Sun Flexilink is the cheapest life insurance with an investment plan from Sun Life. A good plan if you are a low-income earner or elderly seeking income protection and wealth accumulation plan in a more affordable scheme. Providing you financial security while making your money grow at the same time.

UPDATE (Oct 2019): Sun Life has released a new, better, and cheaper version called Sun Maxilink 100.

READ: Sun Maxilink 100 | New and Affordable VUL Plan From Sun Life

Table of Contents

Why You Must Get Life Insurance?

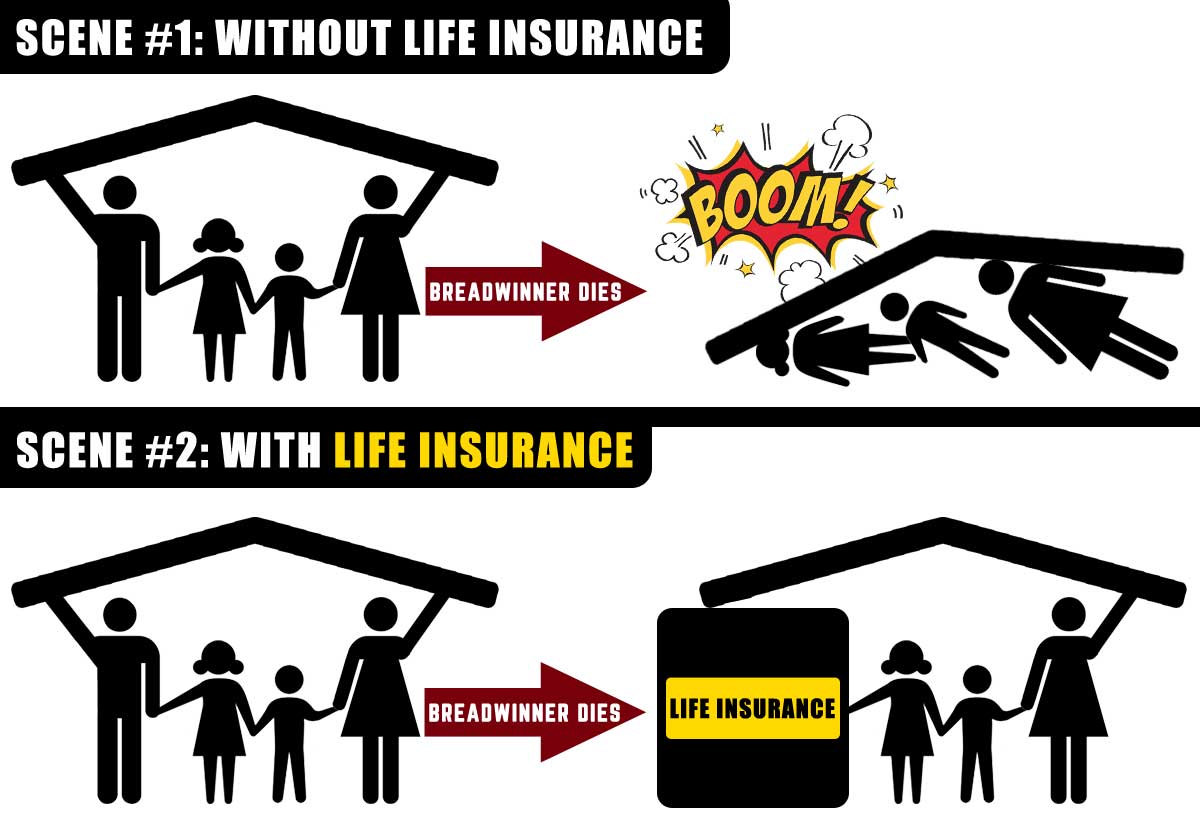

My father died a few years ago without life insurance since then it has been a financial roller coaster ride for me. I have to take up the role I wasn’t supposed to. Aside from the fact that I’m not ready yet. It’s the point in my life that I felt like I was lifting something so heavy that my body cannot handle it.

To think that I already graduated from college and have a decent job but I still felt that way. What more if it happened when I was still studying?

You Want Nothing But the BEST For Your Family

Please don’t get me wrong. I do love my father even though he didn’t prepare for it. During that time financial literacy is not as big as today. Maybe no one dared to offer him life insurance. It was totally not his fault that he didn’t know about his option and have no one to ask.

