Beneficiaries of a deceased member can claim two benefits, i.e., funeral and death benefits. The SSS funeral benefit is a lump-sum amount. On the other hand, the SSS death benefit is either a pension or a lump sum, depending on who claims it and the number of contributions paid before the semester of death. Here is a complete guide to help you claim the two benefits.

Table of Contents

How to Claim the SSS Funeral Benefit

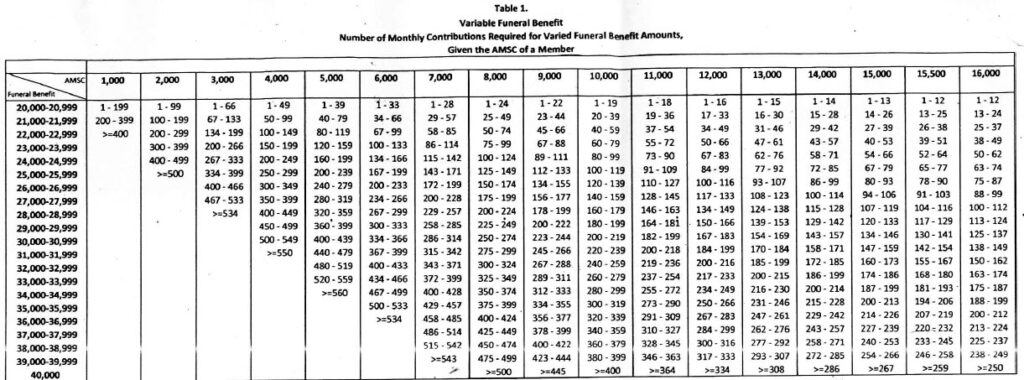

Anyone who paid for the funeral expenses can claim the funeral grant. The benefit ranges from Php 20,000 to Php 40,000, depending on the contributions paid, the average monthly salary credit, and the submitted receipt.

The formula for computing the funeral benefit is:

Php 20,000 + (0.005 x number of contributions x average monthly salary credit (AMSC))

You must treat this benefit as a reimbursement kind of benefit.

Here is where things can get a little complicated. The maximum benefit you can claim or reimburse is equal to your submitted OR or computed funeral grant, whichever is lower.

For example, if the computed funeral benefit is Php 40,000 using the formula above but the amount indicated on the receipt is Php 35,000, the lower amount is the funeral benefit. So in this example, the claim is only PHP 35,000.

It was my mistake when I claimed the funeral benefit. The receipt given to me was only for PHP 20,000 because I only made an initial payment. It simply means that I can only claim up to a maximum of Php 20,000, even though I paid almost Php 80,000 for the funeral expenses, excluding the lot and interment.

So what are our recommendations?

- If you don’t need the money, claim this benefit after paying the funeral expenses.

- If you need it immediately, ask the funeral parlor for a provisional receipt for the actual amount.

- Don’t be afraid to ask the funeral parlor; they know what to do. Some could even extend help to you.

Here are the steps for claiming the SSS funeral benefit:

1. Go to the nearest SSS branch

Check for the nearest SSS branch in your area and inquire about the requirements needed. You may also use this time to ask about the death benefit.

Forms are readily available in the branch. However, you may print them if you want. If you do so, you can file the claim on your first visit. The SSS accepts death certificates duly certified by the local civil registrar’s office. You can get it from the city hall where you filed the death certificate.

Here is the list of requirements:

- Claim for Funeral Benefit (SSS Form BPN-103)

- Death certificate duly certified by the Local Civil Registrar

- Receipt of payment issued by the funeral parlor

- Affidavit of funeral expenses

- Report of Death (if the cause of death is work-connected)

- Photo of the filer and valid IDs

- Original or certified true copies of the supporting documents should be presented during the filing of the claim.

2. Submit the requirements

You can instantly file the SSS funeral claim on your first visit. Of course, you need to brave the long queue of claimants. Set your expectations; it took me about half a day every time I visited the SSS branch. Once you have submitted the requirements, ask for their number and the return date.

3. Claim the cheque

If you prefer to receive it in check, go to the SSS branch on the specified date. But because SSS is pushing checkless transactions, you may be paid online. If you are an SSS member, you must enroll a disbursement account in the Bank Enrollment Module (BEM) in your My.SSS portal.

Members may enroll in their preferred disbursement account, such as any PESONet participating bank, e-wallet, or Remittance Transfer Company/Cash Pay-Out (RTC/CPO) like M. Lhuillier.

If you are not an SSS member, you must submit a copy of a deposit slip, ATM card, or bank certification containing the bank account number, and you must be a PESOnet Participating Bank account holder or have an active mobile number for non-bank payments, e.g., e-Wallets like Paymaya and RTC/CPO like M. Lhuillier.

4. File it online

If you’re comfortable using the technology you can easily file it in the comforts of your home. Just log in to the My.SSS members account. Click the e-services tab and then click the “Submit Funeral Claim Application.” Complete the form and choose how you want to receive the money in the “Disbursement Account Enrollment Module.” Once done, click “Proceed” to validate and for you to upload the required documents. The SSS will send a confirmation email to you once you completed the process.

How to Claim SSS Death Benefit

Now, you’re ready to file the SSS death benefit. But don’t expect it to be a blissful experience just like how you claimed the funeral benefit. Based on my experience, it’s very time-consuming and the requirements are harder to get. You’ll know why in a bit.

So here are the steps in claiming SSS death benefit.

1. Go to the nearest branch

You may skip this part if you previously went to a SSS branch. If not, take this time to ask for the process, requirements, and eligibility to claim. Most of us don’t know that there are four types of beneficiaries and not all of them are eligible.

So this is how you can check who is/are eligible to file the claim.

4 Types of Beneficiaries:

- The primary beneficiary is the spouse of the member.

- If there is no spouse or if the spouse remarried, the secondary beneficiary, the parents of the deceased member can claim the benefits.

- If there are no parents, the assigned beneficiary based on the SSS E-1 record can file the claim.

- Lastly, if there is no assigned beneficiary, the claim can be filed by the legal heir/s based on the law of succession under the Civil Code of the Philippines.

You must allow at least half of a day in queuing. This is because several claimants lined up even before the branch opens.

