Table of Contents

Save For New House or Invest to Own a House?

We often save to get the things we want from gadgets to new clothes. I bet everyone would agree that saving money is never easy. What makes it even harder is when we go to the mall seeing all those lovely items on sale. But what will you do if the pair of shoes you are eyeing is currently at 60% off its original price? Some would definitely get the item as it is already a steal. Imagine you saved 60% already? And 60% is a huge saving. Mind you, that is a different kind of saving. For someone who is disciplined enough to know his goals and priorities, he will not get the shoes as his savings is allotted for other things. Proud to say, I am among those who will not buy the kicks unless I really need it.

My Early Saving Habits

Would you believe that as early as grade school, I already know the value of money so whenever I feel the need to buy a toy, I always ask myself repeatedly if I really need to buy the toy or just keep the money as part of my savings. Because I ask myself repeatedly I often find a lot of excuses not to buy the toy anymore. Yes, I also believe I started to overthink at an early age. Please do not feel bad for me as I had wonderful memories playing hide and seek, patintero, luksong-baka, and other traditional Filipino games in our neighborhood. That is what I call enjoyment at a minimum cost.

Saving has been a lot easier as I grow old as it becomes a habit. To be honest there are still months that it becomes very hard to do especially during Christmas season and enrolment period. Being the youngest of the three boys with least responsibilities, single for now, I took charge in helping my younger sister in her school expenses. Though I may not be able to save during these months, I really love the sense of responsibility that I get by sending her to school.

Getting Started in Investing

While saving is a good habit to form and a must for everyone there are reasons were saving may not be the best choice. Believe it or not, there are really times we should not rely on saving alone. We will talk about it in a bit.

Luckily, I met this guy who taught me about proper wealth management who happens to be my manager. He is Raymund Fabro Camat. A licensed Financial Advisor of Sun Life Financial. He is the owner of the blog MoneyTalkPH which teaches fellow Filipinos on investing both in health and wealth for a well-protected investment portfolio.

Raymund Fabro Camat with Twink Macaraig on TV5 Good Morning Club Show

Savings are a good way to fund emergencies like sudden job loss, health emergencies, and other major expenses that require immediate payment, hence called emergency fund. An emergency fund should be enough to cover 3-6 months worth of monthly expenses and must be replenished soon after every use. Aside from emergency fund savings are also good to cover anticipated expenses in the near future or let’s say within five years from today. So when the need arises it can easily be addressed because the money is much safer to place in banks.

What if you will need the money later than five years? Is it still wise to place it in the banks?

The answer is both a YES and a NO.

YES, if you are relatively old. Sorry for the term. I love the elderly savers as I was raised by my Lola. Because you might need the money sooner than expected in that case your money must be placed in a low risk financial vehicle like in a regular savings account or at most in a time deposit. Your goal NOW is to protect your wealth than to make it grow.

NO, if you are still young and ready to take advantage of your money. Younger folks tend to be risky. And in investing, risk is proportional to return. It simply means that the higher the risk the higher the return. When you invest your money it will have a chance to grow higher compared to any regular savings account offered by banks.

Inflation: Acting Against Your Savings

Inflation is a good indicator of economic growth as an increase in the price of goods and services translate to increase of earnings on the side of the companies. When a company grows the economy also grows. While it may be a good indicator of growth, it tends to affect the consumers who purchase these products or avail the services at a HIGHER cost.

In other words, inflation is like a silent thief that takes away the value of money. Did you know that inflation averages around 4% in the Philippines? In 2016, inflation is just 1.8%. While in 2008, inflation balloons at a whopping 8.3%. If you have placed your money in a bank last 2008 which only earns 0.5% p.a. it means you lost the value of your money by 7.8% (i.e. interest minus inflation).

In other words, inflation is like a silent thief that takes away the value of money. Did you know that inflation averages around 4% in the Philippines? In 2016, inflation is just 1.8%. While in 2008, inflation balloons at a whopping 8.3%. If you have placed your money in a bank last 2008 which only earns 0.5% p.a. it means you lost the value of your money by 7.8% (i.e. interest minus inflation).

What is even scarier is when you left it until 2017. The purchasing power of your money is almost reduced in half.

Investment: Making Your Money Grow While Fighting Inflation

As a general rule of thumb, anything that has a higher return than inflation is considered as a GOOD investment. We often save for our life goals, like buying a new car, owning a house, or acquiring other assets. But without accounting inflation, it may you more time to acquire the asset than expected.

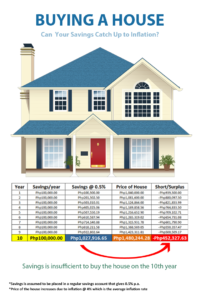

For example Mr. Federico Suan, Jr. would like to buy a house for his family worth Php 1 Million. So he decided to save Php 100,000 every year hoping to acquire the property at 10th year. Would he acquire the property by that year?

