Assuming you’re a reader of my blog, you know that I’m an engineer by profession and also a financial advisor in Sun Life at the same time. Just like you, I need to register as a mixed-income earner. I made this post so I can share with you the steps you need to do to get registered in the BIR.

Assuming you’re a reader of my blog, you know that I’m an engineer by profession and also a financial advisor in Sun Life at the same time. Just like you, I need to register as a mixed-income earner. I made this post so I can share with you the steps you need to do to get registered in the BIR.

READ: How to Renew Certificate of Registration BIR (Form 2303)

Table of Contents

What is BIR Form 2303?

BIR Form 2303 or Certificate of Registration is one of the basic requirements for individuals who conduct business in the Philippines. It gives you the right to print and issue official receipts. And also specifies the taxes you need to settle.

Why do I need to register my profession? I need to register my income to be able to renew my license as an insurance agent under the Insurance Commission (IC) and also take pride as a good taxpayer/citizen of our country.

What is a mixed Income Earner?

Mixed income earners acquire income from different sources such as employment, business, practice of profession, etc. Just like an example from Rappler, you are a mixed income earner if you’re employed and works as a part-time photographer.

The process I’m about to share is only valid for employed individual with part-time jobs or practicing their profession.

If you are employed in more than one employer, doing business, trade, etc. then the process might be different.

What are the Requirements?

The basic requirement I guess is patience so don’t forget to bring an extra of it throughout the process and put a smile on your face because you’ll be needing them badly.

Here are the requirements to get a certificate of registration in BIR if you are a mixed-income earner:

- 3 pcs. Form-1905 (Application for Registration Information Update)

- 3 pcs. Form-0605 (Payment Form)

- 3pcs. Form-1906 (Application for Authority to Print Receipts and Invoices)

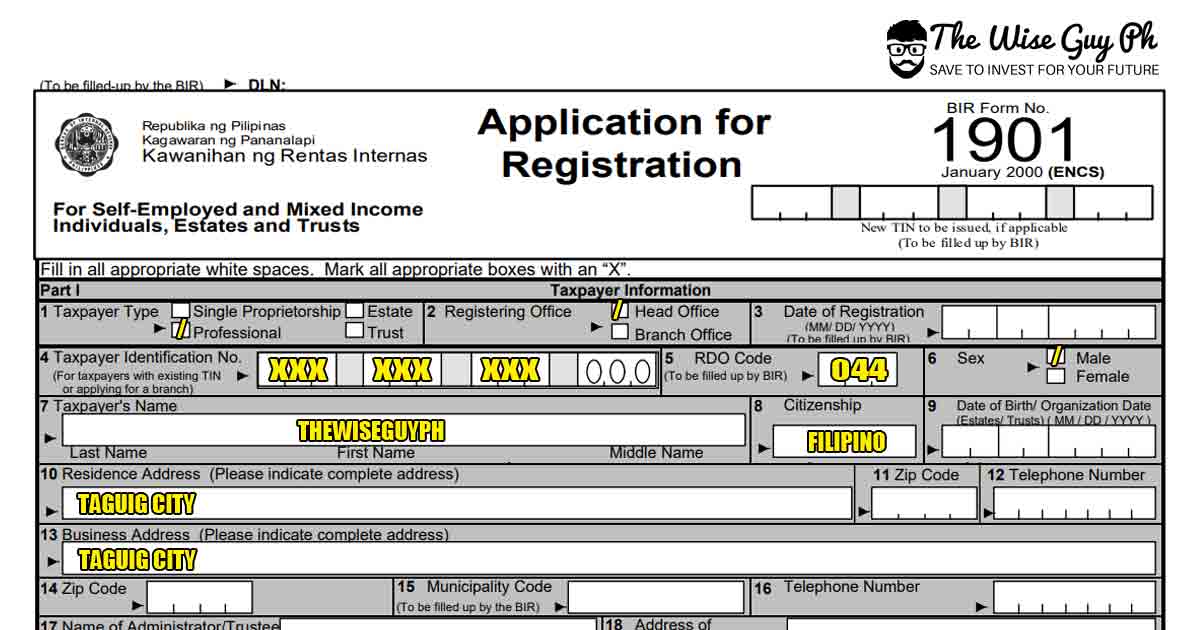

- 3 pcs. Form-1901 (Application for Registration)

- 2-columnar

- Original Certificate of Employment

- Photocopy of Valid ID containing your address

Steps in Obtaining COR or Form 2303 from the BIR

Check if Your TIN is in the Correct Revenue District Office (RDO)

This is the first mistake I made for the day. It’s actually the most common mistake. The correct RDO is the prevailing RDO where you will conduct your business and NOT where you obtained your TIN number or even the RDO of your current employment. Use form-1905 to transfer your TIN number.

