The COVID pandemic made us realize the importance of preparedness in health, finances, and job security. The SSS pension, for example, is one of the most sought-after retirement packages for Filipinos. Many rely heavily on their SSS pension, which is why it is a common topic for discussion between peers. Thus, it makes sense to ask, “How to maximize the SSS pension?”

By now, you already know how to compute the SSS pension. If you don’t, click the link below or watch the video.

READ: SSS Retirement Benefit: An Easy-to-Follow Guide in Computing Your Pension

Table of Contents

What are the assumptions?

The computations below are for those who started working at 20 and retired at 60.

Another thing is that we used the SSS schedule of contributions for 2022, which is at 13% of the MSC. The final contribution rate will be 15% in 2025.

Fret not. Even if you started at an older age, the comparisons are still valid. It’s just that the digits will differ, but the general idea will remain logical.

2 Ways to Maximize the SSS Pension

There are two suggestions we often hear from our friends or relatives.

First, you only need ten (10) years of contributions. Second, you pay the minimum and then jack it up five years before retirement.

They seem like superb suggestions. But if we put them to the test, would they still be good suggestions?

Let’s find out.

1. Complete the 120 contributions

For new SSS members, one way of getting Credited Years of Service (CYS) is by dividing the number of contributions by 12. So it means 120 contributions are equal to 10 CYS.

You must have made at least 120 contributions to qualify for the pension. Hence, others recommend stopping paying after ten (10) years.

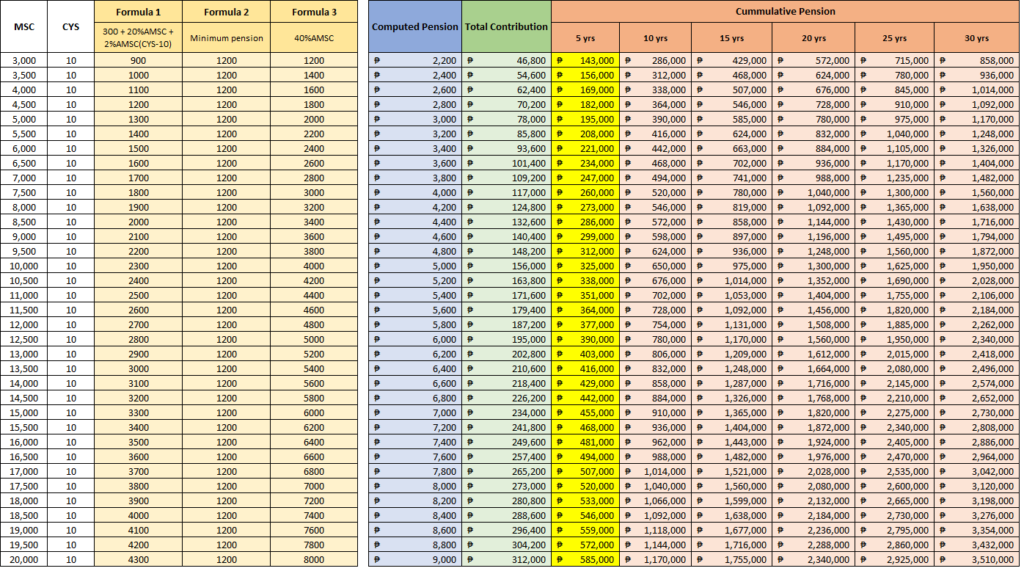

We have created an Excel sheet to see how much pension you’ll get with only 120 contributions for the MSCs available.

So here it is.

The least amount you can get is Php 2,200, comprising the Php1,000 given to all pensioners, while the maximum amount is Php 9,000.

Aside from the monthly pension, we have included the cumulative SSS pension. You can use this to compare it with the total contribution paid.

You will notice that breakeven happens within five (5) years of getting the SSS monthly pension.

So, do we think it can help you maximize your pension?

The answer is no.

Again, 120 contributions are the minimum requirement to qualify for the pension. Hence, you will also get the minimum for that bracket.

2. Pay the maximum contribution 5 years before retirement

Many are clamoring for this suggestion. Maybe it is because the computations are already available for our consumption. They already tested it, just like what we are doing now.

Unlike the first recommendation, you will pay the minimum contributions until you turn 56 and the maximum for the last five (5) years.