The answer is NO.

Let’s take a look at the table below how inflation makes his savings insufficient on the 10th year.

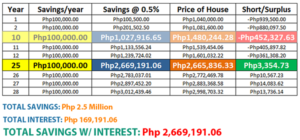

Note that you need Php 1,480,244.28 in the tenth year to buy the house that is previously priced at Php 1 Million 10 years ago. But your savings is short by Php 452,327.63 hence you cannot buy it yet.

If he continues saving, it may take him an additional 15 years just to catch up with inflation. He will only acquire the property in the 25th year of saving. That’s a bittersweet reality he needs to swallow if he relies on saving alone.

Suan help, I do not want to save that LONG just to buy the house.

Okay! As mentioned, a good investment can answer your problem.

Investment: A Wise Choice in Achieving Your Life Goals

You may opt to allow most of your savings in investment vehicles like bonds, stocks, UITF, VUL, SPVUL and so on. In this way, you are maximizing your money without losing its value.

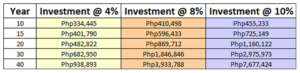

What if Mr. Federico Suan, Jr. is wise enough to invest his money in order to buy the house? This is how his investment will look like if he invests his money at 10% p.a.

He can now buy the house as early as the 9th year. If he proceeds to invest until the 10th year, he will have a surplus of Php 272,872.42. He may use this extra cash to decorate his newly acquired house or add to his next investment. That’s sulit, right?

If you’re in his shoes, would you rather save and acquire the property at the 25th year when you can invest your money to buy the property on your 9th year of investing?

VUL: Insurance with Investment

Variable Unit-linked plan or VUL is a 2-in-1 product combining the benefits of income protection and investment opportunity for everyone. Income protection comes in the form of life insurance. Though life is uncertain and no one can tell how long we will live but nevertheless, we want to make the future of our family certain. Life insurance is the best way to make it possible. Imagine if you die early most probably you still do not have enough to leave for your family. In return, your wife will return to work, kids transferred to public school, or may not be able to finish their education because they need to work for survival.

Your plan of giving them a house instead of renting is not possible anymore. Life insurance prevents these unfortunate things to happen. It prevents your dreams from dying together with you.

In other words, insurance is a safety cushion against life uncertainties and making your dreams into reality. Would you like this unfortunate thing to happen to your loved ones? When you have a choice to protect them?

Sample Proposal: 10 Years To Pay

Federico Suan, Jr., 25, Male, Non-smoker would like to buy a house worth Php 1 Million (2037) at the age of 45.

Annual Premium: Php 36,000/yr

Semi-annual: Php 18,000

Quarterly: Php 9,000

Monthly: Php 3,000

Daily: Php 100 (equivalent to a 1-pc chicken meal)

Total Investment: Php 360,000

This is the projection of his fund value which is nowhere near when he just placed his money in the bank.

Aside from the fact that Mr. Suan can now buy the house, he is also protected against life uncertainties.

Life Coverage: 1 Million Pesos

This is the amount of money your family will get just in case you die due to an accident, illness, or natural cause. This is the amount of money I can leave peacefully to my family without worrying what will happen to them when I am gone especially my Lola. Hopefully, my brothers will use the money to finance the needs of my Lola and our younger sister.

Total Disability Benefit (TDB): Waiver

This is a rider (optional) that can be attached to an insurance policy. If I get disabled and can no longer work, this rider will waive my future payments. It is as if I am still paying the premiums. Though optional, (it just cost me less than a thousand pesos for it) I consider this a MUST have rider in any life insurance policy.

Accidental Death, Dismemberment, and Disablement Benefit (ADDD): ₱500,000

If I die due to an accident my family will get this amount together with the life coverage totaling ₱1.5 Million. If I survived the accident but lost any part of my body, I will receive a percentage of my ADDD coverage. For example, if I lost one eyesight, I will receive ₱250,000 (half of my ADDD coverage). In any case, I become totally disabled, I am entitled to receive ₱50,000 per year for 10 years with a total of ₱500,000.

Maganda ang VUL di ba? You can have both in a single product. You get your income protection together with the investment of your choice for maximum savings and protection.

WANT A FREE PROPOSAL?

You too can protect yourself from uncertainties by getting a VUL policy. Some terms are technical in nature that an ordinary person cannot understand without the help of a Licensed Financial Advisor. A personal meeting is strongly recommended. No pressure nor obligation on your part will be imposed upon appointment. You may not like it and it is perfectly fine with me. You can reach me through 0917-775-8352 or e-mail me at federico.suan@gmail.com.

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.