Updated: September 20, 2022

8.7% or more than 4 million Filipinos are unemployed as of April 2021. On the other hand, the underemployment rate rose to 17.2%, equivalent to 7.45 million. The growing need for life insurance, especially during this pandemic, opens great opportunities to unemployed and underemployed Filipinos.

This additional job is for you if you want to supplement your income for your family’s needs. It is also a perfect job for those looking for a career with purpose, independence, and freedom.

Table of Contents

Get to know Sun Life?

Sun Life is the first and the oldest (127 years) insurance company in the Philippines. It also has more than 5 million clients as of 2020. So if you are up for the challenge of helping others, you are in the right place.

READ: Sun Life Remains the Top Life Insurance Company in the Philippines

Sun Life was established in 1895, three years before the Republic of the Philippines was founded. So, Filipinos can enjoy the humanitarian benefits of insurance.

Why Become a Sun Life Financial Advisor?

Aside from the attractive compensation package, here are some reasons you should join Sun Life.

Earn Unlimited Income

Have you ever felt salary-restricted when shopping in a mall? How about eating out and being freaked out by how much a single dish costs? Ughh, your dream vacation is on hold because of a limited budget?

Did you know that Financial Advisors get to write their paychecks?

Similarly, if you pursue this career, you may get to buy your wants, eat without looking at the price on the menu, and take a vacation without breaking your budget.

I bought my first car using my earnings as a Sun Life advisor. It is something I need to service my beloved clients. Now, I’m looking forward to buying my dream car.

I earned my first million. Most advisors will say that they bought a car, started a business, made their first million, and so on when they joined Sun Life. I guess it’s possible if you’re working hard in a great company. It’s genuinely a fulfilling job when you can get the things you deserve.

Work on Your Most Productive Time

Are you tired of waking up daily at 4 am to prepare for work at 8 am? How about the ever stressful traffic from home going to your office? I know it’s frustrating to brave EDSA to arrive late.

But once you join Sun Life, you’ll not be required to wake up early. In other words, you can rise from bed at 9 am and still be productive.

(But of course, if you can still wake up at 4 am, that’s even better.)

Enjoy Professional Growth

Sun Life offers financial assistance to further your competency. They also provide FREE training and seminar, so you can be confident in answering your clients.

Regardless of age and tenure, if you perform well, you can be promoted.

I’ve seen as young as 22 yrs old being promoted to unit manager, making him the youngest unit manager in Sun Life’s history.

Who knows if you’re the next in line?

Our picture while enjoying our all-expense paid trip by Sun Life for three (3) days and two (2) nights in Shangri-la Boracay.

We did not even spend a centavo on this trip on food, transportation, and accommodation.

Get Rewarded for Your Efforts

Don’t you love to be recognized for your hard work?

No matter how big or small the battle, Sun Life knows how to recognize it through simple prizes like jackets, certificates, cash incentives, medals, trophies, and even one of your dream vacations like a trip to Boracay, Bohol, Japan, the Caribbean, etc.

On top of that, Sun Life is very generous in giving bonuses you won’t usually get by working in an office setup.

A Business of Helping Others

What I truly love about being in this career is the power vested in us to change the lives of our clients.

Commission, incentives, and bonuses are just like icing on the cake. Above all, nothing beats the happiness that comes from securing a family.

The simple “thank you” that we receive are a motivation that keeps us going no matter how challenging it might get.

Always remember this, financial advisors’ work is not just about selling life insurance and collecting payments. But to be integrated into the journey of clients toward financial freedom.

How to Become a Sun Life Financial Advisor

I’m glad you are interested in becoming a Sun Life financial advisor. Keep in mind the steps and procedures of regular employment are different.

Nonetheless, I can guarantee that it will be worth it.

So here’s how to become a Sun Life Financial Advisor.

1. Fill Out the Form

Are you excited to be a Sun Life financial advisor?

Kindly fill out the form at the end of this article and put the complete and correct information.

It is not your regular job.

You’ll be dealing with money from people you may not even know personally. So we must get to know you, especially since you’ll be part of our team. We will also ask you to upload your updated CV or resume for the same purpose.

Once you submit the form, you have read and understood this article. Once you submit the form, we will enroll you in the online training.

2. Pay the Examination Fee

As mentioned earlier, this is not your regular corporate job. Here, you will get licenses to sell insurance products as mandated by the insurance code. There are two licenses you need to secure: traditional and VUL.

So you must pay Php 2,020 for the two licensure examinations held online, at the Insurance Commission, or in a remote location (Sun Life BGC Centre).

I expect you to settle your examination fee immediately. You can pay it by sending it to Sun Life’s bank account.