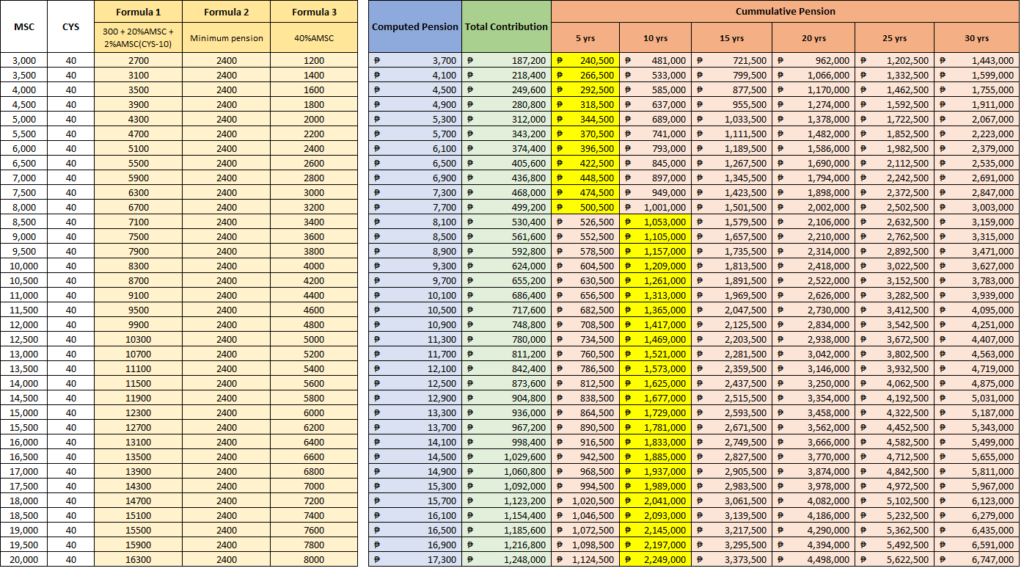

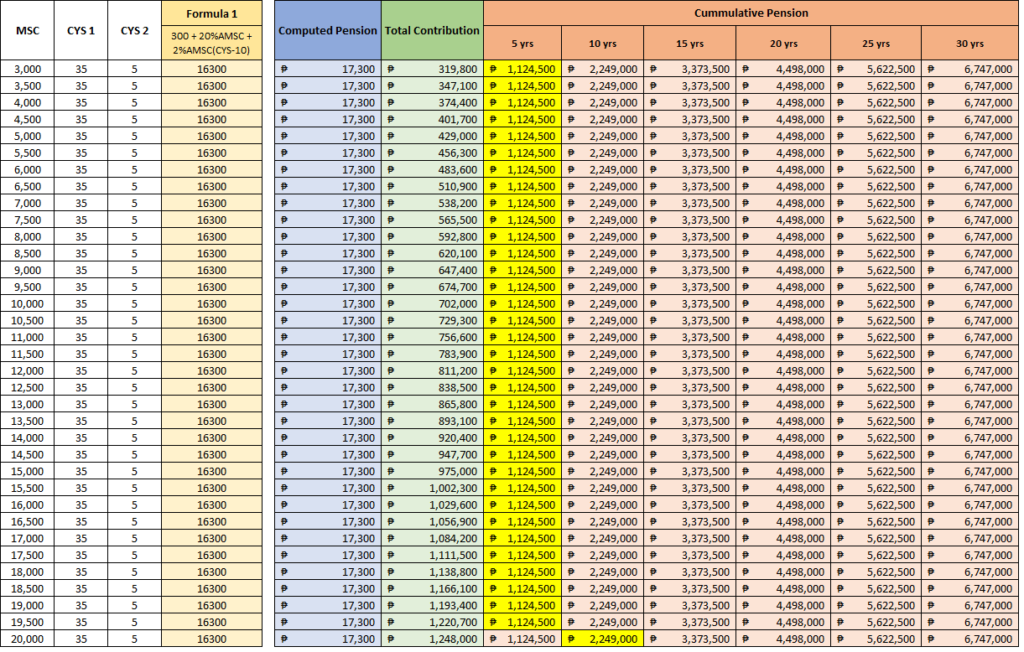

For this example, we will show two (2) tables.

The first is for someone who paid the same salary bracket for 40 years. Then the other one is for someone who stayed for 35 years in the same salary bracket and contributed the maximum MSC in the last five (5) years.

Both of them have 40 CYS.

The maximum pension you will get is PHP 17,300 for 40 CYS.

You will receive this amount regardless of whether you pay the maximum for 40 years or just the last five (5) years with 40 CYS.

If you do the latter, you will save a lot of money. That’s a difference of PHP 928,200 that you can redirect to other investing activities.

Hence, it is the way to get the maximum SSS pension for less money.

Final Thoughts:

The SSS pension is like a fortress we lean on in our golden years. It is something we can rely on when we can no longer work.

Retirement can be a dream or a nightmare, depending on our financial decisions while still working.

You can indeed get the maximum pension while contributing a smaller amount. It might even appear like a loophole to some.

However, you can avail yourself of seven (7) SSS benefits, and pension is only one of them. When you take this route, it’s like letting go of the other benefits.

You get the maximum pension but a minimum on the other six (6) benefits.

