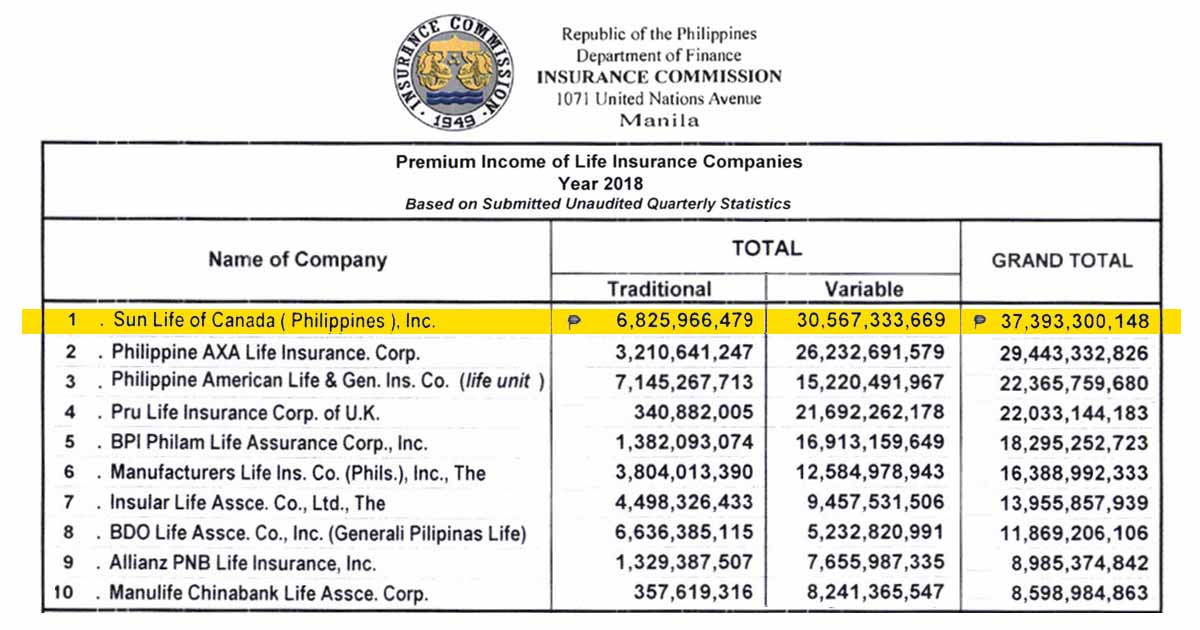

The Insurance Commission (IC) has released the top 10 life insurance companies in the Philippines in 2018. Among the 5 categories, only one of them is widely used. It is not just in the Philippines, but the entire life insurance industry in the world, and that’s “Premium Income.”

The Insurance Commission (IC) has released the top 10 life insurance companies in the Philippines in 2018. Among the 5 categories, only one of them is widely used. It is not just in the Philippines, but the entire life insurance industry in the world, and that’s “Premium Income.”

Premium Income is the revenue that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customers cost for a specified term of the policy is called the premium. (Investopedia)

Table of Contents

Sun Life Remains the Top Life Insurance Company in 2019

The latest performance of life insurance companies released by IC based on premium income has hailed Sun Life as the number one insurer of 2018. It is the 8th consecutive time that Sun Life managed to top the premium income category both in traditional (whole life, term, and endowment) and variable plans.

So why it’s important to be the number one (or to be included in the top 10) insurance company?

Because this serves as a validation that companies like Sun Life can still fulfill its promise to their clients.

Remember that life insurance is an aleatory contract or a contract of promise that when a specified event occurs like death, then the insurer will have to pay the promised amount.

Of course, you want your family to get the benefits by the time it happens to you, right?

Sun Life’s Traditional and VUL Plans

It is why it’s important to consider the standing of an insurance company before availing of any insurance plan. You want that by the time that the need arises, the company is still performing well to fulfill its obligations to you. But this shouldn’t be the sole basis for getting a plan might as well consider convenience, customer service, a reputable Financial Advisor, etc.

