The much-awaited part of the year, aside from the series of holidays, is receiving your 13th-month pay. After a year of hard work and anticipation, finally, you’ll be getting it together with your bonuses. Friday the 13th might scare you to the bones but 13th-month pay just makes you bounce off the wall.

Before you get too excited about it. You may want to consider these wonderful tips you can do to maximize your 13th-month pay.

READ: Sun Maxilink Prime: The Best-Selling VUL Plan From Sun Life

Table of Contents

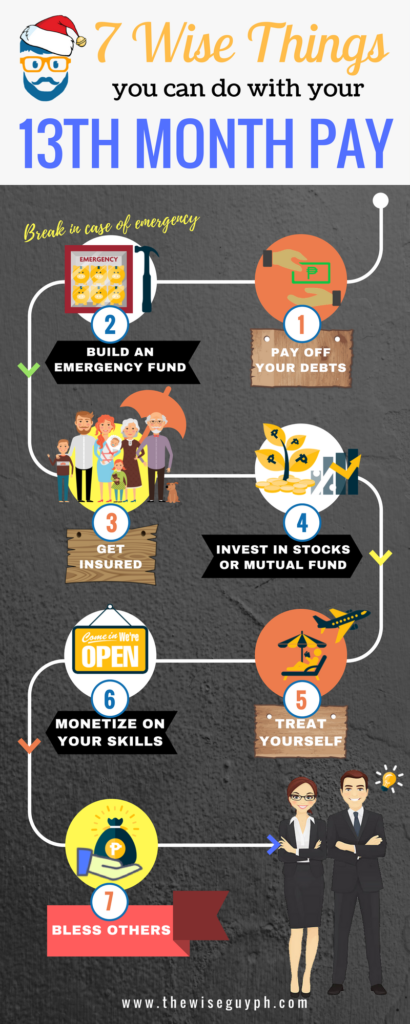

7 Wise Things you can do with Your 13th Month Pay

1) Pay Your Debts

You may say that all your debts are a good one but regardless of what they are, you must still pay it when you can as soon fast as you can. You may use your 13th month pay to lessen your debts because this is one of the best time to start nice and clean for the next year. Isn’t it neat to begin the year without any of it? You may also want to pay your credit card/s. Your credit card maybe charging you 3.5% every month or 42% a year. If you have Php 100,000 worth of credit it means you will pay Php 42,000 worth of interest a year. Imagine the things you can do with that amount.

Clearing your debts means extra savings on your part. Use this saving to finance those things that truly matter.

2) Build Your Emergency Fund

If you don’t have an emergency fund yet then you may consider building one. An emergency fund is something you use to finance emergencies like sudden loss of job, medical emergencies and alike. This fund should be at least 3 months worth of your monthly expenses. The fund must also be replenished soon after every use to fund the next emergency.

Some of you might be thinking to quit their jobs after receiving their 13th-month pay. But before tendering your resignation you might want to check if you have enough emergency fund.

Why 3 to 6 months? Simply because it’s the average time range an employee may need to find another job.

3) Get an Insurance

It’s the best time to call your Financial Advisor friend to check your insurance options. From the wide array of insurance products available in the market, you will surely find a plan that can answer your needs. Again, life insurance is a prevention tool. So get it before something happens. Imagine if you caught yourself in a car accident without having an insurance plan. Just a single incident like that may wipe away your savings in paying your hospital bills (i.e. if you are lucky enough to survive the accident).

If you already have an insurance, you may still call your Financial Advisor (like me!) to find out if there are areas you fail to cover from your existing policy. It’s good to know that life insurance coverage should also increase along with your assets.

4) Start Investing

You can use your 13th month to start investing. Nowadays, financial institution lowered their requirements to help encourage people like you to start investing. Why limit yourself to low yield savings account when there is a better place to put your money than banks. You may want to consider entering the stock market for as low as Php 5,000. If you are not yet ready to brave the volatility of the market you can still enjoy its benefits by going to mutual fund or UITF’s.

There’s also a way to enjoy the benefits of life insurance and mutual fund at the same time thru VUL or Variable-Unt Linked policy.

You may also want to check out this article about the best-selling VUL of Sun Life called Sun Maxilink Prime.

5) Treat Yourself

It’s been a year of hard work. You deserve to treat yourself to a nice dinner or vacation probably. Don’t stress yourself from “savings” you still need to enjoy the fruit of your labor. You don’t want to give that staring game at a reunion when asked about your experiences. Go ahead and let yourself experience the beauty of life. But just remember to put it in moderation.

6) Monetize on Your Skills

We all have ideas we want to venture. Your 13th-month pay can jump-start that idea into a profitable business. Or you may have other skills you want to market to your neighbors and friends this season like your self-made parol sand other Christmas decors. If you think you have skills in cooking, why not go and sell those pastries or dishes you always bring for potlucks?

7) Bless Others

Do not forget to share your blessings with others. We are merely managers of what God has given us. It is when we know the value of sharing the more we will appreciate how blessed we are. Be it your friends, family, or even a stranger. It will return to us a thousandfold.

I hope this helped you decide on what to do on your 13th-month pay. Remember to do something today that your future self will be thankful. Do everything in moderation. Happy Holidays!

****

Federico is an electronics engineer, financial blogger, insurance agent, and a certified investment solicitor. A multi-awarded financial advisor with clients ranging from lawyers, doctors, engineers, accountants, business owners, company directors, and OFWs to minimum wage earners had sought advice from him in achieving lifetime financial freedom.