2. Get a list of requirements

- Death claim application (SSS DDR-1)

- Affidavit of the claimant or Filer’s Affidavit

- Death certificate of the member duly certified by PSA

- A death certificate of the spouse duly certified by PSA

- Death certificate of the member’s parent duly certified by PSA

- Affidavit for Death Benefit Claim (SS Form CLD-1.3A)

- Affidavit of Legal Heirs (SS Form CLD-1.3)

- Marriage Contract

- Marriage Contract of the parents

- Birth/Baptismal Certificate of dependent children

- Birth/Baptismal Certificate of member

- A Birth/Baptismal Certificate of the member’s brother(s)/sister(s)

- Birth/Baptismal Certificate of the minor beneficiary/ies

- Proof of relationships such as the record of birth, a statement before a court of record, or any document acknowledging the relationship

- Medical Certificate of incapacitated child/spouse

- Accident Report/Report of Death (SS Form BPN-105)

- Application for Guardianship (SS Form CLD-15)

- Guarantor’s Form (SS Form BPN-107)

- Joint affidavit of two (2) disinterested persons attesting to the fact, if such is the case, that _________ and _____________are one and the same person, stating therein the correct name.

- Passbook /ATM card with a name or copy of validated deposit slip (original and photocopy) or Cash Card Enrollment Form, if pension

- Recent residence certificate of the filer

- Latest 1 x 1 picture of the claimant

- Original and photocopy of claimant’s Social Security Card, Passport, PRC Card, Seaman’s Book, Driver’s License, or any two valid Ids, at least one with photo(e.g., Company ID, Senior Citizen’s ID, Police or NBI Clearance, Voter’s ID, etc.)

- Other documents deemed necessary by the SSS

3. Compile the necessary documents

One of the most challenging parts of claiming the SSS death benefit is completing the required documents. If there are several claimants, you need to compile the supporting documents of each claimant. Also, they only accept death certificates duly certified by PSA which take several months before they will be available in their system.

Aside from the beneficiary, the dependents of the deceased member are also eligible to claim a dependent pension equal to 10% of the monthly pension or Php 250, whichever is higher.

- Dependents must be below 21 years old unless incapacitated and financially dependent on the deceased member.

- It can be claimed by up to 5 children starting from the youngest and no substitution will be allowed.

- Children must be legitimate, legitimated, or legally adopted.

- If there are less than five legitimate, legitimated, or legally adopted children then the illegitimate child(ren) may also claim to complete the 5 dependents.

- The dependents must have no work.

- The dependents must have no spouse.

4. Submit the requirements

In my experience, getting a death certificate from PSA is a headache. I went to the nearest PSA about 3 times before I was able to get it. This is because it took about 3 to 6 months before it will be uploaded on their system.

Mind you, you cannot just ask the PSA if it’s available or not because you have to fall in line each time. Also, you must pay for it every time regardless of whether it’s not yet available.

I just wished someone gave me a heads-up.

Now, if you already completed the requirements, you may submit them to the nearest SSS branch in your area. Once submitted, the SSS will hand you a document containing the list of requirements you gave them. They will also tell you when to come back.

During my time, I was asked to go back after a month. Don’t forget to bring a bag of patience and try to smile to brighten up the process.

5. Claim the cheque

Usually, the cheque will be ready in a month after submitting the requirements. Just go to the branch wherein you processed the claim and get your cheque. But to set your expectation they don’t give any computation, summary, or even a breakdown. Even if you ask them, they may not be able to give you one.

If you want to have an idea of how much you may expect to get, the benefit will depend on two things i.e., how many monthly contributions are paid and who is claiming the benefits.

- If the deceased member has less than 36 monthly contributions, the beneficiary is entitled to get a lump sum benefit. The lump-sum amount is equal to the computed monthly pension times the number of credited monthly contributions. (E.g. the deceased member had paid 35 monthly contributions and the computed monthly pension is Php5,000 then the lump sum will be Php175,000).

- If the deceased member had more than 36 monthly contributions, the beneficiary may be entitled to a monthly pension.

Note: The computation for the monthly pension is the same as how you compute for the SSS Retirement benefit. Just follow the link for a comprehensive discussion about this topic.

Back in 2015, the only way to claim this benefit is via cheque. Now that they are pushing for a checkless transaction, you may get the SSS death benefit in your preferred PESONet participating bank, e-wallet, or Remittance Transfer Company/Cash Pay-Out (RTC/CPO) like M Lhuillier.

Final Thoughts:

Losing a loved one is never easy from the emotional pain to the financial struggles the bereaved family has to endure. For some, the SSS funeral grant and the death benefit are a ray of hope to start another chapter of their life. Maybe, for the deceased member, it’s the only legacy he can leave to his family.

But regardless of reason, try to immortalize the money that you’ll get from the claim. Don’t forget to settle your debts, buy things that will make you remember your loved one, save, invest for the future, get insured, etc.

I hope this blog helped you!

*****

Hey there! Please check the comment section before leaving a comment. Someone might have already asked the same thing, and we don’t want you to miss anything. Thanks for your cooperation! 🙂

*****

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

192 thoughts on “How to Claim SSS Death Benefit in 5 Easy Steps”

hello po , just asking po , my mother died this month po , will process po sana her sss benefit , since she died at the age of 57 , makakakuha pa po ba sya ng lump sump , dahil hindi naman po nya napakinabanggan ang kanyang pension . o funeral at death benefit po , sana masagot po . salamat

Sorry for your loss. To answer, it will depend; it may be pension if your dad is still alive. Or it may be a lump sum. If you can go to an SSS branch, it would be a big help to clear things out.

Namatay ang asawa ko last May 2022 at meron po kaming isang anak. Gusto ko sanang mag claim ng burial sa SSS, kaya lang alam ko ay isang beses lang nahulugan ang SSS ng wife ko at di na nasundan pa at bukod pa dun ay hindi pa sya nakakapag change status sa SSS. May makukuha pa ba akong burial assistance at sa ngayun ay nawawala pa at di ko din alam ang kanyang sss number. Sana po mabigyan nio po ako ng payo kung ano ang nararapat gawin. Salamat po 🙂

Yes, you may claim for a funeral grant for as long as the deceased has an SSS number. However, in the case of death claim, you may go and check it with SSS.

ask ko lang po nagclaim kasi yung lola ko nga death claim ng lolo pero nagkaroon sila ng problem for processing kasi hinahanapan sila ng death certificate ng unang asawa ng lolo q which is di namin alam kung saan kukunin it because kapanahunan pa yun ni kupong kupong sobrang tagal na dati daw kasi di naman uso yung mga marriage,death at birthcertificate na yan, nag ask na din po kami sa munisipyo dito samin if ever na may record sila pero sabi wala daw. ano po dapat naming gawin to claim the death claim of my grandfather without the death certificate of my first grandmother?

You are asking if you can file the claim in the absence of the spouse?

They are requiring the 2nd wife of your lolo a death certificate of the 1st wife to determine the validity of the claim.

The best thing to do is to ask SSS if they can give you workaround. Or ask an attorney to give you legal counsel.