Bank: Bank of the Philippine Islands (BPI)

Account Name: Sun Life of Canada (Phils) Inc

Account Number: 0993015679

Don’t forget to screenshot your payment as proof and send it to me.

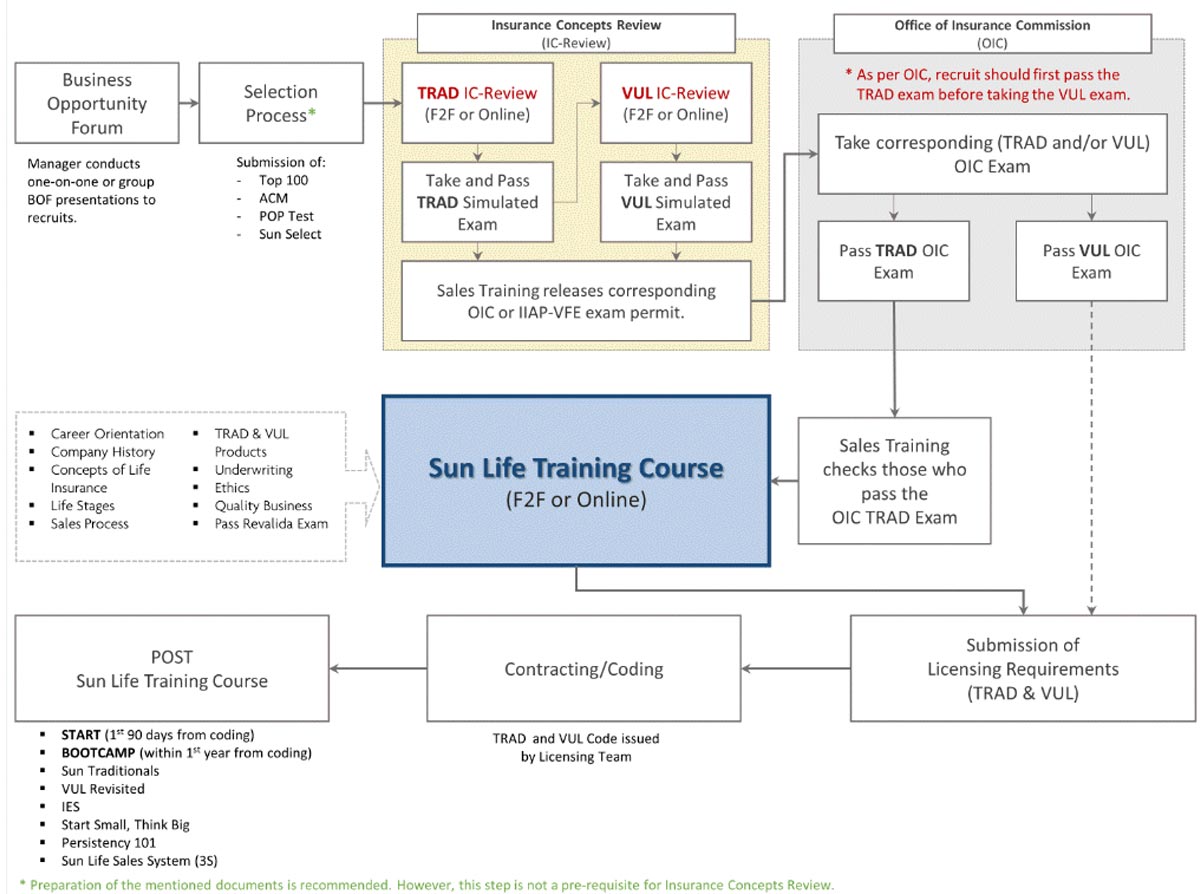

3. Insurance Training

You’ll be enrolled in online training to equip you with the general concepts about life insurance that you need for your IC exams.

At times, the unit manager trains you to speed up the process. The online training is available any time of the day. You can finish this in one or two days.

Once completed, you’ll receive a certificate. By then, we can now ask for an examination schedule.

4. Completion of Requirements

Most of the requirements needed are very easy to secure except for one, i.e., NBI clearance. So set an appointment as early as possible, or you may opt for home delivery if you’re only for renewal.

I divided the requirements into two sets so we can be systematic.

Requirements (Set A)

- Soft copy of ID picture (preferably in the yellow background)

- Latest Income Tax Return (ITR)

- TIN Card or any BIR document indicating TIN

- Proof of SSS (any record showing SSS number like payslip, company ID, E1, etc. except UMID)

- Payment of Exam Fee (Php2,020)

- Insurance Concepts Training Certificate

- NBI Clearance

- Photocopy of clearance from employer (if currently unemployed)

- Permit to Sell from management (if government employee)

You have to finish these requirements while waiting for your examination day. You have two (2) weeks before your examination. That’s enough time for you to review for the exam and complete these.