But it would be different for you because you’re well aware of its importance.

Which makes you lucky because you can still do something about it for the BEST of your family.

Ask Yourself This

If you’ll be called by our creator today? Will your family still live the same lifestyle? Can your sibling/kids go to the same school? If not, you better get life insurance now!

What are the Benefits of Sun Flexilink?

Sun Flexilink is the oldest VUL plan of Sun Life that basically offers life insurance coverage until age 88. Investment is in the form of a pooled fund similar to a mutual fund.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan

If a mutual fund is new to you, don’t worry because your Financial Advisor can help you pick the most suitable fund for you.

Sun Flexilink Sample Proposal

Like any of the plans out there, this is best explained with an example. I will share a sample proposal I made for myself.

Federico Suan, Jr., 25, Male, Non-smoker, Index Fund with an ave. historical return of 10% p.a.

Yearly Premium: Php 31,670

Semi-Annually: Php 15,835

Quarterly: Php 7,918

Monthly: Php 2,640

Daily: Php 88 (just the price of your favorite fast food meal)

Life Insurance Coverage: Php 1 Million

This is what my family can get to continue the life they are living today when I die (Lord, please not too soon). My brothers can use this amount to finance the education of our younger sister and provide the needs of my Lola. It shows how much I love them even when I’m no longer present to provide their needs.

Total Disability Benefit (TDB): Waiver of Premiums

This is an additional benefit I attached to my plan. It will waive my future payments if I get totally and permanently disabled due to an accident. It is as if I am still paying my plan. This is a must-have rider to any insurance plan.

Accidental Death, Dismemberment, and Disablement Benefit (ADDD): Php 1 Million

My family will get this amount together with the basic coverage making it Php 2 Million. If I am lucky to survive the accident but lost any part of my body, I will receive a corresponding percentage of my ADDD coverage (e.g. if I lose one eyesight then I will receive Php 500,000). If I become permanently disabled I will receive Php 100,000 every year for the next 10 years for a total of Php 1 Million in benefits.

Hospital Income Benefit (HIB): Php 1,000/day

This is the amount I will receive if I get confined in a hospital. It will serve more like a daily income replacement. This will double or become Php 2,000 when I get confined in ICU or hospitalized due to any of the dreaded diseases listed below.

Dreaded diseases include stroke, chronic liver disease, dissecting aortic aneurysm, end-stage lung disease, end-stage renal disease, multiple sclerosis, major organ transplant, invasive cancer, poliomyelitis, progressive muscular atrophy, and acute heart attack.

Critical Illness Benefit (CIB): Php 1 Million

Medical treatment can be costly and can wipe out all my savings if I get critically ill. But if I get ill then somehow I will be confident that I can afford the treatment without touching my savings (or maybe just a portion). The premium of this rider increases every 5 years and paid continuously until age 70.

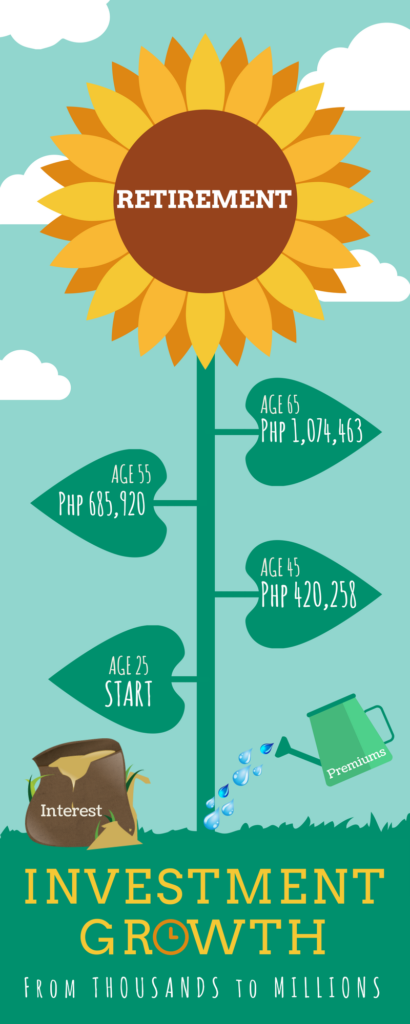

Investment Benefit

There are 9 available funds you can choose just ask for the assistance of your Financial Advisor in picking the fund. In my case, I’ve chosen the index fund with an average historical return of 10% p.a. The index fund invests in top publicly listed companies like Ayala, SM, Jollibee, etc. allowing me enjoy the benefits of the stock market indirectly.

