Good news! Sun Life is now accepting online application for mutual fund accounts anywhere in the Philippines. Now, you can open a Sun Life mutual fund account via online application. It gives you another reason to start investing today!

If you do not have enough knowledge yet with a mutual fund, then you may click the link below. It contains most of the things you must know about mutual funds.

READ: Mutual Fund 101 | Sun Life Prosperity Funds

You may also message me on Facebook by clicking [HERE], so we can have a short discussion about this.

Table of Contents

Basic Requirements

I know you are ready to start your application. But before that, you may prepare the following first so that you can finish it in just a couple of minutes.

- One (1) valid ID

- Selfie while holding the valid ID

- Initial investment (minimum of Php 1,000)

- SSS number

- TIN

10 Steps to Open a Sun Life Mutual Fund via Online

Now that you have prepared the requirements, you can quickly finish your application in 5 minutes. Above all, you can easily follow the steps with the links, images, and short descriptions I provided.

So here are the steps on how to open a Sun Life mutual fund account via online:

1. Go to Sun Life official website

You may click this link or simply type www.sunlife.com.ph on your browser.

Do you want to make it even faster? Then proceed to the 3rd step now.

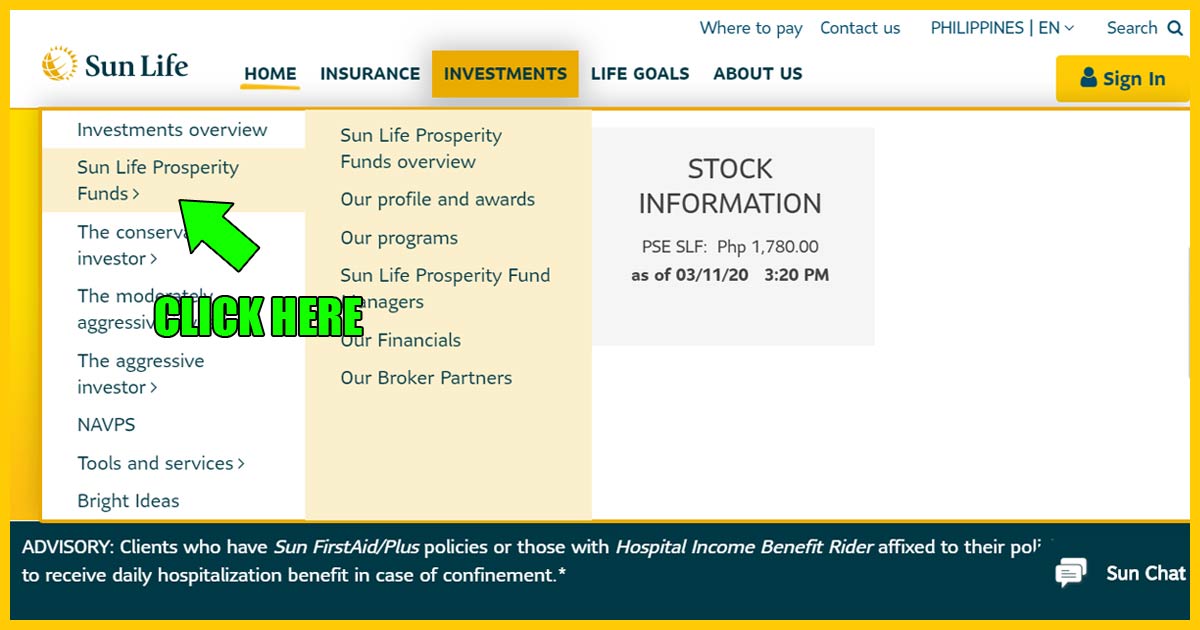

2. Go to the “Investment” tab and click “Sun Life Prosperity Funds.”

Hover your mouse over the investment tab and then click the Sun Life Prosperity Funds. So it will lead you to a new page where you can discover it’s benefits.

But you may skip reading it if you have read my blog about Sun Life Mutual Funds.