Hi ask lang, my father died year 2015 and hanggang ngayon di parin akukuha death claim niya, kasi by that time 16 years old pa lang ako and bunso namin 10 years old pa kang, kasi yong dalawang kapatid ko walang balak, ngayon kasi gustk ko sana eprocess anonkaya magandang gawin na first step para ma process na yong death claim ng father ko and by the way di po ako naka apilyido sa tatay ko . pero may marriage contract sila ng mama ko

My husband died last March 12, 2022, I am the legal wife but he had 3 kids with his mistress. He died in the province of his mistress and his mistress tampered his death certificate, instead of married he put the status as single so that I have no right to claim for the benefit. I have no kids from my husband because I was miscarriage due to stress and overworked because i am the one who has a job at that time and he had a mistress already. So sad on my part and because of that he totally leaved. The mistress tried to claim the death benefit after claiming the funeral in their province but the sss staff told her that I may file a claim first for her to file for her kids. So she tried contacting me. I file a death claim as the mistress wishes, but suddenly the sss staff rejected my claims and told that I have no right to claim because I have no kids with my late husband even I am the legal wife. Since then I didn’t came back anymore to the sss office nearest me. Is it true that I have no right to claim the death benefit of my late husband and the only person that can receive is the mistress because they have 3 minor kids?

I am not in the position to give you advise. But I’ll just give you a general idea.

In your case, there can be 3 claim: funeral claim, death claim, and dependent’s pension.

Based on the the IRR, spouse is automatically the primary beneficiary. While the kids, illegitimate, are also entitled for a pension.

***ulitin ko po, may correction***

Hi Sir, honestly nakailang balik na ako rito sa page mo and napasadahan ko na mga comments and answers mo mostly. Super appreciate your kindness to provide us all of these useful information. Kudos!

But my question is, ang dad ko was a pensioner since 2020 and he passed away April this year. Hindi updated ang beneficiary nya sa E1 records nung iprint ng SSS. Bale ang nakalagay dun is Lolo and Lola ko both dead na, sumunod dun is Auntie ko – sis ng father ko na matagal na ring patay. Kasal ang father ko sa mom namin (not an sss member) but deceased narin 2 years ago. Dalawa na lang kaming ng brother ko… both on legal age and unmarried. Worth it ba iready ko pa lahat ng hinihingi ng SSS na documents? Sobrang dami, tipong pati death cert ng parents ng father ko at marriage cert nila need din daw.. May makukuha pa ba kami? Bale 192 total contributions ng father ko in total. And 33 mos ang walang hulog before the semester of contingency kasi nagretire na nga sya. Sabi kasi sa taas pag less than 36 contributions lang may lump sum death benefit for secondary beneficiaries.. tapos surviving spouse or dependent lang allowed if monthly death claim naman pag more than 36 mos. In our case, baka pumatak na kami as legal heirs ng brother ko. Nalilito talaga po ako.

Or, if totoo na ginawang beneficiary ng father ko ung anak ko (single mom ako btw), pano ang process dun? Binabanggit nya kasi un sakin dati, minor pa ang anak ko, he is just 8yo now. Baka you have an idea po? Thank you so much in advance and sorry if complicated ata tanong ko pero I know it could help others rin if may katulad man ng case ko.

God bless.

Thanks for the kind words, Ree.

As per your question, it depends. You may or may not be entitled to the benefit. If your father had received his SSS pension, it can only be survived by his spouse. In your case, your mom is already dead. Then the secondary beneficiary may be entitled to a lumpsum (which is equal to the balance of 5 years guaranteed period).

Example:

1. Your father received 1 year’s worth of pension. Then you may get the remaining 4 years.

2. If he got 4 year’s of pension, then you may get the remaining 1 year.

3. If he is a pensioner for more than 5 years, then you may not get the death claim.

Still, it is best to talk with SSS 🙂

Regarding sa pagclaim ng funeral benefit ang nskalgay kasi sa receipts po ay yung live-in partner ng kapatid kong bunso. Kasi siya ung resident ng lugar kung saan namin balak ilibing ang tatay namin kasi sa Cavite na siya namatay kaysa i-travel pa namin sya sa province namin. Ako po yung pangatlong anak na beneficiary ng tatay namin pwede po ba ako yung mgclaim since ako po ung ngbyad pero po sa kanya nkpngalan ung affidavit at ung name sa receipts.Xa po kc ung tgarito kng san nmtay tatay nmin kya s kanya po nmin pinapangalan para po tugma yung affidavit at ung sa receipts instead na saakin po.

As mentioned above, funeral claim is payable to the one who paid for it. It doesn’t matter who’s money was used. It can be claimed by the one written on the receipt.

Of course you can help in filing the claim, but the money is only payable to the partner of your sibling.

sa mga naglumpsum na mag pension, kelan sila mag start mag pension after makuha ang lump sum sa sss?

SSS retirees have option of advancing 18 months’ worth of pension. Thus, it will resume at 19th month.

Blessed day ask ko lang po sana. Kakamatay lang po ng ex live in partner ko last week. And we have 4 kids. 18 yrs.old, 13 yrs. Old, 10 yrs. Old and 5 yrs old. Sad thing is mga kapatid niya ang nag aasikaso ngayon ng mga requirements to get the burial benefits. And all the documents ay nsa kanila. Is it possible that my daughter who’s at the legal age ang mag asikaso ng pension nila from his father’s sss since sila ang nakalagay as beneficiaries. Or need pa ng assistance ng mga tita niya?

It’s always best to go to the SSS branch and ask for the specifics. As mentioned, this blog is just my experience in claiming for the benefit. I am not affiliated with them. Ty.

Hi po makukuha pa ba ang cheque na hindi naibigay ng sss sa buwan ng May at June sa kasalukuyang taon?

Sorry, I do not know the context. The best thing to do is to ask SSS.

ang nanay ko po ay pensioner ng sss 13 years namatay po sya last nov 08 2022 at the age of 74 bale nakakuha na kmi ng funeral benefits ang tanong ko lang may makukuha pa ba kami na death claim sa nanay ko? wala na syang asawa at wala na din minor na anak

The guaranteed period is only 5years. If she’s been receiving pension for 13 years then she already maxed out the guaranteed period.

Hi, is it advisable to follow their instruction? they told us to file the death claim through their website, but up until now, it’s still pending death claim application upon checking on the status and then after a month the pending status will be gone and no notifications from them why the application was gone and next thing is I am going to re-apply the said application, my mother passed away last feb 5, 2023 also we got the funeral claim through their website. We assign a bank account under the name of my father and the amount was credited to the bank account. Will you advise us to go to the nearest SSS and file it there manually or wait for a couple of months for an update from the website?

If I’m in your shoes, of course, I’ll file it manually. Because you can ask them directly about the requirements and how to fill out the forms. You can also ask the TAT (in 2017, it was 1 month which I found too long). Nowadays, TAT is longer based on the comment section.

Online filing should make it easier and faster for the members but it is only easier for them and TAT is becoming longer.

