I bet you just learned about investing in the stock market and wanted to open an account to get it started, right? The stock market is one of the best investment vehicles out there that can give you decent profits in the comfort of your home or office. (Bawal yan ha maliban na lang kung professional trader ka. Okay, okay, di kita isusumbong sa boss mo hehe.)

This is one of my favorite quotes in investing, and I’m very much happy to share this with you. This kinda changes my money mindset by not depending on salary alone, realizing that we can’t work forever.

“Never depend on single income, make investment to create a second source” – Warren Buffet.

Table of Contents

What is COL Financial?

COL financial or COL for short is an online broker that offers its services to investors just like you to execute a trade. I bet you already watch a film where someone calls over the phone to sell his stock position from a certain company. They are called as licensed stock brokers.

READ: How to Open a Sun Life Mutual Fund Account via Online

No, they didn’t replace the traditional brokers, so don’t you worry about them as others still prefer their services over the online brokers.

What’s good about COL is the ease of creating an account and its user-friendly interface. If you’re not that tech-savvy just like me and can still manage to use Microsoft Excel, then you can surely use this one. No wonder why COL is a popular choice for many newbies like you (and me hehe).

Choose Among 3 Types of Account

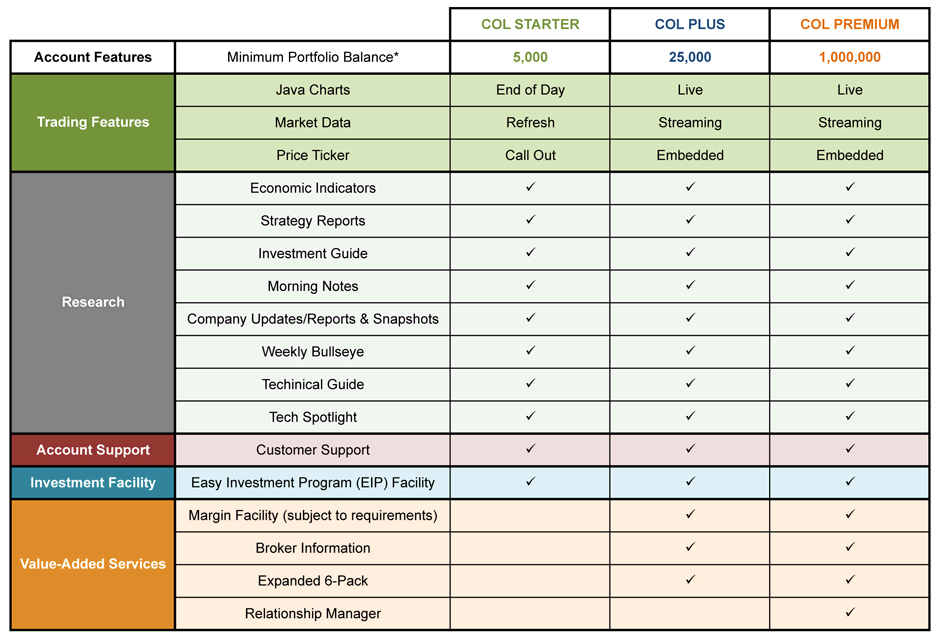

COL offers 3 types of accounts depending on your needs and experience, or let’s say capital. You can easily identify one type that will satisfy your needs. But as for me, I started with a premium account which I funded with Php 1 Million pesos from the Bank of my Mind haha

Okay, I need to get serious here. Just like you and many out there, I started my journey in the stock market with only Php 5,000, and it’s a COL starter account. Certainly, it’s kind of addictive to save and invest your money. As a result, my account is no longer a starter account, and it’s now drumroll, please, a secret hehe.

READ: 5 Easy Steps to Achieve Financial Freedom

1. COL Starter

An entry-level account is suitable for long-term investing. It provides access to basic research reports, standard market information, and end-of-day charting data. You can open this account with just a Php5,000—a very affordable option for anyone who wanted to gain in the stock market.

2. COL Plus

For active traders, it provides streaming quotes, comprehensive research reports, and live chart data with some customizable features. You can open this account with only Php 25,000.

3. COL Premium

For active traders, it provides streaming quotes, comprehensive research reports, and live chart data with some customizable features. You can open this account with only Php 1 Million.

The table above represents the services included in each type of account. Just to clarify, I don’t own the table above; it’s actually from the 1COL official website.

What are the requirements to open a COL Financial Account?

So here are the requirements you must ready.

- 1 valid ID

- Tax Identification Number (TIN)

In some instances, additional requirements might be required.

1. If you are a non-resident foreign applicant, passport is needed.

2. If you are a resident foreign applicant, passport and Alien Certificate of Registration (ACR) or Work Permit from DOLE.

READ: Top 10 Life Insurance Companies in the Philippines

2 Ways to Open a COL Financial Account

There are 2 ways on how you can open an account. Unlike before, your option is just to go to a COL Business Centers.

1. Online Application

The easiest way is to go online. Probably the most economical option because you will get to save time and money from transport.

Go to www.signup.colfinancial.com and then fill out the online application form.

After that, you need to fund your account first before it will be activated.

2. Go to any COL Business Centers

Application forms can be downloaded from their official website. Because I love my valued readers, you can download the forms by clicking here. You just need to fill out every detail that is necessary and prepare the requirements.

Submit the Forms and Other Requirements

You have two options here, and it’s either you go personally to their office or send the signed forms and requirements via snail mail. Thus, if you wanted a speedy process, I guess you should do it personally.

Here are their branches:

COL Business Center

2403B East Tower, PSE Centre, Exchange Road, Ortigas Center, Pasig City 1605, Philippines

(+632) 651 5888

COL Investor Center – Makati

Ground Floor, Citibank Tower, Valero corner, Villar Streets, Makati City 1227, Philippines

(+632) 478 2954, (+632) 478 3316 (+632), 478 3275

COL Investor Center – Davao

2nd Floor Robinsons Cybergate, J.P. Laurel Ave., Bajada, Davao City 8000, Philippines

(+6382) 287 8192, (+6382) 287 8193, (+6382) 287 8194

Note: If you pick to send your forms via snail mail, please refrain from using a packaging, brown, manila develop as this takes more time because they will be subjected to an investigation in the post office. Instead, use the white standard letter envelope.

Go Ahead and Fund That Account

If you submitted the forms personally, then you will receive a piece of paper where your account number is indicated. After you open a COL Financial account, you can fund it in their office. But you have several options just in case you are looking for alternatives.

So here are your other options in funding your account.

1. Online Bills Payment

You can fund your account via online bills payment and the good part is it’s free. But remember that posting will take up to 24 hours.

- Bank of Philippine Islands (BPI)

- BDO

- Asia United Bank

- Metrobank

- Chinabank

- Robinsons Bank

- Unionbank

- GCash

2. Over-the-counter Bills Payment

Some of you might prefer to transfer money by going to the bank. It is safer, most especially if you are going to put a considerable sum of money.

So here are the banks that accepts over-the counter bills payment.

- BPI

- Metrobank

- BDO

- Asia United Bank

- Robinsons Bank

- Unionbank

Remember, whenever you deposit into your account, make sure to indicate your account number.

You can now enjoy investing after you funded your account. So play around and search around.

Tada! You are now a stock investor until you purchase your first stock, of course.

Happy investing!

P.S. Read books and articles prior to buying your first stock. Believe me; it pays to be knowledgeable about this kind of investment.

1 https://www.colfinancial.com/ape/Final2/home/open_an_account.asp

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.