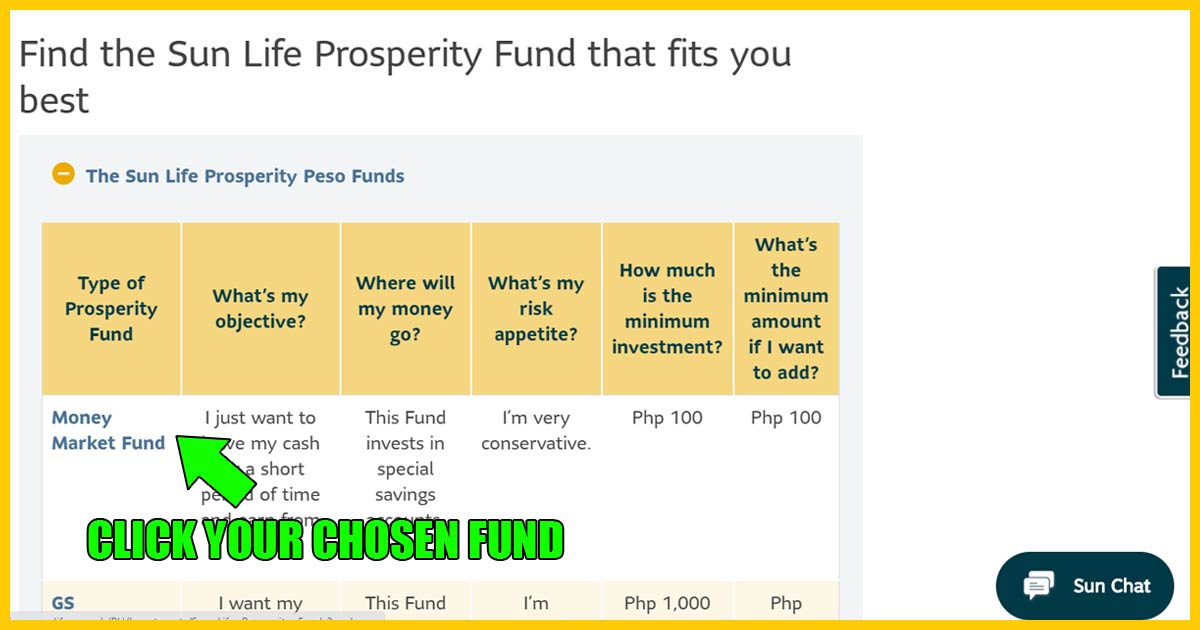

3. Scroll down and look for “Peso Funds” or “Dollar Fund.”

There are several funds you may choose from, but I have recommended funds. In short, interest and timeframe are the two factors considered.

So here’s the table of my recommended fund for you.

| Peso Funds | Description |

| Money Market Fund | 3-4% p.a.* less than 5 years (time frame) Conservative |

| Bond Fund | 4-6% p.a.* 5 to 10 years (time frame) Moderate |

| Index Fund | 8-10% p.a.* more than 10 years Aggressive |

Minimum Investment:

- Php 1,000 is the minimum investment for peso-denominated funds except for money market funds, which you can open for as low as Php100.

- $ 1,000 is the minimum investment for all dollar-denominated funds.

*Historical return is not indicative of future performance.

4. Click the “BUY NOW” button

Click the BUY NOW button on the left side if you have chosen a fund you like. It will lead you to another page.

