Did you know that you still need to renew your BIR Certificate of Registration (form 2303) every year? This is paid, yes, every year, on or before January 31. I know you are already familiar with the registration fee, right? It’s the Php 500 you paid using the form 0605 when you got your COR. It’s the same thing when you’re renewing it.

Did you know that you still need to renew your BIR Certificate of Registration (form 2303) every year? This is paid, yes, every year, on or before January 31. I know you are already familiar with the registration fee, right? It’s the Php 500 you paid using the form 0605 when you got your COR. It’s the same thing when you’re renewing it.

READ: How to Get Certificate of Registration from BIR | Mixed Income Earners

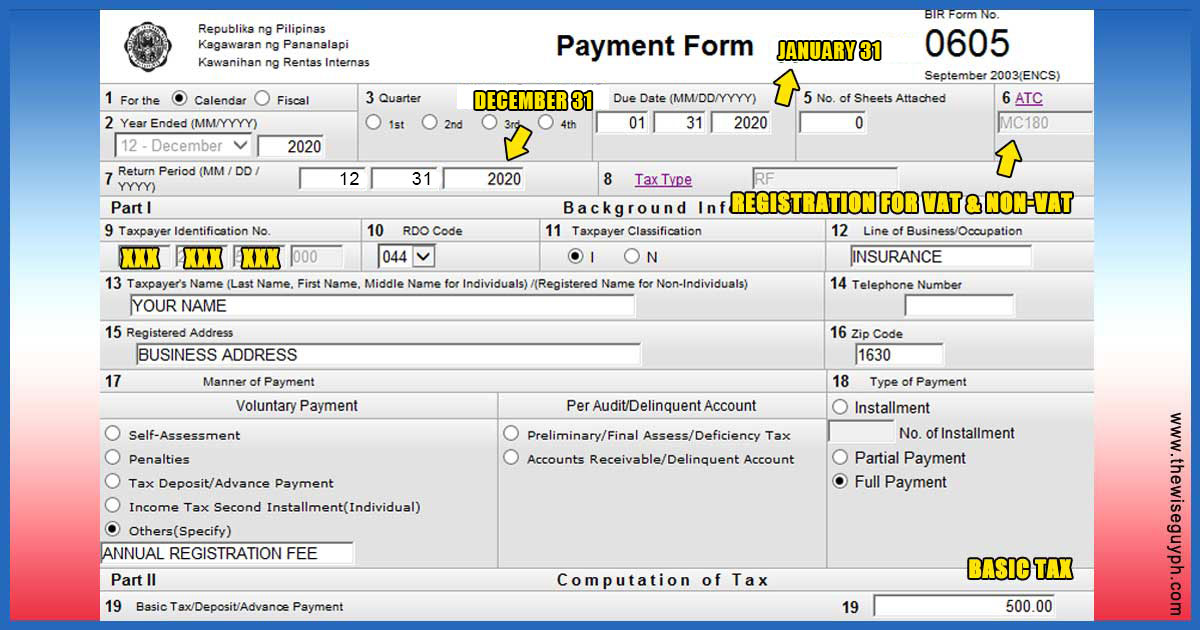

You need to fill out form 0605 and then pay in your preferred payment facility. But if you want to learn how to file this using the eBIRForms, this post is perfect for you.

Table of Contents

Download and Install eBIRForms Package

Previously you can print form 0605, write your information, and then pay the registration fee. Now, everyone is encouraged to use the online facility or the offline eBIRForms package when filing tax returns. Don’t worry because filing your return online is a lot easier than going to your RDO. But first, you must download and install the package.

Click here to download the Offline eBIRForms Package.