Ask lang po sana ako. Talaga po bang matagal magprocess ang online funeral claiming ng death member ng SSS? March pa po kmi nag start magprocess funeral claim online, 3x na po kami nagsubmit dahil narereject ng online funeral claiming. Time consuming po ba if kukuha ka lang po muna ng list of requirements para sa death claim? Feb 27 kasi nagpassed away ang father ko.

The right thing to do is to follow their instructions. But I still believe that with this kind of claims, it is best to do it personally whenever possible. At least for now, nothing beats transacting with an actual person because you can easily ask questions.

Btw, most of the requirements are very easy to obtain other than the PSA death certificate. It took me almost half a year before I was able to file the death claim because of that. Hoping it’s a different story with yours.

Hi, good day,sir. My grandma passed away 2 years ago. Her sole benificiary (as i was told) is my uncle, her youngest son. And he’s too busy with his life to process and undergo all the hassle of claiming. Can I be the one to process all of it? My uncle doesnt mind for we have a close family. Everyones just too caught up with their own lives. My grandma also dont have any IDs, her one and only ID was her Senior Citizens ID that has a wrong name (he used her “second husband”s name and theyre not married)

Yes, you can help your uncle in claiming the benefit. You can use SPA so you can do the legwork. But then, the money will be under your uncle’s.

Hi po, namatay po kapatid ng asawa ko na lalaki, pero ang benificiary ay ang isa pa nilang nakatatandang kuya, maari po bang ma claim ng bunsong kapatid na babae ang Death benefit kung bibigyan ng karapatan o authorization ng benificiary ang bunsong kapatid na babae? Hirap na po kasi kumilos ang isa nilang kapatid n syang benificiary.. Salamat po..

Yes, you can use SPA. Btw, I also used SPA for my claim. Thanks 🙂

I want to ask if my son had a 3 iligitimate children but they are beneficiaries too, i am the mother of thier father , i am beneficiary too, wth his father but passed away already so ,socan i ask if who were in title to claim the death claim? Is it me and my grandchildren? My grandchildren are 3 the eldest is a girl aging 18 and the two are boys aging 17 and the youngest is 16 … Sorry this is my ist time to ask this comment, thank you God bless ?

If he’s not married, you are the secondary beneficiary. So you may claim the death benefit, and your grandchildren can still get a dependent’s pension. I hope that helps.

Hi Sir ok na po lahat ng requirements naipasa na may binigay na stab sa mama ko and need daw itabi for claim napo yun SSS ng lola ko. Ilang beses na bumalik ang mama ko paulit-ulit for claim lang sinasabi mag antay lang daw. Mag first death anniversary na po ang lola ko sa June 25. Paano po kaya ang gagawin ok na po lahat waiting nalang. Inaano lang po namin sana bago mag first death lola ko para maipaayos yun pinaglibingan dahil ayun ang huling habilin dapat daw maganda ang libingan nya.

In reality, we can’t do anything but wait. So wait and do follow-ups. Btw, you didn’t mention when you filed it. In my case, it took me a month to claim the benefit. I did not do anything aside from following their instruction. But just like you, I filed it more than half a year since my father died. And I can somehow relate to the struggle of waiting for approval.

After my father’s death on February 4, 2022, are the claims of death and funeral expired or not this year?

SSS death claims do not expire.

Bakit hanggang ngayon wala pa rin yung pension ko. Mag 1 year na sa death claim na ipasa ko naman po lahat ng mga requirements na hiningi sa akin bakit hanggang ngayon wala pa din.. Wala naman sinabi sa akin kung may problems pa basta ang lagi sinasabi I-follow up niyo lby po it ito every 2nd week of the month. Until now wala pa din results if kailan ako mag start ng pension ko.. Bali survivor po ako nung namatay sya yung pensioner…

It’s best to follow the recommendation by SSS. Btw, we are not from SSS so we cannot say why it happened. In our experience, I got it in a month.

hello sir my sister died Last Month she is single at the age of 36

Question: My Mom gave me a autorization to file a death claim of my late sister

sss evaluator can accept my mom autorization for filing of death or not ? thanks

Yes, you can file it on her behalf. Secure a list of requirements if I will be the one processing the claim. And then I secured a SPA.

naguguluhan kasi kami about sa death claims ni mama . patay na po si papa na dapat siya ang primary benificiary tpos c lola ay patay na den which is secondary benificiary . at ung sino man daw ang itinalagang isinulat sa benificiary ng namatay sa kany records ang sss ay syang benipisyaryo at wala den po kming asawa which is ayun sa mga site na nakita ko ay kpag parehas wala n ung primary at secondary benificiary ay ung mga anak na dapat diba?

Yes, as far as I know, you’ll fall under the assigned beneficiary. If there’s no designated beneficiary, the proceeds will go to your father’s estate. Anyways, we can only give our point of view. The best way to deal with it is to ask them why you are not allowed to claim.

Btw, are your parents married? I guess it is a different story if they aren’t.

ang nanay ko po namatay last sept 10 2022 ,, naclaim na po namin ung funeral benifits nya .. pero sa death claim ni mama ay ndi pa. anak po ako ng namatay . bkit ndi po samin idinerekta ang claims ni mama . patay na po kase si papa ang unang benificiary .. sino po ba ang next na benificiaryo? kase ang sabe ng taga sss is ung magulang ni mama which is si lola ay patay naden .. tpos ang susunod na claimant ay ung mga kapatid ni mama legal heirs ni lola.. bkit hindi po sa aming magkapatid dinirekta ang benifit.?

ang nanay ko po namatay last sept 10 2022 ,, nacalim na po namin ung funeral benifits nya .. pero sa death claim ni mama ay ndi pa. anak po ako ng namatay . bkit ndi po samin idinerekta ang claims ni mama . patay na po kase si papa ang unang benificiary .. sino po ba ang next na benificiaryo?

Goodpm sir, tanong ko lang kasi. nakapag submit na kame ng mga documents para sa death claim last nov 28 2022. until now hindi pa din nag rereflect sa atm. mga ilang bwan po kaya yun? and may idea ka po ba kung paano ma compute yun? 360 contribution kasi yun. ayaw kasi mag bigay ng break down yung mga staff sa sss. THANKS ALOT.

Hi Mark! You may compute the estimate on the SSS portal or follow the steps in computing the SSS retirement benefits. In my case, it only took a month. But other commenters shared that it took them several months. If you think that it’s getting long, you may follow up with the branch you filed the claim.

Magandang araw po, Sir. Ako po ang nilagay ng tita ko na beneficiary niya. Ang tita ko po ay walang asawa at walang anak. Binigyan ko po ng authorization ang kapatid niya na i claim ang death benefits. Siya rin po ba ang makakapag encash ng cheke o maiilagay po ba sa pangalan niya ang cheke na galing sa sss? Salamat po sa sagot.