READ: Sun Life | The Top Life Insurer in the Philippines

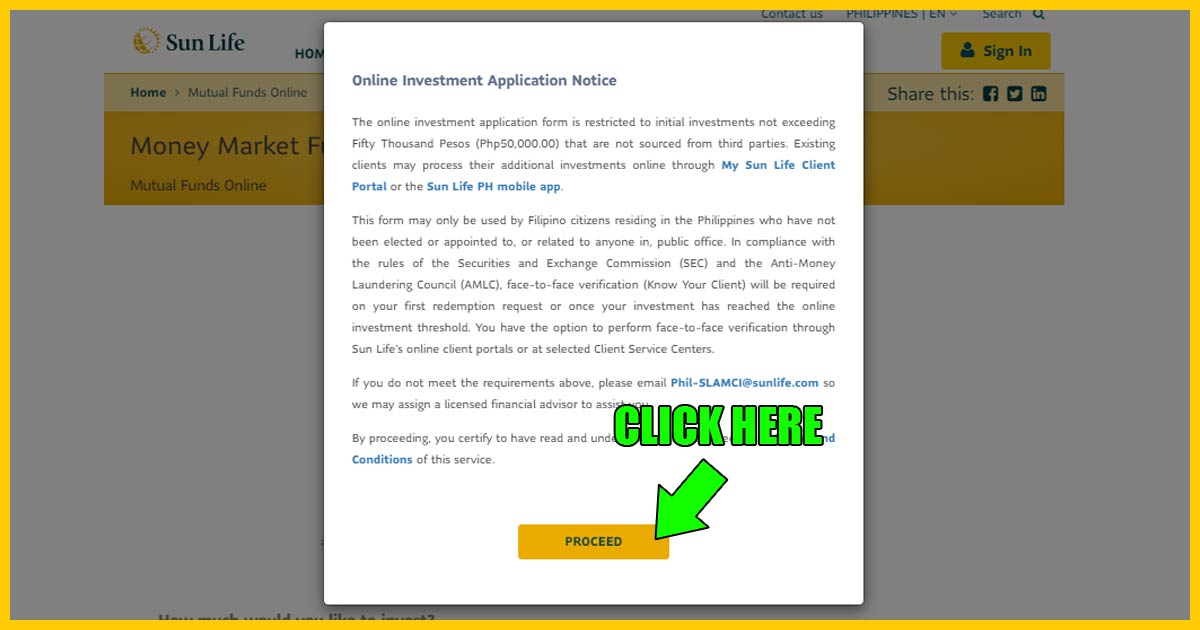

5. Read the Notice and then Click “Proceed.”

Firstly, read the online application notice and click proceed if you agree and understand the stated terms and conditions.

6. Answer the Investment Suitability Assessment (ISA) and click “Continue.”

Fill out the Investment Suitability Assessment (ISA) and then click continue. Click the continue again.

The assessment aims to give you an idea if your chosen fund is aligned to the type of investor you are—conservative, moderate, and aggressive.

It will provide you with an idea if your selected fund is suitable for you. However, these are just recommendations you may or may not follow.