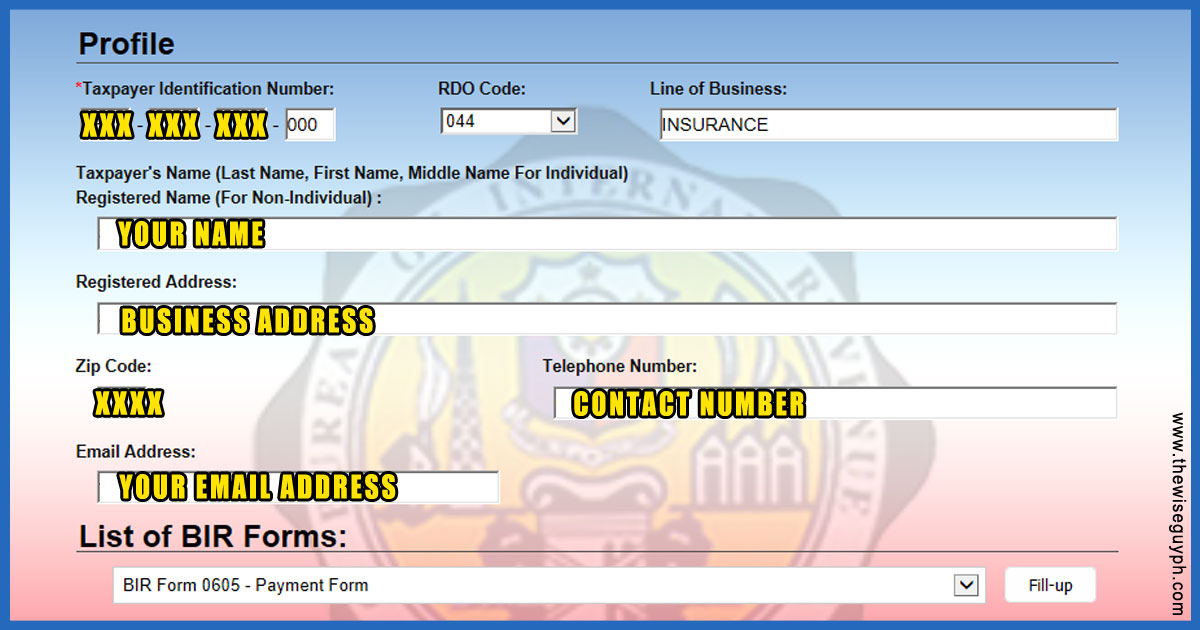

Fill out the Profile

Launch your downloaded offline eBIRForms Package, and you’ll be seeing a similar image above. You must fill out the profile as follows. Once you fill them out, you need to put in your TIN and RDO the next time you’ll use the eBIRForms. Please remember to put your personal email address because this is where the BIR confirmation message will be sent once you submitted form 0605.

Launch your downloaded offline eBIRForms Package, and you’ll be seeing a similar image above. You must fill out the profile as follows. Once you fill them out, you need to put in your TIN and RDO the next time you’ll use the eBIRForms. Please remember to put your personal email address because this is where the BIR confirmation message will be sent once you submitted form 0605.

