I guess you want to invest in mutual funds too? I understand that because it could potentially give you better earnings compared to banks. Oh yes, you can open an account with Sun Life for as low as Php 100, giving you more reasons to start it now!

I guess you want to invest in mutual funds too? I understand that because it could potentially give you better earnings compared to banks. Oh yes, you can open an account with Sun Life for as low as Php 100, giving you more reasons to start it now!

I know you don’t like complicated financial terms, so I will keep this blog short, simple, and direct to the point.

But in case you want something more comprehensive, then you may click the link below.

READ: Mutual Fund 101 | The Good and Bad You Must Know

Table of Contents

What is a Mutual Fund?

According to Lianne Laroya, you can just break it in two words.

- Mutual – common

- Fund – a collection of money

In short, a mutual fund is simply a collection of money from different investors (like you) with a common investment goal.

How Mutual Fund Makes Money?

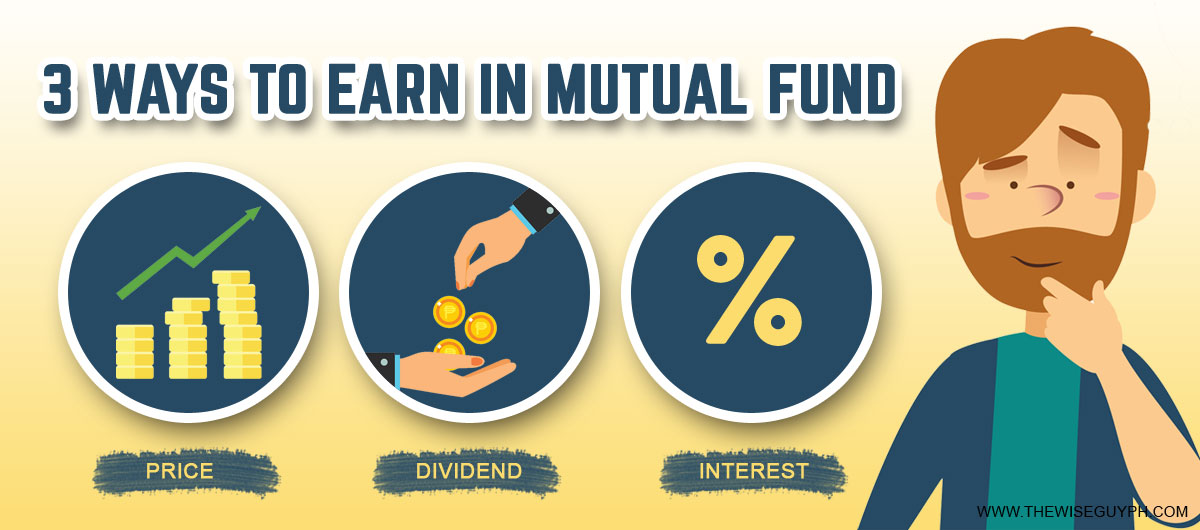

You can earn in a mutual fund in 3 ways, and that is thru price appreciation, dividend, and interest. Making you feel confident with your investment, knowing it has ways to make your money grow.

So here are the 3 ways how mutual fund makes money:

Price Appreciation

The money you invest in a mutual fund will be used to buy shares of investments. When it appreciates, it means your investment is earning, just like how you make from buying a property.

Dividend Earning

You will also get to earn if the companies where your money is invested share their earnings with you in the form of dividends. It may be in cash or additional shares to be added to your capital.

Interest

Your money earns interest from lending it to the government or any private institutions. It is the prize you get from supporting them in their business expansion.

5 Easy Steps in Opening a Sun Life Mutual Fund Account

It is a step-by-step guide to give you an idea of how you can quickly start your mutual fund. To show you that investing can be simple and easy through proper guidance of a financial advisor (like me).

So here is how to open a Sun Life Mutual Fund account:

1. Check Your Investment Profile

First, you need to understand if you are a short-term or long-term investor? Worst comes worst is if can you accept when its value falls below your capital? The good thing is that Sun Life has an investor suitability questionnaire. It’s something that you must answer so you can understand yourself better as an investor.

[INSERT IMAGE HERE]

Now, tally your score to see if you are a conservative, moderately aggressive, or aggressive with your investment stance.

I answered this before, and I got a perfect score of 12.

It is because I am a long term investor, who is comfortable with the volatility of the investment in exchange for capital growth and can meet emergency without accessing my investments.