If you want income protection with a wealth accumulation plan, then a VUL plan is perfect for you. VUL plan is designed to give you financial security and peace of mind while growing your money over time. You can request a quotation and financial consultation by following the link below.

READ: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

If you want a cheaper VUL from Sun Life, then you can follow the link below. It is for those who are looking for other VUL plan with a cheaper tag. It has better life insurance coverage than Sun Maxilink Prime but with a lesser investment fund.

READ: Sun Maxilink 100 | Affordable VUL Plan from Sun Life

*****

Top 10 Life Insurance Companies in the Philippines

While knowing Sun Life as the number one life insurance company is good, it’s better to know more about the other companies who made it to the list.

So here are the top 10 life insurance companies in the Philippines 2019.

1. Sun Life of Canada (Philippines) Inc.

Officially founded in 1895, making Sun Life of Canada (Philippines) the first and the oldest life insurance company in the country. The ability to fulfill the promises to its clients has made Sun Life as the preferred life insurance company in most households. No wonder why it is still the top life insurance company in the country.

READ: Sun Life | A Company that Love to Pay Claims

READ: Sun Life is the Only Life Insurance Company in Top 100 Brands Ph 2018

2. Philippine AXA Life Insurance, Corp.

AXA Philippines was only established in 1999 in the Philippines but has shown massive growth and market penetration thanks to its bancassurance business. It is a joint venture by AXA Group and Metrobank Group.

3. Philippine American Life & Gen. Ins.Co.

Philam Life was founded in 1947 by Cornelius Vander Starr and partner Earl Carrol. Their incredible partnership has made Philam Life as the number 1 life insurance company in 2 years, 1949, in the business.

4. Pru Life Insurance Corp. of UK.

The company started in 1996 or 23 years in the life insurance industry in the Philippines. Despite being relatively new compared to its rivals, Pru Life UK bagged the 4th place in the list.

5. BPI-Philam Life Assurance Corp., Inc.

Previously known as Ayala Life Assurance Incorporated, founded in 1933. It is the country’s top bancassurance in the list thanks to the strategic alliance between BPI and Philam Life.

6. Manulife Philippines

Manufacturers Life Ins. Co. (Phils.) or just Manulife is a wholly-owned subsidiary of The Manufacturers Life Insurance Company. It was established in 1907, making it one of the oldest insurance companies in the Philippines.

7. Insular Life Assurance Company, Ltd.

Insular Life is the first Filipino owned life insurance company in the Philippines founded in 1910. It is a mutual company, which means its policyholders own it.

8. BDO Life Assurance Co. Inc.

It was founded in 1999 is a joint venture between Generali Pilipinas Holdings Company Inc. (GPHC) and BDO. Generali is now renamed as BDO Life Assurance Co. Inc.

9. Allianz PNB Life Insurance, Inc.

Allianz PNB Life was founded in 2001, operating as a subsidiary of Alliance SE. The company has shown incredible growth coming from 12th place in last year to being the top 9 this year.

10. Manulife China Life Assurance Corp.

The company is a strategic alliance between Manulife Philippines and China Bank. It aims to provide a wide range of innovative insurance products and services to China Bank customers.

Top 10 Life Insurance Companies in the Philippines (NBAPE)

Getting more clients means generating more income that can be used for business expansion and payment of claims. It can also lower administrative and insurance charges, thus, more allocation in the investment fund of your VUL plan or dividends for a traditional plan. Sun Life dominated this category with Php 8.2 billion worth of new business premium.

Here are the top 10 life insurance companies in the Philippines.

- Sun Life of Canada (Philippines), Inc.

- AXA Life Insurance Corporation

- Pru Life Insurance Corporation of UK.

- Philippine American Life & General Insurance Corporation

- BPI-Philam Life Assurance Corporation Inc.

- BDO Life Assurance Corporation

- Manufacturers Life Insurance Corporation Inc.

- FWD Life Insurance Corporation

- United Coconut Planters Life Assurance Corporation

- Insular Life Assurance Corporation

You may refer to the table below for a more comprehensive look at the performance of each life insurance company for the year 2018.