In your case, you should be the one eligible to claim because you are the assigned beneficiary. You may check and confirm with SSS.

Hi sir. Tanong ko lang po, namatay po yong father ko last feb 11 2023. Then nakakuha na po kami ng burial 27k, tapos nong last day lang po tinignan po namin yong ATM ng mama ko kasi ng punta yong mama ko sa SSS nagtanong kung kelan ba daw papasok yong lumpsum, then nong isang araw po tinignan namin yong ATM ni mama kung may laman ba, meron po syang 49k, 18yrs sya mahigit sa SSS po. Yon na po ba yong lumpsum sir? Thankyou po. Keepsafe always sir!?

Given that your father contributed for 18 years, it means the bereaved spouse is eligible for a monthly pension. I think the lump sum you are talking about here is that your mom probably took an advance of her pension (which is up to 18 month’s worth of monthly pension) and not the “lump sum” we talked about in this article. You may check it with SSS to validate.

Pwede ba makuha yung death benefit maski di magfile ng funeral claim? or dapat funeral muna bago death benefit?

I think this is possible given that a funeral claim can be filed by anyone.

Sir ilang months po ang aantayin once submitted na lahat ng requirements para sa pension.

My husband died June 2021 and filed my pension this Jan 2023 ilang months po kaya antayin kasi babalik na din po ako soon sa abroad I’m an OFW.

Thanks in advanced.

In my case, it only took a month. But most commenters shared that it took them several months.

Namatay ang father ko last 2018. Meron natira pang pension, kapatid ko lang ang pwede mag-asikaso kaso nasa abroad sya. Now lang nya maasikaso kc pauwi na siya pinas. Ano po ang kailngan requirements? Patay na rin po pala ang mother ko.

It’s actually included in the article. You may check it again. But if you want the exact list, then you need to go to an SSS branch to get it.

Hi Sir, magkano po ba kung sakali ang lumpsum na makukuha if 310 contributions po ang total na hulog ng papa ko, namatay po sya at the age of 61 pero di sya nakapagfile ng retirement pension, estimated nasa 3600 po ang monthly pension nya

Hi, Ailyn! Lumpsum is only available for those with less than 120 contributions. In this case, your mom will survive the pension.

Hi Federico! Pwede na po ba PSA copy ng birth certificate ng namatay ang ipasa kesa sa LCR certified true copy?

Yes, actually it is more desirable.

Hi, okay lang ba nag file ng death benefit claim online?

Yes, you can file it online 🙂

45 years old n ako pwede k p b makuha yung death benefits ng mother ko kahit nakuha ko n yung sa burial nya. Patay na po father ko 2 lng km magkapatid at ako ang bunso at ako din yung benificiary ny. Thank you

Hi Aim! You should have asked the SSS about it when you filed for the burial claim. Anyways, you may still check it with them to be sure because it will depend on how many contributions are made and if she did get her pension while still living. Thanks 🙂

If I will file it online, which SSS account will I use? The SSS account of the deceased member or the SSS account of spouse who is still living (primary beneficiary)?

Very informative and helpful. Thank you.

Thank you 🙂

As i mentioned earlier po hindi po sss pentioner yung mom ko maaga lng po sy naka pag file ng dissability dahil maaga po sy na diagnose na meron sakit sa puso.

Makaka kuha parin ba ako ng death benefits nya.

Hi maam/sir tanong ko lng po..yung live in ko po namatay nah my 3 anak kmi..ako din po yung nag claim ng funeral claim nya..tanong ko lng po kung ako parin po ba pweding mag process ulit?at ano2x po yung requirements na dapat ko pong dalhin??pls reply po..salamat and god bless❤️❤️❤️

Yes, you may claim the death benefit. The possible requirements are listed above. You may go to the nearest SSS branch to get the actual requirements.

My dad died at 91 y.o. my mom is still alive and is 88y.o wd dementia. Question on deatch claim:

1. Is the death certificate of my dad’s parent still needed when they have died long, long, long time ago?

2. With my mom’s condition, who can file for the claim?

Hi, Ranilo. You may use SPA for this one. Thanks 🙂

1). My aunt has paid the fee of creamation of my decreased father. My mother has paid the fees of interment and food catering. Can I as claimant apply for funeral benefit claim?

2). Regarding as death benefit claim, my father was SSS member but his retirement claim application was rejected because the certification portion was not accomplished by last emplyer. So can I not apply for death benefit claim?

3). Is death report the same as death certificate?

1. For the funeral claim, the claimant should be the one who paid the funeral expenses like the funeral home.

2. You may still file a claim.

3. Death certificate should come from PSA.

I hope it helps 🙂

Ilang months po ba bago ma-receive po ung lumpsum?

If po namatay si Lola, ilang months po ang allowed leeway para iclaim ang death benefit ? it has been almost 2 months na po. Isa pa pong tanong, di ba may ATM sila? what if na withdraw yung laman nang ATM nila, tapos nag claim nang benefit – ibabawas po ba yun?

The claim has no expiry. As for your second question, I think SSS will be the best to ask.

Hi sir. Tanong ko lng po. What if iba po Yung birthday na nakalagay sa sss sa mga documents nya. Sa mga I’d po nya 1946 xa ipinanganak. Sa sss po 1947.paano ko po maiclaim Ang mga benefit nya. Thanks po

Apologies, I think SSS will be the best one to answer that 🙂

Good Afternoon, tatlo po kami magkakapatid pero di kami naupdate as benifeciary ng mother ko before mamatay? ok lang po kahit yong isang anak or yong dalawa na lang ang mag update as beneficiary kasi andito po ako manila yong isang kapatid ko kc ang naglalakad ok lang po kaya yun kahit dina nya ako isama sa beneficiary ng mother ko sila nalang sana kasi beneficiary na ako ng asawa ko.

We don’t think it’s possible. However, you may just give your portion to your siblings.

Pwede po bang anak ang mag-claim ng death benefit?

What do you mean? You will be representing your parent or are you asking if children are eligible to claim? Either way, please refer to the different types of beneficiaries we shared above. Thanks 🙂

Magandang araw po. Namatay yong father ko last July 2022, may pension po siya galing sa mother namin kasi surviving spouse ang father ko. Mayroon din siyang sariling pension na kanya kasi retired na rin sya. Hindi pa namin na claim ang death benefits at funeral benefits niya kasi dahil sa mga requirements. Hanggang kailan pwedeng ma claim ang mga funeral at death benefits? Mapuputol narin ba ang pensions? Or ma continue pa ba. Thank you po

You may claim the benefits at any time. When it comes to survivorship, you may ask the SSS as to what will happen to their pension. Because it will depend if they still have minor children and how many months of pension are paid.

good pm po… my husband died a few months back . we do not have minor children and although we were separated neither one of us remarried. I was told he has contributed for 43 months…so does that mean i could not get the lump sum of his death benefit?

another question po… if and when I die and like i said we do not have minor children, my children cannot get anything from my more than 3oyears of contribution?