Use Form 0605 to Pay Annual Registration Fee

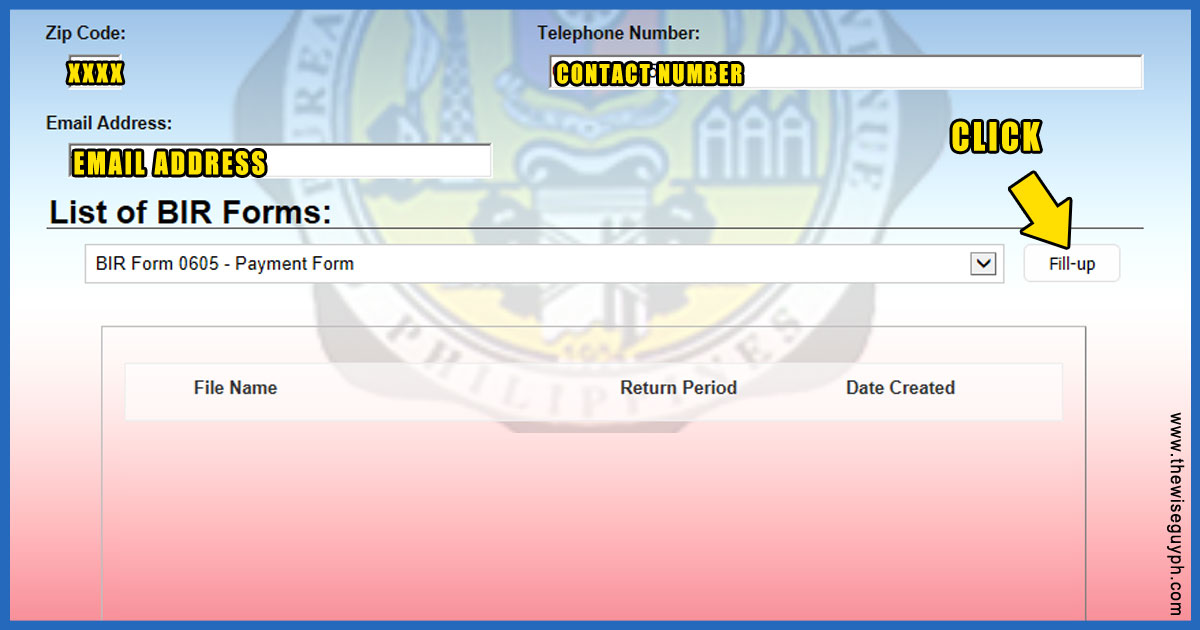

1. Search for form 0605 in the list of BIR forms section and then click fill-out.

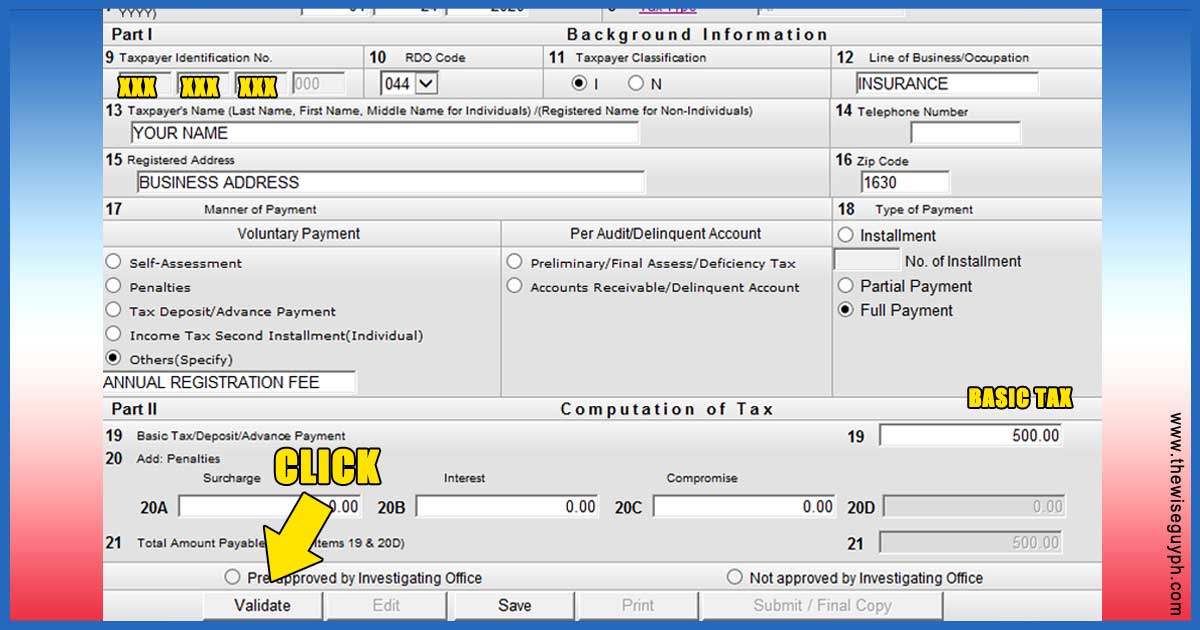

2. Fill out form 0605 and click validate to check if you missed answering any required item.

3. Once everything is validated, you can now click submit, and you will see a pop-up saying a confirmation email will be sent to your email address.

4. Print 3 to 4 copies of form 0605 if you will be paying the registration fee in an authorized bank.

Print BIR Email Confirmation

After submitting the form 0605, wait for the confirmation email coming from ebirforms-noreply@bir.gov.ph. You can usually get this confirmation email within two hours upon submitting the form online. Print 3 to 4 copies of this together with the form 0605. Usually, 3 copies are enough, but other payment facilities require 4 copies.

Pay at your Any Preferred Payment Facility

You can pay the Php 500 annual registration fee in an Authorized Agent Bank / Collection Agent / GCASH or use other payment options. By the way, an authorized agent bank is any authorized bank in the jurisdiction of your RDO. You can check here if your bank is an authorized agent bank of your RDO.

Pay BIR Annual Registration Fee via GCash

If you are looking for a convenient way to pay your taxes, then GCash is the option you might consider. You can now pay it with just a click of your fingers.

