Table of Contents

Retire Early or Never Retire at All?

Did you know that Filipinos only start to think about retirement at age 35.5? That’s only 24.5 yrs from the typical retirement age of 60 yrs. old. It may seem enough only to those affluent as they have more money to invest that will generate a sufficient fund to retire. But for ordinary citizens like us, time is our best friend. We may have a little to invest but when we start young, the interest may accrue equal to or even more than the amount our rich counter part could have made.

The popular phrase “isang-kahig isang-tuka” maybe dated but is still experienced by many. We often heard our colleagues say this on payday “pamasahe lang ang dala ko” hence they will wait for the “sahod” so they can have lunch. That’s basically the product of improper money management. You don’t want to live from paycheck to paycheck, right? Retirement planning helps you live the lifestyle you want upon retirement or even earlier. Who says that retirement should be boring when you can still enjoy the things you love like travelling, eating at your favorite restaurant, giving donation to the charities you support, sending your grandchildren to school, etc.

Why You Shouldn’t Rely on SSS Pension Alone?

The average monthly SSS pension is only Php 8,000 which is just enough for food expenses. Noting that in our prime years our body starts to weaken making us prone to a lot of diseases and illnesses. Which makes maintenance drugs and routine checkups part of the total cost we need to consider. Adding up the utility bills and other miscellaneous expenses your pension of Php 8,000 will be gone in just a week or two. Even if you are a total cheapskate that pension will not last for a month.

To give you an idea one of my Lola only gets a pension worth Php 7,000 and more than half of it is for her maintenance drugs. Most of the time her pension is inadequate to cover her expenses so we will help her fill the gap.

Do not get me wrong here, I love the idea of returning the love but at the same time I hate seeing her or making her feel that she’s being a burden to us when we are totally okay with it.

That’s why I started preparing for retirement. I don’t want to become a burden when I retire or give the same feeling to my family. By that time my funds will be sufficient to continue enjoying life and helping my family.

Millennials on the Quest of Early Retirement

Time is one of the three basic aspects we consider prior in investing along with money and interest. When it is utilised, this could help the young investors to accumulate an adequate amount they will need upon retirement even if they start with low capital.

How to Take Advantage of Your Time?

Time is obviously one of the best things in this world. It is also the obvious advantage of millennials. Though they may have slim paycheck, it is more than enough to start investing. Nowadays, entering the market is much easier to do as financial institutions lowered their requirements to encourage investing and eventually form it as a habit.Compounding interest works best thru the passage of time. This is where time kicks in. You want to double your money, triple, or even quadruple and so on? Compounding of interest makes it possible.

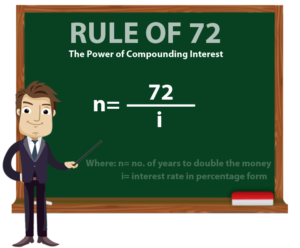

Rule of 72: The Promising Power of Compounding Interest

The rule states that when you divide the number 72 with the interest rate (in percentage form) you will get the number of years needed to double your money.

As an Engineer who encounters numbers more often than usual. This is clearly just a short cut to see how much time is needed to double your money. This is derived from the humble formula of compounding interest [(F = P(1 + i)^n]. Where F is the future value, P is the present value, i stands for the interest rate, and n for the number of years.

Sample Computation:

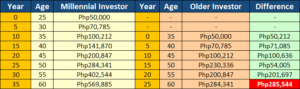

A millennial investor age 25 and an older gen investor age 35 have invested Php 50,000 in a financial instrument that gives 7.2% per year in contemplation of retirement. Who do you think among the two will acquire bigger retirement fund at age 65?

By using the formula, it will take 10 years to double your capital or it will earn 50% every 5 years. Looking at the table, the millennial investor is ahead by Php 285,544 and it’s BIG difference. With the difference he can go and have an international trip with his family. He can still afford to help his kids financially. Give something to his grandchildren maybe? Or just leave some of it as a legacy to hisfamily. We are talking a capital of Php 50,000 only what more if he invested a bigger sum.