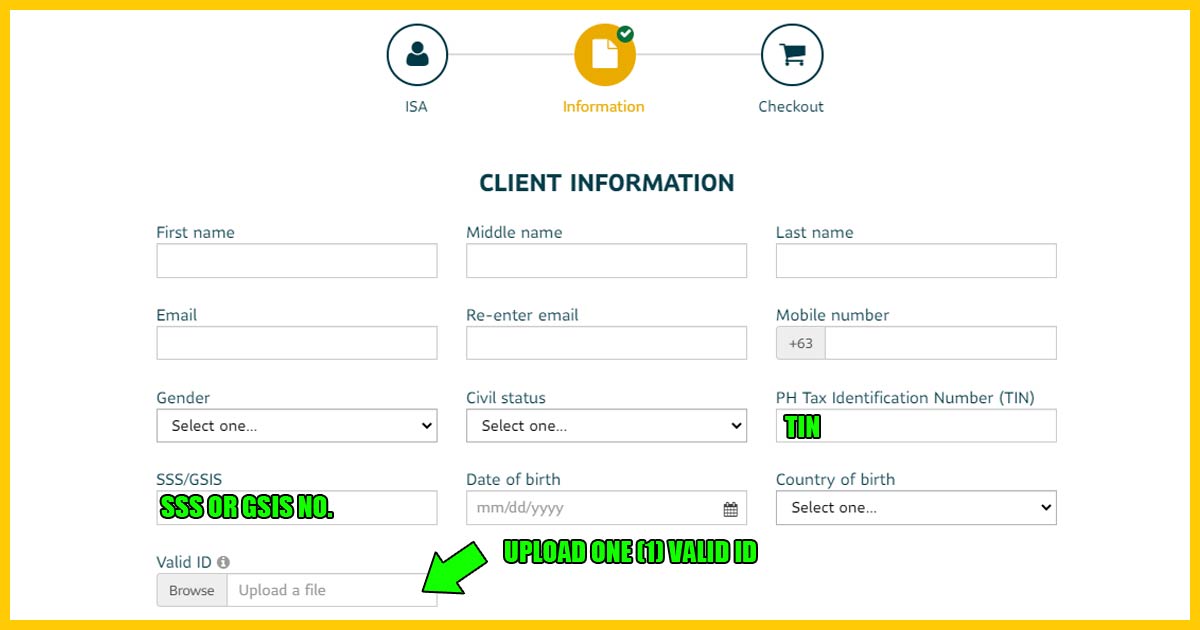

7. Fill out the “Client Information”

Just like opening a bank account, you must fill out the client information form. You must also upload the following:

- one (1) valid ID

- selfie while holding the valid ID

READ: Sun Maxilink Prime | The Best-Selling VUL Plan of Sun Life

8. Fill out the ‘Financial Advisor Information’

Now, you may put the following details on the financial advisor information.

Financial Advisor Name: Federico Suan, Jr.

Financial Advisor Code: 111890

Please don’t forget to connect with me on Facebook by clicking [HERE] so I can monitor your application.

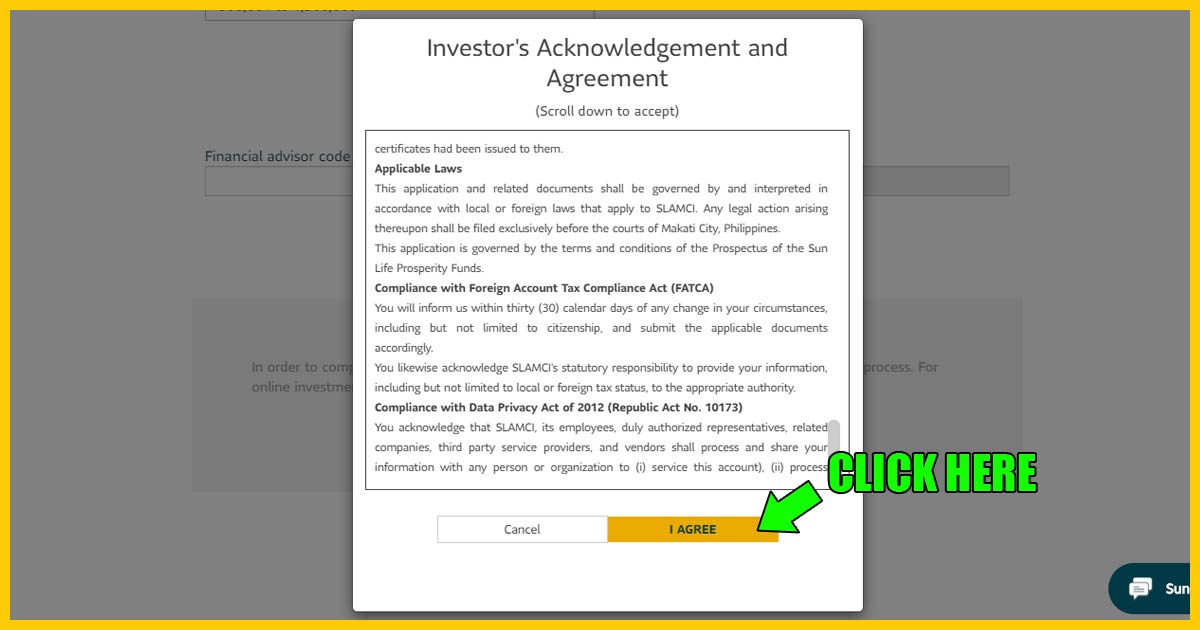

9. Read the ‘Investor’s Acknowledgement’ then click ‘I Agree.’

Check if the information is correct and read the “Investor’s Acknowledgment and Agreement.” And then scroll down, and if you agree, click, “I Agree.”