I work in Kapitolyo, Pasig City that’s why my TIN is in RDO-043 but because I live in Taguig City, where I’ll register my business/professional service, I need to transfer it to RDO-044. The transfer normally takes 5 working days. So before you leave your old RDO, make sure to ask for a contact number you can call anytime to check if your TIN number is successfully transferred before proceeding to your new RDO.

Here are the steps to get a BIR Form 2303:

Ask for Applicable Forms

Go to your new RDO and ask the guard at the entrance for a queuing number along with form 1901, 0605, and 1906 all in a triplicate copy. Normally, you’ll just ask for COR application forms and they already know what to give you.

Pay Registration Fee at any Accredited Bank

Fill out the form 0605 and indicate that the payment is for the registration fee worth Php 500. Go to the nearest bank from the RDO (make sure they are accredited) and pay. Photocopy the bank validated payment forms because BIR will only need a photocopy.

Buy Two Columnar Books and Photocopy Your Documents

You can buy columnar outside the BIR just ask around the premises. I bought mine for Php50/book. Don’t forget to have a photocopy of your ID. After buying the columnar, have it stamped by the guard at the entrance and write the necessary information.

Get a Clear Sample of Your Receipt

Fill out the form-1906 or the Application for Authority to Print Receipts and Invoices and proceed to any printing press outside BIR (normally just a few steps away from the entrance). You’ll know it when you get there. I paid Php 1,500 for 10 booklets of receipts. Give the printing press about a week to process your request so for the meantime ask for a sample receipt under your name and computerized form-1906 (you can now ditch your handwritten form-1906).

Head back to BIR and Proceed to COR Counter

Remember that you already secured your queue number earlier, right? What will you do if your number is already passed? Proceed to the counter and explain what happened. Anyways, he’ll let you return to your line so don’t worry.

Submit and Get a Copy of Form-1901

The second to the last step is to submit the following: form-1901, photocopy of 0605, two stamped columnar, form-1906, certificate of employment, and photocopy of ID. You will get a copy of 1901 and again ask for a contact number. COR is normally ready after 3 working days but make sure to call the RDO first. Sometimes the signatories get busy so expect that it may take more than 3 days.

Get Your COR or Form-2303

After verifying, you can now get your form 2303 or the certificate of registration from your new RDO and your receipt from the printing press where you get your sample receipt.

Frequently Asked Questions (FAQ’s):

How much did you spend?

The total fees I paid were around Php 2,100 excluding my expenses for photocopying.

The time needed to Process the Registration

I spent about two weeks processing my 2303 that requires me to be there for one single day. Half-day to transfer and the other half to process the remaining steps.

Do I Need to Print the Forms?

No, just ask the guard to give you the forms you need but if you really wanted to bring your printed forms then why not.

READ: What to do next after using the e-BIRForms

*****

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

124 thoughts on “How to Get a Certificate of Registration from BIR: Mixed Income Earners”

Hi Sir, I’m currently under training and I’m supposed to take the licensing exam as an insurance agent this month. I wanted to process my COR, but does BIR accept certificate of training instead of certificate of employment as a requirement for getting COR? I want to process it even before my licensing exam.

Sorry, we don’t have an idea if that’s allowed. You may ask the BIR instead.

Good day! Wala po ba changes , kasi online payment na kasi sa insurance company namin, baka di na kailangan ang booklet for receipt?

The receipt stated here is the one you issue to the company for rendering your professional service. In your case, it is what you give to the insurance company.

Hi, I would like to ask I would like to ask where will i file my Mixed Income COR and Receipts. I have my Business Permit Registered in Bulacan. I am currently employed in Paranaque in a Hospital. I need to file COR and ATP receipts for becoming Insurance Agent, Real Estate and HMO Sales Agent. Im currently living as well in paranaque.. thank you

You may now file your taxes using eBIR form or in your RDO where you got your COR.

