The Insurance Commission (IC) made a statement on its press release last November 8, 2018, regarding the ranking of life insurance companies in the Philippines. This is based on the respective reported premium income, asset, net worth, net income, and new business income equivalent.

The Insurance Commission (IC) made a statement on its press release last November 8, 2018, regarding the ranking of life insurance companies in the Philippines. This is based on the respective reported premium income, asset, net worth, net income, and new business income equivalent.

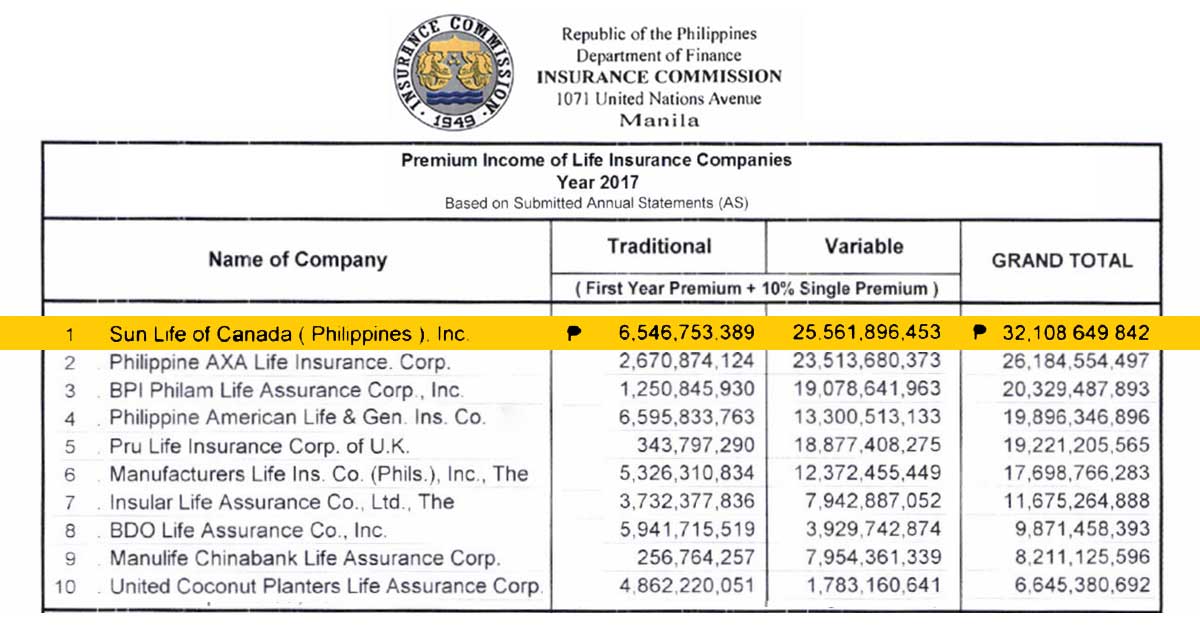

Sun Life is the Top Life Insurer of 2017

Despite the competitive market, Sun Life has retained its market leadership for the 8th consecutive time. Sun Life collected a total premium of Php 32.11 Billion being followed by AXA Life with Php 26.18 Billion. BPI Philam, Philam Life, and Prulife UK have also made it in the list of top 5 life insurance companies in the country based in Premium Income.

Despite the competitive market, Sun Life has retained its market leadership for the 8th consecutive time. Sun Life collected a total premium of Php 32.11 Billion being followed by AXA Life with Php 26.18 Billion. BPI Philam, Philam Life, and Prulife UK have also made it in the list of top 5 life insurance companies in the country based in Premium Income.

READ: Top 10 Life Insurance Companies in the Philippines 2018

Insurance Commissioner Dennis B. Funa also announced 2017 as the new banner year for the insurance industry. It marked a new record high in terms of premium, net worth, asset, investment, and net income.

Increase in Net Worth Requirement

IC also made a statement regarding the new minimum net worth requirement in the insurance code, as amended by Republic Act No. 10607. This is an increase from the current minimum of Php 550 Million to Php 900 Million at the end of 2019. And at the end of 2022, insurance companies will be required to have a net worth of at least Php 1.3 Billion.

Net worth, in a nutshell, is the amount by which the assets exceeds liabilities. The new increased in the minimum net worth requirement will have an added security to you as a policyholder. Giving you more peace of mind knowing that the insurance company you have chosen have the capacity to meet its short term and long term obligations, including to you.

Sun Life Traditional and VUL Plans

As of 2018, Sun Life has a net worth of Php 27.55 Billion which is beyond the minimum requirement. This is another reason why more and more Filipinos are trusting the company for their life insurance needs. Aside from the financial statements that give confidence to its clients, it is the company’s true dedication in serving its clients like you in terms of insurance claims that makes them love the company more. Sun Life is also one of the fastest, if not the fastest, turnaround time of the processing claims in less than 3 hours. Just the way you want your family to get the benefit when they need it the most.

If you are looking for income protection with wealth accumulation plan then a VUL plan is perfect for you. VUL plan is designed to give you financial security and peace of mind while growing your money over time. You may request for a quotation and financial consultation by following the link below.

If you are looking for income protection with wealth accumulation plan then a VUL plan is perfect for you. VUL plan is designed to give you financial security and peace of mind while growing your money over time. You may request for a quotation and financial consultation by following the link below.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan of Sun Life

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.