It’s also good to note that because VUL plans like this is directly linked to your investment. It will be affected by how the market performs so funds are not guaranteed. You may still be required to continue paying the plan when funds become insufficient.

When I retire at age 65, I will have a projected fund value of Php 1,074,463 which I can use to build a small business or other things I may need for my retirement. The fund can also be used as an educational fund for my future kids. We all know how much the cost of sending a child to school nowadays that’s why it pays to be prepared for it as early as now.

In your case, you can use the fund for whatever purpose you may deem beneficial to you like buying a car probably, building your own house, etc.

Inquire NOW!

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in-person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

READ: 6 Reasons Why You Haven’t Received a Proposal

Frequently Asked Questions (FAQ):

This is insurance with an investment plan being offered by Sun Life. A good plan to start if you are on a budget but would like to get decent insurance coverage while growing your money for future needs.

They are both variable unit-linked plans or VUL. The main difference is that Sun Flexilink is designed to be paid continuously until age 88. While Sun Maxilink Prime is payable for a minimum of 10 years.

None. No plan is superior over the other as a good plan for you may be different from another person because both of you have different financial needs.

You can start for as low as Php 2,000 per month. But it will still depend on your age and other factors.

You just need one valid ID together with your initial payment of at least one quarter or equivalent to 3 months worth of premium.

****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

82 thoughts on “Sun Flexilink an Affordable Insurance with Investment Plan from Sun Life”

Hi! Thank you for writing this very informative entry about Sun Flexilink. I would just like to ask how to withdraw partially from the cash surrender fund value? Is there a minimum amount? Thank you in advance.

Yes, a minimum of 5,000. Btw, thank you for your kind words 🙂

How many years to pay si SunLife FlexiLink?

Hi.. i currently have a Sunlife Flixilink with face amount of 1 Million with riders of Hospital Income Benefit and 1M Accidental Death.. my question is:

1. is it possible to request to reduce the face amount (ex. 500k)?

2. is it possible to request to remove the riders?

Thanks in advance

Yes, you may do that. But check with your advisor first what are the repercussions of doing so.

Good pm! sir may Sun Flexilink po ako ngayon and 7 years na po akong nag bayad, may nakuka po akong pera P40,000 nakaraang Pandemic last year pa. problema ko po hindi ko sya naibalik pa ang sabi un daw po ung pwede kong ma withdraw last year. Tanong ko po, kailangan ko pa syang bayaran? o pwede na ring hindi na. nag alala po ako baka mawala ung kinuha kong Plan -Sun Life Flexilink.

2nd question, may dumating na po kasing billing sa akin for this year payable kaso wala po akong pambayad pa. Due date nya is October 9, 2021. ask ko po kung hangang kailan po palugit ng bayaran dahil nawalan po kasi ako ng pasok.

Nag alala po ako baka masayang yong pinaghirapan kong Plan ng Sun Life.

Pls answer my question.

Maraming salamat,

Lyn

It’s always best to connect with your agent for policy specific concerns. But in general, your plan is good for as long as it has funds even if you missed your due date. That’s what makes VUL, like your plan, a good choice in diversifying in insurance.

Hello sir. How much will the beneficiary get under Sun Flexilink? Thank you.

Hi Tanya. It will depend on the coverage. Thanks 🙂

Hi good day. 4 years na po Sun Flexilink ko ask ko lang po until kelan ko sya babayaran. Payable ba sya ng 10 years or upto 88 years? Kung 10 years man tapos nag stop ako di ba sya maglalapsed nun? Thank You

It may be terminated. I don’t know the inclusions of your plan so it’s best to talk again with your agent.

Hi Federico. I do have a Sun Flexilink already, what if after 10 years I do have an emergency or I’m in a situation where I am in need of money, can I withdraw my contributions?

Yes, you can withdraw your “fund value,” which may be more or less than the actual payments made. Thanks 🙂

Hello do all Sun Flexilink have a Hospital Income Benefit (HIB)?

Gayle, as mentioned, riders are only optional. If you wish to add it to your coverage, you may reach to your advisor. Thanks 🙂

Hi Sir, I have question with regards to insurance fund.