You may get to maximize the SSS pension, but your dependents may only get the minimum out of it. It is something you have to balance.

But if, in the end, you follow this, make sure to protect your dependents. Make good use of the amount you saved by doing it.

Get life insurance to safeguard your family. Get health insurance to get the treatment you need without using your savings. Lastly, don’t forget to invest the remaining amount for a brighter future (retirement).

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

17 thoughts on “2 Ways to Get the Highest SSS Pension”

Sir Iam 60years old. Its okay Iam continously paying my monthly contribution. Im planning to retire at the age of 65. Is it helpful to pay more monthly premium . Para mo maka kuha ako nga monthly pension na malaki. Na kita ko na po ang future pension ko at the age of 60 mababa po. Can you give me advice to increase my pension before I retire at the age if 60. Now im paying 2030.00.thank u

Yes, you may do that. But for me, I think it is much better to get the benefit no matter how small it may be. From age 60 to 65, nothing is certain, you know, if something happens, at the very least, you get to avail your pension. Just my two cents.

Extending beyond age 60 is more appropriate for those who cannot avail pension since they have less than 120 contributions upon reaching age 60.

Hi, I was wondering if my sss expected pension will increase if I pay the max amt of 4,200 monthly for 1 yr (I’ll be 60 next yr). I stopped paying after I made 155 contributions more than 20 years ago. Is it wise to pay the maximum for 1 year? Will it increase my expected pension? Thanks

Yes, it will help increasing your AMSC.

puede po ba malaman kung na deduct ba ung remaining SSS Loan ko which was approved for condonation and with repayment of 12 months starting July 3, 2023.. na released na po ung advanced sss pension of 18 months.. thank you po..

Sorry, your question is out of topic 🙂 Anyways, you may ask SSS for assistance.

I have a total of 263 monthly contributions as of this time equivalent to 21.92 years which is more than the required Credited Years of Service (10 CYS). My question is, what will happen to the contribution I invested to SSS for more or less 12 CYS on top of 10 years? Another question is, can I divert this excess contribution to WISP Plus instead to maximize the ROI of my investment? Can I refund may entire contribution from SSS and use this instead to other investment platform? And lastly, why SSS did not explain this properly to its member?

You have great questions. Btw, it was already discussed in our previous posts.

Excellent

Very interesting on how to get the Maximum pension.

I want to calculate my future pension using your excel sheet. is it possible for you to share your spreadsheet with the calculation formulas.

I want to build my pension so i can get the maximum when the time comes. Thanks.

I have to find it first. I’ll send it to your email 🙂

Nag work ako sa private school for 20 years, maximum naman ang contribution na umabot ng 240 contribution kung ndi ako nagkakamali. but during the time na nag early retirement ako sa school obviously mahihinto ang contribution ko sa SSS, so i went to SSS at sabi ko gusto ko icontinue, wala naman akong idea na maapektuhan ang pension ko kung ibababa ko ang hulog ko ang nasa isip ko para maicontinue lang naman at makadagdag sa hulog ko from maximum to 990 pesos. and nobody na naginform sa akin about this. Nang nagpacompute ako for mu future benefits napansin ko parang maliit, i asked them about this at ang sagot nila sa akin. “SANA NA PO NDI NA NINYO PINAGPATULOY ANG PAGHUHULOG NINYO KASI QUALIFIED NA NAMAN KAYO, SAYANG NAMAN ANG PENSION NINYO” yan ang sagot nila sa akin. Feeling ko ver unjust naman sa akin kasi wala naman nagadvised sa akin about this. My question po may PAGASA PA BANG MAITAAS ANG PENSION KO NGAYON NA NAGKAKAHALAGA LAMANG NG 6,000 PLUS.?

MSC is computed as the average of the last 5 yrs or the average of all contributions, whichever is higher. In your case, it will have very little effect unless you contributed for another 20 yrs. Also, it lacks information because you didn’t mention your MSC during the time that you were still working and how many contributions you made after retirement.

2nd way is always my option. Imagine the huge difference let alone the inflation through those 40 years. The question is, will this not be changed in coming years?

We think it will. It must adapt to the changes. Like 17k is a big help now but not as much after 10 years. The changes must be for the better to encourage members, especially voluntary ones, to keep contributing. Else, their funds will be depleted 🙂

Can you tell me your source to corroborate item#2 (see below) of your article? I am 55 years old, turning 56 this May so I’m wondering if I can maximize my payments from now until 60 years of age to get the maximum SSS pension upon retirement. Thank you.

2. Pay the maximum contribution 5 years before retirement

It is the most recent suggestion we heard. Maybe because the computations are already available for most of us, they have probably done the thing we are doing now. We are putting it to the test.

Unlike the first recommendation, you will pay the minimum contributions until before you turn 56 and then the maximum for the remaining five (5) years.

You may read the SSS Act of 2018 🙂