Requirements (Set B)

- Advisor Contracting Manual (ACM)

- Photocopy of Exam Results

- Licensing Fee (Php3,030)

- NBI Clearance hardcopy

- SLTC training certificate

- 2 Documentary stamps to be affixed in CA forms

- 2 (Trad & VUL) filled out and “notarized” with documentary stamp Certificate of Authority (CA) Forms.

After your examination, the Insurance Commission releases the results in 1 to 2 weeks. You’ll use this time to finish the second set of requirements, including the second online training, and to list your prospects.

5. IC Licensure Examination

You’ll have to take and pass the licensure examination by the Insurance Commission. It’s a 50 items test per license, and the passing mark is 70%.

Don’t worry.

There is a review session so you can pass the exam on your first try. It will be a waste of money and time if you fail.

I bet you don’t want that.

6. Pay the License Fee

You have to pay Php 3,030 using the same bank account of Sun Life for your license.

Like before, you have to screenshot the confirmation to serve as proof of payment.

7. Contracting and Coding

Good news!

You can now sign the contract online.

Once you understand the benefits and guidelines of the company, you can now sign the contract.

By then, we can now request your code.

It will serve as your identity in Sun Life. You use it in every transaction you have while representing the company.

8. Protect and Serve

You’re now ready to secure the future of your friend, family, and even strangers. It is because you know they need life insurance.

They need you to help them.

That is something you have to understand.

You will be there to show the value of life insurance. But it doesn’t end after the sale because it’s just the start of your commitment to your clients.

Learn More About Our Team

Our team is called “Acqua di Gio Unit.” You may watch my Youtube video to learn why I picked this name.

Who is Federico?

My name is Federico Suan, Jr., an electronics engineer and the founder of TheWiseGuyPH.

I joined Sun Life in the hope of creating more income for the growing needs of my family since my father died in 2015.

I am one of the youngest successful financial advisors in one of Sun Life Branches in Makati, despite being timid, lacking the right market to offer my services, and having no sales experience.

You may wonder how I made it, right?

My need during that time is more significant than my fears. So I just have done what I have to do.

Shy? I joined several activities and communities wherein I practiced my social skills.

No market? I created my own thru Facebook and Google marketing.

No sales experience? I read books, watched sales techniques on youtube, and enrolled in several workshops to upskill myself.

And if I’ve done it, then there’s no reason for you not to.

You might surpass me, and I’ll be happy to be part of your success.

Meet Our Team

Our team is composed of engineers (just like me), accountants, hoteliers, salespersons, professors, government employees, etc., who are hard-working and very passionate about helping others.

What are the Qualifications?

The qualifications I’m looking for in an advisor must empower the team. So before you fill out the form below, please assess yourself if you’re fit for my team.

Some are non-negotiable, so we will transfer you to another unit manager if necessary.

So here are the qualifications I’m looking for:

- 25 to 40 years old

- Living (willing to work) in NCR

- Open for additional job

- Reachable via messenger, text, call, etc.

- A college graduate is preferable but not needed

- A former student leader is a PLUS

- Management experience is a PLUS

- Sales experience is a PLUS

Being a Sun Life financial advisor is an additional job. Unlike your day job, you’ll not get a salary. Instead, you will get commissions, bonuses, incentives, etc., depending on your productivity.

Aside from it, I expect you to be reachable via messenger, texts, and calls when needed. It’s just that I want alignment with our goals and direction. Open communication will help you achieve your goals and eventually help the team.

The last four qualifications are negotiable.

And if you qualify from those might mean you will be an asset to the team. Of course, I am looking forward to having an advisor with strong leadership skills.

Lastly, it’s not listed above, but it is a crucial value to possess, and that is obedience. This journey is never a walk in the park. You may encounter struggles and numerous rejections in this job, but never lose hope and remain obedient.

I have had a fair share of difficulties in this career. I have overcome them by being obedient to my manager.

Thus, you must be obedient to me as your manager, and I’ll assure you of your success in this job.

Join Our Team Today!

So are you ready to jumpstart your career in Sun Life? Fill out the form below, and we’ll contact you within 24 hrs. See you soon 🙂

Frequently Asked Questions (FAQs)

If you want to be a Financial Advisor, you must ready Php 5,500.

You can finish the process in less than a month, but it will still depend on the time you are willing to spare it.

A financial advisor earns from the commission of selling insurance plans. The earnings will depend on what type of insurance plan you are selling.