Thank you for taking time to answer my queries…

Sadly, a pension can only be survived by the spouse or if there are any minor children.

I would like to ask, who usually fills up the Fillers Affidavit? Because my mom is the claimant but my brother is the one who pays for the burial of my father.

A funeral claim and a death claim are two different claims. Your brother can file for the funeral claim, and your mom for the death claim.

Hi good day ask ko lang kung pwde ba kumuha ng funeral benefits ang anak mg namatay kahit d sya ang nag bayad?? Then 2years na kasi d parin naasikaso busy kasi yung nag bayad na pamangkin kaya gang ngayon d parin nakukuha. Salamat

It’s allowed to use SPA. But then the proceeds will be in the name of the who paid the funeral expenses.

Hello! Ask ko lang po about sa funeral benefit ng father ko actually nabigyan na po kami ng stub, kasi po gusto ko po i-check kung this week may makukuha na po ba kami kasi halos 1 week na po kami naghihintay. Salamat!

We can’t say that for sure, but you can go to the SSS branch for a follow-up or call them 🙂

Hi, Federico. My mother died July 18, 2021 due to Covid, and was cremated. And I was able to finish her death certificate just this Month. Is it possible to get death benefits even though she died last year and the death certificate is from the city hall, not the PSA because it’s not yet in their system (based on your story, I think we’re the same na matagal ma upload sa system). Thank you

Hi, Ivylyn. I just wish it is allowed. However, as mentioned, they only accept PSA copies if you processing the death claim. Don’t worry, you can claim this amount at any time 🙂

Good day! Let you know that I’m Deaf. About funeral claim of my decreased father, I’m confused about who are me or two claimants. The first claimant is my aunt, eldest sister of my father. Her name is put on the receipt of cremation fee in where she and I shared together to pay. The second claimant is my mother who is divorced. Her name is put on the receipts for increment and food. They are non SSS members but I’m SSS member. Can I apply for SSS funeral claim?

In claiming, it doesn’t matter if you’re a member or not. The receipt is needed to file a claim. Maybe you can talk with your aunt regarding the distribution of the proceeds.

Namatay po kapatid ko nung pandemic, nag-try ako mag apply ng funeral pero na-reject. Anyway, (since before yearly ang ACOP, at ngayon, tinigil na nila.) ang alam ko kung hindi mag-submit ng ACOP, automatic STOP na pension. Ang gagawin ko para ma-stop yun pension ng kapatid kong namatay. Kasi meron pa din binibigay ang SSS sa kanya.

As mentioned, we are not from SSS. It’s best to ask them for these types of concerns. Thank you!

Hi Federico, would like to ask if pwede po ba sabay yung application for funeral claim & Death claim? O need na Funeral first before the Death Claim?

As far as I know magka-iba daw yang dalawa?

Yes, if you have all the required documents. However, it takes a few months before you can get a PSA copy of the death cert (as mentioned above).

My filipino born mother is a german citizen when she died but she has been a SSS member for almost 20yrs. She died 63 and she mentioned that at 60 she should have started her pension but wasnt able to process it since she was abroad. My question is can i still file a claim for her death and funeral claim? Also her death certificate is in german how do i inform PSA so she has a record? Do SSS need the members #, as I am not sure if we have it.

Hi Adrian! You may file the death claim anytime, but it is best to do it soon after the demise. Then you may inform the nearest embassy about her death.

Hi Federico, ask ko lang yung death certificate na nasa akin ngayon ay from LCR do I still need a copy from PSA para maka file ng death claims? And one more noong nagbayad ng cremation ng husband ko ay yung bayaw ko pero akin ang pera pero because di nga ako makagalaw pa ng mga oras na yun siya n pinag-asikaso ko lahat. Paano po ‘yon need ba siya mag-claim o ako pwede rin kahit siya nakapirma sa resibo.

Hi, Maureen! Yes, a PSA copy is a must. For your second question, the funeral grant can only be claimed by whoever paid the last expenses. Although you technically shelled out the money, the proof is needed to establish a claim. So, it is your BIL who should file it, but you can also do it on his behalf by securing a SPA.

Ask ko lang po, ok lang po ba mag provide ng baptismal instead of original birth certificate? Nawala na po kasi ung original birth cert ng tito ko. Pero hinihingan pa din daw sila ng original na birth cert kahit may other requirements naman po sila na maprovide. Thanks po!

Hi, Janella! As mentioned, they need the PSA copy to process your claim. Sadly, there’s nothing much we can do but comply, or else they will not process it. So get a PSA copy first.

Hello po Sir! Tanong ko lang po tungkol sa papa ko po na mag 4yrs na ngayong December 2022, siya po Yung member pero mas nauna pang pumanaw mama ko. 9 anak nya kaso lahat ay may asawa na. Yung eldest po namin ng process. Funeral lang na claim nmin kasi sabi ng SSS daw yun lang ang benefits na makukuha naming mgkakapatid kasi legal age na daw kami lahat, ganun po ba yun? Wala na ba kaming matatanggap na death claim? Sabi din daw nila kapag pensioner na wala na raw funeral nalng matatanggap. Nakakadisappoint kasi sa amin noon walang wala kami tapos ganon pala?

Hi, Shirley. As far as we know, a pension can only be survived by a spouse or a minor. Because your father is already a pensioner, your mom died before your father, and there’s no minor child/ren to survive the pension, which is why you can only claim the funeral grant.

Hi Federico. Itatanong ko lang po sana kung paano po kaya kung nagkaroon po ng kinakasama ang tatay ko bago po sya namatay, beneficiary din po ba sya? Salamat po!

It depends if your father was never married before. To be sure, check it with the nearest SSS branch.

Good day po Sir! Mag-claim po ako ng Death Claim ng husband ko po namatay lang po last year. Lahat po ba ng requirements na nakalagay po diyan is need na meron po lahat at need po ba sa PSA po lahat kukunin?

Hi Ghie! I listed all the possible requirements, but in actual you don’t have to secure all the documents indicated. Please go to the nearest SSS branch to get a list of requirements as it may differ for each claimant. Thanks 🙂

Hi po sir, tanong ko lang po,

namatay po yung ka live in ko po at may anak po kami na 5yrs old, pwede po ba na ako yung mag file ng sss death claim nya kahit hindi po kami kasal? At mag kaka pension po ba ang anak ko kahit, 80 contribution lang sya?