You have two choices prior to retirement: to ask assistance from your kids because you only have pension to rely on or you can make the right choice today by investing for you future.

The best time to invest was yesterday, the next best time is today, and the worst time is tomorrow.”-Randel Tiongson

Without a doubt the millennial investor wins! Why? Because he took advantage of his TIME. This is how to make the quote “time is gold” into reality.

WANT A FREE PROPOSAL?

You too can enjoy the fruits of your labor by getting a VUL policy. Some terms are technical in nature that an ordinary person cannot understand without the help of a Licensed Financial Advisor. A personal meeting is strongly recommended. No pressure nor obligation on your part will be imposed upon appointment. You may not like it and it is perfectly fine with me. You can reach me thru 0917-775-8352 or e-mail me at federico.suan@gmail.com.

Millennials No More: The Journey to Retirement

Even if you’re no longer young like the millennial generation you can still enjoy a worry-free retirement. Older generation investors earns relatively high compared to what the millennials make. This is a clear advantage of your part. When used properly this can lead you to a good retirement years.

How to Take Advantage of Your Money?

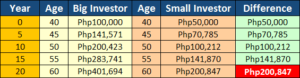

Aside from time, money also plays an important part in investing. The more money you invest the shorter the time needed to accumulate the funds you may need upon retirement.

If two investors whose age is 40 decided to invest Php 100,000 and Php 50,000, repectively. Who among them will generate bigger fund?

Of course it is the Big investor. The difference of Php 50,000 grows to Php 200,847. This is a clear example of how you may want your money work for you.

Of course it is the Big investor. The difference of Php 50,000 grows to Php 200,847. This is a clear example of how you may want your money work for you.

Remember to use whatever you have and turn them to something you would like to have. Like in retirement planning. Your salary is not yet big that’s why you cannot invest a lot compared to your older counter parts. But you have time to make your humble investment grow to a sizeable amount enough to retire splendidly. The same goes to the older gen. You may not have a lot of time but your money can still lead you to a wonderful retirement.

VUL Plan: The Answer to Your Retirement Needs

Yes to VUL Plan

VUL or the Variable Unit-Linked plan is an insurance product coupled with the power of investment leveraging the performance of your fund compared to the traditional insurance plans. Traditional insurance plans only give cash values (guaranteed) plus dividends which is never guaranteed. Meaning your money will have a little to no chance to surpass your total investment.

If you would like to reap the benefits of a traditional plan and maximize the value of your money thru investment. Then VUL plan is the BEST plan for you.

Sample Proposal: 10 Years To Pay

Federico Suan, Jr., 25, Male, Non-smoker

Life Coverage: 1 Million Pesos

This is the amount of money your family will get just in case you die due to an accident, illness, or natural cause. This is the amount of money I can leave peacefully to my family without worrying what will happen to them when I am gone especially my Lola. Hopefully my brothers will use the money to finance the needs of my Lola and our younger sister.

Total Disability Benefit (TDB): Waiver

This is a rider (optional) that can be attached to an insurance policy. If I get disabled and can no longer work, this rider will waive my future payments. It is as if I am still paying the premiums. Though optional, (it just cost me less than a thousand pesos for it) I consider this a MUST have rider in any life insurance policy.

Accidental Death, Dismemberment, and Disablement Benefit (ADDD): ₱500,000

If I die due to an accident my family will get this amount together with the life coverage totalling ₱1.5 Million. If I survived the accident but lost any part of my body, I will receive a percentage of my ADDD coverage. For example, if I lost one eye sight, I will receive ₱250,000 (half of my ADDD coverage). In any case I become totally disabled, I am entitled to receive ₱50,000 per year for 10 years with a total of ₱500,000.

Critical Illness Benefit (CIB): ₱2 Million

A lump sum of worth ₱2 Million is the amount I can claim whenever I will be diagnosed or treated from any of the 36 critical illness listed here. This rider covers most of the critical illnesses around like stroke, heart attack, brain tumour, major organ transplant, and invasive cancer.

The premium for this rider increases every 5 years. After the paying period, the accumulated earnings from the investment component is assumed to be enough to pay for this rider.