2. Choose a Mutual Fund

You are now ready to pick one from the funds below based on your investment profile.

| Prosperity Fund | My investment objective? | Where will my money go? | Risk Appetite | How much is the minimum investment? |

| Money Market Fund | I want to leave my cash for a short period and earn from it, too. | It invests in special savings accounts | Conservative | Php 100 |

| Government Securities Fund | I want my money to earn, but my investment should be kept intact. | Invests mainly in government debt | Conservative | Php 1,000 |

| Bond Fund | I want my money to earn, but my investment should be kept relatively stable. | It invests in government and high-quality corporate debt | Moderately Conservative | Php 1,000 |

| Balanced Fund | I want my money to earn more, and I can afford to lose some of my investment for a higher return | This Fund invests in a mix of high-quality debt and equity securities | Moderately Conservative | Php 1,000 |

| Philippine Equity Fund | I want to maximize the potential of my money for higher return over the long term | Invests mainly in high-quality equity securities | Aggressive | Php 1,000 |

| Dollar Abundance Fund | I want to invest my US dollars in preserving it. | Invests in foreign-denominated government and high-quality corporate debt | Conservative | USD 1,000 |

| Dollar Advantage Fund | I want to invest my US dollars, and I can afford to lose some of my investment for a higher return. | The fund invests in a mix of high-quality debt and equity securities. | Moderately Aggressive | USD 1,000 |

*short-term: 1-5 yrs, mid-term: 6-10 yrs, long-term: 10 yrs and above

3. Type of Account

There are four types of mutual fund account you can open with Sun Life. Choose the type of account you would want to get.

- Individual- if you are getting it for yourself.

- Joint- this is for you and your partner (it can be anyone)

- In-Trust-For (ITF)- if this is for your baby or anyone below 18 years old.

- Institutional Account- for companies and cooperatives who want to get better returns compared to banks. They may also get this for the provident fund (retirement) of their employees.

4. Sales Load Option

Mutual companies earn from investors by charging what we call sales load. In Sun Life, you will have an option to get away from these charges if you choose the “back-end load” option.

- Front-End Load -you will be charged every time you add in your investment.

- Back-End Load – allows you to invest without initial deduction of sales charge. But you will be subject to exit fees if you make withdrawals within 5 years.

5. Download & Fill-Out Forms (Optional)

It is optional, but you may download these forms and fill them out. And don’t forget to send a scanned copy of your 1 valid ID to my email (federico.l.suanjr@sunlife.com.ph).

6. Meet a Financial Advisor

You are now ready to meet a Certified Investment Solicitor (CIS) for a personal discussion. Don’t worry because I will personally guide you on your investment in Sun Life. Just Fill out the form below to schedule a meeting with me with your most convenient place and date.

Quick Summary:

What is Sun Life Prosperity Fund?

It is a mutual fund being offered by the country’s multi-awarded Asset Management Company, I.

How much money do you need to open a mutual fund?

You can start investing in a mutual fund for as low as Php 100 for money market funds. While other funds start at Php 1,000 for peso account and $1,000 for dollar account.

How mutual fund makes money?

You can earn in three ways in a mutual fund: price appreciation, dividends, and interests.

Which is better life insurance or mutual fund?

Both of them are excellent financial tools, but if you are just starting on your financial journey, then get life insurance first because this will give you stronger financial footing if any unplanned events happen.

Who will handle my investment?

Professional fund managers will handle your investments. They are trained and have more than 10 years of experience in managing investors’ money.

How to invest in a mutual fund?

You should meet a certified investment solicitor like me. And from there, you will have to sign some forms and present 1 valid ID along with your initial investment.

*****

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

4 thoughts on “How to Open a Mutual Fund with Sun Life”

The Wise Guy Ph is super helpful. Already been added to my favorites. Thank you.

Thank you!

Hi Federico, is this a monthly payment basis?

For example, Money Market- P100 x 12 mos x 5yrs for short period.

If ever how much is the front end load charges?

Thank you!

Hi Jed. You may invest at any time with a minimum of Php100 in the money market fund. Also, it is a no-load mutual fund, so it means no charges will be deducted on your investment. The holding period is just 7 days. You may consider it as a savings account with a higher interest rate.

I do recommend that you add on it regularly to form a good habit of investing. If you need assistance with this, just let me know. You can message me on FB at any time. Thanks 🙂