Sun Maxilink One and Sun Flexilink1 are single-pay VUL from Sun Life. It combines the benefits of life insurance protection and investment in one product without upfront premium charges. Thus, it accelerates the fund accumulation.

Table of Contents

Get Better Returns than Banks

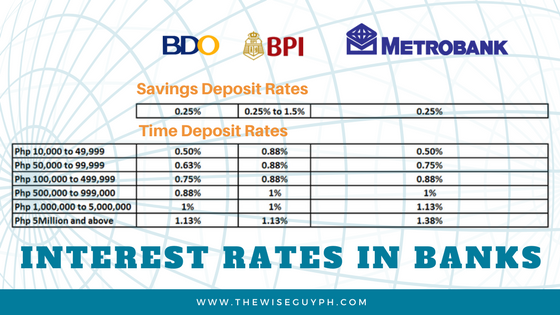

Would you agree, saving in a bank will give you less than 2% p.a on your money? Don’t get me wrong. I’m not telling you to pull out your money in your bank. Emergency funds and cash needed in a few months or years are better off in banks.

READ: Emergency Fund 101 | Quick Ways on Saving for Unexpected Expenses

But for the rest of your money, there are better options for it to grow.

Currently, the average inflation rate is 4%.

(UPDATE: Inflation is at 6.4% as of August 2018.)

It means that your money is being eaten up by inflation.

At first, you might be thinking that your money is earning, but in reality, it is decreasing in value. For example, you have a time deposit that makes 2% per year. Then it means that your money is also losing its value by 2% (currently losing 4.4%) every year. (Yung akala mo na tumutubo pero nalulugi ka na pala.)

The only time your money earns is when you beat inflation. And you can only do it by putting your money in a high-yield investment product like Sun Maxilink One or Sun Flexilink1. These products will let your money work harder for you. As they say, money can work 24/7 without getting exhausted.

The benefits of Sun Maxilink One and Sun Flexilink1

So here are the benefits of Sun Maxilink One and Sun Flexilink1.

1. Life Insurance Coverage

Your family will get a lump sum that they can use for your final expenses and continue the life they are living before your demise. Life insurance coverage is the minimum death benefit or the fund value, whichever is higher.

RELATED: Sun Maxilink Prime | The Best Selling VUL from Sun Life

The minimum death benefit is equal to 125% of single premium less 125% of each partial withdrawals if any.

2. Guaranteed Insurability

No medical exam, health restriction, and age limit are applied to Sun Maxilink One. However, this is still subject to company guidelines.

3. Investment Component

You have the freedom to invest in the 9 available funds, depending on your risk appetite and financial objectives. It is best explained by a Financial Advisor who will guide you in picking the most suitable fund for you.

Sun Flexilink1– if you wanted to invest at least Php 200,000, then this plan is for you.

Sun Maxilink One– if you have more than Php 250,000, then go with this plan.

Bank Interest Rates Vs. Inflation

We all know how inflation becomes a hindrance in making our financial goals come into reality. Now, the problem is how we can knock inflation down? So let’s get down and dirty with numbers.

Are you ready?

Teka lang Suan, kung totoo yan, bakit sinabi sa akin ng lolo’t lola ko na magandang mag-ipon sa bangko?

Gone are the days that banks give high-interest rates for a savings deposit that your grandparents enjoyed. Today savings deposit rate and even time deposits can no longer beat inflation. That is why you must find a better place for your money, like Sun Maxilink One and Sun Flexilink1.

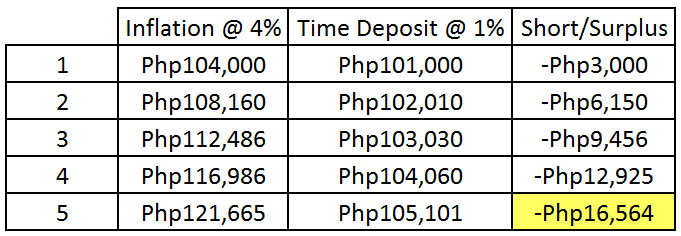

Sample Computation:

Mr. Unwise has Php 100,000 in a time deposit account locked for 5 years that pays 1% p.a. in the hope of getting better rates. Can it beat inflation?