Hospital Income Benefit (HIB): ₱2,500/day (1000 days maximum)

I will receive ₱2,500 per day when I get confined in hospital as a result of sickness or injury. This amount doubles or become ₱5,000 when I am admitted in ICU or confined due to any of the following dreaded disease: acute heart attack, chronic liver disease, dissecting aortic aneurysm, end stage lung disease, end stage renal disease, invasive cancer, major organ transplant, multiple sclerosis, poliomyelitis, progressive muscular atrophy, and stroke.

Annual Premium (10 Years To Pay): ₱38,465

It is just about ₱3,205 per month or just ₱107 per day.

Total Premiums Paid: 10 x ₱38,456 = ₱384,650 ONLY

Imagine, I will only pay a total of ₱384,650 for all the benefits listed above.

But what if I am lucky enough not to die early, get disabled, or hospitalised?

(Suan, parang lugi ako kapag nagka-ganyan?)

Don’t worry because a VUL policy has an investment component which is designed to accumulate wealth while giving you protection.

If the investment was placed in Index Fund composed of top 30 companies in the Philippines (i.e. Jollibee, Ayala, SM, San Miguel, URC, BPI, etc.), the average return is around 10% p.a. but not guaranteed.

The projected fund value at age 45 is ₱848,275

The projected fund value at age 55 is ₱2,181,982

The projected fund value at age 65 is ₱5,642,255

The accumulated fund value can as an educational fund for your kids, retirement fund, additional fund when hospitalised, etc.

(I thought insurance is just about death benefit. There is so much more I can gain pala if I avail a VUL policy)

Exactly! VUL is more than just a life insurance combining income protection and investment opportunity for every Juan.

For all Financial Advisors like us, we treat life insurance as LOVE insurance. Because when you love someone, i.e. your family, you don’t leave them hanging. You want every protection you can get to make sure their safety and well-being, right?

I hope you enjoyed my blog!

WANT A FREE PROPOSAL?

You too can protect yourself from the lingering uncertainties by getting a VUL policy. Some terms are technical that an ordinary person cannot understand without the help of a Licensed Financial Advisor. A personal meeting is strongly recommended. No pressure nor obligation on your part will be imposed upon appointment. You may not like it and it is perfectly fine with me. You can reach me thru 0917-775-8352 or e-mail me at federico.suan@gmail.com.

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

6 thoughts on “VUL Plans: The Best Retirement Fund”

Have a nice day Sir, kami poy ofw asking lngpo if gusto namin mag avail sa VUL..Papaanu at Saan?

Salamat po comply..GOD BLESS..

Hi Julius. Kailangan na nandito ka para mag apply ng insurance. Mas okay if may makakausap ka na advisor. Meron ka na bang advisor? Usap tayo sa email. Salamat 🙂

Hello is it still advisable to get VUL even though you don’t have dependents? The goal is just to get a short term to mid term retirement fund that will sustain the expenses after let’s say 5-10 years? at most 20 years?

I think Mutual fund with a balanced fund is the most appropriate for this but I might be wrong. What do you think?

Hi Eder. Yes and no. VUL is just one of the best options anyone can consider but then again it is still a matter of preference and if it fits their financial goals.

Well, maybe, for now, you do not have dependents yet but in the future, you may or you may choose to just live on your own. Even if you choose the later you may still need insurance for the purpose of protecting yourself from financial difficulties that may arise due to accident and grave illnesses.

Other people prefer things bundled up like VUL and some don’t. The mutual fund is also good for retirement planning, best if insurance is prioritized first, some find it sluggard so investing in bonds or stocks is their choice.

If you really like investing in a mutual fund, you may still choose to invest in an equity-based fund if you can stay invested for more than 10 years. And if you can handle the price fluctuations. But if you are not that aggressive then I have to agree that balanced fund is a great choice for you.

This is very difficult to explain online, might post this in the future, usually, this is done thru personal financial planning. Just ask some advisors around and they will surely help you with your concerns.

Thanks 🙂

I want to know the scheme of payment for my age

Hi Ms. Ma. Lorena. May I know po your age?