Hi Sir Federico,

Ask ko lang po, yun sister ko po compensation earner siya and then magbusiness po siya small canteen/ eatery as sole proprietor. Magpaparegister po siya as mixed earner sa BIR para maregister yun business nya. yun local residence address nya po (dun din po naka register yun TIN nya) at yun place address ng business nya, same CITY but different BIR RDO. Saan RDO po siya dapat pumunta para magparegister… Sa RDO kung saan nakaregister yun TIN nya o kung saan place address ng business nya (canteen /eatery). Thanks!

Btw, you get a COR to register another source of income aside from employment. When you apply for a COR, you have to transfer to the RDO wherein you will conduct your business/profession. As mentioned in the blog, you need to go to your current RDO to request for a transfer. Once transferred, you may now apply for a COR 🙂

Hi Sir Federico. I just want to know, how did you used your booklets (Official Receipts) Do you issue a separate invoice for your clients aside from the Provisional Receipt issued by the company. If you do, how much amount to you reflect there, would it be the commission amount. Please enlighten. I’m afraid I won’t be able to pursue this because of the pandemic, most of my prospects are having a hard time deciding to get a policy hence I was wondering how will I close the business in BIR if I don’t know how to fill up the booklets. Thanks in advance

Hi Merian. I am assuming you are an insurance agent. Btw, you issue provisional receipts to clients while you issue OR to the “company” every salary received. You may check it with your finance department where you are connected with. Thanks 🙂

Hi Sir,

I was coded last January lang, do i need to file COR this year? Or is it okay to file next year? Thank you

Hi Shiela. Ideally, you should get your COR as soon as you start operating your business or offering your services. So, yes, you should get it asap. Thanks 🙂

Hi Sir,

Can you share how you requested for the transfer of RDO? Can it be done online?

Hi Helen. As far as I know, you must personally go to your RDO for that matter. Thank you 🙂

Sir, question lang, i am FA before from 2017- early 2019, june 2019 i stopped being an FA, pero nakapag file pa po ako ng tax ko non. what will happen po sa succeeding quarters or month na hindi na po ako operating? ano po dapat ko gawin?

Hi Ashley. Even if you are not operating, you still have to file your returns. Better if you can go to your RDO and update your COR. Thanks 🙂

Thank you for this article Sir! It’s very helpful. I hope you can help me. I am a full time mom who recently became a licensed financial consultant mid year of 2019. Do I also need to apply or have a COR?

Hi Julie Ann. Actually, you need to secure it as soon as you started working as an FA regardless if you are a part-timer or full-timer. Thank you 🙂

Hi Mr. Suan, this is very informative. Thank you for this. I’m a part time FA. I currently work in Pasay (my fulltime job). Saan po ako magttransfer ng RDO? Sa residence ko ba or sa branch office ng SL team namin sa makati? Thank you. ?

Hi Cherrie. It’s good to know that you find my post informative. As per your question, you will be asked to transfer it to your residence. Thanks 🙂

Hello, Sir.

I started as a FINANCIAL advisor this May 2019 but working for the past 13 years here at Binan Laguna.Im currently living at Calamba City. My market as FA is Binan and Calamba. Pwede ko ba ifile Yung COR of mixed earners at Binan City kc dun din me work and registered RDO or sa Calamba where I lived. If Calamba I think I need to transfer my RDO from Binan to Calamba. Tama po b? Thanks!

They will ask you where do you live. Some will even look at your ID to verify. It’s relatively easy to transfer your RDO so don’t worry. Thanks

Hi Sir Federico. Im also a full time emoloyee and part time FA, can i ask, if is it ok na di na itransfer ung RDO ko from Pasay to Manila? Can i just get a new one for my part time? Or need ko po ipatransfer? Thank u! ?

Hi Donna. That’s the basic requirement to get the COR. You must really transfer it. Thanks 🙂

Your post is so really helpful! Concise and easy to follow. One thing I am not just sure of, what Original Certificate of Employment you are referring to? is it the one from my current employment?

Hi Monaliza. I’m referring to your secondary source of income. Thanks 🙂

Hi Sir, can i get a copy of the PTR in any cityhall or should it be city hall of my residence? And what are the requirements for securing ur PTR 1st? Thank u.

