The results are already out but who really made it to the top? This post aims to help you in making that important decision of getting life insurance. Some websites and blogs claim that their personal way of measuring leadership is more objective. You might have read those different articles and thinking if it is really true. So if you want to find out then you’re in the right place.

Table of Contents

How to Measure Performance of Insurance Companies?

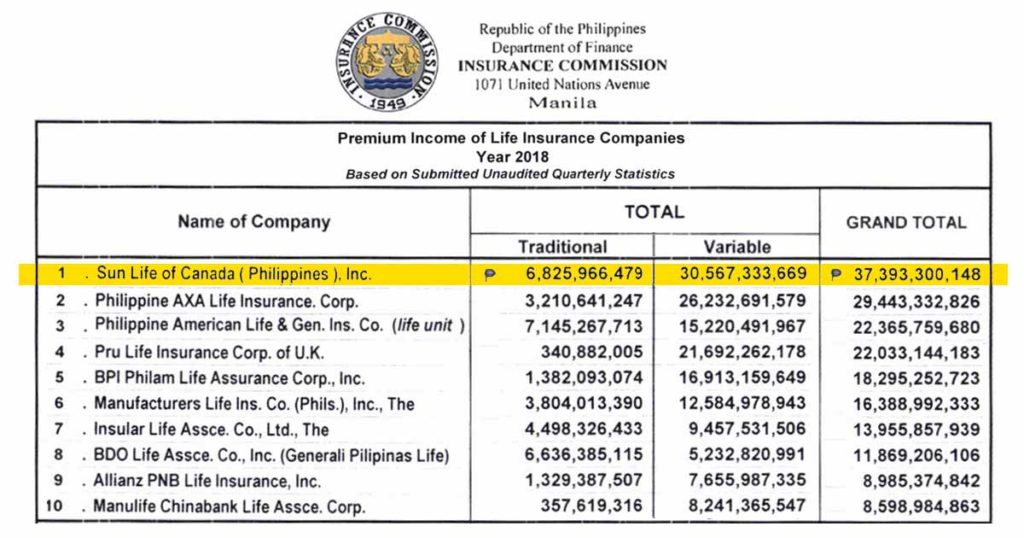

The Insurance Commission (IC) releases the performance of insurance companies in 6 categories such as New Business Annual Premium Equivalent (NBAPE), Premium Income, Paid-Up Capital, Networth, Net Income, and Asset.

Yes, you’re right, every category has a different leader in performance. But the question is which one to use in determining top performers or do we really need to consolidate the results?

Premium Income

Premium income is the total premium collected by insurance companies from their clients. Market leadership is measured using Premium Income. Simply, the company that has the highest collected premium is considered the market leader or the best life insurance company in the Philippines for that year.

READ: Top 10 Life Insurance Companies in the Philippines 2020

You may also refer to the other categories to check their financial standing. For example, Sun Life is the top life insurer in the Philippines based on Premium Income but only second to Philam in terms of Assets.

Due to the fact that Philam used to be the market leader for quite some time and have accumulated many assets. However, if Sun Life will be able to maintain its position then it may surpass the total assets of Philam in the future.

READ: Sun Maxilink Prime | Best-Selling VUL Plan From Sun Life

This is true for all other insurance companies. Let’s say AXA overtakes Sun Life in Premium Income it may take years before it can surpass the Assets of Sun Life.

Consolidated Reports

Some blogs have posted consolidated reports claiming that it’s the most objective way to measure leadership. While I must agree that their only goal is to help you with your decision but the way it was consolidated might be considered a little unfair. Here’s why.

1. Equal Weight

We noticed that they just added the placement of each company in every category. Thus, the resulting list might be questionable. This is because they treated each category with equal importance.

2. Using Paid-Up Capital

Paid-up capital is simply the money collected from investors in exchange for shares of stock. In 2019, IC has required a minimum of Php 900 million for all the insurance companies. This is more of a minimum requirement and doesn’t give significant meaning when added. Thus, it may dilute the consolidated reports with numbers with little to no importance.

3. Self-Serving

They might have other intentions of why they have to post it. Personally, I even received emails and comments on my blog coming from them. Some even left malicious comments on my FB posts making me wonder why?

Final Thoughts:

While the main objective of some blogs is to help it also pay to consider if the information is backed up by facts. Maybe an extensive study regarding the consolidation of results because it has never been used in the past. So the only way to determine the best life insurance company in the Philippines, for now, is by using the Premium Income report.

I hope you learned from this blog to become an even more wise insurance buyer.

Cheers!!!

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.