Hi, Jean. They allow common-law spouses provided that both of you are not married to someone else. YOu may check it with the SSS branch near you.

Good day! May marereceive po ba muna na email from sss or text messages just to know na ready na po ang death claim? Salamat

Before they used to send snail mail, now, they send notifications thru SMS.

Hi po, ask lng po, kmi po ang unang pamilya, pero ang pinakasalan ng tatay ko ay ang second wife nya, now po nmnatay tatay ko, ang nakalagay sa sss benefeciaries nya ay ang nanay ko which is hnd cla kasal, pwede po kaya maclaim ng nanay ko ung death benefits ng tatay ko kahit hnd cla kasal?

Hi Arlene! There are 4 types of beneficiaries. The primary beneficiary is still the spouse. If you proceed, SSS may require you to submit CENOMAR to check their civil status, which you may not be able to provide because your father is already legally married.

Good day po ask ko lang po if maclaim ko pa ang burial benefits ng anak ko 2018 po siya namatay at di ako ready ayusin ang sss niya its been 4 years may makukuha pa po ba ako??

You may check it with SSS, Adonna. As mentioned by SSS, there is no expiration of the death claim. Thanks!

Please help!

Totaly blind po ang mother ko both eye sigth (PWD), sya po ang benificiary ng father ko na namatay 3yrs from now,

Di po kami makapag open ng bank account for ITF

anu ano po bang bangko ang tumatanggap ng ITF for sss death benificiary claimant.

Thanks!

Hi Liza. Apologies, I cannot answer your inquiry as we are not from SSS. Please kindly check it with them. Thanks 🙂

Sir yung Funeral Benefit claim po ba may deadline or nag-eexpire kung matagal nang di na file?

Dun sa Death Benefit naman ang daming requirements pero oonti-ontiin ko rin yun kasi sayang din naman yung nacontribute ni mama…

Pero miss ko na rin talaga sya 🙁

Hi, Ryan, I bet you really missed her 🙂

There’s no expiration date when claiming this benefit. And it really takes a lot of legwork.

I completed all the requirements last Aug. 1, 2022, for a death claim and the sss staff told me to wait for 3wks-1mo. for result. will it really take a month to wait?

Normally, it takes a month but for some, it may take even longer.

Magpa-file ako ng SSS death claim ng brother ko. Kaso wala ako SSS no. nya pero alam ko na member sya ng SSS ky nakapag work sya ng 3 private companies. . Mapa-process ba ang claim ko. Patay narin mga magulang namin. mga kapatid ko ay mga babae, ako at ang namatay kung brother ang lalaki.

They can search for it for you, but it will be easier if you have his SSS number.

How to claim the SSS benefits of my spouse?

You may follow the steps above 🙂

Paano kung ang deceased SSS pensioner nakapag update ng E4 beneficiaries at inilagay nya ang second wife nya as wife, makakapag claim pa rin ba ang first wife na nasa abroad maski nakapangasawa na ng foreigner sa ibang bansa?

As mentioned above, the spouse of the deceased member is the primary beneficiary. However, the benefit ends when the spouse remarries or dies. So in this case, the first wife may no longer be eligible for the claim.

losing my father was never easy and is still painful up until today. thank you wiseguy for helping us out. indeed all the information has been helpful

Thanks, Vele! It means a lot to us 🙂

Tanong ko lang po sana kung pwede ipasa ang ctc copy ng death cert at marriage cert ng magulang para po sa death claim ? Maraming Salamat po

Btw, we have stressed above that you have to submit a PSA copy. Sadly for us, we have to comply.

Lima po kami na benefeciary ni lola ko na namatay na, nagka usap po kami, kung pwede ba na sa aking nalang i-account lahat kasi hindi na sila maka proccess nang requirements due to busy sa work walang time. Pwede kaya po yun? Na sa akin nalang lahat i-account, mag special power of attorney nalang tapos pirma nalang yung iba sa SPA?

Yes, you may do that.

Ask ko lang paano maclaim yung sa tatay ko dahil kulang yung SSS number niya. Nanduon naman yung name niya sa system.

If you are already in the SSS, you may ask them as to how you can claim it. They may not be as friendly, same with other gov offices, but be intentional and prepared whenever you go there. As mentioned, we are not from SSS. So the best thing to do is go there and ask all the pertinent questions.

Hi! How do I know po if approved na po ‘yung Death Claim Application? Kasi po nagpasa po ‘yung mama ko ng requirements para sa Death Claim last February po. Until now, wala pa rin pong update. Thank you in advance 🙂

You may check it with the SSS for updates.

Hello po, regarding po sa requirements na kung saan kailangn ng sinumpaang salaysay. kailangan po ba ay may nakaharap na judge dito, at may nakapirma ding judge, katunayan na ako ay nanumpa na tama ang mga peprs an binibigay ko?

As far as we can remember, you don’t have to do that. You just need to submit a notarized copy.

Ask lang po funeral expenses total is 38,000 ang na claim lang namin os 20k+ ganoon lang po ba talaga ang amount na ma-claim? Thanks po 🙂

As mentioned above, you will get the lesser amount between the actual expenses (OR) and the computed grant.

After po makatanggap ng lumpsum ng mother ko. Kelan po sya makakatanggap ng monthly pension? More than 36 months po ang naging contribution ng father ko.

Lumpsum is only given to the beneficiary/ies of the deceased member with less than 36 months of contributions prior to the semester of death.

Hello po.tanong ko lang po.dalawa po sila magkakapatid tapos patay na mama nila and sila yung beneficiaries.tanong ko po. Pwede po ba na ang isa ang magpapatuloy mag process ng DEATH CLAIMS NG MAMA NILA.kasi sa Burial is yung isang YOUNGEST ANG NAG PROCESS EH TAPOS NA CLAIM NA NILA.ang itong eldest kasi gusto nya sya magpapatuloy magprocess kasi parang tinamad yung youngest na magprocess. At sa burial na na claim nila is nakapangalan lahat ng finil upan duon sa youngest.

Yes, it’s allowed.

Hello. Pano po gagawin kapag na-receive ko na yung approval ng disbursement account ko sa e-mail? For funeral claim po ito. Pano po makukuha yung pera?

You may get the SSS death benefit in your preferred PESONet participating bank, e-wallet, or Remittance Transfer Company/Cash Pay-Out (RTC/CPO) like M Lhuillier.

Hi Sir Federico! Paano kung sa SSS ng papa ko Lola ko at Tito ko nakalagay sa beneficiary nya then parehas na po patay si Tito at Lola pwede bang anak Ang mag claim? Kaso 14years na syang patay, di namin na asikaso kasi wala naman kaming alam pa sa mga ganito nung bata pa.