Hi Enzo. I got it from my city of residence. I just presented my examination results coming from the insurance commission and paid Php300. But it will depend on your secondary source of income. Thanks 🙂

Hi Sir,

Magtanong po kasi pinalalakad ko po yung sa Registration ng business sa BIR po kaso nakita nung nag aasikaso na sa Pasig daw at kailangan ilipat sa Taguig. . .matagal po ba yun ilipat?at incase mailipat na sa tamang code mabilis na po ba makakuha ng COR kasi po yung lessee ko corporate sila requirements nila OCR dapat submit ko bago sila magbigay ng full payment sa napag usapang deposit at advance sa space na uupahan nila. . .

Hi Ligaya. Yung paglipat ng RDO tumatagal ng 1 linggo. Tapos yung COR mismo halfday kayang tapusin yung submission ng requirements. Isang linggo ulit tsaka mo pa lang makukuha yung COR mo. Mag allot ka siguro ng 2 weeks at wag kalimutan tumawag sa RDO para magconfirm kung nailipat na ba ng RDO o ready to pick up na yung COR. Salamat 🙂

Hi Sir Federico. I need your advice. My TIN No. is registered as self-employed since I get it personally online prior to applying a job when I am just a fresh graduate; thus, my RDO is in the province.

When I started working at Makati, no transfer of RDO was done by my employer. Currently, I am a life insurance agent (Taguig) and also establishing a business (sole proprietorship) at Cavite.

Questions:

1. Is there a difference in registering as Life Insurance Agent and Business as sole proprietor? What forms are needed?

2. Do I need to transfer my RDO from the province to Makati (Employer) or to Taguig (Life Insurance) or to Cavite (Business)?

3. Can I retain my provincial RDO as the head while Taguig (Life Insurance) and Cavite (Business) as extension?

Hi Lian. You need to transfer your RDO to your place of residence or where you will conduct your business. Thanks 🙂

Hi Federico,

Can I use this when applying for a House Loan instead of looking for a co-borrower?

Hi Sheychelle. I am not sure. But isn’t a co-borrower is someone you share the loan with?

Hi Sir Federico. Applicable ba ‘tong process if I’m employed and I need Certificate of Registration for Grab business?

Thank you!

Ellen

Hi Ellen. Oo kasi mixed income ka na. Salamat 🙂

Hello, Sir Federico! Your blog is really really helpful po! It’s just my first time to apply for a 2303 and I think I just made a mistake. I applied for a 2303 on the rdo where my residency is the closest to (sta.maria, bulacan) , I’ve accomplished it already. It’s just days after that I’ve read that my rdo should be as to where my current work is located (quezon city). With that, if I transfer my rdo, should I process a new 2303 again?

Hi Rimo. Your RDO is where you conduct your business or residency. And it should not affect your current work. Thanks 🙂

Hi Sir Federico,

May idea po kyo kung magkano ang penalty sa late registration? Let say mga one year late po.

Thank you

Hi Erwin. No idea. Better if you can go to your BIR branch and have it computed. Thanks 🙂

Please help. My Cor is dated july 11, 2019. Kailangan ko na po ba mag file sa bir kahit hindi pa naguumpisa business. Ano po dapat ko ifile na forms at ano mga date. Thank you

Hi Maida. Yes, kailangan mo mag-file kahit na zero yung resulting tax due. Salamat 🙂

What if I’m still using the same RDO. Do I still have to apy 500 peso or I could just proceed in BIR and ask for my COR?

Hi Angel. The transfer of RDO is free of charge and Php 500 is for the application of registration. So you still have to pay this. Thanks 🙂

Hi,

I have an existing business in RDO of Dipolog City. My TIN is registered there while employed in Pagadian City, different RDO. Now I am resigning and applying to a new employer RDO in Quezon City, I am asked to submit a BIR FORM 1905 by my new employer. They provided me with a pre-filled up form and one item ticked for updating RDO. As far as I know, the RDO where my business is located should prevail. I have not informed my employer yet about my business where my parents are managing, but in case I need to submit 1905, should I submit it in new employer’s RDO or my business RDO? Thank so much!

