Are you familiar with the rule of 72? I guess some of you might know it well if you are reading investment books and articles online. The rule is just an approximation from the basic formula of compounding interest. In this post, we will focus on how you can quickly compute how long your capital will double in amount.

Table of Contents

The Rule of 72

Did you know that this formula is most associated with Einstein? He has a quote that goes like, “Compounding interest is the 8th wonder of the world. He who understands it earns it, and he who doesn’t pay it.”

READ: How to Open a Sun Life Mutual Fund via Online

Let’s Get Started

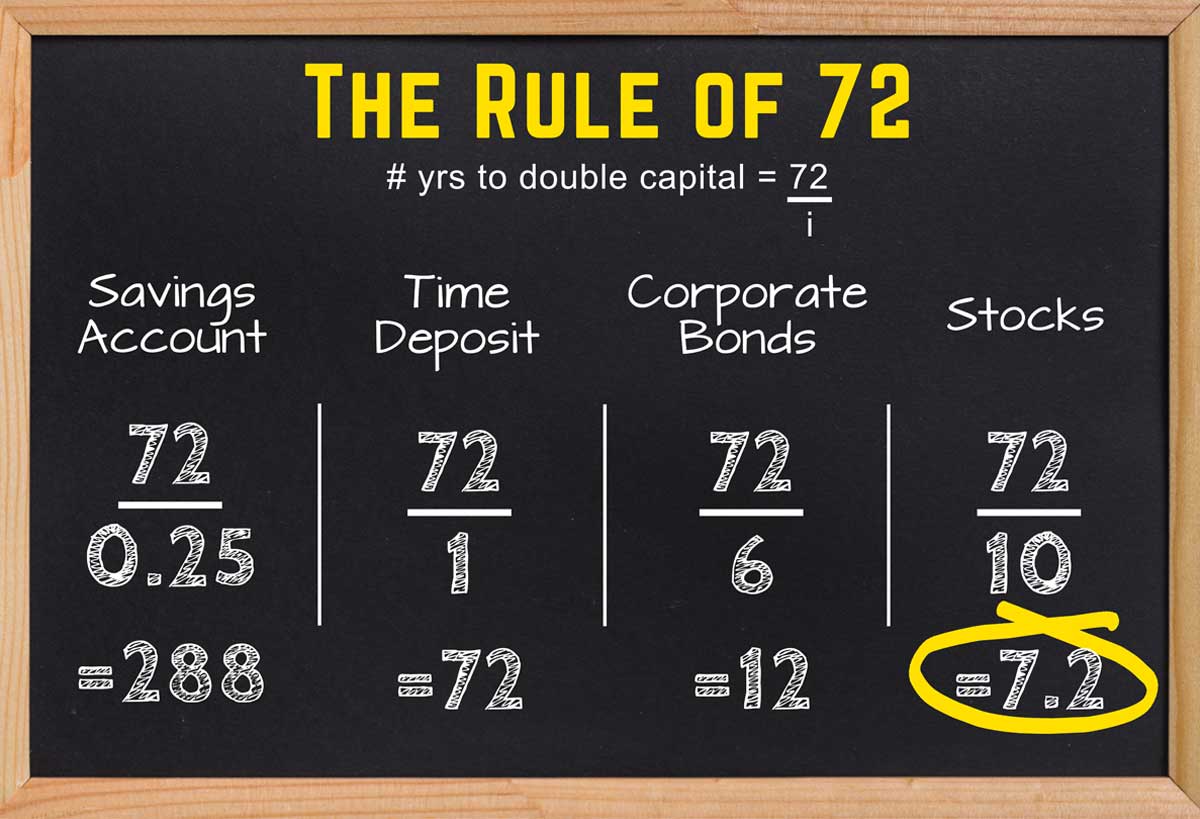

The formula is rather straight forward, you just need to know the interest rate, and you’re done. 72 is just a constant number, and when divided by the interest rate, it will give you the number of years you need to double your capital.

When using the formula, you must use the interest rate as a whole number. So if you’re going to invest in a financial vehicle that gives 6% p.a. then it will take you 12 (72 divided by 6) years to double your money.

RELATED: 5 Simple Steps to Achieve Financial Freedom

Basically, that’s it. You just have to divide 72 by the interest rate of the security you are planning to buy. But of course, knowing how to use the formula is just half of the battle.

Applying the Formula

Now that you know how to use it, then we may proceed on how you can practically apply the formula. It will give you a quick insight on how much yield you may expect from any investment you’re planning to make.

READ: Top 10 Life Insurance Companies in the Philippines

It is best explained with an example using the interest rates usually available for investors like you. For comparison purposes, we will be using the interest rates you can normally get from the banks (regular savings and time deposits), interest from corporate bonds, and the stock market.

