thanks!

Hi Sir,

My salary is 105k per month, I am 37 yrs old how much is my monthly contribution and how much my monthly pension when becoming 60yrs old?

Thanks

Hi Angelito. As much as I would like to help you but the info you provided is not enough. You may follow the 3 formulas above and let me know if you still need help. Thanks 🙂

This yr. 2018 i fully paid my sss ,,im on my 162 months already,,my latest contribution is 650.00. I will continue my contribution , this january 2019 one step forward which is 715.00 until i get my 200 months,,,im 55.y.o now….by year 2021 ill be in my 15 years CYS..how much will i get on my monthly pension when im 60 y.o

Hi Elsa. Your case is a lot harder to compute but just to be sure please kindly go to the nearest SSS branch in your area to assist you. Just a rough estimate as I really don’t know how much you did exactly pay but it will be around Php 2,500 using the 3rd formula. Thanks!

I am completing my SSS 120 months by April 2019. For the last 5 years, I pay the maximum MSC. In the early years, MSC was not 16K but around 11K but still , I pay whatever is the maximim contribution asked for. Now I am 62 will be reiting when I am 63 which is next year. May i have an estimate based on this data? salamat

Hi Ms. Bernadette. Please kindly use formula 3. This will result in the amount of Php 6,400 per month. However, it may still change based on your advances or loans in SSS if there’s any. Thanks!

Let’s say I can only pay for 20 years. Comparing formula 1 and 2, formula 2 still gives higher pension. I was thinking that if I only want pension benefit then it is wise for me to pay only 120 contributions with the last 5 years at the maximum monthly contribution which is 1,760 (for OFW and voluntary) to get 6,400 monthly pension.

Hi Lee. The SSS allows the change in MSC for SE, VM, NW spouse, and OFWs without any limit and frequency in a year if you’re below 55 yrs old. In that way, you can minimize your contributions and maximize your pension for someone who paid 120 contributions.

However, just my to cents, if every one of us does the same things it may compromise the available resources of SSS. Thus, it will shorten the life span of the institution because the money coming out is more than the money coming in

Thanks 🙂

hi there! found this informative site. really helpful!

i was employed continuously for 8 years, hence SSS is paid faithfully during that time, I resigned and stopped paying for 3 years, then resumed again now, as a voluntary member – on to my 7th month payment this year…

but im planning to just meet the 120 contributions reqd for the retirement benefit (and maybe just add another year pa) and then stop na ulit… (because I don’t think SSS will survive that long anyway… I’m just 32 so that’s roughly 30 years before retirement claim)

so in case SSS doesn’t go bankrupt in the next 30 years… fast forward to 2048… do you think the 3 years gap I had will have an effect on my contributions? coz the AMSC is computed based on the “last 5years” right?

Hi Cesz. It will not affect your AMSC because it will be computed based on your last 60 MSCs. But if you plan to only pay for 120 months it may really compromise the SSS resources. Thus, shortening its life span. You may still opt to paying the minimum if you would like and somehow it will give you a higher pension due to the increased CYS. Thanks!

Ask ko Lang po 550 php hulog love last 5years. Din nabago po siya ngayon sa 960php monthly..pwede po ba mabago Yun contribution ko gusto gawin maximum.so ask ko po mgkano po pension ko Kong sa 960monthly hulog ko.thanks

Hi Pedro. You can pay your contribution at the maximum provided that you’re still below the age of 55. Else, you’re only allowed to jump one salary bracket per year. Thank you 🙂

Ask ko lng po kakahulog ko lng po ngayon bale nahulog po ako for 3 months til dec 2018 pede n po b ako mgapply ng sss id