The answer is no because, after 5 years, Mr. Unwise has only Php 105,101 on his time deposit account.

It is short by Php 16,564 to beat inflation (imbes na tumubo ay nalugi pa siya ng Php 16,564).

If he just invested his money elsewhere, like in Sun Flexink1, then it might have changed.

Make Your Money Grow in Sun Flexilink1 or Sun Maxilink One

As a general rule of thumb, any financial instrument that beats inflation is a good investment.

At this time, you must be looking for an investment with at least 4% p.a.

Index Fund is one of the best performing funds of Sun Life, which mimics the performance of PSEi (Philippine Stock Exchange Index). The fund invests primarily in common stocks that comprise PSEi and in cash and other money market instruments.

The rest of the funds include Growth Fund, Income Fund, Growth PLUS Fund, Opportunity Fund, My Future Fund, Captains Fund, Money Market Fund, and Opportunity Tracker Fund (newly launched).

Note: Risks associated with this plan are borne solely by the investor. Interest rates are not guaranteed as it may fluctuate in value due to the volatility of the market where you plan to invest.

Remember: Risk is not always bad. Investment return is proportional to the risk you are willing to take. The higher the risk, the higher the return.

What is Index Fund?

This fund is for an aggressive investor who is willing to take a higher risk for higher returns. The average historical return of the Index Fund is around 10%, thereby not only beating inflation but can help your money grow faster.

If you have invested Php 500,000 last January 2017 in Index Fund, then it would have grown to Php 611,300 by October 2017 or total earnings of Php 111,300 in less than a year.

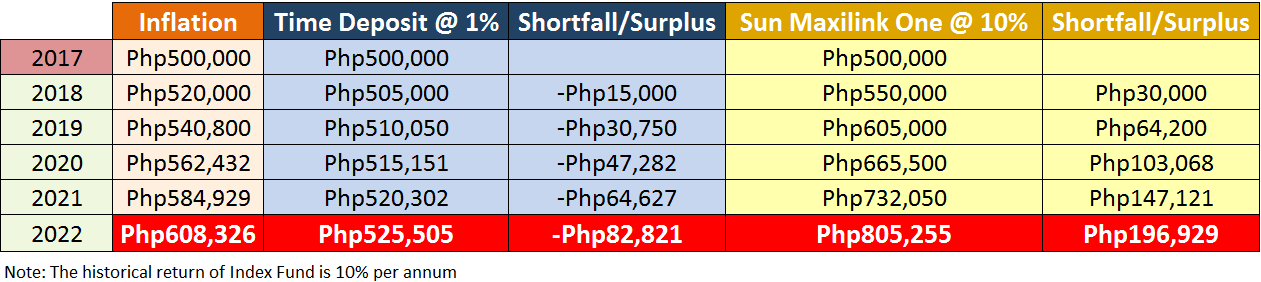

Sun Maxilink One Vs. Time Deposits

Who gets the best value for his money? Mr. Wise Guy, who gets a Sun Maxilink One Plan with a single premium of Php 500,000 invested in Index Fund or Mr. Unwise Guy, who places his Php 500,000 in time deposit that yields 1% p.a.? Here’s a table that shows how an initial investment of Php500,000 can grow in time deposit versus Sun Maxilink One or Sun Flexilink 1.

Both of them need to have at least Php 608,326 by the end of 5 years to be able to retain the purchasing power of their money.

In the first year, Mr. Unwise Guy is already having difficulty in keeping up with inflation, and this continues until the 5th year. He falls short by Php 82,821 to retain the purchasing power of his money.