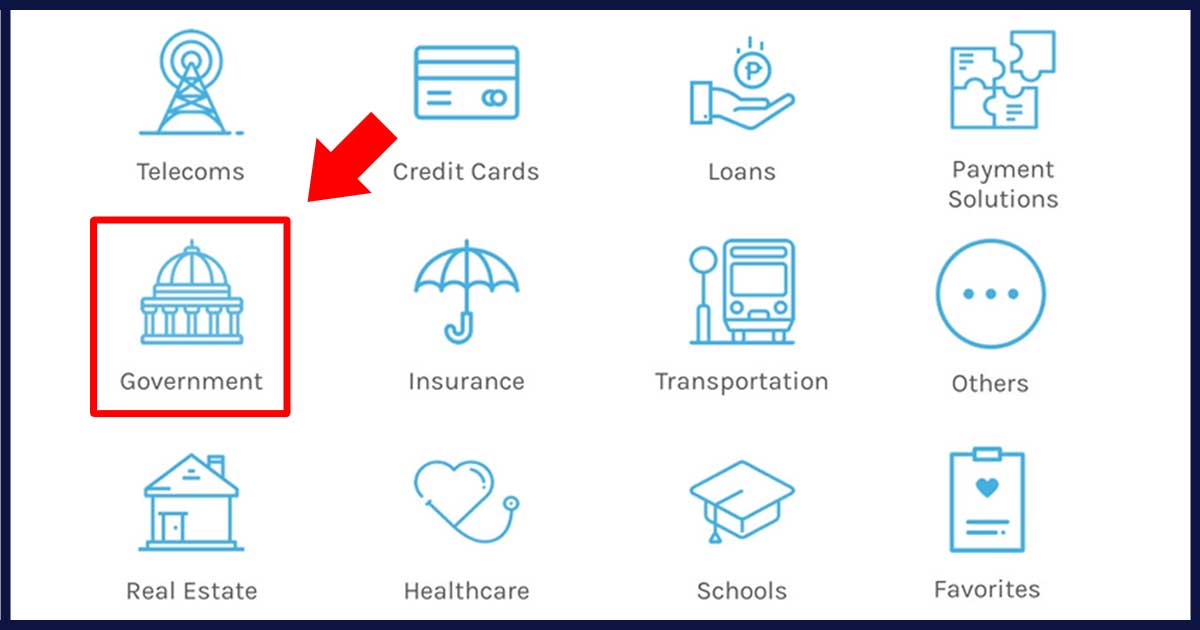

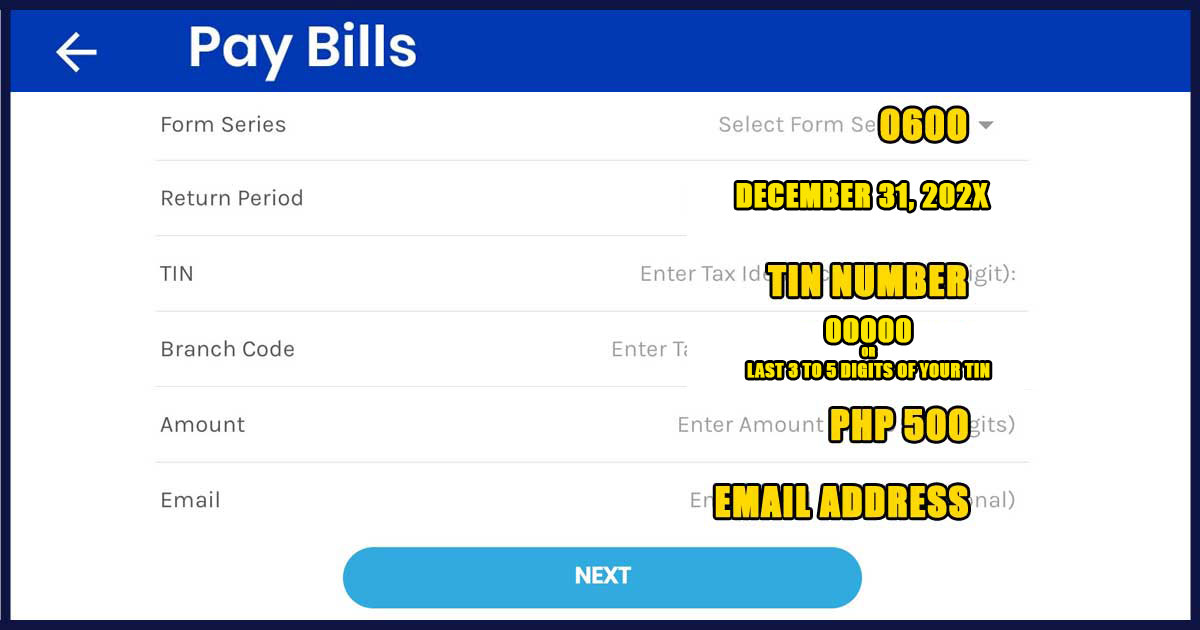

So here’s how you can pay the BIR annual registration fee via GCash:

1. Launch your GCash App

2. Choose Government

3. Click BIR

4. Fill out the form and then proceed to confirmation.

Return period is the last day of the type of tax you are paying. Because this is for the annual registration fee then the rerun period is December 31 of the current year.

Branch code is the last 3 to 5 digits of your TIN. If you’re TIN is 123-456-789-000 then your branch code is “000.” Put two additional zeroes in front if needed for GCash payment.

That’s it, and you’re done. You don’t have to print anything nor go to any accredited agent, thus, saving you time.

Final Thoughts

At first, you might be overwhelmed by all the things you need to do. But don’t you like the convenience of settling your due from the comfort of your home? Goodbye, long lines, and commute going to your RDO to renew your registration. I hope you learned from this and use it in renewing your certificate of registration. If you have anything to share, please let me know.

READ: What to do next after using the e-BIRForms?

*****

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

91 thoughts on “BIR Certificate of Registration Renewal (Form 2303)”

Hello! Are there any other forms needed to fill out other than payment form 0605 for renewal of COR? And need pa po ba dalhin sa BIR office or their acknowledgment email is enough?

Thank you

Good day Sir

Will there be any issue or implication if I inputted the wrong branch code while paying in Gcash?

Your payment may not be receive by your RDO.

Hi sir… what does this error messages meaning?

Background information saved/updated successfully as profile….

aftr ko po mag fill up ng 0605 form.. thanks for the help po

It means that you have successfully filled out the form. To check its correctness, click the validate button.

Hi Federico, do i need to submit the manual book (journal, ledger, voucher, etc) upon renewing?

Good day, and branch code namin 00010. pero sa Offline BIR eforms 3 numbers/digits lang ang pwede ilagay instead of 5. tama po ba na 010 ang ilagay ko? Thank you

Yes, you’re correct.

Hi, after filing 500 PHP for registration fee, do I need to pay 30 pesos for documentary stamp if the submission was done through ebirforms?

No, you don’t have to.

I missed to renew COR last year ( Jan 2022), how can I pay it this year together with the present year. Thank you

You have to go to your RDO and pay for surcharges and penalties.

Happy New Year Mr. Federico. My question is can I get a copy of my CERT OF REGISTRATION,BIR FORM 2303 every year so long as I have paid my ANNUAL REGISTRATION FEE (payment form 0605)? Can I get a copy from BIR? My actual COR is the copy I have when I first filed to become self employed way back in 1999. Every year I file form 0605. Thank you so much.

Hi Ves. You may get a replacement COR using form 1905. You must also bring your old COR for verification 🙂

If I will pay thru Gcash do I still need to fill out form 0605? Btw, your post is very informative. Thanks, alot?

Yes, you should still complete the form 🙂

Hi sir, question how to change my bir info in my COR like i want to change my business address. Thank you!

You may use Form 1905 for the update.

What happens if I do not renew my COR?

There’s a penalty. If you are closing your business or ending your professional career, it’s best to formally cancel your COR in BIR.

If I make the payment via GCash, will the BIR be notified that I already paid the RF?

Or do I need to notify them myself thru email?

Yes, they will be notified.

For similar questions, you may refer to the link inserted in the post. Thanks 🙂

Is the annual registration fee and form 0605 different?

Form 0605 is a form you use in paying the registration fee. But it can also be used in paying taxes and fees that don’t require the use of a tax return.

I already got the answer form the below comments. Thanks for this nonetheless

Glad you found it!

Maraming salamat po. Laking tulong po ito.

You’re welcome 🙂

Hi, I am financial advisor also. I’d like to ask after I fill the COR. when can I submit the ITR 1701? Do you have any idea about the penalties? I just received email from my company that I need to renew my license and the requirement is ITR 1701 but my RDO informed me that I just registered this month and after 3 months that’s the time I can fill ITR 1701. This is my first time to file. Can you share your insights or process

Sheila, I think you have to ask assistance from your superior on how to deal with it. As you know, you have to have PTR, COR, and ITR. So you must have PTR and COR first before you can file for an ITR. I cannot share anything about the penalty because I do not have experience with it.

