Last January 20, 2018, Chinkee Tan had released a new book called “My Ipon Diary” which is a follow-up to his successful book “Diary of a Pulubi“. If you’re not yet familiar with the author, he is known for his direct attacks on financial topics with a hint of humor. He makes each topic easy to follow especially for beginners in financial literacy. A good approach in starting your “ipon” journey.

I’ve seen him once and I can say that he’s really made to speak in front of a huge audience. I also follow his Facebook page Chinkee Tan to get a daily scoop of financial advice that I can also share with my clients.

If this is your first time reading my blog, I’m an electronics engineer and a Sun Life unit manager. I help my clients achieve lifetime financial security by offering a comprehensive financial planning session.

I’m also expanding my team, just message me on Facebook if you are looking for a side hassle where you can grow and earn in your own time. You may also read my post so you can have a better idea.

Okay! Let’s get started.

The books are personally signed by Chinkee Tan. You can really feel his dedication by imagining how many books he already signed.

Table of Contents

3 Things I like in My Ipon Diary

Tipid Monitoring Chart

We all know that saving money starts with monitoring expenses. As they say, “You can’t control what you don’t measure.” A very important part of saving money is to get to know how you manage your money. So you can diagnose the current state of your finances.

This is a great tool to start monitoring your expenses and identifying your needs from your wants. And once you identified which is which, you can now remove some of your wants pretending to be a need.

Just don’t be too hard on yourself, your cash flow will improve with time.

S.M.A.R.T Goal

Another thing I like about the book is how he emphasizes the importance of having a SMART goal. As you already know, a goal is a plan with a course of action.

Remember to start with the end in mind.

Ton, kaka-start palang eh end na agad?

That’s why you need to have a SMART goal.

Kung smart ka dapat ang goal mo ay SMART din.

SMART means specific, measurable, attainable, relevant, and time-bound.

Once you have a SMART goal then you’re bound to achieve it. Okay, I’ll explain this with an example.

Example: I want to save Php71,690 for a new laptop (Apple Macbook Pro 13″) that I will be using for the growth of my creative space. And I plan to buy it in 5 months.

A SMART goal should look like this.

Specific: brand new laptop (Apple Macbook Pro 13″)

Measurable: the laptop is worth Php71,690

Attainable: I need to save Php14,339 per month

Relevant: graphics needs for FB page, blog, and vlog

Time-bound: 5 months

52-Weeks Ipon Challenge

This challenge has been really popular this year so you might know someone from your workplace who accepted the challenge. What I don’t like about the challenge is it becomes tricky and very hard to do especially in the latter part.

Chinkee, on the other hand, suggested a cool and more manageable way of getting started. Instead of joining the bandwagon of saving 1 peso, 5 pesos, 10 pesos, 20 pesos, up to 1000 pesos can be really hard for someone who just started saving up.

Yes, Chinkee you made a fan out of me.

Come on guys, save what you can save, and don’t limit yourself from it. If you can save 52,000 per year then good. If you can save more then that’s even better.

You don’t need to challenge anyone but yourself.

READ: How to Open a Sun Life Mutual Fund via Online

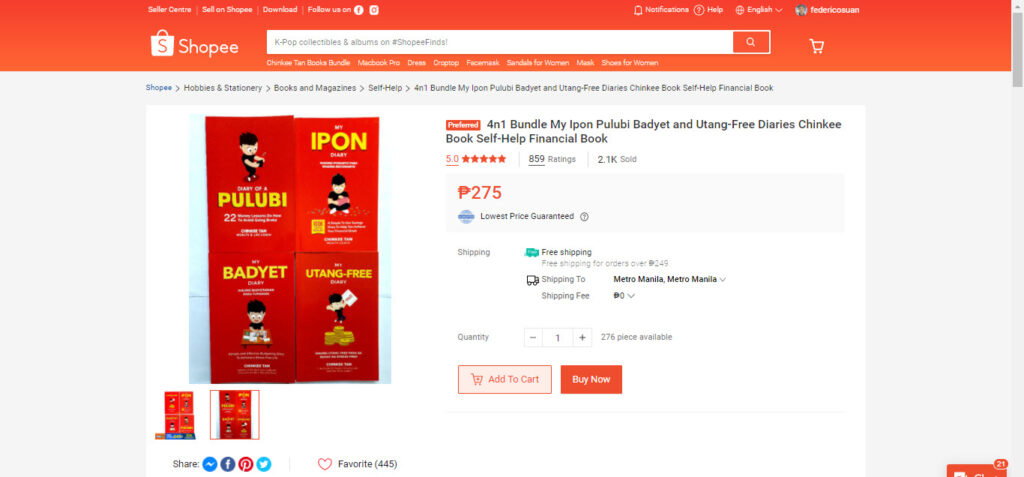

Save More with Bundle of 4

You can buy the My Ipon Diary together with 3 other books by Chinkee Tan, i.e. Diary ng Pulubi, My Badyet Diary, and My Utang-free Diary. It’s now available in Shopee for Php275. You can visit the store by clicking here.

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

9 thoughts on “My Ipon Diary: A Realistic Approach in Starting Your 52 Weeks Challenge”

I will try again for saving money..teach me pls..

Hi Anna. You can read my articles that can surely help you with your IPON journey. Or you may book for an appointment with us to discuss more of what you can do to improve your finances. Thanks 🙂

Hi Federico. I’m interested in the book. I think it’s a good buy.

Yes Jimmy, it is. I hope you can grab a copy 🙂

gusto ko po magkaroon ng ipon diary sir chinky..

Sobrang ganda niya Albert at mura lang din.

You can get it sa Shoppee Store ko. Ito yung link.

https://shopee.ph/My-Ipon-Diary-Chinkee-Tan-i.87706927.1691294379

Gusto ko mag start paano po mag order

You may order it on their official website. Just follow the link below. Thanks!

https://chinkeetan.com/ipon

I want copy of my ipon diary