Hi Thesa. The prevailing RDO would be the RDO of your business. But to make sure you can call their hotline or visit any RDO near you and ask them where your actual RDO is. Thanks 🙂

Hello! Nag-register ako sa BIR dati para makakuha ng TIN for freelancing, then eventually nagbalik sa pagwowork sa Private Company. Posible kayang nalipat na yung RDO ko (kung saan ako nagregister ng TIN since nagwork nako sa private company? Medyo nalilito kasi ako saan ako pupunta. And, hindi ko alam kung nakakuha na ako ng COR before. pwede bang kumuha lang uli nito?

Hi Jean. In my opinion, yung RDO mo kung saan ka nagwork dapat doon ka pumunta dahil duon na nagbabayad ng tax yung company mo. Salamat 🙂

Hi Sir,

Is the process above applicable also to grab business?

Please help.

Thank you very much.

Hi Mary Ann. I think it will be different for you because of the steps I shared are for mixed-income earners only. Just to be sure, please visit your BIR branch. Thank you 🙂

Hi,

I have existing COR as real estate agent but di ko sya nagamit. I am now licensed life insurance and non-life insurance agent, can I use that COR and OR even if I am registered in BIR and my OR shows real estate agent?

Hi Cris. You need to secure another one. Thanks

Hi, I’ve got a question about the printed receipts. I’ve registered my prof tax as an FA with Sun Life last Dec but I failed to have printed receipts up until now because of life changes.

I read that there’s a penalty fee for it since I have yet to print. But I also read I wouldn’t be able to use these receipts since I’ll be using the PR from Sun Life.

Would you know how much is the penalty fee and if I can just skip printing these?

Hi Jennifer. You just need to get another PTR because you have to secure it every year. I guess you haven’t got a COR yet? Because it’s one of the requirements before they can issue your COR.

For the penalty, I don’t have an idea, you may go directly to BIR for accurate computation.

Your OR is different from PR. You issue PR to your clients every time they make payments to you while OR is the one you issue to Sun Life every time you receive your salary.

Thank you 🙂

Gud pm po, tanong q lang po, about sa expanded, pwde po bang dumiretsyo ako ng bayad ng quarterly, kung hindi ako nakayad ng monthly??? Salamat po

Hi Lalaine. Ang alam ko penalty ka na once di mo siya nacomplete before the due date. You may call your RDO to make sure. Thanks

Hi sir, good am, nagtrabaho ako as an employee hangang april 2017, tapos nagbusiness ako, Aug 2017, kumpleto business permits. Kaso di ko na tinuloy, hanggang dec 2017 lang. Tapos fast forward, magaaplay na ako ngayon 2019 para maging employee ulit. Alam nyo po ba dapat gawin, kasi may open cases daw ako sa BIR, yung req diba sa employment ay dapat parehas ng employer RDO. Medyo madami na penalty ko at wala ako pambayad sa ngayon. Pwede kaya makapasok sa regular day job ng hindi ko muna babayaran penalty? Thank you

Hi Ms. Joanna. You may ask your RDO about your options and possible lowering down your penalties. Thanks

Hi Sir! May tanong ako. Nung 2013 nasa isang DOST Project ako dati sa UP pero sabi ng UP is wala kaming employee-employer relationship kaya nirequire kami magkaroon ng COR w/out really understanding what it is for. Lumipat naman ako ng work at binabawasan naman ako ng 10% tax pero wala akong finafile na kahit ano sa BIR. Ngayon gusto ko na sanang isara ang COR ko, ano pong dapat kong gawin?

Hi Shai. You may go to your RDO where you’re registered and ask them if what documents you need to secure. Thanks 🙂

Hi. Ask ko lang po, kasi registered as mixed income earner na ako bec of business ng family (ginamit nila tin ko). Then gusto ko magwork ulit sa isang company to earn my own money, requirement is transfer of RDO. Is it okay? Is it necessary? Itatransfer yung current RDO ng business sa employer rdo? Will there be any effect with the business? Thanks.

Hi Janine. I don’t think transferring your RDO will affect the business. To give you relief, you may kindly call or visit a branch and talk with the officer of the day. Thanks!

sir magpapa register po kmi sa bir kukuha po kami business permit ano po ba yung cor ? san po makukuha yun

Hi Sara. Sa BIR mo siya makukuha. Certificate of Registration siya. Salamat!

