Being a credit card holder, knowing how to maximize its uses is an advantage. For example, you can get the best deal out of your credit card while building a good credit score. In the Philippines, BPI is one of the leading credit card issuers. If you have a credit card with them, it’s best to know the possible charges it may incur, such as finance charges, cash advances, BPI SIP loans, and other bank charges.

READ: BPI Credit Card | Why Getting a Secured Credit Card a Good Choice?

Table of Contents

Which is better Finance Charge or SIP Loan?

I was on Reddit when I chanced a post about BPI credit cards. He shared that whenever he cannot fully pay his balance, like during the Christmas season, he converts it to BPI SIP loans. And I was like, why do you have to convert it? So I browsed for more, and he said it was to save on finance charges.

Again, it left another question. Can you save on finance charges in that way?

BPI Credit Card Calculator

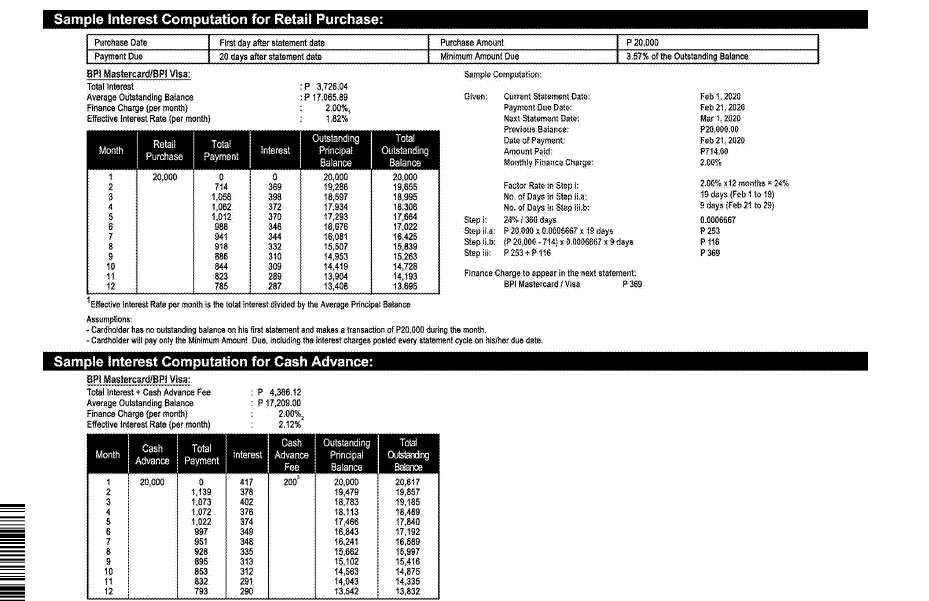

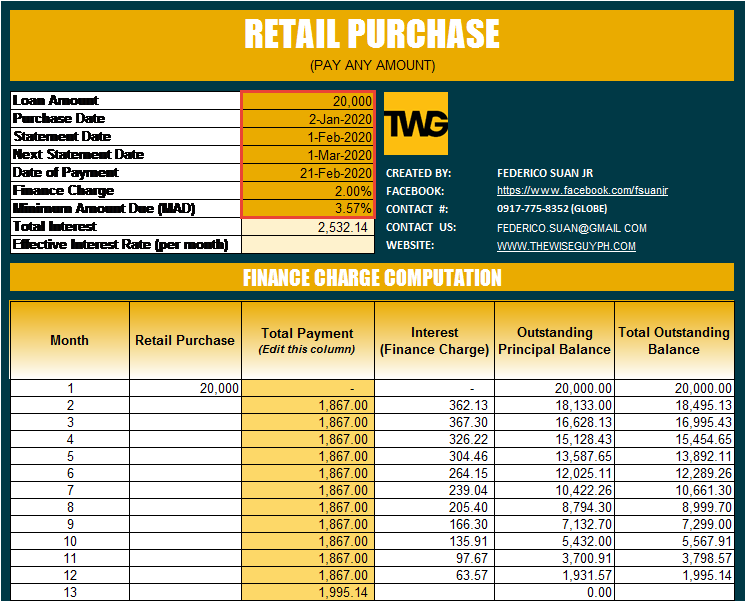

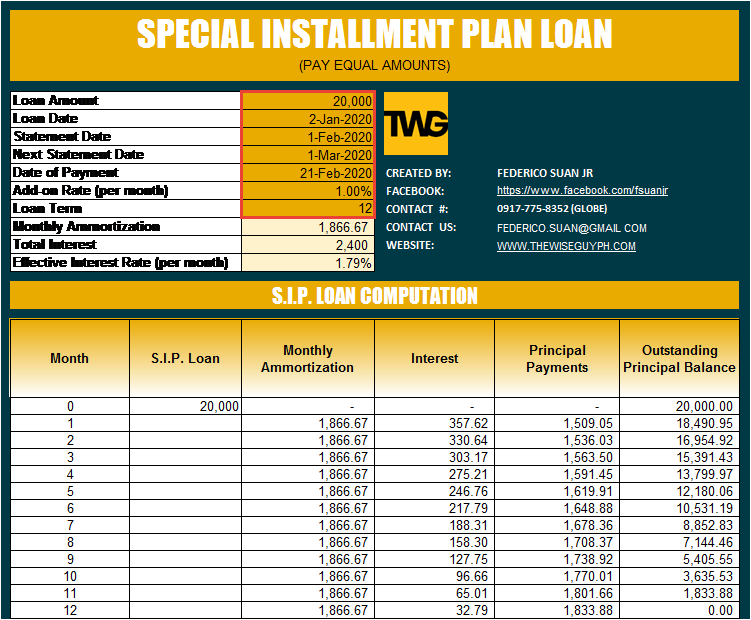

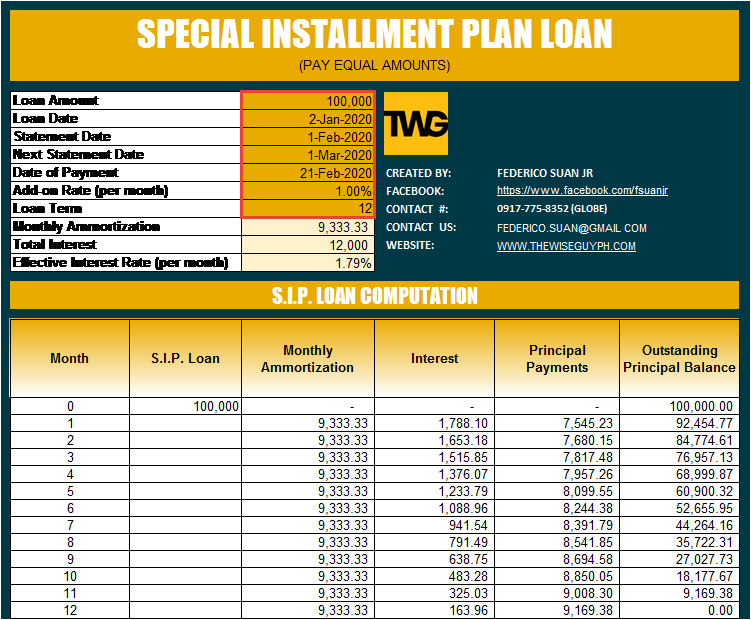

I made a calculator using the examples on a BPI’s billing statement. I wanted to compare the BPI SIP loan’s interest and finance charges using an Excel sheet. While at it, I also added the computations for a cash advance, personal loan, and car loan to my Excel file.

Finance Charge vs. SIP Loan

After I created the calculator, I realized that you save money if you convert your retail purchase to a SIP loan. But in some scenarios, going for a finance charge is desirable.

For example, if you have a total retail purchase of Php 20,000 that you want to pay for 12 months, the finance charge will only be Php 2,532.14. But with a SIP loan, the interest and conversion charge will amount to Php 2,700. So for this scenario, the finance charge is more desirable.