The quota or validating requirement is very easy to achieve. It’s the amount you don’t want to get because it’s too small. If you join our team, we’ll help you unleash your maximum potential.

Aside from the commission, Sun Life has a lot in store for you like HMO benefits, car loans, house loans, monthly bonuses, local and international trips, provident funds, and so much more.

Yes, part-timers are welcome to join. For instance, I joined Sun Life as a part-timer and eventually became a full-time advisor. Aside from compensation, self-development, and a stress-free environment made me decide to go full-time.

No, because the license issued by the Insurance Commission is only binding inside the Philippines.

*****

Disclaimer: I am a proud Sun Life Financial Advisor who can help you in your journey towards financial freedom. However, my posts only reflect my personal views and opinions.

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.

68 thoughts on “How to Become a Sun Life Financial Advisor in the Philippines”

Hi Federico! I’m interested to join the team as a part time agent. I would like to ask do I still need to prepare 5,500 even during pandemic. Coz, I think licensure exam has been postponed? Also, I’m living in Makati however, I am stranded in our province. Could I still join? I am also turning next year on January, would that be a problem if I join now? Thank you. God Bless and More Powers!!!

Hi Claudine. Yes, you are correct there’s no examination now. The good news is that the IC is now issuing temporary insurance. The process is practically the same less the examination. So you just need to prepare Php 3,030 for the license.

Please kindly fill out the form if you are serious about being part of my team. Thanks 🙂

Hi there, I am very interested. Kindly send me the requirements. Thanks!

Hi Lovely Rose. Please kindly fill out the form above and send your resume to federico.suan@gmail.com. You may also reach me via FB. Thanks 🙂

Hi Sir Federico, I live in Bulacan and currently working in Quezon City. Can I still join your team? I want to be a part-time financial advisor.

Hi Gracey. I have an advisor in Bulacan. Don’t worry, for as long as you are willing to in Makati; it doesn’t matter. Let’s connect on FB or email 🙂

Hi Federico, I want to become a Sunlife Financial Advisor. I have been unemployed for about 5 years because I focused in helping my parents in our family business. Do I still have a chance po ba if mag apply ako as a Financial Advisor?

Hi Ma. Dennisa. Yes, you are welcome to join us here in Sun Life. We offer training that can supplement your existing skillset. And of course, we’ll also guide you in your journey here with us. Please connect with me on FB to know more. Thanks 🙂

Add me on Facebook: Federico Suan, Jr.

Alright sir. Thank you. I added your fb na po.

I am an ofw here in sg and ‘will be going back for good (just waiting for lockdown to lift up ?). I want to be a part of your team if i may. Hoping to talk to you about it.

Hi Jun. Let’s connect soon so I can share with you how Sun Life can add value to you and your family. Thanks 🙂

Greetings!

I would like to be part of your team. I am goal oriented and I love to earn more money and helping people too.

thanks and regards,

Mary Joy

Hi Mary Joy. We also want you to be on my team. I’ll email you for details. Thanks 🙂

Hi Sir Federico. I just purchased a new policy, can I also apply as an FA. Thank you very much. You are a big help 🙂

Hi Cindy. Even if you don’t have you are still welcome. But it’s a plus if you have. Just in case you would want to pursue this purposeful career please fill out the form above. Thanks 🙂

Hi I would like to join your team.

Thank you

I would love to have you on my team as well. Let’s talk more about this over an email. Thanks 🙂

Hi Federico, I’d like to join your team on a part-time basis. Please get in touch with me. I’ve already passed the trad and variable insurance exams last April. Thank you 🙂

Hi Rubi. It’s a delight to have you on my team. Let’s talk over email. Thanks 🙂

I really want to be a financial advisor, however i dont have much experience yet but im willing to undergo training, i hope you will accept me and be my mentor. Thank you

Hi Mary Jane. Good to know you are very interested to join my team and for sure you will be a wonderful addition to it. I’ll e-mail you for more details. Thank you 🙂

Hi Federico. I want to join your team and I want to be a part time Advisor. Is there an age limit?

I got a Life Insurance in year 1996 at Sun Life of Canada and I am still paying my premiums until now.

Thank you and more power.

What are the qualifications to become a financial advisor? Is there any educational attainment required?

Hi Mateo. It is a plus but not necessary. Thanks 🙂

open for a variety of opportunities towards financial freedom.

Hi Adelaida. Good to know that you are open for opportunities like this. If you are interested please kindly fill out the form below. Thanks 🙂

Hi Sir Federico,

Good Morning! I am working as an OFW.

Can I join your team in a part time basis?