Btw, COR is a requirement when you are doing business or side hustles. It just so happens that it’s needed for license renewal. Thanks 🙂

This content is very helpful. Thanks a lot Sir Federico.

You’re welcome Lisa 🙂

After paying for the renewal fee do I have to go to my RDO to claim anything? Like new receipts?

Hi, Marj. It’s already explained above. Just to add, the deadline for this is on or before Jan 31. You may ask your RDO to double-check for the possible penalty. Thanks.

Hello po,

what if po nag expire ung COR ko? do i need to register again?

Hi Donna. If you fail to pay your annual registration fee then you have to go to your RDO for computation of penalties and surcharges. Thanks 🙂

Hi Sir,

What if the business owner failed to pay previous year’s renewal of COR (2018 pa ang last na payment), how is he going to settle? Pwede bang twice the amount na this year, or kailangan 2 separate payments?

Thanks!

Hi Wamie. You have to go to your RDO for the proper computation of penalties. Thanks 🙂

How to check if your agency is paying tax?

Hi Emma. If you are currently employed, you will get a certificate of withholding tax. If you wanted to be sure, you may go to your RDO and have it checked. Thanks 🙂

What if I did not receive an email confirmation from eBIR, how can I pay? It says 2-3 hours, I will be receiving an email from ebir but still I did not receive. Can I proceed to payment or not?

Hi Nessie. Have you checked if the form was indeed submitted? You’ll get a prompt message once it did. And oh, I just notice that your beyond the deadline which means you need to settle late fees. You may go to your respective RDO to ask for assistance. Thanks 🙂

Hi Federico,

thanks for this great information.. big help 🙂

You’re welcome Nelia 🙂

Thank you very much! Big help po ito 🙂

Thank you for this Sir Federico! Very informative 🙂

Could you also share how to file percentage tax? hehe Thanks in advance!

Hi Pao. Thanks for your recommendation. I’ll surely put that on my topic list. Thanks again 🙂

Hi Sir! I need to reprint my COR since the BIR officer’s signature had already faded. After paying the 500php, what’s next po? How do I get my new copy na? Thank you!

Hi Julie. You may go to your RDO to ask for reprinting. Paying 500php using 0605 is only for the annual registration fees. Thanks 🙂

Hi Sir Federico, may I know what to put on the return period (form 0605)? Is it the current year or the previous year? Thank you 🙂

Hi Levy. You should use the current year. Thanks 🙂

I would like to ask COR is this every year be renewed?

Thanks

Hi Nicetas. Yes, you need to renew this every year by paying the annual registration fee until January 31. Thanks 🙂

Hi Sir Federico. I just want to ask and I hope you can help me out. What if I want to update my BIR certificate? Do I need to go to the RDO? Thanks!

Hi Marilen. Yes, you may go to your RDO. Thanks 🙂

Hi Federico! I need help in filing the 0605 Form. What should I put in the ATC section? I am renewing my COR.

Hoping for your fast response. Thank you!

Hi Janica. You may find it on your COR. As I don’t know what profession you are in or the type of business you are running now. Thanks 🙂

BIR Certificate of Registration Renewal (Form 2303) YOUR HEADING – – WHAT DO YOU MEAN TO RENEW COR-FORM 2303? OR THE PAYMENT OF THE ANNUAL REGISTRATION FEE OF P500.00 YEARLY? (BIR FORM 0605). I DON’T SEE ANY EXPIRY DATE OF COR AS MR RODEL IS ASKING. IF THERE IS ANY CHANGES IN THE DATA IN THE COR, JUST UPDATE USING BIR FORM 1905, THIS IS THE TIME A NEW UPDATED COR WILL BE ISSUED BY BIR TO REPLACED THE OLD COR.

Hi Nelly. You may find it on your COR such as 2551Q, 1701Q, 1701, and annual registration. As per BIR, you must renew this every year on or before January 31. Thanks

Hi Sir Federico. I just paid for my registration fee of 500 using 0605. There won’t be any changes to my COR (2303). Do I still need to go to the RDO? Thanks!