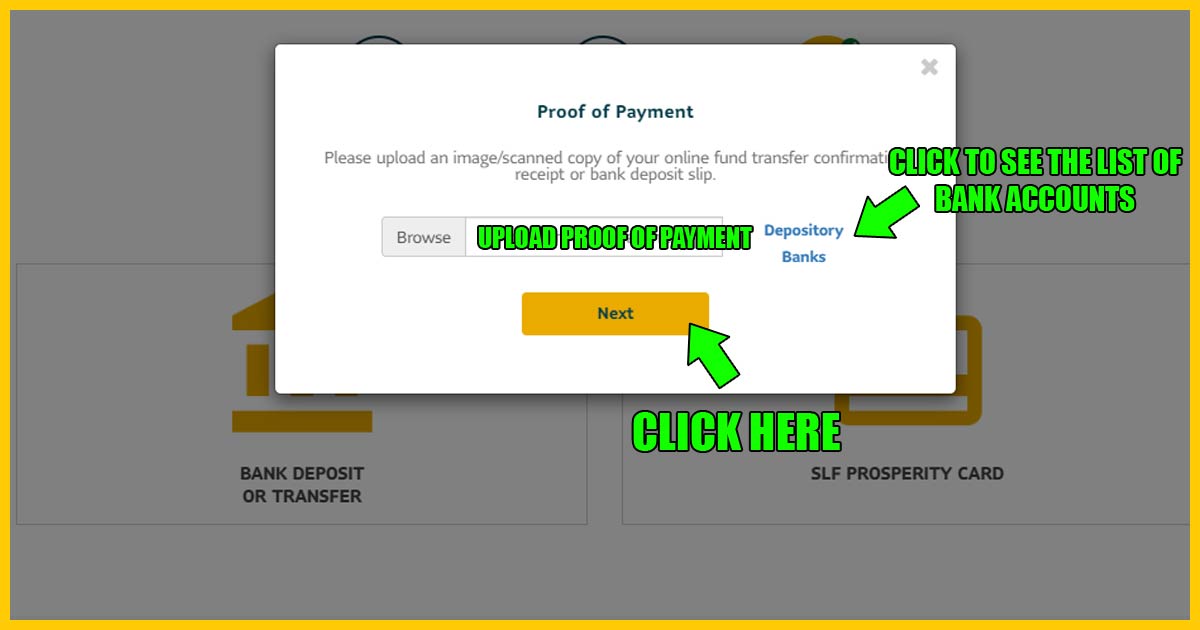

10. Select your payment method

Choose from any of the 3 payment methods, i.e., bank deposit, Sun Life Prosperity Card, or via Sun Life Financial Store.

Congratulations! You have now completed the steps. Meanwhile, processing of your application will take 2 to 3 business days.

Frequently Asked Questions (FAQs)

The limit for accounts opened online is Php 50,000.

You may go to any Sun Life Client Center near your place and have a face-to-face verification. Most importantly, don’t forget to bring a valid ID with you for confirmation. A verified account has no investment limit.

Yes, there will be charges on your mutual fund. It is called the sales load, which can be front-end (deposit) or back-end (withdrawal). If you chose back-end, after 5 years, your investment would no longer be charged.

Start Investing NOW!

You may message me on Facebook by clicking [HERE] or using the following details.

Engr. Federico Suan, CIS

0917-7758352 (Globe) or 0943-8214752 (Sun or Smart)

federico.suan@gmail.com

*****

Disclaimer: I am a proud Sun Life Financial Advisor who can help you in your journey towards financial freedom. However, my posts only reflect my personal views and opinions.

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.