What will happen if my monthly premium is only 2000 but I will pay 2500 or 3000 which is more than my premium. What is the effect of this to my fund? Thanks,

Hi Jongie. Anything you pay in excess of what you are supposed to pay for a year will be added to your investment fund.

Hi! Sir if I withdraw my fund value. How much interest should I pay? Would I still

be insured?

You don’t have to pay any interest. As mentioned, full withdrawal of funds is like surrendering your plan. But it’s okay if it’s only a partial withdrawal.

Hello! I just got a Sun Flexilink policy days ago. Ngayon ko lang nalaman thru your website na need pala to bayaran until age 88? So meaning, if I finished paying the 10 year term, need ko pa rin ba magbayad o pwede ko na siya stop at i-withdraw na ang money ko? Thanks.

Hi Bea! As mentioned in the comment section, it will depend on how your plan is created. Do you have enough excess premium in place? Because if you have, you may do a premium holiday option which means you may not pay after 10 years. The best thing to do with it now is to go back to your advisor and get things checked.

Hi Federico. It is mentioned above that “Sun Flexilink is designed to be paid continuously until age 88”. But when I was introduced to the product, the advisor said that after 10 years, the policy should pay its own premium. That sounds somewhat contradictory to me. Can you please shed light on this?

Hi Rico. Sun Flexilink is a regular pay VUL which means it must be paid regularly until age 88 (or until you are able). There are some instances wherein you can do a premium holiday, as I mentioned in my previous comments. Again, at this point, I cannot tell if your plan has excess premiums and what riders are attached to your plan. So it is best to reconnect with your advisor to get a solid explanation as to why he said that.

If he is no longer with Sun Life, just feel free to connect with me on FB. Thanks 🙂

That was also told to me when i had my flexilink 2 years ago. What will happen if i stopped paying my premiums at 15th year?

It will depend on how it was created. You may do a premium holiday, but you should also be aware of the possible scenarios na may arise. Btw, you may always go back to your advisor for clarification. Thanks 🙂

Hi! If the CIB is added as a rider, and you mentioned that “ The premium of this rider increases every 5 years and paid continuously until age 70.” does this mean that every 5 years, i will pay for a increasing amount? For example my annual premium is 25,000, after 5 years it will be higher?

Yes, you got that right 🙂

Hello. I just want to ask lang po. I got my plan Sun Flexilink last July 2011. I was 24yo back then and I dont have a full grasp of what I will get through when I signed my plan. However, I recalled my advisor said something about 10years after I paid my premiums. Would you have any idea what will happen 10yrs after I paid my plan? Thank you po

Hi Lexter. You may read my previous comment about the premium holiday option. If you still need assistance, you may ask your advisor as to why and how you can do this option. Thanks 🙂

Hi Sir Federico, How would we know the payment maturity or duration? As Rico mentioned, I was told that my flexilink plan is payable for 10 years. Is this somehow stated in the policy docs? I hope you can answer my question. Thanks

Cristi, the maturity of Sun Flexilink is the year wherein it will end. So it will be at the age of 88. You may read your policy for guidance, and if you need clarification, please ask your advisor as he knows your plan well. As for me, I can only give general info about the plan. Thanks 🙂

Hi po, we have same surname and thought it was rare 🙂

Nag avail po ako ng MaxiLink Prime VUL, gusto ko lang poi-ask what fund allocation you think is best? and am I allowed to it change if ever?

Hi Kate. It’s so nice to connect with you. Who knows if we are distant relative, right? Yes, you can re-allocate your funds. I can’t recommend at this point because I haven’t identified your financial needs and risk appetite. But, if you are still a millennial, you may consider stock-based funds like Equity Fund and Index Fund. This way, you’ll get to maximize the investment return of your money, and also you still have many years ahead of you, which can somehow mitigate the inherent risk of these stock-based funds. I hope it helped. Thank you 🙂

Hi Federico. May I know po the difference of Sun FlexiLink and Sun FlexiLink Assist? If I do have a Sun FlexiLink now, which rider do I need to add for illness? Thank you 🙂

Hi Elrod. It’s already decommissioned and the coverage is only limited to Php700k. You may check Sun Maxilink 100. Here’s the link. Thank you!

READ: Sun Maxilink 100 | New and Affordable VUL Plan From Sun Life

hi, i am currently having my sun flexilink insurance policy. let say i already have a fund value in 3yrs, and something emergency happen, will i able to withdraw my fund in full?

