A typical Filipino family will regard life insurance as an expense that they simply do not need. While it is true that life insurance is an expense. But thinking of it now, among all the expenses it is the only one that will turn into an asset when you die, God forbid, for whatever reason.

You may imagine it, maybe, as a time deposit that maturity comes when you die.

Or some may even compare it to placing money in the bank. You put big capital in exchange for small interest.

But getting an insurance plan is the complete opposite. This is because you are just putting the interest (premiums are small) in exchange for the capital (death benefit).

READ: Sun Maxilink Prime | The Best-Selling VUL Plan From Sun Life

How much would Php 1M insurance policy typically costs for a millennial? Php 24k per year maybe or even pay it per month for only Php 2k.

Certainly, no other plans can turn your Php2k into millions.

So the question is “Do you want to leave Php 1 Million or more to your family when the time comes?”

Undoubtedly, your answer is like the rest of the population. Yes, of course, that’s the very reason all of us are working this hard, right?

We all have the same line, “Someday I will give my family a better life.” And this is no wonder given the fact that Filipinos have strong family ties.

READ: Sun Life is the Top Life Insurance Company in the Philippines 2019

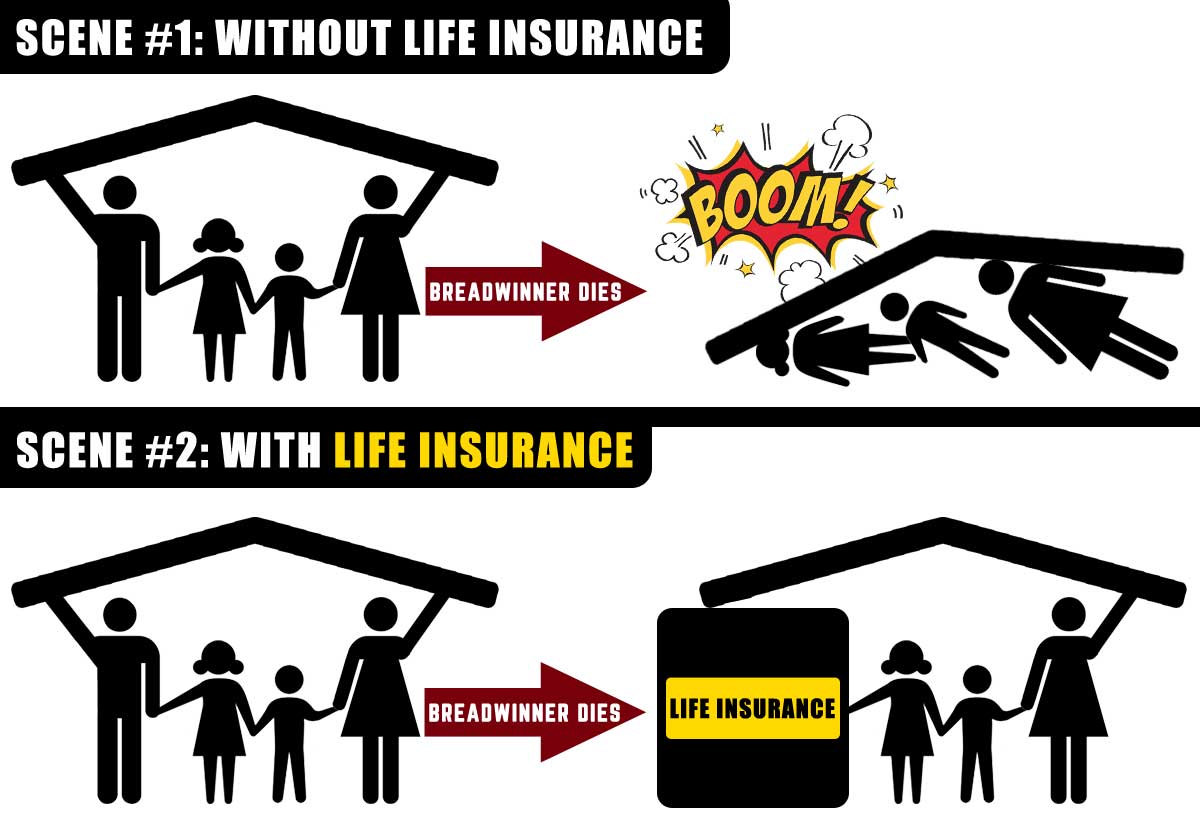

But what if, just what if, that someday never comes?

That’s when life insurance replaces your someday into today I will give them a better life.

Let’s talk about your SOMEDAY? And how you can make your dreams come true while securing the dreams you have for your family?

Contact Us:

Engr. Federico Suan, Jr., CIS

Financial Advisor

0917-775-8352

www.thewiseguyph.com

Ton is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.