Hi,

I have COR in Mandaluyong RDO 41 as a Professional. Now with my new employer, I was asked to transfer to Makati RDO 50. I live in Mandaluyong and is home-based.

Can I opt not to transfer RDO?

Hi John. You may transfer your RDO. Ask the officer of the day of your current RDO for requirements. Thanks

One of the requirement of ltfrb for tnvs accreditation is BIR Ceritificate of registration (BIR Form 2303) transportation as line of business, my question is, do I have to go through the same process that you did? which I think is not as easy as 123.

thanks

Hi Myrna. I think so. Pero iba na yung requirements. Pang mixed income kasi yung sa post. Anyways, mukhang overwhelming lang siya pero madali lang naman. Usually, sa umaga walang pila. Salamat

Good day..ask ko Lang kung alam nyo po ang requirements kung para sa company ang kukuning COR?Please I need answer..

Hi Annie. I think you need to go to your RDO and ask the officer of the day. Thanks!

Hi Sherwin! Thank you for your post. This is super helpful especially for people like us who needs to be multi-income earner, hahaha! I am currently employed and also a practitioner of my profession. I’m just wondering I can use my PRC license or PTR in exchange for the Certificate of Employment, since I will become a mixed-earner because of the practice of my profession while being employed. If not, what options do I have? Thank you in advance.

Hi Nolie. I’m not Sherwin, though but I think you can call your RDO to better assist you with this. Thanks!

Hi Sir,

I would like to ask regarding our franchisee’s COR. It’s been more than a month and still we can’t proceed with our POS permit application. Our staff went to RDO 099 and still nothing happened. We badly need your help. Thank you

Hi Shelly. Sadly, I’m not from BIR so I cannot extend my help. This blog post is about how I was able to get my COR hoping that others can also know how to get theirs. Thanks!

Thanks so much for this guide! I’m at the BIR Taguig now and it’s easier to follow these instructions kasi malinaw and on point 😉 Thanks much talaga!

Hi,

May I ask what are the things/taxes/fees that we need to pay or update from BIR after acquiring the COR?

They have issued me COR but did not apply for authority to print receipt.

Hi Melody. You may kindly look on your COR it’s actually written there. The requirements are different on what you choose and what type of taxpayer you are. But to give you an idea it may be a combination of the registration fee (per annum), 1701Q, 1701, 2551, and so on. Thanks!

Hi! Thank you for sharing this. Very helpful especially to people like me who is about to start a career as a life insurance financial advisor of Sunlife.

Hi Quenne. Thanks for the good words. Have a nice day and hopefully we can share our best practices someday. Thanks!

Do I need to file sa BIR even if I do not have any income thru out the year from the start na naregister ako dahil pinalakad ko lang COR at OR ko sa isang service provider. At umalis ako as real estate agent after almost a month na walang benta. Also, I never received my allowance because of incomplete requirement. That was last year 2017. May new employer na kasi ako this month and isa sa requirement is to update RDO. Pagpunta ko sa BIR, they give a form for transfer out for closure. Someone told me that there are penalties. Wala naman ako idea sa filing since then.

Hi Erickson. What I know is that you are still required it to file even if the tax is zero. Because you won’t pay the tax you need to file it in your RDO. The penalty is 1k per month, just check it with your RDO to be sure. I hope you can settle it the soonest time. Thanks!

What kind of Receipt ‘yung pinagawa niyo po as Insurance Agent? Professional Tax Receipt (PTR) or Occupational Tax Receipt (OTR). I am confused kasi. Thanks!

Hi DJ. It’s PTR. Thanks!

Hi Fed, we are in an almost the same situation but I got first my self-employment as a consultant, before I became an employee. I am currently registered as self-employed in RDO 089 (ormoc city). What I am concerned about is that my new employer’s RDO is not the same with my current RDO. I am a home-based employee of a company under RDO 080(mandaue) Do I need to change anything?

Hi Niva. As per my understanding when I did mine, the prevailing RDO is where you are a residence or where you will conduct your business or professional service. So if you live in Ormoc then you don’t have to transfer your RDO. Anyways, you will consolidate your income tax after the year end. Thanks!