Insurance Company | NBAPE |

|---|---|

| Sun Life of Canada (Philippines), Inc | P8,221,221,183 |

| Philippine AXA Life Insurance. Corp | P5,998,076,869 |

| Pru Life Insurance Corp. of U.K. | P5,758,660,185 |

| Philippine American Life & Gen. Ins. Co. | P4,425,212,142 |

| BPI Philam Life Assurance Corp., Inc. | P3,727,064,538 |

| BDO Life Assce. Co., Inc. (Generali Pilipinas Life) | P3,488,805,557 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P3,479,023,654 |

| FWD Life Insurance Corp. | P2,516,095,794 |

| United Coconut Planters Life Assce. Corp | P2,313,865,366 |

| Insular Life Assce. Co., Ltd., The | P2,177,840,122 |

Top 10 Life Insurance Companies in the Philippines Based on Net Income

In a nutshell, net income is the total profit of a company after subtracting all the expenses in operating a business. Philam Life was able to claim the number 1 spot in net income.

Insurance Company | Net Income |

|---|---|

| Philippine American Life & Gen. Ins. Co. | P9,796,104,537 |

| Sun Life of Canada (Philippines), Inc. | P6,769,777,847 |

| Philippine AXA Life Insurance. Corp | 2,745,920,000 |

| Manufacturers Life lns. Co. (Phils.), Inc., The | P2,593,034,081 |

| Insular Life Assce. Co., Ltd., The | P2,302,848,891 |

| BPI Philam Life Assurance Corp., Inc. | P1,704,932,133 |

| Pru Life Insurance Corp. of UK. | P840,049,243 |

| United Coconut Planters Life Assce. Corp. | P626,335,238 |

| Philam Equitable Life Assurance Co., Inc | P528,797,799 |

| BDO Life Assce. Co., Inc. (Generali Pilipinas Life) | P473,882,653 |

Top 10 Life Insurance Companies in the Philippines Based on Assets

An asset is anything expected to bring future benefits by generating cash flow, reducing expenses, increase sales, etc. Philam Life has once again dominated this category having Php 246.7 billion assets. Being followed by Sun Life with Php 222.4 billion.

Insurance Company | Asset |

|---|---|

| Philippine American Life & Gen. Ins. Co. | P246,751,301,491 |

| Sun Life of Canada (Philippines), Inc. | P222,435,091,951 |

| Insular Life Assce. Co., LTD., The | P130,415,994,981 |

| Philippine AXA Life Insurance, Corp. | P115,129,009,149 |

| BPI Philam Life Assurance Corp., Inc. | P101,376,320,926 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P95,854,435,286 |

| Pru Life Insurance Corp. of U.K. | P94,832,563,076 |

| SunLife Grepa Financial, Inc. | P44,562,132,022 |

| BDO Life Assce. Co., Inc. (Generali Pilipinas Life) | P41,291,896,464 |

| Manulife Chinabank Life Assce. Corp. | P34,647,474,877 |

Top 10 Life Insurance Companies in the Philippines Based on Net Worth

Philam Life bagged the number 1 spot in the net worth category or the amount by which the assets exceed its liabilities. It is followed by Insular Life and Sun Life, respectively. AXA Life has shown a remarkable movement coming from the 10th place last year to being top 6 for this year.

Insurance Company | Net Worth |

|---|---|

| Philippine American Life & Gen. Ins.Co. | P78,872,723,360 |

| Insular Life Assce. Co., LTD., The | P37,028,437,013 |

| Sun Life of Canada (Philippines), Inc. | P25,406,830,608 |

| Manufacturers Life Ins. Co. (Phils.), Inc., The | P14,431,503,648 |

| United Coconut Planters Life Assce. Corp. | P10,992,339,403 |

| Philippine AXA Life Insurance, Corp. | P8,550,908,245 |

| BDO Life Assce. Co., Inc. (Generali Pilipinas Life) | P7,701,898,262 |

| BPI Philam Life Assurance Corp., Inc. | P6,284,060,631 |

| Pru Life lnsurance Corp. of U.K. | P3,259,979,275 |

| SunLife Grepa Financial, Inc. | P3,008,814,124 |

RELATED: Sun Maxilink Prime | Best-Selling VUL Plan of Sun Life

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.