On the other hand, Mr. Wise Guy was able to beat inflation and earned Php 305,255 at the end of the 5th year, and this makes him a wiser investor compared to the other one.

(Mr. Wise Guy knows where to put his money!)

Did you see the enormous difference of Php 279,750?

Why would you settle for less when you can have more with Sun Maxilink One and Sun Flexilink1? Enjoy the benefits of wise investing today!

Inquire NOW?

It’s not just about the plan—it’s about you. That’s why we’re offering a FREE financial planning session via Zoom or in-person to discuss this plan. We’ll address all your concerns, tailor the plan to your needs, and make sure the plan aligns with your goals. Best of all, it’s absolutely free and comes with no obligation. Inquire NOW!

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

17 thoughts on “Sun Maxilink One and Sun Flexilink1: Get Better Returns than Banks”

Hi, which one is better in terms of returns (sun maxilink one or flexilink 1). How long, (estimated yrs) before I will be able to withdraw? thank you

Hi Jenny. They are almost the same thing. Well, in terms of returns, I’ll go for Sun Maxilink One. You can do withdrawals at anytime with depreciating charges. After 5 years, withdrawals are free.

Hi Federico,

Do you have a ball park figure on the average Return of the Index Fund in this time of pandemic era out of covid19?

Your presentation for Sun Maxilink 1/Sun Felxilink 1 is very good and easy to understand especially for those who are new to Financial Planning.

Let me know po..

Hi Luke. In 2019, the equity fund posted an average compounded return of 10% for the past 10 years. Just to answer your question, the Index Fund is down by more than 30% YTD as of this writing. It is also a relatively good time to invest because the price per unit of investment is cheaper. Thus, you will get to buy more units.

If it sparks interest with you, please connect with us.

Federico Suan Jr.

0917-775-8352

federico.l.suanjr@sunlife.com.ph

Does Sun MaxiLink One have a lock in period if i have 500k to invest for. Can I withdraw it anytime as emergencies arise?

Hi Micah. You have a really nice question. Yes, this is withdrawable anytime. However, fees may apply. If your timeframe is less than 5 years I will not recommend any kind of single pay VULs like Sun Maxilink One. If the need arises in the early stages of your plan you may incur losses inherent to the fluctuating nature of the investment product.

Please meet a financial advisor who can give you a piece of sound financial advice and your other options to answer your needs. Thanks 🙂

Hi Federico – mum has put her retirement money down on MaxiLink One. Given current environment, what fund allocation would yield a good result 10years down the line? Thank you and stay safe.

Hi Maria. When it was taken? We are currently experiencing recession, switching fund at this time may not be the best thing to do as you will realize the losses in your fund. You may reconsider your options once we go back to the normal condition.

If your mom got this plan during the pandemic and your timeframe is 10 years you may go for a combination of bonds and stock-based funds to maximize returns and somehow lessen the risk. Thanks 🙂

Is the only difference of Sunflexilink1 from Sun Maxilink One will be the amount of single pay?

Hi Herbert. You can add additional money in Sun Flexilink 1 but not in Sun Maxilink One. The differences and which one is best suited for you can be known thru personal financial planning. Thank you 🙂

Hi Sir Suan,

I have heard about this Sunlife Investment from a friend. It was interesting. I have few questions pa po.

Kindly send me po the complete details?

Salamat.

Kind regards,

Rose

Can i have a complete details of Sun Maxilink One and Sun Maxilink Prime? Thank you.

Hi Ma’am Veegie. I’ll send it shortly but may I know first if you have filled out the form above? If not, please fill it out so I can give my initial assessment. Thanks!

Kindly send the complete details of Sun Flexilink One. Thank you

Hi Jeffrey. I already sent the details to your wife. Hopefully, we can set a meeting the soonest time. Thanks!,

I dont understand why im not able to fill out the investment amount required. It kept telling me i entered the invalid amount.

Hi Ms. Melona. I emailed you. Thank you for showing interest 🙂