Hi! Newbie freelancer here and I find your post super helpful, thanks! I used to be a registered engineer; but haven’t renewed since my license expired last 2016. (not a big fan of CPD bill) Anyway, I’m considering to do freelance consultancy and research services. I’m wondering if I still need a PRC and/or PTR when I register as mixed earner. Would you happen to know? Thanks in advance!

Hi Carly. I’m not also a fan of CPD bill too many points to acquire hehe but to answer your question. I honestly do not have an idea about your case. What I do know is if you will register as a professional then you must present something to prove that. In case your you would like to do freelancing but is that related to you being an engineer? If so, you may be required to have a PRC license for that. But just to be sure go to the nearest BIR in your area and ask the officer of the day. Thanks!

Hi Suan. As a mixed-income earner(as professional and sole proprietor), do I need to pay income tax quarterly?

Hi Butch. Yes, you still need to file the quarterly income tax using the 1701Q form. You may also need to file the 2551Q, kindly refer on your COR. Thanks!

Hi. I’m a full time Mom and currently applying as an insurance agent (non-life). One of the requirements of this company is the COR from BIR. Is this really neccessary? I’ve been unemployed for more than 5 years and I’m not even an insurance agent yet..

Hi Elaiza. That’s one of the requirements to process this is a certificate of employment. You must secure this first. You may call the BIR in your area to confirm this to you. Thanks!

I live in Valenzuela but I work in Makati. Does it mean I won’t be able to register in my RDO in Makati since my ID address is in Valenzuela?

Hi Irvin. The question is where do you reside or where do you intend to offer your services/products? If you reside in Valenzuela then you must file it there. You gonna file everything in that RDO like 2551Q, 1701Q, 1701, etc. whichever applies to you. This is a way of BIR to monitor businesses or entities subject to tax collection and such for easy monitoring. BIR is not yet centralized (I don’t know if they will ever will) but for now, we must bear with them. Thanks!

Good read, Federico! Question, is BIR allowing an authorized person to process this on another person’s behalf?

Hi. I’m not sure about that. You may kindly call your RDO to properly help you with that. Thanks!

Question Sir Federico. Instead of 1906, the officer asked for ATP from a printing press. Why? Thank you so much 🙂

Hi Giulia. Is ATP means Authority to Print? If yes, they are just the same thing. Fill out the 1906 form first and proceed to the printing press. That’s what I’ve done before and then from there, you will get a printed copy of 1906. I think you missed the part of going to the printing press first. Thanks 🙂

Hi, I recently joined Sun Life as a financial advisor. I don’t have any other employment this year and do not have a sole proprietorship business. So what applies to me is purely professional services as a Licensed Insurance Agent . In this case, will I be under the ‘mixed income earner’ category? Also, may I skip the part of Form-1906 if I do not issue the invoices and official receipts because my branch/unit will do that? I will only issue the provisional receipt when I receive the premium payments. Your advice would be much appreciated. Thanks!

Hi Ms. Gigi. You’ll still have to register as a professional and not as a mixed-income earner. Receipts and invoices are needed. Why? Because your registration as a professional is under your name. Meaning, you still have to get the receipts so you can issue it to Sun Life stating that you’re being compensated for your professional work as a life insurance agent. PR is for the company use while your official receipt is for acknowledging that you’re being compensated by Sun Life. Thanks!

Thanks for the very helpful answers. You mentioned that an original certificate of employment is also required. In my case where I will register as a professional, can I skip this? Or will I get this certificate from Sun Life? Thanks.

Hi Gigi. Certificate of employment should be given to you by the SSA in your branch. You’ll receive this together with your contract of employment. If you haven’t received it until this day, you may contact your UM or your SSA so they can expedite this. And yes, original COE is needed. Thanks!

Hi, would just like to ask if im a non life insurance agent and at the same time having a wholesaler business (sole proprietorship), will i be considered a mixed income earner? I am not employed and both are freelance businesses.

Hi Kennard. Btw, those are not freelance businesses. If you are a non-life insurance agent then you must be registered as a professional at the same time you must also be required to register as a sole proprietor for your wholesale business. A mixed-income earner is any of the two: local employee, professional, and sole proprietor. So it means that you fall into that bracket. I honestly hope it helped you. Thanks!

Hi Sir, since being employed and registering as a professional will make me a mixed income earner, how will I pay for my taxes? Will my employer continue to pay for the taxes from my salary and I will pay the taxes derived from my profession separately? Also how will the filing of income tax will go since I have two sources of income?

