It’s now 2018 but the ranking of the insurance companies I’ll show you is based on 2016 performance of insurance companies. Don’t worry because this is the most updated list available for now. There’s still no news when they will release the 2017 list but I’ll update this post when it’s available. The rankings I’ll show you are based on 5 categories such as premium income, paid-up capital, net worth, net income, and assets.

It’s now 2018 but the ranking of the insurance companies I’ll show you is based on 2016 performance of insurance companies. Don’t worry because this is the most updated list available for now. There’s still no news when they will release the 2017 list but I’ll update this post when it’s available. The rankings I’ll show you are based on 5 categories such as premium income, paid-up capital, net worth, net income, and assets.

I will enumerate the ranking of the insurance companies in each category based on the data provided by the Insurance Commission (IC) under the Department of Finance (DOF).

Table of Contents

Top 10 Insurance Companies Based on Premium Income in the Philippines 2016

Investopedia defines premium income in insurance as the revenue that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customers cost for a specified term of the policy is called the premium.

Top 10 was from the 2016 Performance of Life Insurance Companies based on Premium Income issued by the Insurance Commission.

Insurance companies worldwide use it to determine their ranking in the market. This is also the metric used in the Philippines that’s why Sun Life of Canada (Philippines) Inc. is the number 1 insurance company of 2016. The company has maintained its position for 6 times in a row with a wide gap of more than Php 10 Million from its nearest rival.

Know More About the Products of Sun Life:

READ: Sun Maxilink Prime | The Best-Selling VUL Plan of Sun Life

READ: Sun Maxilink One | Grow Your Money Faster Than Your Savings Account

Top 10 Life Insurance Based on Paid-Up Capital in the Philippines

Paid-up capital is the amount of money a company has received from shareholders in exchange for shares of stock. Paid-up capital is created when a company sells its shares on the primary market, directly to investors. When shares are bought and sold to investors on the secondary market, no additional paid-up capital is created as proceeds in those transactions go to the selling shareholders, not the issuing company. (Investopedia)

Generali Pilipinas Life is the number 1 in this category with Php 1,515,050,500.

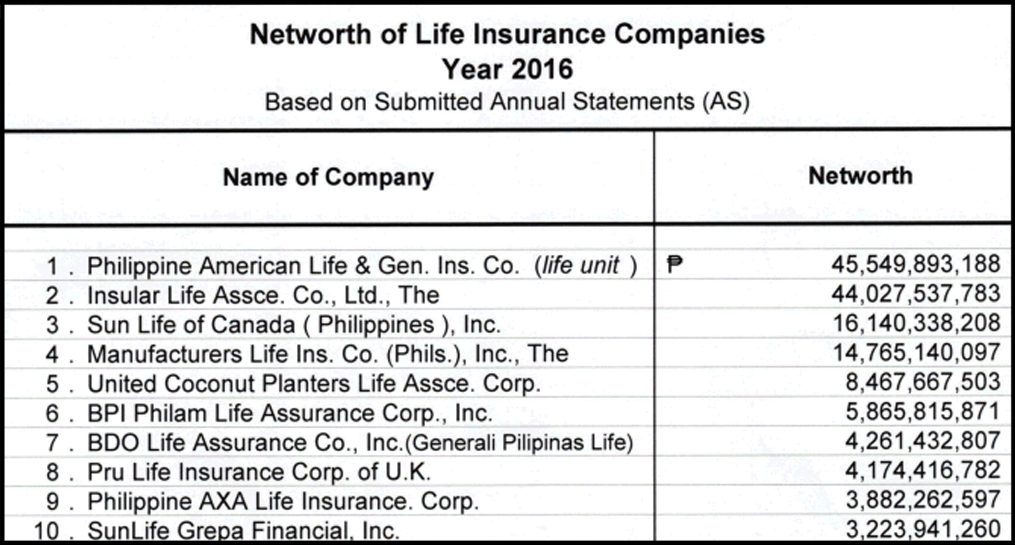

Top 10 Life Insurance Based on Net Worth in the Philippines

According to Investopedia, net worth is the amount by which assets exceed liabilities. Net worth is a concept applicable to individuals and businesses as a key measure of how much an entity is worth. A consistent increase in net worth indicates good financial health; conversely, net worth may be depleted by annual operating losses or a substantial decrease in asset values relative to liabilities.