Hi Meg. Sun Flexilink is an insurance plan. You will be charged in exchange for a bigger amount called life insurance coverage. Thus, after 3 years you will not be able to get all your payments. I think you need to talk again with your advisor and have your needs reassessed to see if this kind of plan fits you. Thank you 🙂

My child is 14 and iam 40 year year old what insurance plan suite us

Hi Apin. It is good to know that you are interested in life insurance but I do suggest personal financial planning to further assess your needs. In this way, we can offer a plan that can add value to you and your family. Thank you 🙂

Please send me a proposal which fits my needs and income. thanks

Hi Amelia. Let’s talk thru email. Thanks 🙂

My wife a beneficiary undergone open heart surgery. Does she entitled for any health benefit?

Hi Renee. None, as beneficiary, she is only entitled to the death benefit when the insured dies. The person entitled to health insurance coverage is the person insured which is you. Thanks

Hi! I currently am insured with sunlife’s flexilink.. my face amount is currently less than a million. is it possible to change my face amount to a million?

Hi Charm. Sadly, it’s a no because your application was approved for the face amount you applied and health condition at that time. However, if you still think you needed more coverage or maybe it’s based on your financial planning before then you may apply for another insurance plan. Thanks 🙂

Hi Sir, question lang.. Pwede ba maipachange yun insurance plan from flexilink into maxilink?

Hi Melissa. No, it’s not allowed to convert your plan. You may, however, ask your advisor to make amendments on your plan to suit your current needs. I hope you’ll keep your plan as Sun Flexilink is also a good plan to start with. Thanks and regards,

How long is the paying period for this sun flexilink..thanks..

Hi Roy. Sun Flexilink is a regular VUL which means you’ll have to pay it until age 88. But you can do a premium holiday like you can pay it in 3 years or 5 years but of course, that is if you are willing to set aside more. Thanks

Hi Sir Federico. I am now enrolled in Sun Flexilink, how would you apply for a Premium Holiday? And since you can’t change the face amount is it really ideal to get another plan rather than amending the plan that you first signed up for? Parang mas costly kasi kung ganun?

Hi Kelly. Nice to know that you already got yours. I think it is best to contact your advisor. I don’t have an idea of how it was tailored-fit to you. But just to give you an idea, you can do a premium holiday for as long as you have sufficient fund value on your policy. And yes, you need to get another policy if you want to increase your coverage. This is because your application was approved based on your health and other declarations before in which it might have changed now. Thus, you cannot increase your insurance coverage for your existing plan. Thank you 🙂

Hi Sir Federico. I have a Sun Life Flexilink since 2015..and I think I am not satisfied with this insurance since you need to pay until you are 88y/o.. but you you mentioned the premium holiday.. can I still avail that? And when can you say that your sufficient fund value is enough?

Hi Jennylyn. I think you have to discuss this with your advisor. But to give you an idea, you may not pay the plan after number of years. You can put it like pay until you are able but then you have to have close monitoring of your plan. Because this is not designed to last that long when not paid continuously over a long time not unless you do top-up regularly. Thanks 🙂

Hi, totoo po ba na pwede yan 10 yrs to pay lang? Tapos hindi na huhulugan? Ano po mangyayari?

Hi Janice. Yes, pwede mag holiday sa Sun Flexilink para 10 years mo lang siya bayaran. Pero kailangan di mag zero yung funds mo para ma enjoy mo pa din yung insurance benefits. Thank you 🙂

Hi Federico. Can you explain further po yung mag holiday. Do I need to inform Sunlife about this holiday? I have a Sun Flexilink account and already paid for 10 years and I remember that my agent told me that I can only pay it for 10 yrs but when I check my account I still need to pay an annual premium.

Hi Jona. You don’t have to inform Sun Life if you would like to do a premium holiday. But please monitor your plan from time to time. Even if you stop paying, charges will continue, as indicated in the plan.

Sun Flexilink is a regular pay plan payable until age 88 (or simply put it as until able). The only time you can do a premium holiday without sacrificing the growth of your investment fund is when you are regularly putting excess premiums or top-ups.

If you need a policy review, please kindly connect with me on Facebook. Thanks

Is the fund for both maxilink prime and Flexilink are withdrawable?