You may go to the nearest SSS branch to have it checked 🙂

My aunt died at the age of 83, 2 months ago wala po syang anak kami ng nanay ko kasama nya sa bahay magkapatid sila ng nanay ko at meron pa isang kapatid na madre meron pa po bang death benefits na makukuha at sino po pwedeng kumuha? Last question po a month after nag submit ng for funeral and death bakit meron pang pumapasok na pension sa account ng namatay kong tita? Diba dapat tumigil na yun? Thank you!

Based on SSS IRR, primary and secondary beneficiaries can file the claim. When it comes to the pension, many commenters shared the same thing. You may go to the SSS for the cessation of pension.

Hello po ask ko lang pano malaman if may SSS yung deceased, not sure kasi kung meron

You may go to the nearest SSS branch to have it checked.

Hi po ask ko lang sir totoo ba nawala ng death claim na makukuha ang naiwang mga anak o apo kasi wala ng wife at minor na anak .

As per SSS, a pension can only be survived by a spouse or minor child/ren.

Ask ko lang Po Kelan Ang start ng monthly pension ng benificiary after ng approved Mula sa sss. Tnx po

According to SSS, pension is credited on the 1st day of the month if contingency falls from the 1st day to the 15th day of the month. And 16th of the month, if contingency falls from 16th to the last day of the month.

Hi sir, I just received the email notif. na approved na funeral benefit ko, tanong ko when is the exact time to apply for death benefit? salamat mo sa sagot

You may apply at any time. But make sure you have all the required documents so you can have a smoother transaction 🙂

11 yrs. n po nming di n process ang SSS ng byenan q ksi yong dlawanf benefiary nya ay yong dlawang pmangkin tpos di n change status hnggang s nkamatyan nlng ngaun sbi ng SSS smin need nla yong Authorization ng dlawang pmangkin at photo copy ng valid i.d pra sya n mgclaim ng death claim lumpsum ng byenan q s tgal ng pnahon mku2ha p nmin b yon?

Yes, the fact that they have given you the list of requirements means it’s claimable. According to SSS, death benefits do not expire.

Hello Sir, ask ko Lang po paano makuha ang contribution Ng Lolo ko sa SSS. Kung Yung asawa niya ay matagal ng nawawala hanggang ngayon. Di malaman Kung patay na or buhay pa po. Pwede po ba mag claim ang secondary beneficiary (apo)?

It’s something you have to check with SSS remember, there is a classification of beneficiaries. You can also go to PSA to have it checked.

Hello! May I ask po pwede po bang sa ibang SSS branch mag file ng death claim kahit nagkapag-file na ng funeral claim sa ibang branch?

Yes, their system is centralized.

Gandang gabi po sr..

Tanong ko lang po.

Sino po ang ilalagay s claimant if ang namatay po ay may anak n 20 yrs.old pero hnd po sya kasal s asawa.. at meron p po syang nanay. Wala po bang makukuha ang anak n 20 yrs. Old..slmt po

As mentioned, there are four types of beneficiaries. The primary beneficiary is the spouse of the deceased member.

Is the primary beneficiary (wife) also entitled to a funeral claim when she dies? Thanks in advance.

Yes, if you are also an SSS member regardless of being inactive 🙂

Hello, want to help lng po sa kakilala ko na mag claim ng death Benefit Claim ng Tatay nila, kaya lng parang ang hirap nman po pla , now plang po ulit sana mag aasikaso tapos may work pa po kmi wala po tlaga masyado time, last month umabsent ako para makakuha ng Cenomar ng Father po nila, yon nlng dw po ang kulang hahha kaso ang dami pa po pla…5 years mahigit na po na patay father nila dipo tlga na aasikaso, totoo po ba na pinaka panganay ang beneficiary? kc lahat po sila legal age na,,any advise po sana sir please po!

If ayun yung advise sainyo ni SSS. Just follow it, pati yung requirements na needed. Sobrang time consuming talaga ang pag process ng death claim kaya need mo mag allot ng time. If in doubt ka, you may visit the SSS branch and get another list of requirements para tama yung documents na ipapasa mo.

Ano -ano po ba ang requirements na kailangan ng primary benefeciary(wife) for death claim

It may be a combination of the requirements listed above. To be sure, you may go to the nearest SSS branch in your area.

5 mos na since I filed my application for death claim pero hanggang ngayon wala pa din laman atm,,hindi nman aq mkapunta sa sss branch na yun kc sabi taga proseso lang dw cla..saan kaya aq pwede magfollow up..? Thank u

Matagal nga po ang 5 months. Actually, dapat sa kanila kayo humihingi ng update. Surprisingly, may mga iba na mabilis lang ang process. Balik lang kayo sa branch 🙂

If bennificiary is out of the country,can she/he make a waiver to receive the benefits?

You can have someone process this on your behalf. You may check with SSS and the nearest embassy about how you can have a SPA.

Sir ask ko lang po anong next po tapos napo kasing na CI si mother ko about sa death claim na nilakad namin anong susunod po dun? Ma-credit na po ba sa bank account no mother ko yung pension nila at kasama rin po ba yung 5 years na lumipas na ndi namin nailakad agad. Thank you!

You may ask the SSS branch for your specific concerns 🙂

Halimbawa Po bang single ang member tapos namatay sya at yong beneficiary ay mga pamangkin nya (minor) can they claim SSS death benefits nag Tito nila?

They must be assigned as beneficiaries. Thus, you must update your record, or else the benefits will be payable to your estate.

Pag pina check po ba ang sss nong namatay sa nearest branch ano po ang step na gagawin? Makikita din po ba doon yung mga contribution saka hulog and magkano ang makukuhang lumpsum and yung montly na makukuha den sir?

Yes, they have records of contribution. With regard to the claim, it’s either lumpsum or pension depending on the number of contributions made.

Namatay po ang manugang ko at may anak siyang isang anak na 7yo. Ang bilin nya kung mamamatay siya, may pension daw na makukuha ang bata. Ano po ang requirements? Salamat po sa makakasagot.

Yes, her daughter is eligible to receive a dependent pension. As for the requirements, you may be asked for legal guardianship. You may ask the nearest SSS branch in your are for the complete list of requirements. Thanks!

You are indeed a huge help to us minions for freely giving your time to claimants undergoing the oh so daunting Death claims rigmarole, much thanks.

Any possibility of subsequently getting the PSA to convert an overseas Death Certificate to a legitimate local one usable for an SSS Death Claim? I’m sure you’ll advise me – deal with SSS but I still would like my one cent worth query heard. Thanks Mr Wise Guy, more power to you!

Thanks, Ram for your kind words. You know, I try to answer every question, but most of them are already answered in the comment section. It’s why I either reply to visit a SSS branch or check the comment section.

As to answer your question, I can only share based on my experience. But as I remember, you can report it to the nearest Philippine consulate 🙂