The number 1 life insurance in this category is Philippine American Life & Gen Ins. Co with Php45,549,893,188 followed by insular life with Php44,027,537,783. Meanwhile, Sun Life has managed to be the 3rd insurance company on this list at Php16,140,338,208.

Top 10 Life Insurance Based on Net Income in the Philippines

Net income is a company’s total earnings (or profit); net income is calculated by taking revenues and subtracting the costs of doing business such as depreciation, interest, taxes and other expenses. This number appears on a company’s income statement and is an important measure of how profitable the company is over a period of time. (Investopedia)

The first on this list is Philippine American Life & Gen Ins. Co with Php4,568,530,763 along with Insular life at 2nd place, Manufacturers Life at 3rd.

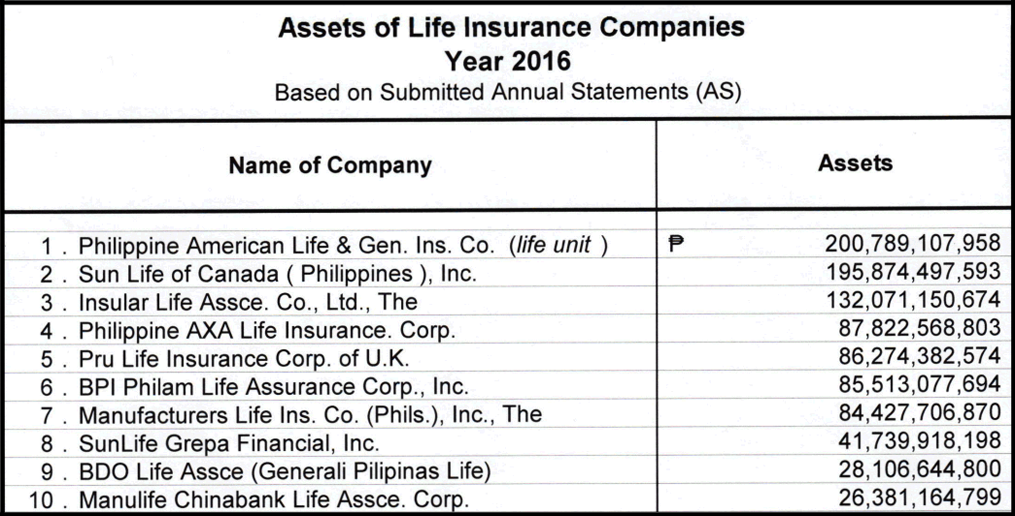

Top 10 Life Insurance Based on Assets in the Philippines

An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. An asset can be thought of as something that in the future can generate cash flow, reduce expenses, improve sales, regardless of whether it’s a company’s manufacturing equipment or a patent on a particular technology. (Investopedia)

Philippine American Life & Gen. Ins Co. assets amounted to Php 200,789,107,958 which makes them the number one in this category. Sun Life has managed to be on the 2nd place with a small gap of less than Php 5 Million to its rival.

Final Thoughts

You may encounter someone from different companies that will boast about being the number 1 in the market. Remember that there are five categories and leaders from each category is different but after reading this you now know that the top insurance company is widely based on premium income. Sun Life of Canada (Philippines) Inc. is the top insurer of 2016.

Remember that this should not be the sole basis for getting your insurance policy. Pick the plan that suits your needs from the company you trust. I hope the lists helped you decide on where to get your insurance policy.

*****

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

4 thoughts on “Top 10 Life Insurance Companies in the Philippines 2017”

Can I ask if the manila bankers insurace is on the list of insurance commission?

thank u for giving time to read my messagge..Godbless

Hi Ms. Rose. I believe they are affiliated with IMG. Please kindly check it with the insurance commission. Thanks!

Hello! I just wish to give a huge thumbs up for the very good information you’ve gotten appropriate here on this post. I will likely be coming back to your weblog for far more soon.

Thanks James for visiting our site. You may also browse other articles related to personal finance on my blog. Feel free to ask questions and I’ll be glad to help. Thanks!