Saving account at 0.25%, time deposit at 1 %, bonds at 6%, and stocks at 10% p.a.

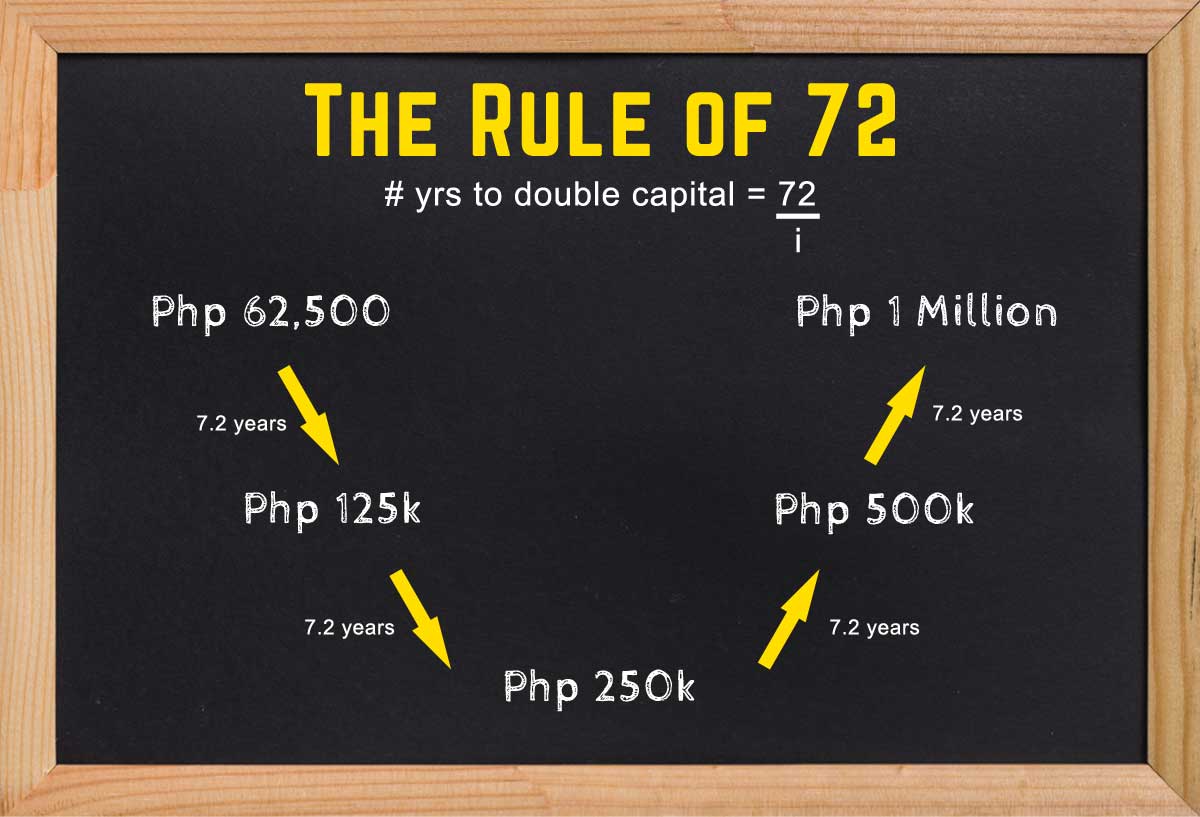

If you put money in a bank, let’s say Php 62,500, then it will take you 288 years before it will double at Php 125,000. But when you put it in a time deposit, it will be cut short at 72 years.

Still, that seems too long, right? But when you decide to invest in a corporate bond with 6% p.a. then you’ll only need to 12 years to double and only 7.2 years if you invested in stocks.

It means that if you’re already happy with your time deposits, then how much more if you invested in bonds or stocks.

READ: Sun Maxilink Prime | The Best-Selling VUL Plan of Sun Life

Let’s take it up a notch!

Don’t you think Php 125,000 is still small to be your target amount to have in the future? Think of it as the first step, and now we can proceed to the second and then the third and so on. Probably you would want to know how long it will take you to make your Php 62,500 into Php 1 Million.

That’s correct. You needed 28.8, or let’s just say 29 years to make your investment grow into Php 1 Million. That’s not bad at all, considering you just made a one-time investment. So what more if you plan to invest regularly.

Conclusion:

Just what Einstein said, knowing how to use compounding of interest is power as it can be your best friend. But if you don’t, then you might pay the price.

Hence, it will become your worst enemy in achieving your financial goals.

Thus saving in a bank, you might be losing the opportunity for your money to grow.

These are just recommendations, and you’re still the one in charge of deciding what to do with your money.

And I hope you’ll make a wise choice.

*****

READ: Sun Maxilink One | Get Better Interest Rates than Banks

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.