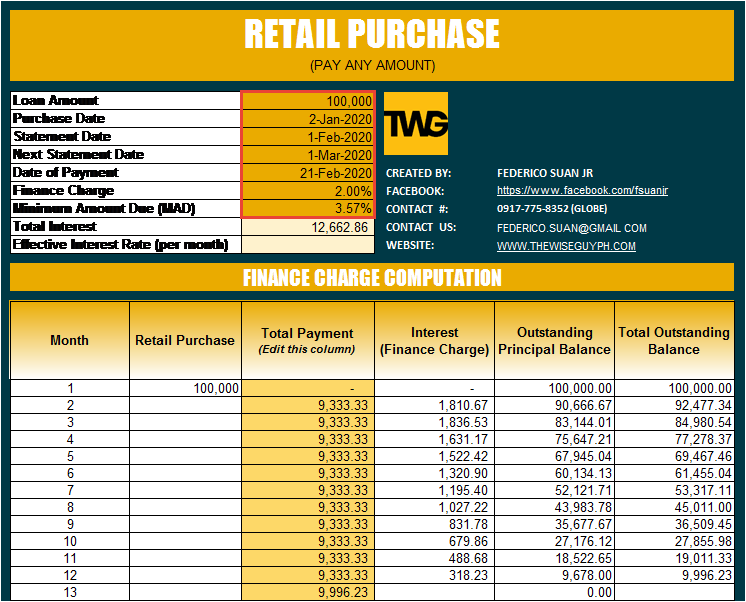

For another example, let’s make the retail purchase of Php 100,000 payable for 12 months.

Now, the finance charge will be Php 12,662.86 while the interest for the BPI SIP loan is only Php 12,300 (including the service fee of Php 300). In this case, a SIP loan is more desirable.

From the example above, we can deduce that a finance charge is a better option in some cases. It depends on the amount of retail purchase and your chosen term.

Summary:

If your retail purchase is below Php 50,000 and payable for up to 12 months, the finance charges will save you more money. On top of it, it’s less hassle because you don’t have to call the BPI hotline for the conversion.

And if you wish to pay your purchase for 3, 6, and 9 months, a finance charge is better, regardless of how much your retail purchase is.

Let’s wrap it up!

It took me several hours before I deciphered and created a computation similar to the examples in BPI billing statements. That is because it’s a rare topic, especially when most of us pay our dues on time.

But what if there comes a time when our expenses suddenly surge? Using our BPI Calculator, you can easily compare which interest rate is better.

Don’t get me wrong. I’m not encouraging you to avail a SIP loan. It’s still always best to pay your dues in full.

What we shared with you is just in case you need it.

*****

Get Your Copy NOW!

Get it for as low as Php 149 only. You can use this calculator to compute the retail finance charges, cash advance interest, BPI SIP loan, personal loan, and car loan.

This small amount will help us grow. So please support us so we can continually create valuable articles and financial tools.

*****

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.