Hi Jayson. Btw, I can only talk based on my experience. Just to answer your inquiry, your employer will still do what they usually do. They will deduct withholding tax and file your ITR. So what now?

You’ll consolidate your earnings from being employed and as a professional at the end of the year and file a separate ITR stating that you are a mixed-income earner. That’s it. I hope it helps.

hi Sir, I have the same situation as with Jayson as a mixed income earner. You mentioned that we just have to “consolidate your earnings from being employed and as a professional at the end of the year and file a separate ITR stating that you are a mixed-income earner.” How is this done? What form do I need to submit where I can state that I am a mixed-income earner? I really am confused with all of these. Thank you!

Hi Glenn. If you register your business or secondary source of income early this year then you must file a 1701Q every quarter paying the applicable tax rate for that secondary source of income. At the end of the year, you need to consolidate all your income using 1701 form stating your main source (employment) and secondary source. Thanks!

Hi! Can i ask you? Are you a life or nonlife insurance agent?

Hi Rojielyn. I’m a licensed life insurance agent 🙂

Hi,just wanna ask. I’m currently employed as a contract of service (COS) employee in a Govt Owned and Operated Corp.,I need my COR so I went to BIR and filled up my forms 0605 and 1901,attached my contract and assumption of office. But I was told by the teller that I needed an Occupational Tax Receipt from the City Hall. I asked my fellow COS friends if they were tasked to do the same,and they said no. Is this really a requirement and do you have any idea how much this is? Hope you could help me out coz my papers are still pending. Thank youuuu!

Hi Ren. I believe you are referring to professional tax receipt. This is paid in the city hall for Php 200 (I paid it last January so I can renew my professional license). But I was not required to have it when I’m processing my COR. You can also ask the officer of the day in your RDO to clear this to you. Thanks!

Hi Sherwin, do I really have to transfer my RDO from the location of my employment to the location of my business? As per my employer, I cannot transfer my RDO as long as I am still employed here (I am employed in Makati and my business in Bulacan, by the way)

Hi Ciello. That was the same thought I have until I decided to go to my RDO (location of my employment). Even my friends are advised to transfer their RDO to either their residence or to the RDO where your business is located. This is the first requirement you need to do prior to getting your COR. You may visit your current RDO and ask for their assistance. Don’t worry because as per BIR it won’t have an effect on your current employment when you do the transferring. I hope this helps.

hello po..kung mag transfer po ng rdo, kelangan ko pumunta sa office ng rdo na nag issue ng tin ko?or pwede din dunmag process sa kung saan ako mag transfer?

Hi Wendy. You have to process it in your current RDO. Thanks 🙂

Hello when i transfer my rdo do i need to go bir in personal? Or it is possible to ask some to transfer my rdo?? Thanks

Hi Leah. Someone told me it is possible if you have SPA. Thanks 🙂

Hello Sir!

I am also a financial advisor in Sun Life ?

Just wanna ask. Do I still need an accountant’s assistance to obtain my COR?

Hi Mel. It’s fairly easy. You can do it on your own. But if you’re really busy then you may delegate the task to an accountant. Thanks 🙂

Did you ask your employer to sign the BIR 1901 / 1905 or have you bypassed that?

Hi Sherwin. You don’t need their signature when you apply for a COR. As per BIR (I ask them last time), you have the right to practice your profession or start a business without their approval. Well, that’s of course if it doesn’t create conflicts with your day job.

Actually, this is my problem because I applied for a COR and they made me a pure business income earner. So I have to go back to change that to mixed-income earner and for that, they tell me I need a 1902 from my employer. However, my employer hasn’t really been cooperative with me so I’m stuck.

This coming filing season, can I just file as if I’m already a mixed income earner even though I’m registered as pure business earner?

Update:

So I contacted my HR and she says she can’t give me a 1902 since she can’t process that because that should have been done by my previous company. Since I was already registered before, they can only give me a certificate of employment as proof. Idk what to do now.

Hi Rose. To my understanding, you get a COR to register a specific activity e.g. freelancing, business, offering professional service, etc. You just need to file for the things you see on your COR like the annual registration fee, percentage tax, 1701Q, 1701, etc. But to be sure you may talk with your RDO.