Yes, it’s withdrawable but just keep in mind that your insurance benefits are linked to the investment fund. If it becomes zero, your insurance plan will be lapsed or terminated. Thanks 🙂

I want a proposal for vul for my one year old baby how much will be the monthly payable in 5 years.And my 6 years old child.How about if i want only to get a mutual fund for them how much is the minimum payment every month.

Hi Norman. You can start your mutual fund for as low as Php 1,000 pesos with Sun Life. The succeeding payment or let say the investment is dependent on how much and when you want it to be done. Thanks!

Hi Sir Federico,

I have Flexilink for 5 years and a face value of over 2.8M, is it possible to withdraw say 1M after the maturity date and still to continue the rest of the fund?

Hi Rose. The maturity of the plan is age 88. However, you may withdraw against your fund value anytime if the need arises. Thanks 🙂

Proposal for Flexilink

40 yo

Non smoker

Willing to pay 1500/mo only

Hi i would like to know more. email me back.

Hi Jak. I’ll reach you thru email. Thanks!

Hello Federico,

My husband and I are retired(he is (he is 74 and I am 70).

We are balikbayans from the US. Do you have any type of insurance for us- we are shopping around locally as we are planning to discontinue our current coverage from the US.

Hi Ms. Bernadette. Sorry, but we only issue life insurances until age 70. Thanks

sir good day im 25 yrs old im interested in investing .. what platform is best suited for me, i would like know my options

Hi Jasper. Sun Flexilink is not an investment plan but rather a VUL plan, an insurance with investment. If you are relatively new about financial literacy stuffs you may kindly see my post about 5 steps toward financial freedom. I’ll link it here below. I hope you’ll get yourself insured first. Thanks!

READ: 5 Simple Steps to Achieve Financial Freedom

Can you tell me more about the concept of excess premium or top ups. Thanks.

Alan

It’s actually best to ask your advisor about it. But I’ll consider writing about this topic 🙂

Hi! Ive read ur post and ive been thnking on applying for insurance..the kind that will allow my family to have something to start on when i die..the problem is..i am already diagnosed with CKD5 and have been on dialysis since..i am still working though ..so is it possible for me to still apply?thank u

Hi Rue. Well, you can apply but I’ll be honest to you that you have little to no chance of getting approved because you already have an existing condition. Insurance is bought by your health and is only paid by your money. For those who would like to get an insurance, get it while you are still young, healthy, and able. If you’ll like to try your chance then you may email me or contact me thru my mobile number. Thanks!

Hi.

Julia here.

I wish to inquire about your products with Sunlife. Hope you can send me a proposal.

Thanks.

Hi Julia. Sorry but you provided very little info about you. This is best discussed in person so you can get all your inquiries addressed. Financial consultation is like going to the doctor. You can’t just ask the doctor for medicine just because you feel you’re ill without him check you for possible reasons. The same goes in getting a financial advice, we can’t address the issue not unless we talk about this thoroughly. If you have time just send me a message and let’s see how I can help you from there. Thanks

how is this compared to the sun maxilink prime po? which is better? and what are the differences? thank you.

Hi RP! Better is subjective and will depend on a lot of factors. But just to give you an idea, if you’re still young (like 20’s-40’s) then Sun Maxilink Prime is a better option as it will generate fund value faster than the Sun Flexilink plan. You may use this fund value for retirement, additional health fund, etc.

This is best explained in person because it may get too technical which you may not understand. Thanks!

to avail of those benefits,How many constributions or payments that i am required to pay to be avail of those benefits such as disability(wholly or partially),Hospital income benefits or critical illness benefits?

Hi Ryan. Even if you just paid once, Sun Life will pay you or your beneficiary if you’re taken out of the picture. Just to give you an idea, there are a lot of insurance claims even on their younger age or in the early years of their plans (i.e. paid only once) died but Sun Life still paid them in a week or some within the day after filing the claim. Thanks 🙂

Can I change the life insured? For example, my child is the insured, while I am the beneficiary., can we swap?

It’s not possible. Why? Because when you apply for insurance, the insured is being evaluated by the insurer. Even though you are the owner, you are not evaluated the same way. On top of it, insurance premium gets higher as we age. If you took it against the life of your child then you are paying a smaller premium compared to getting it yourself. Lastly, the difference in time of the plan inception date versus the date when you wanted to swap coverage corresponds to a financial loss of the insurer if it’s allowed.

The short answer is no.

It’s not advisable to get your kids insured unless you have enough insurance coverage. Instead of swapping, you may want to get another life insurance for yourself.