Thanks and Regards,

Louie

Hi Louie. As much as we would love to have you in our team but sorry we don’t accept OFWs as FA’s because by law applications for life insurances should be signed here. Plus, as FA, you must attend meetings and training to further enhance your skills for the benefit of your clients. However, if you eventually decided to stay here for good you can always reach me in the future. Thanks 🙂

i am very interested to be a financial planner please accept me and be my mentor.

Thanks Joebel for the interest. I’ve seen your request and we’ll contact you soon. Thanks again!

Hi,

I would like to join your team as FA of sunlife, can you please tell me how?

Looking forward.

Thank you.

Ana

Hi Ana. Please kindly fill out the form.

Just to inform others as well. If you would like to join our team please read and “fill-out” the form. Thank you!

Applying for part – time FA 🙂 hope to be part of ur team! Thank u & Godspeed ?

Hi Mary Ailene. We would like you to join our team. Just shoot us a message to know more of how Sun Life can help you jumpstart your dreams. Thanks 🙂

Hi Sir! I would love to join your team, but i don’t have a professional experience yet. I’m a college graduate, but i didn’t have a job because of my medical condition. Am I qualified to be a part of your team?

Hi Anna. I hope you’re getting better. Being your future manager, if you pursue this application, it doesn’t matter what your medical condition is, for as long as you can do the job. How you control your mind is more powerful than what the body can do.

Please fill out the form above so we can move forward. Thanks 🙂

Hi Federico. I am an OFW. But I want to be an advisor part-time. I read that OFW is not allowed?

Hi John Robert. Yes, you read it right. This is due to the limitations of the license issued by the Insurance Commission. It will only allow agents to sell life insurance to someone who is currently in the country at the time of application. Also, it somehow protects the interest of the public from fraudulent transactions.

You may still consider being a financial advisor once you settle here in the Philippines for good. I’m just an email away. Thanks 🙂

I would like to join your team!

We want you to join our team as well Marinissa but please fill out the form first. Thanks

Can I join your team even if I’m based abroad?

Hi Michael. No, you need to get a license here in Insurance Commission and that license is only valid in the Philippines. Thanks

I would like to be part of your team.

We would like you to be part of our team as well. Please kindly fill out the form. Thanks

I am one among the many who disregards financial literacy. As years gone by I felt the need to grow my wisdom in terms of finances. I aim to achieve financial freedom and preferably bring every hard working Filipinos to that same state.

Hi Gracelyn. Thank you for sharing that. It’s true, very common for us to neglect the importance of financial literacy. Though we know we need it but the importance of it only shows when we experience financial struggles in our life. That’s where Financial Advisors like us step in to explain and let them understand the things they need to while they’re not experiencing it or if they wouldn’t want to experience it again in the future.

Hoping you can join us in spreading financial awareness that will bring them into a brighter life while enriching yours as well. Thanks again 🙂

I want to join the team!

We want you to join us Meleyne. Have you filled out the form above? If not, please do so. Thanks!

I would like to be part of your Team.

Hi Antonette. Please kindly fill out the form above. Thanks!

Hi! I’m from Parañaque City and I would like to be part of your team.

Hi Joyce. You are more than welcome to join our team. Please drop us an email so we can discuss the opportunity further. Thanks!

I would like to join your team. I am in Rome. Thanks

Hi Cristina. This is only for those who reside in the Philippines. It’s not allowed to sell insurances coming from here outside the Philippines. Thanks!

hi sir i would like to be part of your team.

Hi Wichelle. Have you filled out the form? If not yet. Please do so we can reach you easily. Thanks!

Hi Good day Sir federico, I’m from Antipolo City and i would like to be part of your team. Thank you.

Hi Daniel. You’re more than welcome to apply. Please connect with me on FB or via email. Thanks 🙂

Good day Sir! I would like to join your team! 🙂

Hi Cindy. Have you filled out the form? I did not see your name. Please kindly answer it. Thanks!

Hi Sir! I would like to join your team. Thank you!

Hi Welalyn. You are more than welcome to join our team. Please reach me thru my email or phone. Thanks!

Hi, I would like to join your team!

Hi Regina. You’re more than welcome to join our team. We’ll reach you at the soonest time. Please keep your line open. Thanks!

I would like to join in your team.

Hi Joanalyn. You are most welcome to join our team. Our secretary will reach out to you regarding this. Thanks!

I would like to join in your team.

Hi Jolly Ann. Thank you for your time in meeting us. Rest assured that you’ll not just enjoy the experience and help others but there’s a lot more you will get than your normal 8 to 5 job. The better life you envisioned to your family, I must say it is possible to diligence and hard work. Can’t wait for you to soar high in Sun Life. Thanks again 🙂