Hi Dandan. You don’t need to go to your RDO unless you need to change anything from your COR. Thanks 🙂

Hi Federico,

Thank you very much for this information. My question may be redundant, but just to be 100% sure, just submitting and paying for the 0605 is already the annual registration? There is no need for any other forms?

Thanks,

Cherie

Hi Cherie. Yes, you just have to pay the 0605 and keep the copy as a proof on your part that you really paid the registration fee. Thanks 🙂

Hi Federico. Thank you for the link you provided esp for us who would want to file online.

I am looking abt the FAQs, but seems not included here.

I have already TIN and used to file my taxes a few years back. Now, I am already OFW (as we are not required to file tax). I have a new line of business as a source of income, aside from my salary as an OFW. Should I use another BIR registration or go on with the same TIN? Thanks

Hi Jiro. You can only have 1 TIN number in your lifetime. You should use yours when filing. Thanks 🙂

What kind of tax do you file quarterly?

Hi Carmina. The tax I file might be different from yours. You may check your COR and see what are the things you need to file. Thanks 🙂

Hello po. What if I missed to renew my bus registration. Can I still renew it using eBIRFORM (online). If so, how can I pay the renew fee and the late fee? Thanks.

Hi Jhet. I think it’s better to go to BIR so you can get help in the calculation of penalties and surcharges if any. Thanks!

Sir

Iwould like to ask what if we an association (homeowners) do we still have to renew COR? & Pay 500 pesos?

Hi Marites. You may look at your COR if you have to pay the annual registration fee. Thanks 🙂

Hi Sir! I would like to ask, is it possible to pay the RF without the confirmation e-mail? Filed online last night and until now I am still waiting for the e-mail. TIA!

Hi Ghena. You must be connected to the internet if you’ll going to submit the form. Anyways, BIR has given some steps on what to do if you fail to get an email confirmation. Please kindly check that out. Thanks!

Hi thank you for this. I’d like to ask, after filing online the BIR 0605 form and paying the registration fee, how do we get the renewed BIR form 2303? Thank you!

I have the same question as Ms. Eunice Palma. I’m thinking of paying the renewal fee online thru Landbank (just like what I’m doing with the Quarterly Percentage Tax and Quarterly Income Tax), but then I remembered that the actual COR needs to be reprinted and issued by the BIR since the old COR is already expired (valid only until December 31, 2018). So appointment with the BIR is still required for securing the new COR?

Hi Rodel. If you have changes on your COR then you may do so. But paying the annual registration is what you need if there are no changes. Thanks

Hi after payment, do i need to still submit 0605 and the receipt of payment made thru AAB

Hi Fredilyn. Once you submit it on the eBIRForms package while connected to the internet then BIR has already a copy of your 0605. Thanks

Hello po. How much the penalty if to be paid only now? Thanks

Hi Memz. It will depend on how many months since the deadline (January 31). You may ask your RDO for computation for the exact figures. Thanks 🙂

Hi! I have already processed my form 0605. I wonder if I need/need not to (re-)process forms 1906 (Application for Authority to Print Receipts and Invoices) and 1900 (Application to use loose-leaf).

Hi Christine. Have you finished your receipts? If not. I believe they’re still valid. You just need to process your 0605 and everything should be fine. Thanks!

Thanks Mr. Federico! Btw, I haven’t used my receipts.

Hi Federico. Thank you for this information. How about an individual forgot to renew his/her COR & 0605? Same as to those who have lost their COR/0605 and their receipts?

Hi Nikolo. I think you have to settle your penalty and surcharges. You may visit your RDO so you can properly ask them what you have to settle. Thanks 🙂

Thank you for your post. I needed this info and glad I found your post.

Hi Maila. Thanks for your kind words. Have a nice day 🙂

Hi Federico,

Thanks for these very helpful information and tips. I am currently using a Macbook and I found that the Offline eBIRForms Package is Microsoft windows based app and currently does not work in the MacOS. Would you know of an option for Mac users?

Thanks,

Gigi

Hi Gigi. I’m using Windows. I missed saying that this is only available for Windows OS. Sorry for that, currently BIR doesn’t support MacOS. Thanks for pointing that out.

Hi Federico! Thanks for writing this post. To clarify, do you mean that as long as we pay the Php500 registration fee every January, we are good? I mean, no need to secure a new copy of Form 2303 (COR) yearly? Or does that need to be reprinted by the BIR yearly? Thanks again.

Hi Roma. Yes, you just need to pay the annual registration fee and you’re set. Thanks 🙂